Good morning, it’s Paul here with the SCVR for Thursday.

Timing - today's report is now finished.

Agenda -

Innovaderma (LON:IDP) - bid approach by Creightons (LON:CRL)

Eve Sleep (LON:EVE) - trading update - still has plenty of cash, and losses reduced.

Intercede (LON:IGP) (I hold) - convertible loan notes dealt with - mostly converting into new equity.

Venture Life (LON:VLG) - Trading Update (from Monday this week)

.

Holiday bookings

I’m definitely getting old, because each passing week seems to fly by in a blur. Maybe it’s because every day is virtually identical at the moment? Get up, analyse shares, have a nap after lunch. Get up again, watch TV, listen to audiobooks/podcasts, go for a walk if it’s not tipping it down, analyse some more shares, go to bed. That’s it at the moment. At least I’m not having to home-school unruly/bored children, whilst trying to work from home, so I count my blessings in that way.

Something had to give, so I booked myself flights to spend 5 weeks in Malta in Sept/Oct, The cost was below £200, and it gives me something to look forward to. I’ll take the laptop and carry on writing the SCVRs here as before.

I wonder if other people are having similar thoughts? If any of you spot forward bookings information from travel companies, do post a comment here, as I’d be interested to find out if other people are booking up overseas trips like me, or are reluctant to do so due to the uncertainty, like some of my family for example. Opinions seem to be mixed.

Covid comments

Most people respect this, but please could those who don’t, take on board this gentle reminder - we’re discussing investment/markets/economics here. We’re not interested in anyone’s views on the pandemic more generally, or which politicians have been clever or stupid, etc. We need to keep focused on how covid is likely to affect the markets. Not the wider issue. Let’s try to keep the focus. There are plenty of other places on the ‘net for a wider discussion/rant.

I’m exercising restraint myself - there are plenty of things I’d like to say about the EU right now, but am keeping my personal opinions to myself, because (a) nobody’s interested, and (b) it’s boring, and (c) it has nothing to do with investment, which is what the SCVRs are all about.

Many thanks! Oh, and please don’t post comments about this comment, that just perpetuates the problem! Let’s draw a line under it, and move on.

.

Innovaderma (LON:IDP)

Bid approach by Creightons (LON:CRL)

This is an interesting, and topical issue.

Creightons issued a statement here at 07:00 on 2 Feb 2021, saying that it made a preliminary approach to Innovaderma (IDP) on 26 Jan 2021, regarding a possible all-share offer for IDP.

This approach was unequivocally rejected by the Innovaderma Board on 29 January 2021 without affording Creightons the benefit of any further discussion. The Board of Creightons continues to have a serious interest in the possibility of a combination of the two businesses, and is therefore publishing today, in the Appendix to this announcement, the text of its letter to the Board of Innovaderma ("Letter") in order that the shareholders of Innovaderma are directly aware of Creightons' interest.

The proposed deal is an all-share takeover/merger, buying out IDP shareholders with 2 new Creightons shares, for each 3 IDP shares held. That initially valued IDP at 44p (subject to change in line with whatever CRL’s share price now does). IDP shares have risen a little, and are now 48p.

IDP’s response - What’s interesting is that IDP rejected the offer, and only made a stock market announcement in response to CRL going public with its announcement.

At 11:41 on the same day, IDP issued this statement.

IDP confirms it received an approach from CRL, saying;

- IDP’s Board unanimously rejected the approach because it:

- Significantly undervalues IDP

My opinion - IDP is in the middle of a fundraising, so this could be seen as a distraction in the short term.

However, it does raise the topical issue of if/when companies should announce to the market any takeover approach(es). There don't seem to be any clear rules on this issue at the moment. Is it right that Boards can rebuff a bid approach, and not even tell its shareholders? The timescales here are very recent, so any criticism of IDP is premature. I’m just flagging it as another example (there have been others lately) where some shareholders feel that they’ve been kept in the dark about bid approaches - costing them money, if they sell out, not knowing that the company is potentially in play.

Sounding-out institutional shareholders in private is all very well, but the fact there has been a bid approach, is materially price sensitive (even if it’s at a modest premium, it still puts the company in play potentially, and it flags that the company is cheap, because bidders see value in it above the current price, otherwise they wouldn’t be interested).

