Good evening. I'm back from Vegas now, but the overnight flight meant that I was too jet-lagged to be able to write a coherent report earlier today. We don't want any gaps in the series, so I'm catching up this evening having had a long afternoon nap!

Oil

I'm always looking for bargains, and it strikes me that the extraordinary collapse in the price of oil might be starting to throw up some buying opportunities? So I'll be suspending my usual rule of not looking at any resource stocks, and might consider the odd one - but only if the investing case is compelling, and low risk - so producers, with cash on the Balance Sheet, will be my starting point. One has to assume that most of the cash-strapped junior explorers are not worth even glancing at.

Lower energy costs will certainly help in particular the US consumer, as they are heavy users of oil for heating & in vehicles, which is taxed lightly compared with Europe - so the benefit of the big drop in oil price is already putting more disposable income into consumer pockets in the US. I might start looking at some US stocks when time permits. Amongst all those thousands of stocks, there must be some undiscovered bargain small caps!

Historically the US economy has always boomed on the back of cheap energy, so it probably will do again. Maybe the apparently expensive US stock market isn't so wildly priced, given the upside on economic growth, on what is still the world's biggest & most entrepreneurial economy?

I did some reading on holiday, and one phrase which stuck in my mind from some investing guru (can't remember which) is that when a share, or a market as a whole, breaks into new highs, then you have to stop and consider that something significant has changed - and that betting against such a move could prove a mistake. On the other hand this is something like the 3rd longest bull market in history, so it must be nearer the end than the beginning?

So lots to ponder. I'm mainly a bottom up stock picker, but it also makes sense to monitor big macroeconomic themes & trends, and at least have a rough idea of where we are in the business cycle, and invest accordingly.

Porvair (LON:PRV)

Share price: 267p

No. shares: 44.2m

Market Cap: £118.0m

This company is a maker of specialist filters. I've had my eye on it for a couple of years, but the price has looked toppy for some time now.

Trading update - for the year ending 30 Nov 2014 looks good to me;

Porvair has continued to trade strongly throughout the year. Both divisions are expected to deliver record results, with revenue for the full year up 24% (28% at constant exchange rates) and earnings marginally ahead of current market expectations.

Strong operating cash flow has increased net cash at the year end to around £5m, achieved after capital investments of £5m, mostly spent on expanding manufacturing capacity to meet demand.

Valuation - broker consensus is for 13.7p EPS for y/e 30 Nov 2014. Therefore the PER is 19.5 times. That would be justified if big increases in EPS were likely to continue, but the 2014/15 EPS forecasts are for only a modest increase in EPS to 14.6p, which would become a PER of 18.3.

Outlook - the order book is described as "healthy", and the company sees a "promising pipeline".

My opinion - the fly in the ointment for me is that the company reiterates that 2014 has benefited from some large one-off orders. That's been mentioned before, but it's material, at £20m turnover (out of around £104.5m total). So if those large orders are not repeated, then maybe turnover & profit could fall in 2015? That seems a considerable headwind to be up against, and hence increases risk from an investor point of view.

accesso Technology (LON:ACSO)

Share price: 625p

No. shares: 20.4m

Market Cap: £127.5m

Trading update - looks good. The key part of this statement says that the group expects to deliver adjusted profit and cashflow ahead of market expectations, on turnover in line with market expectations.

Valuation - Stockopedia shows broker consensus of $115.4m turnover (note the change in reporting currency to dollars) and $5.66m profit, or $0.47 EPS. That translates to a PER of 21.3, which is starting to look more sensible again, after a long period of being considerable higher, and looking stretched.

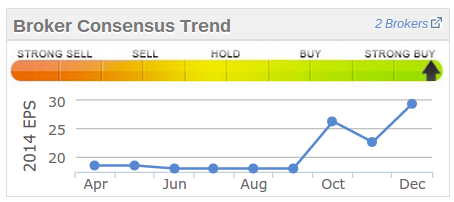

Note how broker forecasts have risen considerably in the last few months, which is clearly very positive;

My opinion - this statement from the company saying that forecasts will now be exceeded, puts the shares on a much firmer footing.

I'll be interested to see what the adjustments to profit are though.

A cynic might also point out that a lot of the growth has been bought in through acquisitions. So the split of organic vs acquired growth will be key.

I don't see value here, but it's not looking crazily expensive any more either.

Bonmarche Holdings (LON:BON)

Share price: 264p

No. shares: 50.0m

Market Cap: £132.0m

Interim results for the 26 weeks to 27 Sep 2014 look excellent at first glance. However, the headline figures are heavily flattered by one-off costs last year. So the adjusted figures show a reasonable, but much less impressive performance.

Underlying profit before tax rose 15% to £6.4m. Underlying EPS was up 1.2p to 9.9p.

The company has been hurt by unseasonal weather in Sep 2014 (as reported by other clothing retailers too), but expects to meet full year forecasts. That's not bad going, and suggests to me that if the autumn weather had been normal, then the company would have beaten forecast.

Valuation - broker consensus is 19.3p for this year, so at 264p that puts the shares on a PER of 13.7, falling to 12.4 times next year's forecast.

Divis are alright, at 2.6% yield for this year, rising to 2.9% next year.

Balance Sheet - this looks OK to me. Retailers sell for cash, so don't have much in the way of debtors, therefore a lower current ratio is perfectly acceptable - anything over 1.0 is fine for a retailer, in my experience. The current ratio here is 1.22, and the company has negligible long term creditors, so that's fine.

Note that the company is spending a fair bit on capex, well in excess of the depreciation charge. This makes me wonder if it was starved of capex when under previous ownership? Store refits are underway, and of course that will act as a drag on cashflow and profits, as the depreciation charge increases. It's not a deal-breaker, but it's worth considering. The stores I've seen have looked a bit run-down, and are often located in rather down at heel areas - maybe not a bad thing, as the rents will be low.

My opinion - I quite like this retailer. Rather than chasing the over-supplied younger female fashion market, Bon Marche targets over 50s females, with a value range. That should be a resilient market in all economic conditions, so it has good recession protection. Also the business seems to be firing on all cylinders, delivering strong LFL sales growth. Online sales are small, but growing nicely.

I am worried about the introduction of a new EPoS system, because I've seen at first hand how badly wrong such changes can go. You can very easily lose control of the business when a new system comes in, if you lose key management information for even a short while. So personally I will sit on the sidelines until the new EPoS system is fully bedded in, and all problems ironed out. Although it is good to see that the new system is being piloted in a few stores first, to see how it works.

Overall this strikes me as quite a good company, priced about right at the moment. It would need to become a bargain at c.200p to interest me though. So it might be one I'd pick up after a profit warning, if something goes wrong in future.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management firm with which Paul is associated may have positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.