Good morning, it's Paul and Jack here with the SCVR for Thursday.

Timing - we'll aim to be finished by 1pm. Quite busy for company updates today. Today's report is now finished.

Agenda -

Paul:

Somero Enterprises Inc (LON:SOM) - a very good update, with forecasts for FY 12/2021 raised 16% by Finncap. Looks cheap, for a high quality company.

Next (LON:NXT) - Q1 update. No section below, this is just to flag up that I've created a separate article here for Next's Q1 update, as we're trying to keep the SCVR focused just on small caps.

Superdry (LON:SDRY) - FY 04/2021 trading update, which cherry-picks positives, and doesn't tell us anything at all about profitability (or losses, rather). I'm impressed with online growth, and wholesale has done better than I expected. So a mixed bag overall.

Joules (LON:JOUL) - an intriguing announcement, saying that borrowing facilities with Barclays have been extended in time, and have been linked to ESG targets, which if met would trigger a lower interest rate. It's new to me, so thought I'd have a ponder.

Virgin Wines Uk (LON:VINO) - a positive update from this recently-floated direct-to-consumer wine merchant. A nice business, and I like management. But how much of the growth is from lockdowns & is it sustainable? I don't know.

Jack:

Gateley Holdings (LON:GTLY) - great update, trading materially ahead of consensus expectations with a clear strategy for growth going forward and a resumption of dividend payments.

Reach (LON:RCH) - digital transformation progresses and operating profit for the year now expected to be slightly ahead of market expectations

Bilby (LON:BILB) - net debt is coming down and improving financial health frees Bilby up to pursue growth opportunities, although operational costs increased due to lockdowns.

.

Paul's Section

Somero Enterprises Inc (LON:SOM)

(I hold)

422p - mkt cap £237m

Strength in US market driving healthy trading ahead of previous guidance

This is a smashing update, from AIM-listed Somero, which is headquartered in the USA, selling laser-guided concrete levelling equipment. It is used to make perfectly flat floors mainly for warehouses. This share has long been a favourite of ours here at the SCVR, producing prodigious cashflows, divis (including specials), with high margins, and high returns on capital. The shares always seem to languish behind other companies displaying high quality traits.

Today’s update covers the first 4 months of FY 12/2021. It looks very good, saying;

The Board is pleased to report that as a result of stronger than anticipated trading momentum in the US in the first four months of the year alongside signs of improving activity levels in Europe and Australia, it now expects to exceed previous guidance for FY 2021 established in the 10 March 2021 final FY 2020 results statement.

The Company's previous guidance for FY 2021 indicated revenues were expected to grow in the single mid-digit percentage range from the US$ 88.6m reported for FY 2020, adjusted EBITDA would grow modestly from the US$ 26.1m reported for FY 2020 and ending net cash would approximate US$ 27.4m. The Board now expects FY 2021 annual revenues will approximate US$ 100.0m, adjusted EBITDA will approximate US$ 31.0m, and a consequential improvement in the anticipated year end net cash position.

The StockReport is showing forecast revenues of $93.3m existing, so upgrading that to $100m is an impressive move coming well before the half year end. Could there be more to come later this year?

Broker update - Thanks to Finncap for publishing an update note this morning, which gives the more meaningful EPS forecasts (I find adj EBITDA fairly useless in valuing shares). This update shows:

FY 12/2021: forecast EPS raised from 34.5c to 39.9c, up nearly 16% - a sizeable increase in forecast. Converting into sterling, at £1 = $1.39, gives 28.7p.

At 422p per share, that’s a PER of 14.7 - which looks very cheap.

My opinion - I think this share justifies a PER of 20, which implies a target share price of 574p (upside of 36%). There could be more upside on that, as the rest of today’s update sounds positive about European markets opening up, new product launches, etc. Hence I suspect we might see more upgrades as 2021 progresses. Management tend to be prudent with guidance.

The macro picture seems very positive for SOM, with lots of infrastructure spending, and huge QE/deficit fuelled Govt stimulus means we probably have several years of boom times coming. What happens after that, who knows? Inflation becoming more of a problem, maybe, but we can worry about that later. For now, SOM is one of many companies reporting strong updates, which generally justify the big rise in share prices we’ve seen in the last 6 months. In this case, I think SOM shares could have further to run - the improving fundamentals justify it.