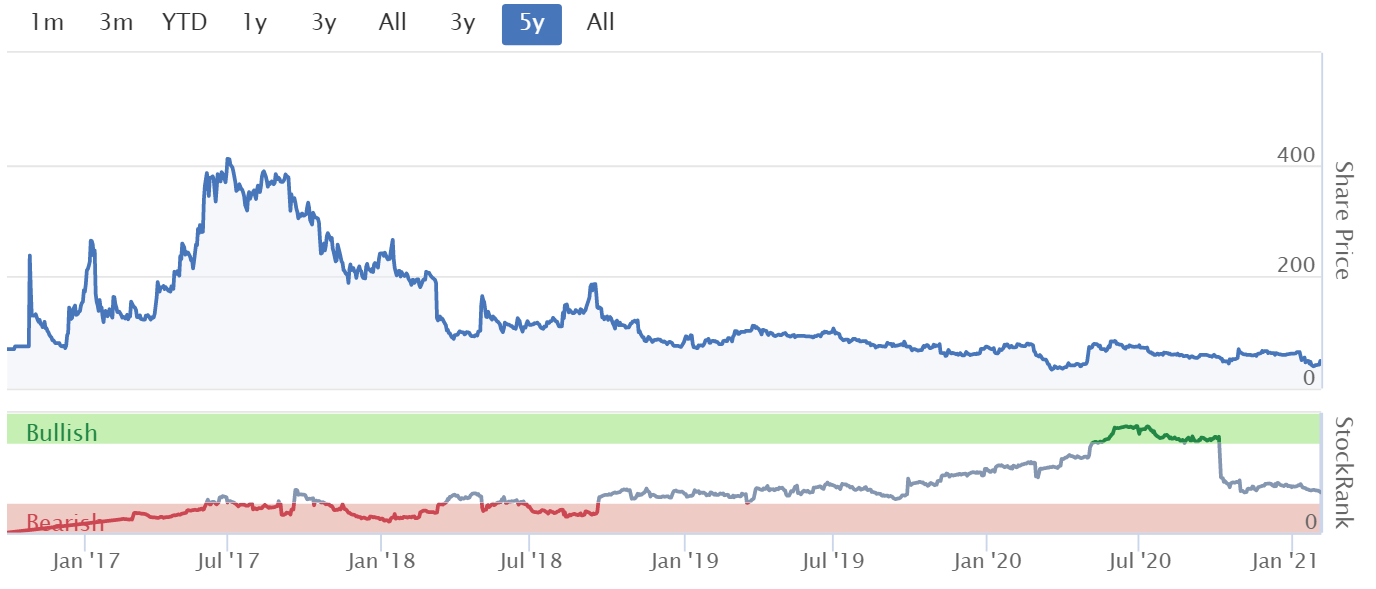

Surely shareholders have a right to choose between holding shares in a tiny illiquid £8.5m mkt cap company (IDP), or seeing their company absorbed into £42m mkt cap Creightons, by agreeing to swap IDP shares for CRL shares? That would improve liquidity, plus no doubt lead to some duplicated cost savings. It's pretty obvious which management has done a better job, so why would you want IDP to remain independent after such a poor track record? Compare the share prices -

Firstly IDP over 5 years:

.

