Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Timing - I think we'll leave it there for today, 5 companies is enough for one day! Today's report is now finished.

Agenda -

Paul:

Christie (LON:CTG) - a quick review of its FY 12/2020 results, issued yesterday. Recovery looks already priced-in, especially when you take into account the increased pension deficit.

Brickability (LON:BRCK) - a positive update, ahead of expectations, but they fail to mention profits are down on last year. This share has more than doubled in the last 6 months - that looks justified, but where's any additional upside going to come from? Probably priced about right.

Porvair (LON:PRV) - positive-ish trading update. Signs of recovery starting, so more optimistic for H2. As always, I struggle with the high valuation of this share, given its lacklustre growth, and sideways share price, in the last 3-4 years. Just feels like the growth story has gone a bit off the boil.

Jack:

Warpaint London (LON:W7L) - this supplier of cosmetics has had a couple of false starts since listing in 2016 but trading momentum is improving. Returns on capital have been poor but the founders continue to run the business and remain its largest shareholders. Have lessons been learned?

Rbg Holdings (LON:RBGP) - acquisitive professional services group adds another business to the fold and sees further consolidation opportunities in its sector.

.

Paul's Section

Christie (LON:CTG)

105.5p (down 5% yesterday) - mkt cap £29m

Christie Group plc ('Christie Group' or the 'Group'), the leading provider of Professional & Financial Services (PFS) and Stock & Inventory Systems & Services (SISS) to the hospitality, leisure, healthcare, medical, childcare & education and retail sectors, is pleased to announce its audited preliminary results for the 12 months ended 31 December 2020.

Reading through the commentary, it immediately struck me what a sprawling group of different businesses this is, considering the market cap is only £29m.

Christie Group operates in two complementary business divisions: Professional & Financial Services (PFS) and Stock & Inventory Systems & Services (SISS). These divisions trade under the brand names: PFS - Christie & Co, Pinders, Christie Finance and Christie Insurance: SISS - Orridge, Venners and Vennersys.

Tracing its origins back to 1846, the Group has a long-established reputation for offering valued services to client companies in agency, valuation services, investment, consultancy, project management, multi-functional trading systems and online ticketing services, stock audit and inventory management. The diversity of these services provides a natural balance to the Group's core agency business.

2020 trading - was grim, as you would expect, given the disruption caused by the pandemic -

Revenue £42.2m (down 46% on 2019)

Hefty loss before tax of £(6.33)m, drastically worse than the £4.42m profit in 2019

Government grants of £8.18m received in 2020, although I imagine most of that would be pass-through furlough funding, to pay employees who would otherwise have been made redundant if the furlough scheme had not been created as temporary support.

Balance sheet - NAV is negative at £(11.4)m. Deduct £2.9m intangible assets, and NTAV is £(14.3)m.

The main problem is the pension deficit, which has shot up from £12.0m at end 2019, to £20.1m at end 2020. Remember that’s the accounting deficit, which tend to be smaller than the actuarial deficit (which is more important, as it drives cash outflows in recovery payments).

There might be some creditor stretch, because “Trade and other payables” is up 15% to £13.3m, when I would expect that normally to have fallen, in a quieter year.

It looks as if Christie has (sensibly) been hoarding cash, so the £10.28m gross cash pile is largely offset by bank borrowings of £3.2m + £3.0m, giving net cash of £4.08m. Take into account likely creditor stretch, and I think the normalised cash balance would probably be closer to nil. Hence people imagining that a third of the market cap is cash, are not seeing the full picture.

Outlook - this is quite interesting. The commentary explains how the company used the pandemic to re-think its cost structure, and make itself more efficient for the future. That’s a really interesting point, and probably applies to lots of companies. Hence could end up seeing companies recover, to higher levels of profitability than they achieved pre-pandemic. That’s supportive of buoyant share prices.

Following business reorganisations in 2020 we have created the ability to generate higher levels of profitability from the levels of revenue previously achieved.

The year has started positively for our Professional and Financial Services and Retail stocktaking businesses. As these activities are joined by hospitality stocktaking and visitor attractions are reopened we shall be firing on all cylinders.