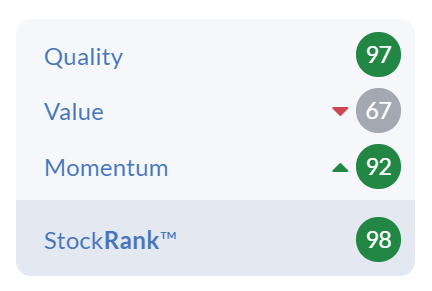

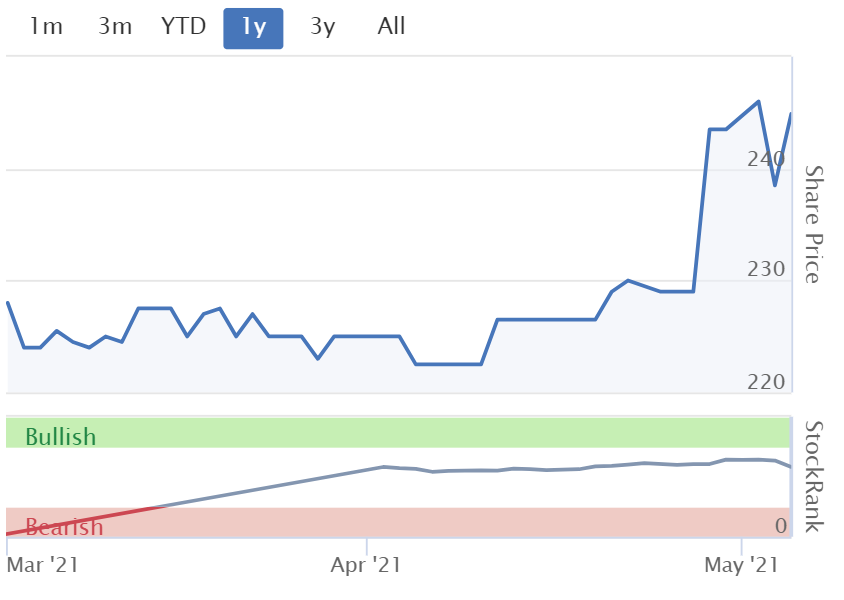

Note below how the StockRank has been on maximum for the last year!

.

.

It's categorised by Stockopedia as a "Super Stock".

Note also that, when the upgraded broker forecasts come through, the value score below should rise further.

.

Superdry (LON:SDRY)

326p (up 18% today, at 10:16) - mkt cap £267m

Superdry announces a trading update covering the 52-week period from 26 April 2020 to 24 April 2021 ("FY21").

Returned to revenue growth in Q4. However, remember that the Q4 last year comparative was hit hard by lockdown 1, from 23 March 2020 closure of all non-essential shops. Hence beating that comparative is not quite as good as it sounds - although physical shops were closed for almost all of Q4 in 2021. Comparisons are difficult. Maybe it would have been better to use comparatives from 2 years ago, as Next has done?

Online sales are growing nicely - this is a key thing I look for, as retailers have to be able to demonstrate a successful shift to selling online, to be investable, in my opinion. In FY 04/2021, SDRY sold £203m online, up 34% on last year, and that’s 36% of the total sales - starting to look interesting!

Gross margin - SDRY is trying to sell at full price, instead of discounting. It says this was successful in Q4 -

… our commitment to a full price stance over the period has seen significant online margin improvement.

That’s encouraging, but remember that retailers don’t price discount product because they want to, they drop prices because they have to, to shift slow-selling lines. Therefore, we need to see strong sales, combined with strong margins. Otherwise, everything not sold is just dumped into the end of season sale at half price, in July. Therefore, sticking to full price at this stage could just be deferring the gross margin problem. Time will tell on that. I tend to find that SDRY announcements are full of upbeat comments, and aspirations, but with not much concrete evidence that the business has actually turned around.

Remember it was struggling, and trading around breakeven, before the pandemic struck, so it’s got a mountain to climb to get anywhere near being a profitable business again.