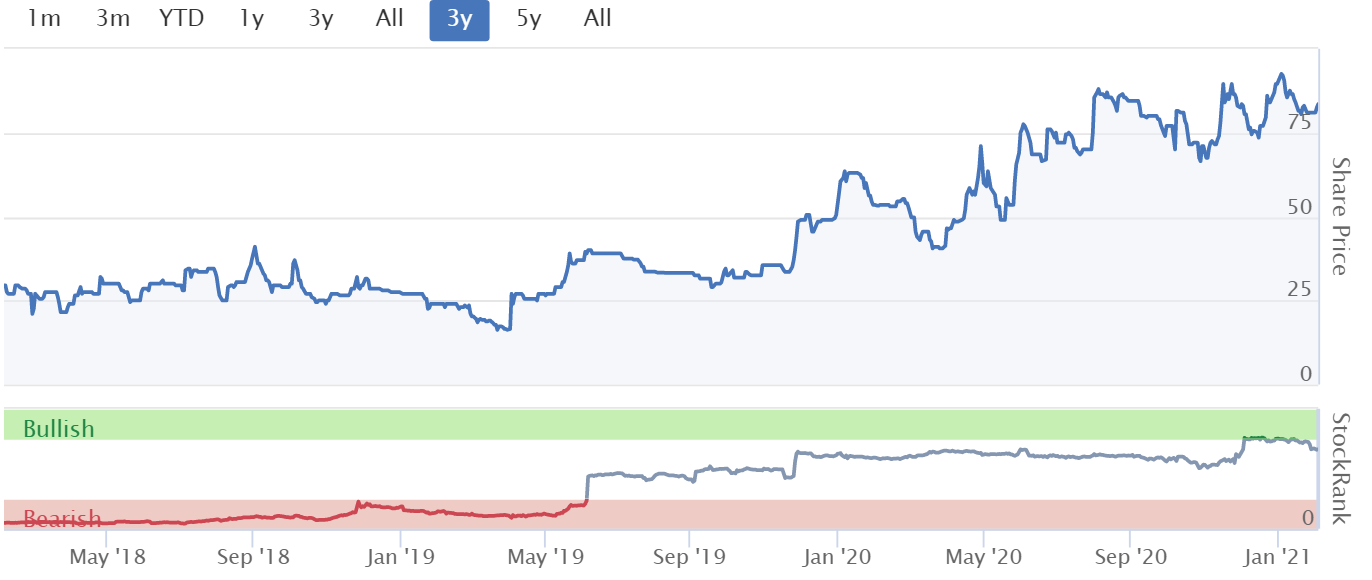

Over the same period, this is Creightons:

.

Have IDP rejected the bid approach because management want to keep their jobs, or because they can genuinely do a better job than if they agree to CRL's takeover?

If you agree with me that we need tighter, clearer rules, on what companies must disclose to the market, then please do support Lord Lee’s & ShareSoc campaign on this issue by writing to the Takeover Panel with your views.

EDIT: See the comment below from davidjhill, who owns IDP shares, explaining well why he agrees with IDP's Board that it has better prospects as a standalone company. End of edit.

Review of Listing Rules

On the same topic of rules & regulations, I read that former UK EU Commissioner, Lord Hill (who? I hear you ask? He’s a mate of David Cameron), has been appointed to conduct a review of the UK stock market listing rules. Some have dubbed it “Big Bang 2.0”. The idea seems to be all about opening up, reducing regulation, to improve London’s international competitiveness, performance & opportunities.

This strikes me as a good idea, and a real opportunity to make things better, so we should get involved.

I might take a day off soon, to have a think about this, and draft some proposals to send to Lord Hill, about the many annoying & outdated ways the stock market works currently - e.g. just off the top of my head these include -

- Excessive costs for fundraisings,

- Leaving shares trading when a fundraising is going on supposedly in secret (yet hundreds of people know what’s going on, so it leaks out),

- Blatant insider dealing before bids,

- Trading statements that don’t include or obscure key information,

- Dis-application of pre-emption rights becoming routine when it should be an exception

- Slow & paper-based processes e.g. AGM/EGM votes which should have moved online 20 years ago!

- The ridiculous nominee system which disenfranchises smaller shareholders, removing proper shareholder oversight

- Excessive Director remuneration & bonus/shares schemes

- Remuneration committees & consultants that ratchet up pay

- Rewards for failure

- Brokers floating rubbish, speculative, blue sky companies, so many of which fail & hoodwink gullible investors

- Overseas frauds welcomed with open arms onto AIM (remember all the Chinese frauds like Naibu & Camkids?)

- Inadequate free floats on many small caps, leaving Directors free to do whatever they want

- No meaningful punishment for any kind of wrongdoing it seems.

- MiFiD 2 making it harder to access, and reduced the production of, company research

- Excessive compliance procedures & costs

- Improving liquidity in small caps, through encouraging a broader PI shareholder base, not just large lumpy institutional placings

- Giving better access to research & companies generally, for PIs

I could go on. There are clearly lots of issues and opportunities to make things better, creating a virtuous circle of more investment, and more listings.

My feeling is that we don’t necessarily need to de-regulate, I think we just need a thorough review, to make sure regulation is necessary, effective, and properly policed. Anything that isn’t, then just get rid of it.

Also, if there are new initiatives which could be introduced to make London a more attractive venue for companies to list, then let’s go for it. I want to see London as a vibrant market, leading the world with growth, tech companies that are maybe not quite big enough to list in New York.

It’s great to see the recent successful floats of Dr Martens (LON:DOCS) - Dr Martens boots, floated at 370p and it’s gone to a premium, currently 443p. Floats that go to a premium are good because they attract more companies to float, and attract more investors keen to get in on the act and make some money.

