Good morning! I'll rattle through today's report asap, as I have to prepare a 10 minute talk about shareholder rights at a ShareSoc seminar later today. Should be an interesting event - I'm really pleased that ShareSoc has decided to tackle the issue of nominee accounts, and will be lobbying to have the system reformed so that shareholder democracy is brought back. I feel that shareholders being disenfranchised by the nominee system is the root cause of many issues in corporate UK - excessive remuneration for Directors, rewards for failure, etc. If you have an absentee ownership class, then the managerial class will run riot - which is exactly what the situation is today! That needs to change. Right, on with today's results & trading statements.

Boohoo.Com (LON:BOO)

Share price: 43.25p

No. shares: 1,120m

Market Cap: £484.4m

With a market cap just under £500m, this is really moving into the foothills of mid cap territory, but being a rapid growth etailer of clothing, it interests me due to my background in this sector.

The shares look expensive at first sight, but when you dig deeper, it starts to look potentially interesting. BooHoo is based in Manchester, and was set up by experienced rag traders, who have been suppliers to retail chains of mainly budget ladieswear for many years. They came up with the idea of cutting out the retailers, and supplying customers direct via a website, and it's going rather well! Whether a wobbly stock market such as we have at the moment is ready to take the shares any higher, is a good question - possibly not, in the short term anyway.

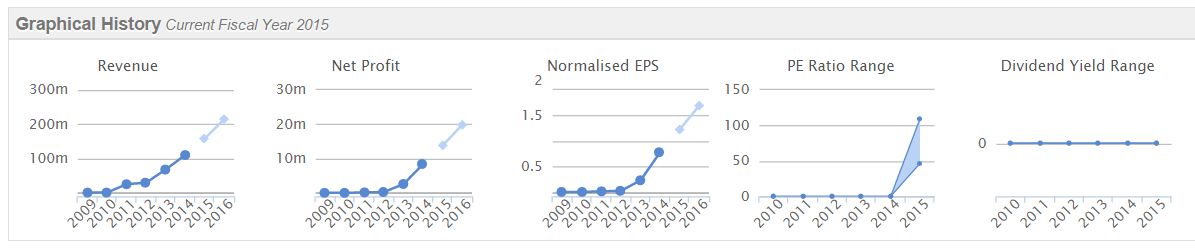

Interim results - to 31 Aug 2014 are issued today. Turnover is up 31% to £67.2m, but the company has an H2-weighted year, so broker Zeus is forecasting full year turnover of £160m (vs. £109.8m last year), so note the very strong, and all organic growth. The market pays up for rapid organic growth, so this share should be on a high PER, which it is.

Pre-exceptional profit before tax was £5.7m for the six months, a little lower than I was expecting, but this is probably due to the rapid expansion of the business - note that their warehouse was enlarged with a mezzanine floor, which must have caused considerable disruption. Although the company now has enough warehouse capacity to handle much larger volumes.

Outlook - the company today says;

Our focus remains on further expanding our international footprint while growing sales in the UK. During the current quarter we have managed our marketing spend and growth during the implementation of the warehouse management system and the launch of the fully responsive mobile website. Following the successful execution of these key initiatives, our marketing spend has again increased in line with our targets and we continue to trade in line with market expectations for the full year.

Valuation - full year forecasts are for 1.28p this year (ending 28 Feb 2015), and 1.92p the following year, putting the company on a PER of 33.8, falling to 22.5. Expensive yes, but look at the organic growth. On a PEG basis, you could argue that this is good value.

Balance Sheet - is very strong, with net cash of £55.7m, and a current ratio of a very strong 3.35. So no doubt the company will be using its strong finances to secure prompt payment discounts from suppliers.

Dividends - none as yet, but these will start once the rapid growth is behind them.

My opinion - this is a very impressive organic growth company. It achieves a higher operating profit margin than Asos, and is growing faster than them too, so its lower rating looks a far more appealing proposition to me than Asos, even after it has collapsed from £70 to £20 per share.

At some point, I can foresee BOO shares significantly rising, but perhaps not for the time being in the current more sceptical market, where people are throwing out their highly rated shares.

Superglass Holdings (LON:SPGH)

I warned readers here on 30 Apr 2014 that things were looking grim at this manufacturer of insulation material, and that the company would need to raise more equity, when the shares were 43p.

They have since slid down to 9.7p last night, and another lurch down today to 5.9p on the announcement of a 5p Placing. Oh dear. This is a very good example of why it's rarely a good idea to buy shares in a poorly performing company that has inadequate cash resources. When the Placing does happen, it will usually be at a deep discount, and of course the price will go down heavily beforehand as most Placings seem to be quite leaky - so the temptation to break the law and do a bit of insider dealing is usually too much for someone in the chain.

There really needs to be a better system, whereby shares are briefly suspended when a Placing is going on. It's a false market if shares remain traded when some people are aware that a discounted Placing is underway, and others aren't.

Anyway, there we are. The company should survive now I think. Last time I looked at it, cost-cutting was beginning to work, and you could see a just-about viable business emerge. Note that the existing bank have taken a 15% haircut to get out. A new bank is making available a new facility. So good luck to the company, it's had quite a few lifelines thrown at it now, so it really has to perform this time - I doubt any further financing will be forthcoming if it remains loss-making.

Digital Barriers (LON:DGB)

This is a share I've been bearish about here for the last 18 months, because the valuation looked nuts, and the company has performed badly - a fairly sensible couple of reasons to be bearish in my view!

Sure enough the share price has dropped heavily from 178p when I first wrote about it here on 2 April 2013, to 67p today (for a market cap of about £43m).

Trading update - today sounds a bit more promising, with a;

"much stronger contracted backlog position and sales pipeline than at the same point last year"

It's still loss-making though;

The Board expects losses for the first half of the current financial year to show a year-on-year reduction and for this reduction to accelerate through the remainder of the financial year driven by continued revenue growth alongside a successful reduction in the cost base.

Net cash as at 30 September 2014 was £7.6 million.

My opinion - I don't know anything about the company or its products to form a view really. However, I'd want to see a very clear path into profits, with a high probability of success, before considering an investment here. Also one would need to carefully check that the cash reserves are enough to get it through to profitability, as another fundraising would dilute the upside. The £43m market cap doesn't skew risk:reward favourably enough, in my opinion, to justify a further look here, as it is forecast to not quite reach breakeven next year, let alone this year.

Allocate Software (LON:ALL) - an recommended cash offer at 153.55p per share has been announced today. This is a 35% premium to last night's closing price - not particularly generous, but a bird in the hand & all that. Irrevocable undertakings to support the bid have been received from 47.1% of the shares held, so it looks close to being a done deal.

Having a quick look at the figures, it looks a fair price for a deal, so if I held the shares I'd probably accept the bid and move on, rather than try to fight it. Although if enough shareholders kick up a stink and refuse to accept the deal, it can sometimes extract a bit more money.

Right, got to dash. ShareSoc have asked me to do a 10 minute talk in a seminar this afternoon about improving shareholder rights, an issue that is close to my heart. So I need to prepare for that.

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.