Liquidity - good, but what about all the deferred creditors, such as VAT, etc? It's curiously silent on that important point.

Our liquidity remains strong, with closing net cash ahead of last year and our facilities remain undrawn.

Re-opening - going well, but no figures provided -

The early signs following the reopening of our UK stores are encouraging, as lockdown restrictions start to lift, and we can clearly see the light at the end of the tunnel. In short, we are on track with our reset of the brand and there's a lot to look forward to."

Rents/leases - this is the biggest issue - it’s locked into a load of flagship, big rent stores. Some have been renegotiated, and big reductions in rents, but what about all the others?

Renegotiated a further 48 leases (~1/5 of the estate) in FY21 achieving a weighted average saving of 52% (65 lease negotiations have now been completed in total), in addition to substantial one-off Covid-related rent waivers.

We’ll have to wait until the actual results come through, to properly assess the situation. For all my criticisms of it, IFRS 16 does have some use when looking at struggling retailers, to see the extent of the leasehold commitments. Its big failing though, is that IFRS 16 doesn’t distinguish between lease commitments on profitable and loss-making shops, which is what actually matters! A lease is only a problem if you’re trading at a loss from that site. If it’s trading profitably, then the future lease liabilities don’t matter.

Wholesale - this is better than I was expecting -

Positive signs are being seen across Wholesale, with in-season orders up 142% and SS21 forward orders up 10% in Q4 year-on-year, both driving an overall increase in Q4 21 which is up 13.5% year-on-year.

Cash collection has tracked ahead of expectations, making a significant contribution to year-end net cash.

Wholesale FY21 revenue was down (19.9)% year-on-year, with our partners suffering the same headwinds in physical trading locations and carrying forward higher levels of stock than normal.

Outlook - no figures given, so investors are in the dark about the current level of trading losses. SDRY left wildly inaccurate forecasts in the market for a long time. I reckon it’s heavily loss-making at the moment, because it didn’t make any money before the pandemic -

There remains significant uncertainty given the varying impacts of the pandemic in our markets particularly to the trajectory and phasing of the consumer recovery. However, we are confident of growth in FY22 revenue and profitability compared to FY21 assuming no further material national store lockdowns and a continuing recovery in footfall and consumer demand through the period.

Profitability will be supported by higher gross margins from our restored full price discipline and positive operating leverage from reduced store costs, partially offset by the end of government support and our ongoing brand marketing investment.

My opinion - mixed. First the positives - I’m impressed with the growth online, and wholesale has fared better than I expected. Liquidity is OK for now, but we’re not told what all the backed-up creditors are, which is crucial information omitted from this update.

Negatives - SDRY was struggling before the pandemic, with its highly profitable glory days well behind it. Big-rented flagship stores remain a millstone, although some progress is being made on renegotiations. Again, we’re only told the positives, not the full picture. SDRY updates do read as mainly PR material, not giving any indication of overall profitability, or the true underlying liabilities. They can’t hide these points when the full year numbers come out, so there's a good case for investors banking the profits before the numbers are published, as I reckon they’ll probably not look very nice.

Checking the last (interims) balance sheet again, it looks to me as if there’s too much in inventories, and maybe some provisions for bad debts might be needed against the large receivables book?

Lease liabilities are horrendous, at nearly £300m, with only £111m in right of use assets, showing the key importance of getting out of those leases, wherever possible. That could takes years, and be very expensive, and is likely to be a dead-weight on this company for years to come.

Overall, I think the company is right to say that there’s light at the end of the tunnel. My assessment is that it looks unlikely to go bust, and has managed so far without having to dilute shareholders at all. That could come later though, as once everything’s back to normal, and creditors have to be paid, new stock bought, etc, then the cash pile and borrowing facilities are going to be needed.

It’s been a good trade so far, on survival & hopes for re-opening, but I think there’s still a lot to be proven about the long-term fundamentals, which remain weak, in my opinion. Let’s see what the actual numbers look like when they’re published. Today’s PR release is really just edited highlights, carefully avoiding mentioning anything about liabilities, or losses. Compare this with the Q1 update from Next (LON:NXT) today - it’s like chalk & cheese.

