Good morning! The futures have rebounded quite strongly overnight, so the mood of despair, even slight panic that seemed to be setting in yesterday should abate today. It will be interesting to see which stocks rebound the most this morning - as that will show where the pent-up buying interest is.

I'm glad to have made it to the weekend without another profit warning anyway - although I suppose there's still time...

Avon Rubber (LON:AVON)

Share price: 654p

No. shares: 31.0m

Market Cap: £202.7m

Trading update - all trading statements should be presented like this - i.e. summary of the key points in the first paragraph, then more detail below - that way readers can instantly ascertain how to interpret the information, without having to wade through a load of positives & negatives, wondering what the conclusion is.

So the key first paragraph says;

Avon is pleased to report that trading in the second half of the financial year has continued to be strong. Currency headwinds have also reduced since the trading update made on 5 August 2014. The Board therefore expects that the full year result will be comfortably ahead of current market expectations.

The year end of 30 Sep 2014 has just passed, so barring any audit adjustments, they should know pretty much where they are.

Valuation - broker estimates at the moment are for 37.6p EPS, so "comfortably ahead" might mean about 10% perhaps? So the ballpark is probably 40-42p at a guess? That puts it on a PER of between 15.6 and 16.4, which is a fairly standard middle of the road price for a company of this size & type.

Checking my previous notes from nearly a year ago, I see that there is a relatively small pension deficit here that potential investors would need to check. It's always worth checking the last Annual Report (near the back of the notes usually) to ensure that the Balance Sheet deficit is not the tip of the iceberg, which it can be with some companies.

Another issue to check is that last year the company capitalised £4.7m costs into intangible assets. This boosts profits of course, so if it is done aggressively, it can lead to investors over-valuing the company (i.e. valuing it on a multiple of inflated profits).

Outlook - nothing is said today about the outlook, so I suppose commentary on that will come with the results which are being announced on 19 Nov 2014.

My opinion - this company seems to be performing well, and looks priced about right. As with most companies, the crux is to dig into the business model, and try to ascertain what the company's future prospects are like. This type of company can be heavily dependent on large individual orders, which could dry up at any point, so drilling down into forward order visibility is probably the most important consideration.

It's been a spectacularly good investment since the depths of the financial crisis though - check out this long term chart. The price looks up with events now though;

Currency headwinds

A few months ago lots of companies warned on profits due to currency headwinds caused by the strength of sterling against the dollar. I wish I'd made a list now, as there could be an opportunity now to buy stocks that were beaten down due to currency issues, and could now be recovering - because there has been a fairly dramatic reversal in sterling:dollar since July - see the chart below courtesy of IG, which covers Feb 2013 to Oct 2014;

Avon Rubber is the first company I've seen that has specifically mentioned that currency headwinds are now easing, although that should be obvious just from looking at recent exchange rate movements.

There should be opportunities to anticipate better trading from some companies which had issues earlier this year with currency conversion, now that this factor has reversed fast, hence why I'm flagging it up here for readers to ponder.

It's mainly the Sterling:Dollar rate that has moved recently - i.e. sterling has weakened against the dollar since Jul 2014. So opportunities are going to be bunched in companies which report in sterling but make a lot of their profits in the USA, e.g. £FOUR - their US profits will now translate into a higher sterling figure.

Other companies that should benefit from recent dollar strength are companies which generate their gross profit mainly in dollars, e.g. Indigovision (LON:IND), and UK exporters (since the weaker pound makes dollar denominated sales overseas more competitive & hence more profitable for UK companies).

Currency hedging needs to be taken into account too, since this negates, or at least defers the impact of currency movements, depending on if, and how much hedging a company does. It might all be too complicated & unpredictable to work out the various moving parts - I tend to ignore currency movements for my long-term holdings, since it's swings & roundabouts, and companies will take action where necessary to remedy any problems caused by currency movements.

The main losers from the stronger dollar will be UK importers - because an item that is bought overseas at a cost of $1.70 would have cost £1 a few months ago, but will now cost about £1.06, thus meaning that the UK retailer of this imported product now has to either raise the UK selling price to compensate for the higher cost, or absorb the 6p cost increase through a slimmer profit margin.