After allowing for inevitable lead time and lags associated with sector reopening, for each quarter that our Group is permitted to trade unimpeded we expect to do so profitably.

There are good reasons to expect Christie to see a strong recovery in trading. For example, its commercial property valuations wing should see plenty of activity from hospitality premises changing hands, companies going bust, valuations for nervous banks, etc.

The stocktaking wing should also see activity return to something like normal, although I wonder how many clients may not re-open, is that likely to be significant?

My opinion - overall it’s the weak balance sheet, and in particular a large pension deficit, that puts me off. That all restricts the ability to pay decent divis in future.

This group has a long, and rather lacklustre track record as a listed company. I cannot really see the point of it being listed. The share price is still nowhere near the peak it reached in 2007. So there’s an opportunity cost to holding this share.

That said, it might make a good recovery situation, as there seems little doubt to me that Christie should return to profits now that re-opening is happening in retail & hospitality.

It doesn’t seem to have issued new equity during the pandemic, so EPS should be able to recover to at least peak, pre-pandemic level of about 10p. Put that on a PER of 10 (due to the weak balance sheet with a large pension deficit), and my target price is 100p. It’s currently 105p, so to my mind, the upside looks already priced-in, hence it doesn’t interest me.

.

.

Brickability (LON:BRCK)

87p - mkt cap £200m

Brickability Group plc (AIM: BRCK), a leading construction materials distributor, is pleased to provide the following update on trading for the year ended 31 March 2021.

In a financial year which commenced during the first national lockdown and significant operational challenges due to the COVID-19 pandemic, the Group delivered a solid trading performance and expects to deliver revenues for the period of approximately £180 million and adjusted EBITDA in excess of £17 million, ahead of previous expectations.

Ahead of expectations, but they fail to mention down from £19.5m adj EBITDA last year, FY 03/2020.

For pity’s sake, why is everyone quoting adjusted EBITDA as if that’s the key measure of profitability? It isn’t. It just creates more work for me, because I then have to check how significant depreciation & amortisation, interest, and tax are! Not to mention exceptional, and acquisition-related costs, which are also adjusted out! Those costs haven’t just vanished.

Surely the people who write RNSs, or the brokers & PRs who buff them up, could give us the full picture, not just cherry-pick the most favourable profit measures (adj EBITDA)?

Many thanks to Cenkos, who come to our rescue with an update note this morning, giving us the additional information which is missing from the RNS.

Cenkos says that the £17m of adj EBITDA turns into £15.0m adj profit before tax (PBT), and 5.3p adj EPS (the most useful number, as we can quickly compare it with the share price of 87p, to calculate the PER is 16.4 - not exactly a bargain for a building products company, which don’t tend to attract particularly high ratings, due to being a fairly basic, and cyclical sector.

Although it’s fair to assume that FY 03/2021 would have had some impact from the pandemic in the early part of the year. Hence the 6.2p EPS forecast for FY 03/2022 is probably more relevant for valuation purposes - bringing the PER down to a more reasonable 14.0.

Query - there seems to be a difference between the adj EPS quoted by the company, which was 4.03p for FY 03/2020, and the significantly higher figure of 5.5p for FY 03/2020 shown in the Cenkos note. Before buying any shares here, or relying on the quoted PERs, that difference would need to be investigated. I think it might be something to do with adjusting the number of shares re the IPO?

Other information in today’s update -

- Strong focus on margins & cost control

- Recently increased sales team, to satisfy ongoing demand - sounds good

- Acquisitions - boosting growth, more acquisitions in the pipeline - watch out that the balance sheet doesn’t get too top-heavy with intangibles, nor overloaded with debt. The last published balance sheet was looking a little thin, only just positive NTAV

- Acquisition of McCann Logistics looks a canny & well-timed move, giving BRCK its own pan-European transport network, and control over supply lines, at a crucial time of some cross-channel disruption

- “No great impact” from lockdown 3, nor Brexit - good to hear - more evidence that businesses have adapted & found workarounds to these problems

Outlook - sounds encouraging. I think the Govt’s new 95% mortgage guarantee scheme could provide a decent boost to first-time buyers, I must look up the terms of this new initiative. Below, this all sounds to have good read-across for the housebuilding & supplies sectors -

Order books indicate confidence in the robustness of the homebuilding market, and underlying optimism that demand will remain strong for quality building materials. We remain conscious of the impact of the pandemic to the broader economy and potential uncertainty as to the strength of its recovery, however the Group fundamentally believes that the underlying demand for UK housing remains robust and expects to deliver further growth in revenue and profitability during the current financial year.