Moonpig (LON:MOON) - Moonpig - floated for £1.2bn, up from the mooted £1.0bn, and has gone to a premium also. All good for the market overall, even though neither share interests me personally, because they look expensive.

.

Eve Sleep (LON:EVE)

(I hold)

4.5p - mkt cap £12.3m

Just a quick note, as this share is high risk, illiquid, a total punt, with a very poor track record.

However, its recent trading update caught my eye as a possible special situation.

Look away now, as regulars here will know that my micro cap punts hardly ever work! I just can’t help myself sometimes.

eve Sleep ("eve", the "Company), the direct to consumer sleep wellness brand operating in the UK, Ireland (together "UK&I") and France announces a trading update for the full year ended 31 December 2020. All figures remain subject to audit.

The original business plan of spending huge amounts on marketing hasn’t worked. So this is version 2, with costs greatly reduced, and a focus on driving sales with online marketing.

Here’s the latest -

- Revenue increased 6% to £25.2m (2019: £23.8m), driven by 18% growth in H2

- Record trading over black Friday period and the first week of the Boxing day sales

- EBITDA losses cut by 81% to £2.0m (2019: EBITDA loss of £10.7m)

- Closing net cash at 31 December 2020 of £8.3m (2019: £8m), bolstered by £0.3m of tax payments deferred until after the year end

The way I look at the above, is it’s producing meaningful revenues, has slashed losses, and has plenty of cash in the bank, at about two thirds of the market cap.

My opinion - there’s a glimmer of hope here. It’s got enough cash to continue trading, and the massive prior years marketing spend has created good brand awareness.

2021 trading has “started well”. There’s a lot more info in the statement, which I won’t repeat here.

Highly speculative, but possibly interesting at 4.5p. Probably more of a trade, than a long-term investment.

.

Intercede (LON:IGP)

(I hold)

Share price: 83.5p

No. shares: 50.63m existing + 6.47m new shares = 57.1m

Market cap: £47.7m

Good news here, as this issue has been resolved earlier than expected.

As has been well documented here, IGP had £4.9m of outstanding loan notes, which were quite expensive, costing £400k p.a. in interest cost.

They were due for expiry at the end of 2021, but it turns out the company had the right to "Call" holders, to elect to either receive cash repayment, or convert into new IGP shares at a fixed price of 68.8125p.

The results are;

Convert into shares: £2,905,000 of loan notes, so 4,221,612 new shares to be issued.

Redemption in cash: £450,000 of loan notes

Intending to convert into shares: £1,550,000 of loan notes, so 2,252,498 shares to be issued.

Overall impact - there is dilution to existing holders, with the share count rising from 50.63m now, to 54.85m now, and another 2.25m shares to be issued, making 57.1m in total once all conversions have occurred. That's a 12.8% increase in the shares in issue.

My opinion - this is good news, as it means profits go up by £400k p.a. from now, due to eliminating expensive debt. Also the balance sheet will now be debt-free, with a big cash pile, so much stronger.

Note that Azalia Trust, connected to a NED, Jacque Tredoux, now holds 29.97% of the company.

The company's making steady progress, and this eliminates the last legacy issue. So far it's been a decent turnaround, as the share price reflects.

.

.

Venture Life (LON:VLG)

82p - mkt cap £103m

Venture Life (AIM: VLG), a leader in developing, manufacturing and commercialising products for the self-care market, announces its unaudited trading update for the year ended 31st December 2020, ahead of the announcement of the Group's audited results on 25th March 2021.

Full year profit ahead of market expectations

The Company expects to report revenues for the year ended 31st December 2020 of £30.1 million, 49% higher than for 2019, and adjusted* EBITDA is expected to be not less than £6 million, more than double the 2019 adjusted EBITDA.

*Adjusted EBITDA is EBITDA before deduction of exceptional items and share based payments

There were no further shipments of product to our Chinese oral care partner in H2, but shipments are due to resume in H1 2021.

Directorspeak - the cash pile looks very impressive, post the big recent fundraising -

The placing and open offer completed in December 2020 has given us substantial funds, leaving us with net cash (excluding finance lease liabilities) of £35.5m as at the year end, with which we can now pursue our ambitious acquisition growth and, with an order book ahead of the same time last year, I look forward to updating the market further as we go through the year. "

Fundraising - why did it raise so much cash in Dec 2020, £36m at 90p (at the time, a 13.5% discount)? It says for working capital, and acquisitions. Maybe there's an acquisition deal in the pipeline?