So especially non-food retailers are likely to be hit by this, where most production is bought in the Far East and invoiced in US dollars. Although retailers forward plan their buying, so can mitigate this kind of thing.

easyJet (LON:EZJ)

It's not a small cap, but it's worth mentioning today's upbeat trading statement from this airline, since it could have read-across for Flybe (LON:FLYB) and Dart (LON:DTG).

Full year profit guidance - at Easyjet has been raised from £545-570m to £575-580m. Important to note this is not a broker upgrade, it's the company itself raising guidance. Which begs the question, if Easyjet and other large caps, such as Next, can give profit guidance to the market (usually done by giving a range, that narrows as the year end approaches), why on earth can't this become widespread practice for all Listed companies?

Companies, even small ones, will have spreadsheets internally where they forecast and plan their own performance. They should have a good grasp on what the range of profit outcomes is for the year. Therefore investors should be told, instead of it being routed through an intermediary (house broker), with everyone then pretending that the forecasts are independent, when you know full well that in most cases they will have been discussed and cleared by the FD!

I don't mind companies saying that there is a wide range of possible outcomes for the year - that is par for the course with small caps, but I think we would avoid a lot of lurches up & down in share prices if companies better managed market expectations, by being more open about how trading is going.

Instead we have to unpick statements, and try to interpret the precise wording used in announcements, companies sometimes backtrack if people misinterpret an RNS, etc. It's madness. More openness is needed, that way there are fewer surprises.

In my days as an FD from 1993-2002 for a private group of companies, I always ran three forecasts - the base case (which was what we thought was most likely), then an upside case, and a downside case. That's what I presented to the shareholders. It should be the same for Listed companies. So my preference would be for quarterly updates to the market, for all companies, on the range of likely profit outcomes for the current year, and the key factors that will drive the final outcome (e.g. big contract wins where timing is uncertain - this should be quantified, i.e. we should make £2m profit if we win a big contract, or £1.5m if we don't).

Back to airlines - Easyjet today notes these factors;

- strong finish to the summer season

- revenue per seat slightly higher than expected

- favourable effect from lower fuel prices (a large element of airline costs is fuel)

- favourable exchange rate movements

- gains from Air France's pilots' strike (yet another own goal by the French)

.

Some of those could help other airlines too. Although it's worth noting that the Ebola crisis could escalate and impact air travel, we don't know yet.

Another negative to consider is that there is over-capacity in the airline sector, so profit margins could be squeezed.

My favourite stock in this area is Flybe (LON:FLYB) where a major turnaround is underway. The new CEO has drastically remodelled the business, stripping out costs & uneconomic routes, greatly strengthened the Balance Sheet with a large Placing at 110p, and the forecasts for next year put it on a modest rating, despite forecasts having been lowered. As always though, please DYOR.

I also quite like Dart (LON:DTG) which is worthy of further research, especially since the price is now a lot lower after a disappointing trading statement in Jun 2014.

Miller Homes

This housebuilder was trying to IPO, but has announced today that the IPO is being pulled.

A statement today says;

In light of the recent financial markets volatility, the Shareholders of Miller Group have elected not to proceed at this time with a public offering of Miller Homes. The Shareholders are excited to support Miller Homes in its next phase of growth as the Company builds upon the momentum evidenced in its recent operational and financial results.

IPOs - bear market?

What is interesting about this, is the way the IPO market is so binary - when the market is strong, IPOs come through at quite a pace, but the moment the market goes a little wobbly, as it has done in recent weeks, then the IPO door just slams shut instantly. Suddenly nobody is interested. It's very highly linked to market sentiment.

I generally avoid IPOs, but there is upside to putting in the work looking at them individually - because most will be under-researched to begin with, so you have a window of opportunity of perhaps several months, to buy into the reasonably-priced ones.

I would like to see more normal companies List - i.e. well-established, profitable, dividend paying companies with good management & sound Balance Sheets, and priced at reasonable levels. Instead we get far too many hyped-up growth stories being floated - and so many of them go wrong, it damages the appetite for decent stocks by sucking out money.

In the last year, I've seen clear echoes of the 1998-2000 TMT boom, when value shares would grind down in price, because nobody much was interested in them. Instead people were chasing the latest sexy growth stories, which went to more & more daft valuations. Until it all collapsed of course in Mar 2000. Value shares did well afterwards actually, even in a falling market.