The acquisition pipeline remains strong with the Group assessing a number of potential opportunities in line with the Group's stated strategy to provide geographic and product expansion whilst focusing on improving profitability.

My opinion - this looks a good update. The outlook sounds positive too. With all the stimulus measures going on, in the economy generally, and in particular the housing market, I can’t see any reason why buoyant conditions for housebuilders & their suppliers would turn down any time soon. We could be in for a multi-year bonanza, who knows? The evidence I’ve seen seems to be pointing increasingly in that direction. Cheap money & stimulus measures are flooding the system, after all.

At the risk of sounding like a broken record, the trouble is with so many cyclical shares at the moment, that the share price has already zoomed up (BRCK has more than doubled from early Nov 2020 lows), which makes me question how much further upside is there likely to be?

The danger is that investors could be getting carried away with strong price momentum, and chase the price too high. Maybe the best gains have been had for now? The same situation pertains for so many shares at the moment, the way I see it.

It’s an OK business, probably priced about right, in my opinion.

.

.

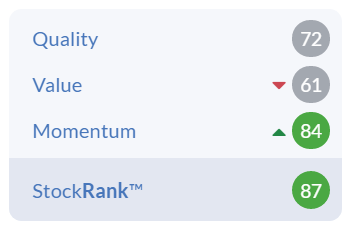

It gets a thumbs up from Stockopedia's system too -

.

Porvair (LON:PRV)

580p (flat on the day, at 10:15) - mkt cap £263m

Porvair plc ("Porvair" or "the Group"), the specialist filtration and environmental technology group...

As background, here are my notes from 1 Feb 2021, where I reviewed Porvair’s results for FY 11/2020, concluding that trading had been resilient during the pandemic, and the share got a thumbs up from me as a sound long-term investment, but with limited upside (because it’s always on a rather expensive rating, not really justified by lacklustre growth in recent years).

Today’s update says -

In the four months ended 31 March 2021, the Group has performed better than management expected at the time of the preliminary results in February 2021, with revenue 6% lower (4% in constant currency) than the comparative period in the last financial year…

- Aerospace still subdued (that’s understandable, due to the pandemic impacting airlines), recent order intake improving - more positive for H2

- Other parts of the business “started to see stronger demand”

- Adj operating profit in line with strong results last year - given that revenues are down 6%, then this suggests margins & costs have compensated for reduced revenues, which sounds encouraging

- Those are the key points, but more detail is provided in the RNS

- Diary date - 5 July 2021, for interim results, 6m to 31 May 2021

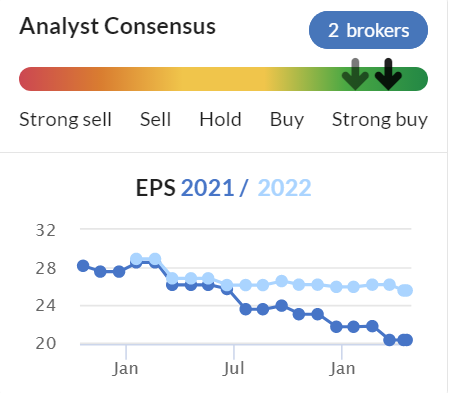

My opinion - the group has “performed better than management expected” - so is that an upgrade to full year expectations or not? Sounds like it could be. Note that broker expectations have been steadily declining for a while now, providing a softer target to beat -

.

.

That’s fine, as it’s due to factors outside their control, e.g. with so many aircraft grounded, it makes sense that PRV will be selling fewer specialised filters to airlines. Hence it’s reasonable to assume that should gradually recover once travel normalises, hopefully.

