Good morning! It's quiet for results & trading statements today, but all eyes will be nervously looking at whether the current sell-off continues or not? Small caps are being hit the hardest, both with the Russell 2000 Index in the USA, and here in the UK with AIM once again hitting a fresh low for the year yesterday.

My view remains the same - market corrections happen from time to time, and providing you take a long term view of decent companies with sound finances, paying good dividends, and at reasonable valuations, then there's really nothing to worry about - short term share price movements are just background noise. The only exception to that is when the economy really is going into Recession, e.g. in 2007-8, when people who sold early would have protected their capital in the short term. Although in my experience nervous sellers rarely have the courage to buy back in anywhere near the market lows, so they might miss a big downturn, but they will also usually miss the big recovery too.

Anyway, we'll see what happens. I've kept a bit of powder dry, and am already seeing one or two companies on my watch list starting to look interesting in valuation terms.

John Lewis partnership

Although a partnership, not stock market listed, the department store and Waitrose group announces weekly sales figures. These show a strong improvement for clothing, after a soft patch caused by mild weather in Sept. That should have read-across for other clothing retailers. In my view the market gave us a buying opportunity in several clothing retailers which saw steep share price falls over what is just a temporary factor - mild weather. As the old saying goes, the only weather that matters is whether you have the right stock in the right place at the right time!

Mothercare (LON:MTC)

Share price: 169p (down 57p today)

No. shares: 88.8m existing + 79.9m new Rights Issue (9 new for 10 old) shares = 168.7m

Market Cap: £285.1m

Rights Issue - Mothercare announces this morning that its nil paid Rights will today be given their own listing. This is normal in a Rights Issue, in that shareholders who are allocated Rights can sell them in the market nil paid for a certain amount of time (about a week or two usually I think), or keep them and subscribe for some or all of their pro rata entitlement of new shares at a discounted price (125p in this case).

I explained the detail of the Mothercare Rights Issue in this report on 23 Sep 2014.

So today, existing holders saw the value of their existing Mothercare shares drop about 57p per share. However, they are also now credited with 9 Rights for every 10 shares they hold. The Rights are exercisable (i.e. can be converted into one new share) at a fixed price of 125p, therefore the Rights currently have a profit of 44p each (i.e. share price of 169p, less the 125p price to exercise the Rights), and can be sold in the open market nil paid for people who want to bank some or all of that profit.

My opinion - I saw some interesting research from Cantors which suggested that the bulk of the Rights Issue money will be effectively wasted in closure costs of old stores (since exiting onerous leases is very expensive). This has to be one of the worst fundraisings in a while - i.e. the money is being raised for largely negative reasons - to sort out historic problems, rather than to drive growth.

It's difficult to see how the £285m valuation now can be justified, and this stock is therefore remaining on my bargepole list. I think it's more likely to drift down over time, than to stage any significant recovery.

Optos (LON:OPTS)

Share price: 200.7p

No. shares: 72.6m

Market Cap: £145.7m

This is a Scottish-based company which from what I can make out, seems to make equipment to photograph retinas.

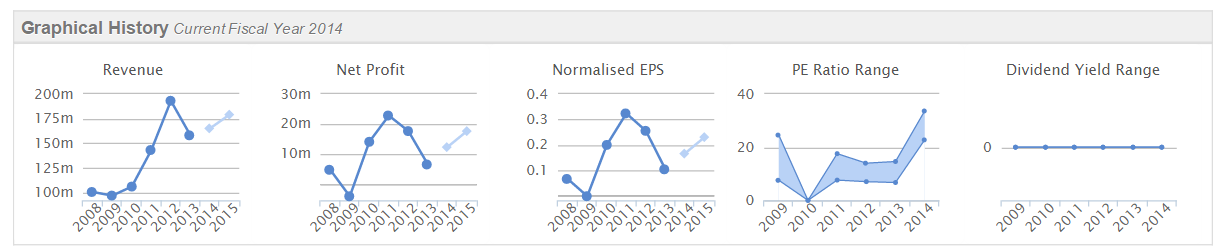

Turnover and profitability seem to have been volatile in recent years, with strong growth followed by a downturn;

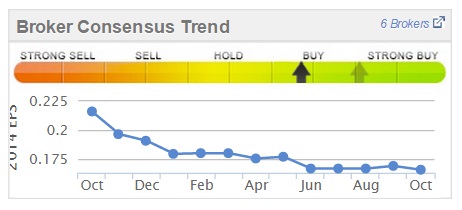

Note also that broker forecasts have been steadily reducing in the last year - usually not a good sign;

The company has a Sep 2014 year end, so it releases a trading update today.

Trading update - actually sounds quite positive, with the key bit saying;

Revenues and adjusted Profit before tax* for the year to 30 September 2014 are expected to be in line with market consensus**, before accounting for the early renewal of a US corporate account which, once included, will result in both being slightly above market consensus.

So I think that is saying that underlying trading was in line, plus they had an extra boost from an early customer renewal.