Still, in a bull market, when everything's going up, do fundamentals matter? Not at the moment they don't! That comes later.

.

.

Joules (LON:JOUL)

(I hold)

240p (up 1.5% today, at 12:44) - mkt cap £266m

Joules establishes ESG-linked financing facility

This is such an unusual announcement (first time I’ve heard of it), that I have to look into this.

Joules, the premium British lifestyle brand, is pleased to announce that it has extended its current funding arrangements with Barclays Bank Plc ("Barclays"), that include a £25 million revolving credit facility and £9 million term loan, to September 2024, and has converted the facility to an ESG-linked financing arrangement.

The new financing agreement links the margin on the facility with Joules' performance against three Sustainability Performance Targets (SPTs) that are aligned with Joules' ESG focus areas. Under the terms of the agreement, Joules will benefit from a lower interest rate loan margin if the Group delivers on the following targets:

- reducing its carbon emission intensity;

- delivering 100% more sustainable materials in the manufacturing of its products; and,

- increasing its employee engagement score

The details of the targets and progress against them will be reported alongside the publication of the Group's annual results and its Responsibly Joules update each year.

I don’t know enough about this to form a view on it. Instinctively, I’m uneasy about bank facilities being linked in any way to ESG. Taken to an extreme, could this give banks an excuse to withdraw borrowing facilities, using ESG as a smokescreen, if a company were to get into trouble?

That said, this could be an initiative launched by Barclays, which offers better interest rates than regular lending, in which case it could be a nice way for Joules to save some money, and implement useful ESG policies.

I’m all for ESG generally speaking, and think it’s great that companies are getting serious about these topics. Although it does seem to be almost becoming something of a mania at the moment, with everybody desperate to prove their ESG credentials. I do wonder how much of it is sincere and meaningful, as opposed to, oh this is what we have to say, and pretend to care about?

In the case of Joules, it’s very much a middle-class, outdoorsy type of brand, where customers virtue signalling about their green credentials is almost socially mandatory! (ignoring the gas-guzzling SUV of course). Whereas the BOO customer clearly doesn’t care two hoots about ESG (as evidenced by record results, despite a media feeding frenzy over its supply chain problems), the Joules customer I think would be very receptive to a meaningful ESG strategy. Therefore this is probably a good thing for JOUL shareholders, as it may well enhance the business over time. And do good, so everyone should be happy.

I’ve googled Barclays, and found plenty of stuff on its website about green lending, but I can’t find anything specific about ESG-related borrowing facilities. If anyone has a link, please do post it in the comments, as this looks an interesting area.

.

Virgin Wines Uk (LON:VINO)

245p (up 3%, at 12:53) - mkt cap £137m

This direct-to-consumer wine delivery company floated recently. I had a look at it here on 16 Feb 2021, delving into the company’s history from filed accounts at Companies House. What I discovered is that it historically made very little profit, compared with the bumper profits achieved during lockdown in 2020. Hence I think it looks like an opportunistic float, on the back of bonanza profits which may not be sustainable, perhaps?

More recently, on 26 March 2021, VINO held a webinar on InvestorMeetCompany, which I tuned into, and enjoyed. Management struck me as exactly what I look for - hands on entrepreneurs, who know their sector well, with plenty of experience. Also it particularly struck me how open & honest they were in the Q&A, including the CEO reading out word-for-word a moderately inflammatory question that I had submitted! The CFO replied, in a slightly prickly way, rejecting my assertion that the business is making one-off profits from lockdown.

Who knows though, time will tell, maybe VINO has won new customers in lockdown who will remain loyal? It is handy having wines delivered, as they’re quite bulky & heavy to buy from supermarkets in quantity. Of course I’ve sampled the range too, with a selection of 12 bottles, and they were fairly good actually, as far as I can remember. As with Naked Wines, they offer a generous discount to attract new customers. So it’s really all about customer lifetime value, versus cost of acquisition.

This diagram from the Admission Document seems to show good repeat orders from each year’s cohort of new customers -

.

On to today’s news from VINO -

FY21 sales and EBITDA ahead of expectations. Strong customer demand continues.

Virgin Wines UK plc (AIM: VINO), one of the UK's largest direct-to-consumer online wine retailers, today provides an update on trading to date for the year ending 30 June 2021 ("FY21").