The problem I have with this, is that at the buoyant price of 580p per share, I’m being asked to pay up-front for a recovery in earnings from 20p to say 28p, when the PER would be nearly 21 times, if the company is successful in growing its earnings back from 20p forecast, to 28p in future.

Why would I want to pay in full, up-front for a recovery that’s only just starting? That just doesn’t make sense to me.

The StockRanks system aligns with my view - note below the highish quality score, but not impressing on either value, or momentum.

I do like the company, with good margins, in fairly lucrative niches, but there’s not enough growth, and the valuation is a bit too high for me.

.

.

Jack’s section

Warpaint (LON:W7L)

Share price: 113.5p (+5.09%)

Shares in issue: 76,749,125

Market cap: £87.1m

Warpaint London (LON:W7L) is a supplier of colour cosmetics that tend to be a bit more budget. You can find them in outlets like B&M although recent news flow has been about getting its ranges into Tesco. It owns the W7 and Technic brands.

This looked like one of the more interesting IPOs back in late 2016, helmed as it is by two savvy sounding ex market traders who remain the company’s largest shareholders (Sam Bazini and Eoin Macleod, with 25.34% apiece).

The company began selling excess and clearance cosmetics to high street retailers back in the ‘90s before introducing its own W7 cosmetic range a decade or so later. But profits after listing failed to impress and lacklustre UK growth and a tricky expansion into the US brought the share price crashing down.

But now the shares do look like reasonable value if it appears that the operations are turning around and a good growth opportunity remains going forward.

Warpaint is made up of two divisions. The largest sells own brand cosmetics under the lead brand names of W7 and Technic. W7 is sold in the UK primarily to retailers and internationally to local distributors or retail chains.

The Technic brand is sold in the UK and continental Europe with a significant focus on the gifting market, principally for high street retailers and supermarkets. In addition, this division supplies own brand white label cosmetics produced for several major high street retailers.

The group also sells cosmetics using our other own brand names of Man'stuff, Body Collection, Vintage, Very Vegan, and Chit Chat.

The other division trades in close-out and excess inventory of branded cosmetics and fragrances from around the world.

Trading update and notice of results

Trading in the second half of 2020 was stronger than previously anticipated and that improved trading has continued in the first quarter of 2021.

Sales for the first three months of 2021 are ahead of the same period in 2020, which was impacted by Covid-19 related lockdowns in its last few weeks. Product gross margin has also improved year-on-year.

Sales of W7 through Tesco stores in the UK continue to perform well, with Tesco stocking an additional 15 W7 product lines in over 600 Tesco Extra Stores and Supermarkets from the end of May 2021. The supermarket operator has also placed a Christmas order for delivery later in the year.

The USA operation has been restructured with the aim of increasing margin, reducing costs and building sales, and W7 products are now being stocked in over 1,000 Five Below stores here.

As part of its focused efforts on its e-commerce strategy Warpaint has worked on driving online sales via its own websites and has launched Amazon FBA (Fulfilment by Amazon) in the UK and USA.

The positive momentum in e-commerce sales achieved in 2020 has continued to accelerate in 2021 with a further launch onto Amazon EU planned to be implemented in the near future.

I remember when I first looked at this company, wishing they would have more of an online focus. So perhaps Warpaint is one of those businesses that will genuinely benefit longer term from the forced innovation required from many operators during Covid.

The company's net cash balances (net a small amount of hire purchase and other debt) as at 31 March 2021 totalled £5.2m, up from £3m the same time last year.

An update on the outlook for the remainder of 2021 will be provided with the release of the results for the year ended 31 December 2020.

Conclusion

There’s an investor webinar at 5:30pm on the 28th of April. If you want to attend, email warpaint@investor-focus.co.uk and submit questions to warpaint@investor-focus.co.uk.

All in all, this one is worth monitoring. Schroders upped its stake back in March and I would speculate that they only did so after closely watching their company operate through lockdown and after discussing future plans with management. I should stress that’s just speculation.

We can see that profits have really been hit, presumably by writedowns arising from the US expansion, but cash flows have remained resilient.

There’s a question mark around the quality and brand equity of the products. It wasn’t just the US expansion distracting management a couple of years ago - the group witnessed a softening in the UK market too.

