Good morning!

The Pubcos really took a battering yesterday, as the news sank in of the potential ending of the tied pubs model. Analysts seem to think it will hurt profits considerably at pubcos, but that they will seek to increase rents to offset the lower profits from inflated beer prices to tenants. So it will be interesting to see how that pans out. Presumably there is likely to be a time lag with increased rents, and tenants may challenge increases with the independent adjudicator. I was considering buying some Marston's (LON:MARS) shares, but will hold fire until the lie of the land is more clear. The key point is to ascertain how many tied pubs (as opposed to managed pubs) each pubco has.

Sprue Aegis (LON:SPRP)

Shareholders here will be pleased with a strong update this morning. The company, which sells smoke alarms, seems to be going from strength to strength, helped by smoke alarms being a new legal requirement in France.

Since the release of its unaudited interim results on 22 September 2014, Sprue, one of Europe's leading home safety products suppliers, is pleased to announce that the Company's financial performance has continued to be strong and October was a record month for sales and profit.

Based on the current order book, and subject to products being built and shipped in line with the current delivery schedule, the Board expects that the Company's results* for the year ending 31 December 2014 will be ahead of market expectations.

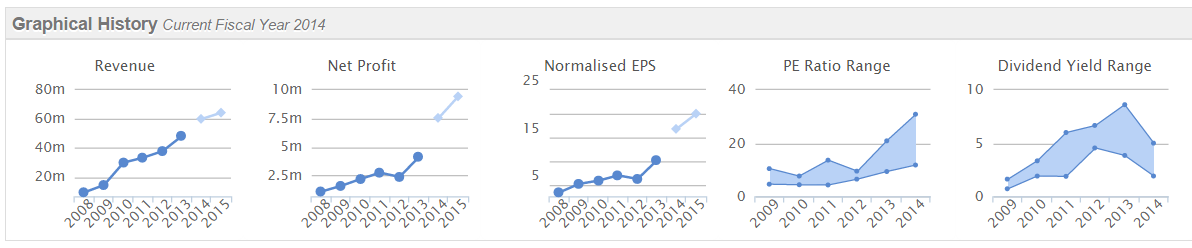

Valuation - broker forecast is for 16.8p EPS this year, so if they are now perhaps heading for (at a guess) say 18p, then at 320p the shares would be on a PER of 17.8, which looks reasonable considering how fast earnings are growing - see the excellent track record below;

My opinion - I made a mistake here, selling out far too early around 200p. Can't bring myself to buy back, but if I still held, then I'd be very comfortable with the company's performance. The key question, as always, is whether the increased profits are sustainable, so more work is needed on that vital question. So far so good though!

Rose (LON:RGI)

This is an AIM-Listed property company, operating in Russia, which has a 73% major shareholder - it doesn't get much worse than that!

Anyway, the 73% shareholder has decided to de-list the shares, reinforcing that it's best to avoid companies with such a dominant single shareholder, as they can do as they wish with the company. No offer is being made to buy out minority shareholders, so they will be left in an unenviable position.

Superglass Holdings (LON:SPGH)

Poor old Superglass struggles on, with more restructuring & refinancing. Having had a quick review of the accounts for y/e 31 Aug 2014, issued today, it's difficult to see any light at the end of the tunnel. Hence not one that I'm tempted to take a punt on for a turnaround.

If a business spends years struggling to get anywhere near breakeven, you have to ask what is the point? Is it viable at all? I suspect not.

Dart (LON:DTG)

This airline & haulage firm, issues interim results today. They're a lot better than I was expecting, as the shares sold off heavily not long ago.

Outlook - sounds solid, with the company today saying;

With winter 14/15 Leisure Travel bookings continuing to perform in line with expectations, the Board is optimistic that current market expectations for full year operating profit, before adjusting for the exceptional provision of £17.0m, will be achieved.

The £17m provision relates to compensation to customers for some delayed flights, previously announced.

Valuation - seems reasonable to me;

The forward PER of 10.8 looks attractive, although the dividend yield is poor, at under 1%.

Balance Sheet - looks fine to me, no issues there. Note that the cash pile is mostly money paid up-front by customers.

My opinion - airlines are benefiting from cheaper oil, and investor confidence seems to be recovering nicely after a sharp sell-off a few months ago - which was a great buying opportunity as things have turned out.

You often hear people say that one should always sell on bad news, but this is a good example of how it's often actually the time to buy, because the market can over-react to bad news, especially if it is a genuine one-off, as was the case here, on the spike down in June.

Outsourcery (LON:OUT)

There are signs of life at Dragon's Den's Piers Linney's IT company.

A half-hearted refinancing took place a little while ago, and this company looked close to death. Today it announces that it has started reselling Microsoft Office 365 cloud services. No figures are given, so it's not possible to ascertain how material this is. It doesn't strike me as madly exciting, but the shares have spiked up over 50% today on this news, so maybe there is some hope after all?

Got to dash, as I have a train to catch.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated my hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.