The Board is pleased to announce that the strong levels of customer demand experienced in the first half of the Company's financial year have been maintained in the second half of FY21 so far [benefiting from pleasing order frequency among existing customers and good levels of new customer acquisitions]. As a result of the continued strong performance, the Board anticipates revenue and profitability for FY21 will be ahead of its previous expectations, with turnover for the year expected to be no less than £73m and an improvement in EBITDA margin.

Whilst remaining mindful of the potential impact from the easing of lockdown restrictions on consumer spending patterns over the coming months, the Board remains confident that the underlying growth drivers, which the DTC wine sector is experiencing, alongside the accelerated shift in consumer behaviour towards online retailing, will continue. Against this backdrop, the Board is confident that Virgin Wines, underpinned by its unique customer proposition and growing, subscription-weighted customer base, remains well positioned to continue to deliver its growth strategy and meet the Board's expectations for FY22.

It’s a bit vague on the numbers. I would have preferred more specific guidance on profit before tax (not bloody EBITDA!). Still, I suppose we could work out the numbers.

Taken from the Admission Document;

H1 (6m to 31 Dec 2020) revenues £40.6m, EBITDA £4.5m

Therefore “at least £73m” for the FY 06/2021, implies that revenues fell from H1 to H2, to c.£33m. Maybe that’s because H1 includes Christmas, and people were busy getting tipsy at home, due to not being allowed to go out to parties & pubs?

H1 saw EBITDA of £4.5m. It’s not clear from today’s update what they mean by an improved EBITDA margin? Since they don’t tell us what the original expectation was.

Putting that together, my guess is that the company is probably heading for £7-8m EBITDA for FY 06/2021, a year which would have been helped a fair bit from lockdowns. Checking through historic accounts, VINO has very little in fixed assets, so the depreciation & amortisation charges are only about £0.7m pa, and the IPO should have wiped out its debt, so finance charges won’t be much, therefore I think profit before tax could be something like £6-7m for FY 06/2021?

What a waste of time, having to plough through the admission document to work out what real profits are, because they only report EBITDA today. When are companies & advisers going to listen, and provide full information, instead of just EBITDA, in their trading updates?

EDIT: I've just found an update from Liberum, many thanks to them for making it available for us on Research Tree. Analyst Wayne Brown estimates £6.3m EBITDA, and £5.0m PBT, so it looks like my guesses above could be too optimistic. This translates into 9.0 EPS (diluted) of 9.0p. At 245p per share, the current year PER is 27.2 - a valuation that seems a bit toppy to me. End of edit.

My opinion - I’m really warming to this share, and reckon it looks pretty good.

The current valuation looks about right to me, or possibly a little toppy - it depends if earnings growth continues in future years, or not.

This is quite a competitive space, with Naked Wines (LON:WINE) to consider, plus Laithwaites and The Wine Club being larger competitors. Plus of course huge competition from the online supermarkets.

.

.

On balance, I like VINO, but don’t think the current growth rate looks sustainable. For that reason, I’ll sit on the sidelines and watch what happens next.

.

.

Jack’s section

Gateley (LON:GTLY)

Share price: 186.5p (pre-open)

Shares in issue: 117,888,007

Market cap: £219.9m

A short but sweet ‘materially ahead’ update from legal and professional services group Gateley Holdings (LON:GTLY) today.

The group is predominantly legal services through Gateley Legal (currently 90% of revenue) advising over 5,000 clients across five core business groups including Corporate, Banking and Financial Services, Property, Business Services and Employment, Pensions and Benefits.

Its origins can be traced back to the 19th Century when the commercial law firm of Stephen Gateley & Sons was established in Birmingham. The family firm grew its business across the surrounding region before merging with Wareing in 1974.

It listed in 2015 following changes to the law in England and Wales to adopt an Alternative Business Structure (ABS), allowing non-lawyers to own and invest in law firms.

As with Rbg Holdings (LON:RBGP) , the company is busy adding complementary businesses to its network. Since the 2015 IPO, the group has acquired:

- Capitus and Hamer Associates in 2016,

- GCL Solicitors, Kiddy & Partners, and International Investment Services in 2018,

- Persona Associates and T-Three in 2019, and

- Paul Tweed and The Vinden Partnership in 2020.

