Good morning! The takeover bids are coming thick and fast this week. Yesterday we had one of my favourite stocks, Kentz announce a potential takeover bid, with the shares now 50% above the price they were flagged here (no less than three times!) as being good value, on 3 May, 17 May, and 26 Jun. Also, as "nswier" pointed out in comment 8 of 17 after yesterday's report;

On Kentz, chalk up another result for Stockopedia's own screen of screens. It has been near the top of that screen for a good few months now.

Well, it gets better, as we've had another takeover bid today! This time on Fiberweb (LON:FWEB). I spotted what good value the shares were at 75.5p on 2 Aug, and devoted most of that day's report to reviewing the company's interim results, concluding that;

"I think this looks an attractively-priced share with good value characteristics, of a healthy dividend yield, reasonable PER, and a strong Balance Sheet. It probably won't shoot the lights out, as it looks a mature, and fairly boring business, but should benefit from the economic cycle improving in its main markets."

This morning Fiberweb announce that Polymer Group Inc. is close to tabling a 97.5p cash bid for them, with shareholders also receiving the 1.2p interim dividend on top. I think that's a fairly tight offer, as the shares look worth about 100p just putting it on a reasonable PER. 100p translates into 15.9 times 2013 forecast earnings, and 13.5 times 2014 consensus forecast earnings.

So it's certainly not generous, and I reckon there's a chance that a higher competing offer could come along, so personally I am minded to hold my shares, as they are bound to be marked up today to around the 97.5p level. Although Fiberweb's Board say they would recommend the offer to shareholders if it is formally made (it's only a potential offer at the moment), which surprises me, as I would prefer management to seek the highest possible bid for the company, rather than recommending the first, not very generous offer that comes along.

On the other hand, "a bird in the hand", and all that. So I reserve my right to change my mind on this, and might decide to sell my shares later today if the mood takes me. Trouble is, it had upside to 100p+ anyway, based on recovering markets, and the modest rating, supported by a good dividend yield and a strong Balance Sheet, so I don't think there is a great deal of risk in holding the shares to see if a higher bid comes along. We'd probably still see the shares around 95p even without a bid. So on balance I will probably sit tight for the time being.

Nice to have chalked up another success though, and I hope plenty of readers hold the shares too. If you have a free account, why not consider spending a bit of the profit from FWEB on upgrading to a premium account here?! Oh, and please hold a bit more back too, for my next Half Marathon attempt! (which will be in early Oct, so I'll be tapping readers for sponsorship for that soon, raising money for Scope. Training has already begun!)

FTSE 100 Futures are indicating a weak open, at 6,422 down 39 points.

Defence contractor Cohort (LON:CHRT) announces a decent-sized contract win, for £11m, to supply external communication systems to BAE Systems, for two of the Astute submarines. Despite having recently broken out to a new 12 month high of 167p at last night's close, these shares still look good value in my opinion.

Defence contractor Cohort (LON:CHRT) announces a decent-sized contract win, for £11m, to supply external communication systems to BAE Systems, for two of the Astute submarines. Despite having recently broken out to a new 12 month high of 167p at last night's close, these shares still look good value in my opinion.

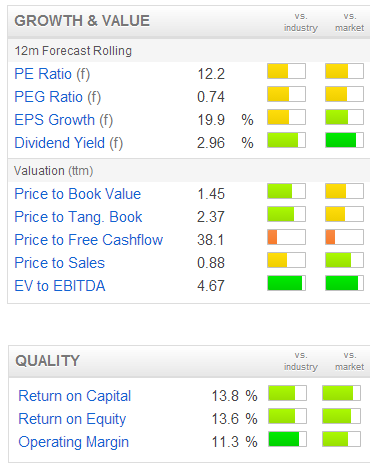

The valuation table for Cohort, on the right, shows plenty of green, indicating good value versus their sector (the left hand bars) and the whole market (the right hand bars).

I should also mention, that the company has a superb Balance Sheet, stuffed with surplus cash. At the last reported Balance Sheet date, Cohort held £16.4m in net cash, which formed the bulk of the net current assets position of £20.9m. Those are material numbers in the context of its £68.3m market cap, and means the company has scope to make some decent-sized acquisitions, or return cash to shareholders. Plus it provides a healthy margin of safety for investors, since the shares look good value even before you factor in the strong surplus cash position. I like this one, and will continue to hold. As usual, please DYOR.

Lidco (LON:LID) issues a positive trading update, saying that they have "traded well in the first half of the year" (i.e. the six months to 31 Jul 2013), and that the company, "remains confident of meeting market expectations for the full year".

H1 will show a "small loss", but they expect to be profitable for the full year.

Broker consensus is for 0.4p EPS this year (ending 31 Jan 2014), so the shares don't exactly look a bargain at 15.25p - I make that a PER of a whopping 38 times. Although in a turnaround year, the PER can be a poor measure, so looking to next year broker consensus is for 0.9, which puts them on a more reasonable PER of 16.9 times.

