Good morning! It's very quiet for results today, so I'll have a ramble about something else - the Scottish Independence vote. Putting aside the politics of it, which would not be appropriate for me to comment on here, it's the potential impact on the markets which worries me. With the latest poll at 47% Yes, and 53% No, it's now looking very close, and the Yes campaigners seem to have momentum, and to be successfully convincing many voters through a mixture of emotion and highly questionable economics, that a Yes vote will be economically beneficial for Scotland. Whereas it seems to me the consequences would be potentially catastrophic. Sadly the main flaw with democracy is that you are asking people to make a decision on things that very few properly understand.

In all likelihood an independent Scottish Govt would massively over-spend, and would eventually default on its debt. So existing holders of UK Gilts are now facing the possibility that their Gilts might perhaps be split into an English part (which should remain pretty solid), and a Scottish part which would inevitably be regarded as far more risky, and could eventually default - bearing in mind that the oil tax revenues are not reliable, and are declining. Why would anyone who bought UK Gilts want to hold Scottish debt? So a run on UK Gilts could easily happen. A run on sterling might also happen - what if UK base rates have to be hiked up to (say) 5% (or more) in order to stem the capital outflows? It would plunge us into a horrendous Recession.

There would be years of uncertainty, which markets hate, as hundreds of years of laws & commercial relationships are unpicked & replaced. It seems to me complete madness to be doing this at a time when the UK is still running a gigantic annual budget deficit, and is dependent on ultra-low interest rates for a recovery. Why put that at risk? Whoever had the idea to do this Referendum now needs to be pensioned off before they can do any more damage!

Even if there is a No vote, if it's close (as seems likely) then the Union will be holed beneath the waterline, and without a convincing vote of popular support, markets will surely realise that it's only a matter of time before the Union eventually breaks up.

Trouble is, I don't want to adjust my shares portfolio, as the bid/offer spread can be 3%+ on small caps, so to sell now, then buy back after this vote would be very expensive. Hence why I've decided to buy some Put Options on the FTSE 100, as insurance. I don't hedge my long term positions, but I do sometimes hedge my short term, geared portfolio, which is what I've done now. Options are a horribly expensive way to insure a portfolio, as they nearly always expire worthless, and the time decay is extremely depressing, as you see the losses mount on an hour by hour basis. However, where there is a specific and potentially catastrophic risk on a certain date, as in this case, then it seems to me that situation is what Put Options are ideal for.

I'd be interested in readers views about the economic risks, but let's try to avoid getting sucked into the political stuff, as I discovered on Twitter it's a black hole for time, and nobody changes anyone else's mind anyway.

I don't want to sound alarmist, but the potential risks here are starting to worry me considerably. When people have a yearning for freedom, common sense about practical issues goes out the window, which is understandable in some ways. I'm sure we'll muddle through one way or another, but this could be very disruptive for the markets.

Tasty (LON:TAST)

Share price: 104p

No. shares: 52.9m

Market Cap: £55.0m

Interim results for the 26 weeks to 29 Jun 2014 are out this morning, and look quite good. It's a small restaurant chain, so assessing the shares is just a question of working out whether it has roll-out potential to expand to a lot more sites?

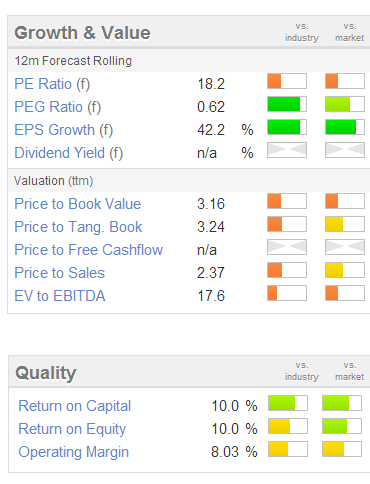

Profitability - it's harder for a small chain to make a decent profit, as they have fewer sites to absorb the central overheads than bigger groups. So in this case I'm impressed with the 8.8% operating profit margin (£1.2m adjusted operating profit) generated on £13.8m turnover in H1.

Turnover is up 25.6% against H1 last year, although adjusted profit is only up 15.8%, which concerns me a little, as the operating margin should be going up as the company expands, not coming down. Although this might be the impact of new sites trading below par in their early days, possibly?

Roll-out potential - I don't have a view on the restaurants themselves (called "Wildwood" mainly), as I've never been to one. However, if you can make an 8.8% profit margin, then the format clearly works, and has roll-out potential. Therefore this is a stock I will consider investing in, if it can be bought at the right price.

Interestingly, looking at the company's Bal Sheet and cashflow, I reckon it is already generating enough cash to self-fund its roll out, at the current rather pedestrian pace. More funding would only be needed if they decide to accelerate the roll-out of new sites.