Gateley has built up a 12.5% compound annual revenue growth rate over that time, although profit and cash generation have been more mixed.

The group has also attracted a couple of institutional names, including Liontrust, which is now its biggest shareholder at 10.24%.

On the back of today’s update, it looks like this roll up strategy is working well.

Following a strong end to the financial year, revenue in FY21 is expected to be materially ahead of consensus market expectations.

Consensus market expectations, per the company, are revenue of £111.7m, adjusted profit before tax (PBT) of £14.7m and net cash of £8.4m.

Profitability is expected to be more significantly ahead of consensus market expectations with a cash position at 30 April 2021 substantially ahead of consensus market expectations.

Dividend payments are recommencing, with a policy of distributing up to 70% of profit after tax (PAT). An interim dividend payment of 2.5p will be made and a more detailed trading statement will be announced later this month.

Conclusion

This is a good update and the company is worth investigating in more detail.

Law changes made in 2015 have unshackled the group and it is now consolidating the market and building out its services platform at pace.

Directors have been selling a lot of shares though. I can’t begrudge successful business owners for wanting to realise some of the value they have helped to create over the years, but the scale and frequency of selling is notable.

Davies and Ward on the Major Shareholders page are group COO and executive director, with a combined c3.5% of the company.

The balance sheet looks ok, but for such an acquisitive company I would want more of a cash buffer. The vast majority of current assets are accounts receivable… £54.6m of current assets, £48.7m of which is accounts receivable (as of FY20). Net plant, property & equipment of £24.8m, plus about £18m in goodwill and intangibles.

Against that we have £26.6m of current liabilities £29.3m of ‘debt’ (mostly in fact £22.1m of capital lease obligations) and some other smaller line items taking total liabilities up to £53.7m.

I suppose that gives some scope to continue executing on its strategy. But compare it to Judges Scientific (LON:JDG) for example. This is the gold standard in frequent acquisitions, and probably acquires more resilient and higher quality businesses with less key person risk.

As of FY20, JDG had about 19% of total assets in cash (£15.5m/£82m). Gateley on the other hand had 3% of assets in cash (£2.92m/£98.5m).

A large receivables balance is probably par for the course given the business model. And the group is cash generative. It also uses this cash gen to pay out healthy dividends in more normal conditions - 8p in FY19, which would be a yield of 4.3% at this morning’s share price.

Gately offers middling value for now, but the outlook is very good and it looks like there’s a clear catalyst and related strategy for growth, so it’s a growth-at-a-reasonable-price (GARP) candidate.

The legal and services sector in general appears to be doing very well at the minute.

Reach (LON:RCH)

Share price: 221p (+0.45%)

Shares in issue: 312,067,649

Market cap: £690m

(I hold)

Reach (LON:RCH) is midway through an important transformation. It is pivoting from the structurally challenged Print newspaper industry and is re-focusing on Digital Advertising. And it has a lot of digital assets, mostly in the form of regional news titles (see here).

Reach gets a lot of traffic through these sites but until recently had not made a great effort to monetize this traffic or harness the data in any meaningful way. Now it is working to improve customer engagement online and create a more informed impression of its readers. This is more valuable to advertisers as it paves the way for more targeted and optimised advertising spend.

The company was very cheap when pitched to the Investment Club. It has since rerated and is now consolidating, so the emphasis is less on whether Reach is a viable business and more on how much growth it can unlock via this shift to digital.

Trading update for the four months to 25 April 2021

Good start to the year with digital and print revenue performing slightly ahead of our expectations

- Continued growth in registrations; now at 6.2m, versus 5.8m reported at the beginning of March (target is 10m by the end of 2022),

- Customer Value Strategy progressing well with continued increase in loyalty and engagement,

- High level of interest from brands in new 'plus' portfolio of products; building strong pipeline for H2,

- Transformation programme efficiencies and digital mix support growth in operating margin.

Q1 print revenue was down 15.2% year-on-year and digital revenue was up 25.2%. Group revenue fell 8.7%. The mix marks a deceleration in print decline and an improving pace in digital, which is probably what is priced into the shares right now. Soft comps due to lockdowns last year should also be factored in.