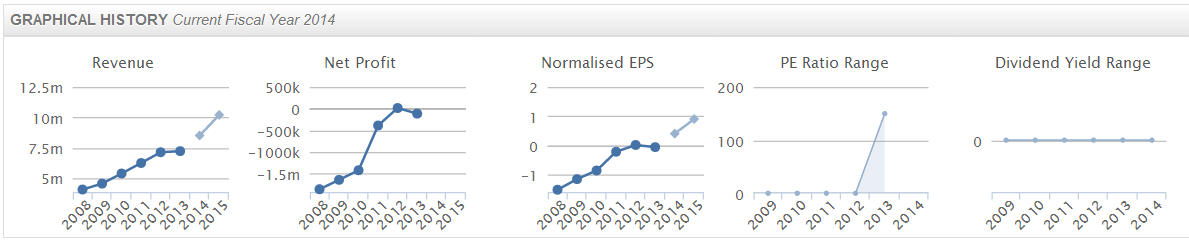

The company has a long track record of making losses (as you can see from the Stockopedia graphical history shown below), although in a slow but steady upward trend in sales, and reducing losses. It just doesn't look very exciting to me for a market cap of about £30m at the current price of 15.25p per share. That factors in a fair bit of future growth. So it would be a question of getting under the bonnet, and finding out more about the company, its products & markets, before one could form a view about the valuation. There's not enough there to excite my interest for the moment.

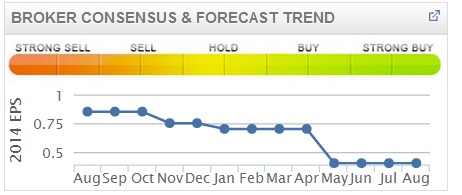

Also, given how forecasts for the current year have been steadily revised down throughout the year, I wonder how reliable the forecasts for next year will be? Or whether they will also be revised down as time goes on?

Also, given how forecasts for the current year have been steadily revised down throughout the year, I wonder how reliable the forecasts for next year will be? Or whether they will also be revised down as time goes on?

Hence the need for more research on the company before relying on forecasts.

Returning to Fiberweb (LON:FWEB), I've been on the phone making enquiries, and this is my understanding of the situation:

The company is now "in play". So anyone interested in bidding for the company now needs to get on with it, and knows what price they have to beat (i.e. the 97.5p possible bid from PGI).

Also, it sets the clock ticking re the PGI potential bid, as they now have 28 days to act, under takeover rules.

So it's not a done deal yet, and there is potential upside from a competing offer, should any other party decide to throw their hat into the ring.

In my opinion, given that the PGI offer is far from generous, I think there is upside both from a competing bid, and from (long term) the company remaining independent. If the bid falls away, then the share price would probably drop about 10p to say 84p, and it's good value at that level on fundamentals, in my opinion.

Give it a year, and the share price might possibly have recovered to 120p+ on improving Western economies?

It's a straightforward cyclical business, so it seems pretty bonkers to sell out near the bottom of the cycle, at a low valuation.

I'm sitting tight. However, whether to sell now and bank the 94p on offer in the market, or hold out for more, is a decision that each investor has to make for themselves. As always I'm not offering any advice, just airing my personal views.

Harvey Nash (LON:HVN) has cropped up here before, and looked a reasonably priced recruitment outfit. They had a wobbly Q1, but today's statement indicates that things seem back on track, with an improved Q2. So the trading statement covers the first half to 31 Jul 2013, and key numbers are that revenue grew 13% to £332m, gross profit rose 6% to £43m, and operating profit (before restructuring charges) under 5% below the prior comparison period.

The reason given for operating profits being down is problems in their German operation, which has been restructured at a cost of c.£2m.

They talk positively about cash collection, and had positive net cash of £1m at 31 Jul 2013, although I've noticed this figure is volatile, and in my view they generally have an underlying net debt position of £10-15m.

The most important sentence is the last one, where they say:

...the Board remains confident of delivering results for the current year, pre-restructuring charges, in line with its expectations.

So that all looks fine to me. Stockopedia shows broker consensus of 8.4p this year, and 9.77p next year, so that puts them on a PER of 10.0 and 8.7 respectively, which looks reasonably good value to me, especially as there could be cyclical upside on earnings in the coming years.

The dividend yield is pretty good, showing a blended forecast of 3.9% on Stockopedia (which weights the forecasts depending on where we are in the year).

Overall, I think it looks interesting, and could see maybe 30% upside on the current share price of about 85p. Probably not enough to get me excited, but given that it's difficult to find value these days, this is looking reasonably attractive both for the divis, and it's easy to see modest upside on the share price too.

VP (LON:VP.) issues a positive IMS today, saying (my bolding):

The AGM statement issued on 23 July 2013 reported that the new financial year had started well and in line with management expectations. Since then, the business has continued to experience good demand, in particular from the infrastructure, utility and housebuilding sectors, which is helping to deliver solid year on year revenue growth.

The Group remains well positioned to invest further into the business in support of new opportunities as they are secured and to deliver further good progress in the current financial year.

So that all sounds good. I do like this business, and was very impressed with management's presentation at an Equity Development Investor Forum some time ago. Sadly, I dithered too long, and didn't buy any shares, as they have since done well.

Checking out the usual Stockopedia "growth & value" graphics, shows that it still looks reasonably priced, despite the shares having risen strongly since May.

Checking out the usual Stockopedia "growth & value" graphics, shows that it still looks reasonably priced, despite the shares having risen strongly since May.

It's not cheap enough to make me want to buy any right now, but it's the sort of stock that looks like a solid, long-term performer, that pays a reasonable dividend, and should have steady growth potential too.

It's the sort of thing I might stick in a SIPP and forget about for 10 years.

That's me done for today, see you as usual tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FWEB & CHRT.

A Fund to which Paul provides research services, also holds a long position in FWEB).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.