Selling shareholders ditched 8.17m shares at the same time, a negative in my view.

Chinese order - if you recall, it previously announced a remarkable 15 year deal with a Chinese distributor for 168m Euros minimum. That orders dried up in H2 is a concern, as is everything related to China.

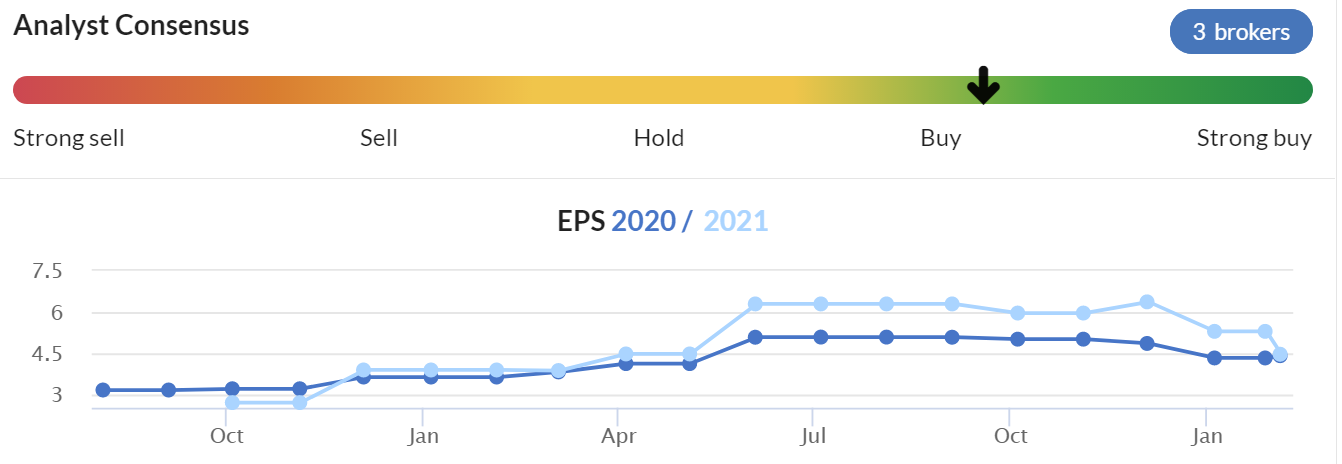

Forecasts - we have 2 fresh broker notes available on Research Tree, many thanks to the brokers for making those available.

They have very different figures. N+1 Singer has FY 12/2020 forecast at 3.5p adj EPS, so a PER of 23.4 - whilst that looks expensive, bear in mind that the company has raised a ton of cash recently, so it will be able to deploy cash to make acquisitions, hence driving up EPS hopefully.

N+1 Singer has a forecast for FY 12/2021 of 3.2p, PER of 25.6. Note this is a reduction in EPS, despite a rise in forecast profit, because there are more shares in issue following the equity fundraising.

Cenkos has higher numbers forecast, at 5.0p for FY 12/2020, and 4.1p for FY 12/2021, PERs of 16.4 and 20.0, which look a more reasonable valuation.

Given the difference in broker forecasts, then investors need to drill into the detail, to satisfy yourself that you're locking into plausible forecasts & hence valuation. It's always a good idea to sense check forecasts, with your own simple spreadsheets. At the moment I find that many forecasts are too cautious, providing an opportunity. I particularly like it when companies report they're ahead of expectations, but brokers leave figures unchanged. That almost guarantees a beat when the next numbers are reported. The reverse happens when companies sound cautious about the future, but brokers leave forecasts unchanged - then you're risking a 30% hit from a profit warning. There's a lot to be said for selling at the first sign of trouble.

My opinion - checking back through my notes from June & July 2020, I was impressed with VLG’s progress last year. The market cap is over £100m now, so the company needs to continue growing earnings into that valuation. I’m a bit wary of the materiality of the lumpy Chinese orders.

A lot hinges on what it does with the freshly raised cash pile, which is about a third of the market cap. If a sensible, earnings accretive acquisition is made, then that could drive forecasts, and the share price higher.

Overall, I don’t know what is likely to happen here, so declare myself neutral on this share.

Note that forecasts have come down recently, probably to reflect the dilution from the issue of new shares. Although how much credence should we give to the "ahead of expectations" heading to the trading update, given that expectations had recently been lowered?!

As always, the darker coloured line is the current financial year, and the lighter coloured line & blobs are next year.

.

.

That's it for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.