Customer engagement has continued to grow and will be supported by increased strategic investment in data and analytics, including a focus on customer journey mapping to help drive average revenue per user.

The business is also benefiting from the efficiencies driven by last year's transformation programme, which together with a growing mix of digital revenues, means that operating profit for the year is now expected to be slightly ahead of market expectations (of adjusted operating profit of £137.1m for 2021).

Conclusion

Digital now accounts for more of Reach’s advertising revenues than print. It’s a bit of a symbolic milestone.

There is sometimes a lack of financial data in Reach’s updates though. It’s not required to go into great detail here but, given the market uncertainty around its transformation plan, it would be appreciated. Perhaps that is behind the static share price today - you’re unlikely to change your position on this stock based on the words in this trading update alone.

Either you think there’s potential here or you remain skeptical.

This is an interesting turnaround situation with an unusual opportunity. The group’s declining legacy business in fact gives it a solid, cash-generative base from which it can execute its digital strategy, based on what is a deep portfolio of potentially valuable local news sites.

But there are risks too. The group has accumulated several pensions and the deficit here is around £255m. Meanwhile, there is no guarantee that the group’s transformation strategy ends up being as profitable as investors are hoping for.

How will a fully transformed, digital Reach fit into an evolving online ecosystem dominated by a couple of large tech players like Facebook?

Whatever your thoughts on that point, the management team here is executing with digital ad revenue now exceeding print for the first time, and promising initiatives like ReachID that will be applied to a large and previously untapped readership.

Margins will rise as this transition progresses. And Reach is still far from expensive even after the rerate, trading on a forecast PE ratio of just 6.3x with a useful forecast yield of 3.28%. As ever though, DYOR.

Bilby (LON:BILB)

Share price: 37.2p (+0.54%)

Shares in issue: 61,214,703

Market cap: £22.8m

Bilby (LON:BILB) is a leading gas heating, electrical and building services provider.

The share price here became too cheap over the lockdowns and this has since been recognised by the market, with the stock rerating by 50% or so over the past few months.

But if you take a longer term view, the chart suggests further turnaround potential.

Shares in issue have gone up by about 50% over this period, too. But even accounting for that a full recovery to previous levels would be a share price of about 77p or more than 100% upside.

The group has managed to grow revenue in recent years, but profit margins have been an issue. The new management team (led by David Bullen) is more focused on winning profitable contracts at good margins.

And, with trailing twelve month revenue of £59m, a market cap of £22m for this company really isn’t that demanding if it can execute. I think it’s worth keeping tabs on.

Bilby delivered essential, regulation-driven maintenance and building services for its clients, through the lockdowns. It expects to report a ‘solid’ performance for the financial year and a ‘strong’ performance in the second half, with FY21 revenues of c£60m

However, margins were affected by higher operational costs arising from the increased no access rates and mix of works resulting from Covid disruption.

Therefore adjusted EBITDA for the full year is expected to be c£3m. The group is seeing signs of more ‘normal’ trading activity in the new year.

Net debt reduction remains a priority and Bilby is focused on working capital efficiencies, cash conversion, and cost management. This has enabled Bilby to repay an additional £2.3m of its term loan.

Over the last 18 months, net debt has fallen by £8.4m to £2.7m as at 31 March 2021. There is a £1m VAT liability to take into account as well, and this is now being paid.

Bilby says the strengthened balance sheet is allowing it to seek future growth opportunities.

Full Year Results will be announced in early July 2021.

Conclusion

This is a solid update and I think there is decent growth potential at current levels.

Net debt is coming down. This paves the way for dividend payments and is opening up doors in terms of opportunities.

The group has operated through the lockdowns and so has been less disrupted than others.

Things did go wrong at Bilby though, and they can go wrong again. What I would say is that it looks like the new management team appears to have a good handle on the mistakes that were made (going after too many low margin contracts in the pursuit of top line growth) and the company has a fair chance of improving its financial health and increasing its profits in the year ahead.

On that note, this is the kind of cyclical value trade I would hope to spend a little more time on.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.