Personally I like to do mainly value investing, but with a bit of growth stuff on the side too in a bull market. Although you have to question whether this is still a bull market? Consider these statistics;

FTSE Intl-aim UK 50 Index (FTSE:AIM5) - down 29% from its peak in Feb 2014

FTSE Intl-aim All Share Index (FTSE:AXX) - down 17.5% from its peak in Mar 2014.

Those figures indicate a bear market, not a bull market. So for those of us who go hunting on AIM, things have been pretty grim this year. Remember these are the averages for a whole basket of stocks, so within that there are plenty that have done even worse.

Clem Chambers made a very good point in a recent interview, where he said that because smaller company indices are "clean" - i.e. there are no speculators playing around with index futures (as happens with the big indices like FTSE 100) - then these actually give you a clearer indication of true market sentiment. The chart is clearly showing us that, for the moment, we're firmly in a bear market for small caps overall, at least for AIM stocks anyway. Of course for longer term investors, that means it's time to buy, not sell, because we need to BLASH. Panic sellers end up doing the opposite of course.

I find at times like this there is an emotional instinct to throw out the baby with the bathwater - to prevent any further pain by cashing out & protecting what you have left. That's completely the wrong strategy in my opinion. Instead I think one needs to carefully re-assess each position in turn, maybe throw out some more speculative stuff, and definitely don't have any significant gearing, then if the remaining stocks are good companies with sounds finances, and priced attractively compared to their likely prospects, then I would keep them, indeed consider buying more.

Some we'll get right, some we'll get wrong, but over the long term the winners outweigh the losers.

Anyway, each reader has to decide for themselves how they cope with a more challenging market, I'm not giving advice here, just thinking out loud. Companies that are growing profits tend to see their share prices go up, even in a falling market, so it's the performance of the underlying company that matters the most, not the short term share price movements.

Sorry this is such a long report today, but things keep popping into my head!

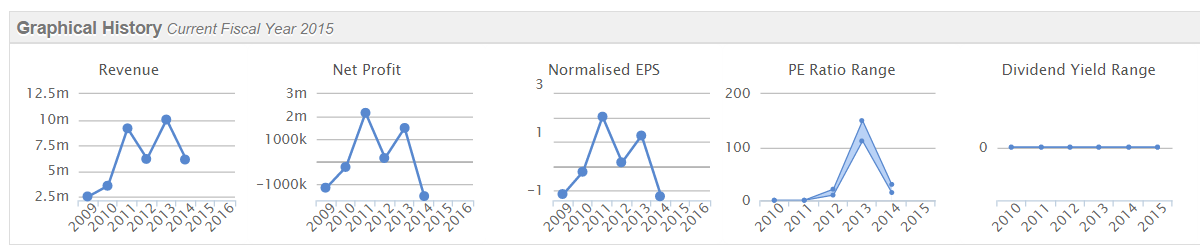

Software Radio Technology (LON:SRT)

Share price: 26.25p

No. shares: 119.0m

Market Cap: £31.2m

Trading update - looks much improved from previous updates. Today's update covers the six months to 30 Sep 2014, so it's impressive to have flash figures available just three days later, indicating decent internal financial controls;

Key points;

Revenue of £5.4 million, a 70% increase over H1 in 2013/14

Profit before tax of £0.5 million (H1 2013/14: loss of £434,000)

£2.6 million cash balance at the Period end

Outlook - the company today says;

With many more projects in progress, coupled with the existing mandates and the pending US mandate in particular, we are excited about the future and look forward to providing shareholders with further updates in due course.

My opinion - It would be good to see this company succeed, as in my opinion management are genuine. However, the company's financial track record to date has been very patchy - as it relies on lumpy orders often from public sector bodies, where decision-making can be slow & unpredictable. It's therefore very difficult to value the company.

Buying these shares is really a leap of faith, all about backing management, rather than something you can base on reliable forecasts, since there are not going to be any reliable forecasts. The market cap is a bit on the warm side for me given the uncertain risk:reward.

I shall leave it there for the day, and the week - certainly a week I shall be glad to see that back of.

Sorry for writing so much today, my brain must have been stimulated by all that cabbage I ate yesterday - am doing the 5:2 diet thing, where you eat vegetables only, on 2 days per week.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FLYB and IND, and no short positions)

(a fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.