This bit sounds positive too;

During the year, we continued to make excellent progress in attracting new customers. We added 1,500 new customers (a record performance), increasing our installed base by 24%. We continued to make progress with corporate accounts globally. This included, as indicated above, the early renewal of a strategic corporate account in the US who upgraded their stores to Daytona devices.

Cash generation was strong during the year, especially in the second half of FY14 and we expect to report further improvement in net debt to around US$12 million (vs US$39 million at 30 September 2013).

That's a big reduction in net debt, which is impressive.

Outlook - the company today says;

Our pipeline of new products is progressing to plan and we remain excited about the future.

That's a bit vague, but sounds alright.

My opinion - I don't know much about this company, so can't give a properly considered view. However, given that broker consensus is for $0.17 this year, then at a PER of just under 20 the shares seem fully priced. However, with a positive outlook, and forecast for a rise in EPS to $0.24 for y/e 30 Sep 2014 the PER drops to about 14, which looks reasonable if growth is sustainable. Might be worth a look once the dust has settled with the current market shake-out?

Carclo (LON:CAR)

Share price: 101.5p

No. shares: 65.9m

Market Cap: £66.9m

Shares here have been a very poor performer in the last year, down by almost three quarters.

It's a plastics company which is profitable, but had some sort of blue sky division that people thought was going to be huge, but that now appears not to be the case.

Trading update - for the half year to 30 Sep 2014 is announced today.

The board is pleased to announce that the group has traded in line with its expectations for the first half of the financial year. The board also announces that it has commenced a full strategic review of the CIT Technology ("CIT") business.

I think the CIT bit is the blue sky hope that I referred to above. So a "full strategic review" sounds negative - it sounds as if they might scrap this project perhaps?

Furthermore, the company says;

The Board continues to believe that the group's underlying profit before tax will be in line with its full year expectations. As in previous years, a greater proportion of the group's operating profits will be generated in the second half of the financial year. The continuing growth prospects in both Technical Plastics and LED Technologies support the board's positive outlook for the group. The financial position remains comfortable and it should be noted that any CIT write down would have no impact on the group's ability to meet its banking covenants.

Any mention of banking covenants usually makes me bolt for the exit. There is a bit too much debt here for my liking.

Also, the H2 weighting may be usual, but it increases the risk.

Looking at the valuation, it doesn't look cheap to me, and could have further to fall in my opinion.

Overall, it's not for me.

I doubt whether many people are reading this, as people are probably transfixed with all the red on your screens. Not good at the moment.

Brighton Investor Evening

Every now and then myself and an investor friend organise a Mello-style event in Brighton, 5 mins walk from the mainline station, so easy to get to from London or the surrounding area.

Our next event is on Tue 28 October, and I'm beginning to panic a bit as we haven't sold many tickets yet. So if you would like to come along, and drown your sorrows with me over some ice cold Peroni, and good quality grub, in a very friendly group, then you're very welcome to come along. The booking link is here.

Molins (LON:MLIN)

Share price: 107.5p

No. shares: 20.2m

Market Cap: £21.7m

Molins shareholders got a nasty surprise at 2:31pm on Friday afternoon, just as they were winding down for the weekend the company issued a profit warning.

Profit warning - various reasons are given (weaker orders, and delays in delivery of existing orders);

...the Board expects profit before tax for the full year to be below current market forecasts. The Board intends to hold dividend payments at current levels.

An interesting further comment is made, which might provide some upside on the shares?

We continue to invest in products and infrastructure and work towards realising the value of surplus property in the Group.

So it would be interesting to look into that, and see what potential value upside there is from surplus property disposals?

Pension deficit - the company has a large pension deficit, and the agreed level of deficit funding is a highly material £1.7m p.a. The pension fund limits any increase in the divis, by requiring a matching payment to be made into the pension fund. So it's no wonder that the company says it won't be increasing its divis.

My opinion - I've never liked this company, mainly because its activities are supplying machinery to the tobacco industry, which I loath with a passion - tobacco is a curse on humanity, and the sooner it is eliminated altogether, the better.

As I pointed out in my review of the company's interim results on 28 Aug 2014, once you add back the hefty amount of costs which are called "development" and then capitalised (and of course reverse out the smaller amortisation charge too) then the company didn't actually make any profit at all in H1.

As I also pointed out in August, "The trouble is, with H1 near breakeven, the year's profits are now totally dependent on H2, which makes the shares higher risk". Sure enough, H2 has now fallen short.

Overall, it's not quite bad enough to go on my bargepole list, but it was a close call. It looks as if this might now be the third consecutive year of falling profits, which suggests to me that there is something structural going wrong - probably lower priced competitors squeezing them on price? It doesn't appeal to me at all, and I suspect the shares might have further to fall as investors who didn't see the profit warning on Friday afternoon react to it on Monday - maybe another 10-20% fall in price on Monday morning perhaps, at a guess?

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions

a fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.