You can find YouTube video reviews - the online Beauty scene is thriving, with many of YouTube’s top earners specialising in this niche, so there’s lots of content.

Lacklustre organic growth prompted the company to make a relatively large acquisition of Retra for c£16m back in FY16, which puts revenue progress since then in a less flattering light:

Things have gone wrong here in the past and capital allocation has been questionable. In fact it’s been pretty dire, with an alarming drop in returns on capital.

The founder-owners retain their large stakes in the business and continue to run Warpaint, so they are aligned with shareholders. Hopefully this becomes a story of lessons learned and profitable growth going forward.

RBG Holdings (LON:RBGP)

Share price: 132p (+10%)

Shares in issue: 85,592,106

Market cap: £113m

This professional services group has been on a heck of a run in 2021, with a three-month relative strength of some +73.2%.

It’s a professional services group and the jewel in the crown is leading dispute resolution provider RBL, but the company is busy adding other businesses to its collection.

Rbg Holdings (LON:RBGP) also provides litigation finance via LionFish Litigation Finance, which is ‘positioned to be a unique, alternative provider to the traditional litigation funders’, while Convex Capital is a specialist sell-side corporate finance boutique based in Manchester.

And today we see the addition of a more transaction-led business: Memery Crystal.

Full year results and acquisition of Memery Crystal

Highlights:

- Group revenue and gains on litigation assets up 8% to £25.6m (2019: £23.7m); of this, Professional Services revenue +12.6% to £22.4m and gains on litigation assets down £0.7m to £3.1m,

- EBITDA +8.5% to £10.2m, adjusted EBITDA of £7.5m (after adding back c£2m of depreciation and amortisation and subtracting £2.6m of non-underlying items),

- Profit before tax up from £7.6m to £7.7m,

- Net cash of £3.5m, up from £1.9m.

Rosenblatt revenue is up 15% to £20.9m, marking its ‘most successful year ever in terms of revenue’, with average revenue per fee earner up from £393k to £425.8k.

LionFish Litigation Finance launched in the period, with total cash deployed of £1.8m across seven cases and a total capital commitment of £4.9m.

Convex Capital significantly impacted by Covid but a recovery underway this year, with seven deals completed since 1 January generating revenue of £4.5m, and a pipeline of 33 details with six at various stages of completion.

And then we have the other big bit of news today: the post-period acquisition of Memery Crystal for a total consideration of £30m, which is expected to be ‘immediately, and materially, earnings and value-enhancing’.

This is a specialist international law firm, based in London, with 146 employees, including 29 partners, and an additional 66 fee earners. Its focus is on transactions, compared to RBL which makes most of its revenue from contentious law.

The total consideration for the acquisition is £30m (comprising £18.8m in cash and £11.2m in RBG shares). RBG has also extended its revolving credit facility to £15m and taken out acquisition finance totalling £10m.

For the year ending 30 April 2020, Memery Crystal reported revenue of £23.2m, profit of £8m, and had £7.3m of net assets. So it looks like a reasonable price on the face of it, and RBGP certainly sounds enthused about the potential.

Conclusion

If this is your area then RBGP continues to see consolidation opportunities in the UK legal sector and clearly has ambition. The execution so far looks impressive.

One point I would flag is the historically poor cash conversion (there are a couple of ways to calculate this, but you can quickly eyeball it in the Financial Summary by comparing the EPS line to the operating cash flow line).

This could be a feature of the business model and today’s results show an improvement in this ratio. But there are a couple of large lines in the cash flow statement that suggest cash generation could be lumpy going forwards, with significant swings in receivables, payables, and litigation assets.

Still, there’s more than enough here to mark this as a share of interest.

Margins and returns on capital are double digit, as are the profit and EPS compound annual growth rates (CAGRs). The forecast dividend yield of 3.39% is also good, and the group’s forecast PEG is just 0.7x.

RBGP will provide a live investor presentation on Investor Meet Company today at 10.30am. That could be a good introduction to the business and growth strategy.

It looks like the group is executing well and shares are up 10% this morning, so the strong run continues.

All done for today, enjoy the sunshine!

Best wishes, Paul & Jack.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.