Good morning! I'm running a bit late this morning, as it's taken about half an hour to get a reliable WiFi signal here in the wastelands of Cheshire (I'm visiting family for Xmas). Plus we were up boozing until 3am, so hangovers all around this morning.

I like this time of year, not just because of getting together with family, but also because the stock market is thinly traded, so there are more opportunities - fewer people are paying attention, so you can gain first mover advantage when significant news is released, and thin trading can create erratic price movements - so more buying and selling opportunities tend to arise.

We're also likely to see a few profit warnings slipped out too - like this one;

Thorntons (LON:THT)

Share price: 91p

No. shares: 68.6m

Market Cap: £62.4m

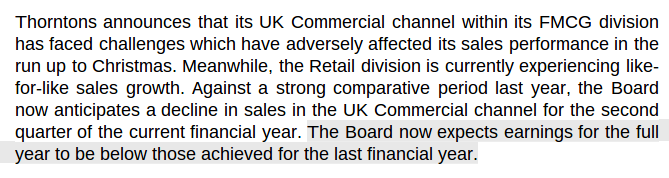

Profit warning - the company mentioned two main reasons for a profit shortfall - reduced demand from supermarkets, and disruption from the move to a centralised warehouse.

That's a disappointment, and it badly undermines the investing case for this share - which was that earnings were in a recovering trend. If that's no longer the case, then really it's difficult to see any reason to invest here - since the operating profit margin is thin, the Balance Sheet has too much debt, and a pension deficit, and there's no divi (although I seem to recall there was talk of reinstating a divi).

Broker consensus was for 10.4p EPS this year (to 28 Jun 2015), but at a guess it looks to me as if perhaps c.8p might be closer to the mark. That would put the shares on a PER of just over 11, which isn't particularly cheap considering the Balance Sheet liabilities.

My opinion - I don't share the Board's confidence in their strategy. Also, bungling a warehouse move just smacks of incompetence. Overall these shares are not of any interest to me - I'd only be interested on a very low PER, so maybe at 50p per share or below. It's just not a very good business, in my view.

Cloudbuy (LON:CBUY)

Share price: 28.7p

No. shares: 119.9m

Market Cap: £34.4m

Trading update - I don't know this company well enough to be able to fathom what today's statement is telling us. The market has interpreted it as a mild profit warning, as the shares are down c.10% this morning.

They seem to be saying that £1m of work that has already been done is going to be booked as revenue in 2015, rather than 2014. Also that costs have over-run. There is then a lot more detail on potential revenue from contracts overseas.

To date this company has a track record of very upbeat-sounding trading statements, but very poor financial results. So I tend to regard it sceptically. Let's see the profits and divis!

Interquest (LON:ITQ)

Bit of a strange one, this. The company seems to have have put itself up for sale, but announces today that no deal has been done, despite discussions with a number of interested parties. That sends a rather worrying message to shareholders - i.e. that potential buyers clearly don't think the company is worth as much as management hoped.

So the formal sale process has now been terminated.

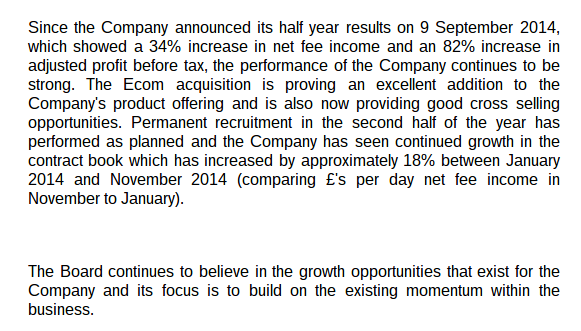

Today's trading statement sounds OK though;

The Stockopedia valuation graphics look middling to good, although it should be noted that lots of small recruitment companies are priced on a similar, fairly modest rating, so there are plenty to choose from. I haven't checked the Balance Sheet, although it looks from the EV figure that there is some debt.

There is a risk that the market might see this company as damaged goods, given that it initiated & has now abandoned a sale process.

Interbulk (LON:INB)

Results for the year ended 30 Sep 2014 are published today.

Its financial position looks precarious - the Balance Sheet has net tangible assets of negative £36m, and it seems clear from the narrative that the company is dependent on bank facilities, and the situation looks precarious to me.

Bottom line, they need to do an equity fundraising to repair the Balance Sheet. That makes it uninvestable for me - it's too high risk, and for that reason it's gone on my bargepole list. Everything might well turn out fine, but why risk the chance of a 100% loss, if the bank turn nasty?

That's it for today. I think it's a half day tomorrow, so I'll do a report here as usual, probably a bit shorter than usual, depending on what news items there are.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.