Valuation - trouble is, the price is high. Broker forecasts look realistic for this year & next, which put the company on a PER of 23 times 2014 earnings, and 16.5 times 2015 earnings. That's not outrageous, but it's about the right price for where the company is currently, in my opinion. Although if they carry on opening new sites, and assuming they all trade well, then I could see these shares going higher next year as the market factors in 2016 earnings increases. That's the beauty of retail roll-outs - they generate their own growth, which snowballs, providing nothing goes wrong of course.

My opinion - I like this stock, but it looks fully priced to me as things stand right now. However, it's going on my watch list as the sort of share that I'd probably buy on a market sell-off, but I'd want it a good bit cheaper than the current price in order to make risk:reward stack up for me personally.

I'm surprised that it only scores 37 on the StockRank system.

The roll-out potential comes through from the graphical history below, but also note that there's no dividend yet, and that profit seemed to almost flat line for the last three years, despite increasing turnover, which is worrying me a little. That suggests to me maybe the restaurant format may not work everywhere?

As a former retailing FD myself, I'd like to meet management of this company & discuss the company & their plans.

EDIT: Sorry to contradict myself, but after pondering this some more & doing a bit more digging, I've decided to buy a small opening stake in this company. The shares are not cheap, but a roll-out never is. Also, as a reader commented in the comments below, it's much better value than CRAW, which is another retail roll-out that the market has got very excited about recently, so on balance I changed my mind & decided to just pay up for a small opening position. I can always buy more if there are any future dips in price.

As usual, I'm NOT giving any recommendations here, this is personal opinion only. I just feel that where I change my mind & buy a bit of stock in something, then readers should be told, even if that doesn't make for a terribly logical flow in this article! What probably tipped the balance for me was the reader comments, where someone pointed out that the Kaye family are behind this stock. I did very well on Prezzo, which I think they were also behind, and on looking at Wildwood's menu, it's very much repeating the same format - although I am a bit concerned that the menu on their website looks terribly unimaginative. I think they may need to revamp the format somewhat & bring in some more interesting menu choices.

Trakm8 Holdings (LON:TRAK) - This telematics company seems to be going from strength to strength, which has been reflected in its share price. The AGM trading update today reads well, with some positive detail about strong organic growth, as well as a contribution from the acquired company called BOX. The summary says;

The Board is confident that, with this good start to the current financial year, the Group is on course to achieve expectations for the year as a whole.

Interestingly though, the shares still look quite good value - broker consensus is for 5.7p EPS this year (ending 31 Mar 2015), so the PER is 13.8 times at the current share price of 78.5p. That doesn't look demanding for a growth company in my view. Watch out for capitalised development spend here though, which flatters the reported profit quite a bit.

Empresaria (LON:EMR)

Share price: 49p

No. shares: 44.6m

Market Cap: £21.9m

This is a relatively small recruitment company. An astute friend told me this one is worth a look, but previously when I've reported on it here the Balance Sheet put me off. I reported on an in line with expectations trading update on 22 May 2014, then on 11 Mar 2014 I reported in much more detail about what I don't like about the company's Balance Sheet - namely that it under-reports net debt by offsetting non-recourse invoice financing against the debtor book.

Interim results to 30 Jun 2014 have been published today. The headline figures look OK, and note the significant impact that currency movements have had - which could reverse a bit in H2, as sterling has depreciated somewhat in recent days, although the main drop recently in sterling seems to have been against the dollar, not particularly the euro, so I doubt the impact on this company will be much.

Profitability - adjusted operating profit rose 20% (despite the currency headwind) to £2.4m in H1, which looks a good result to me. That's 2.2p EPS for the half year.

Outlook - this sounds positive;

Despite currency headwinds we see exciting growth opportunities ahead and are confident in our ability to deliver profit growth over the next few years. Based on performance to date, we are confident that earnings for the full year will be in line with market expectations and look forward to delivering further growth.

Valuation - it looks superficially cheap on a PER basis, with 6.4p EPS forecast for this year, that means the PER is low, at 7.7 times. However, once you factor in the debt, it's not so cheap.

Net debt - the company reports today that net debt fell 27% to £6.5m. I don't accept this figure. Total debt was actually £14.2m, which is the figure I would use to calculate the enterprise value. That's nearly 32p per share, so it's a very material item. The PER would go up considerably, into the low teens if you adjust out this debt, hence in my view the shares are probably priced about right at the moment.

My opinion - The dividend yield is miniscule here, below 1%, which reflects the fact that the Balance Sheet is not in a great shape - net tangible assets are slightly negative at £0.8m. I continue to dislike the company's policy of offsetting non-recourse invoice discounting against debtors, as that hides additional debt in my view. Once that additional debt is factored in, the valuation looks about right. So for me, I'd rather look at other recruiters with better balance sheets & dividend yields, which in the round might actually be cheaper than this. My current favourite (on valuation grounds) is Impellam (LON:IPEL).

That's it for today. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in TAST & IPEL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.