Good morning, it's Paul & Jack here with the SCVR for Weds.

Agenda -

Paul's Section:

Gyg (LON:GYG) - profit warning yesterday, but not enough information is provided to properly assess the situation, now a large customer seems to have gone bust.

Renold (LON:RNO) (I hold) - strong interim results, and Finncap reinstates full year forecasts. Looks cheap, but remember to adjust for the large pension deficit. I'm very pleased with progress here, the turnaround seems to have worked well.

Jack's Section:

Tracsis (LON:TRCS) - growing software company focused on Rail and Traffic data. Notes from call with management now included. Worth investigating.

Zoo Digital (LON:ZOO) - strong revenue growth and the group continues to invest for the future, although there's a loss after tax, and cash burn is a consideration. Progressive ups its FY22 and FY23 forecasts, but the valuation looks high given that Zoo still has to prove the profitability of its business model.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Gyg (LON:GYG)

50p (down 14%) - mkt cap £23m

Trading Update (profit warning)

We already knew that there were uncertainties over contracts at this superyacht painting company. Major shareholder, Harwood Capital, pulled out of a takeover bid recently, over contract uncertainties, which we reported about here on 29 Oct 2021.

I’d like to be able to report that the fog is lifting, but today’s update doesn’t give us enough information to work out properly what’s going on.

This is what the company says today, which sounds a can of worms to me. Note the conditionality of its reassurance below, which I’ve bolded -

As a direct result of the significant operational and financial disruption

caused by Nobiksrug, GYG will now deliver a financial outturn for 2021 much lower than the Board's previous expectations. Importantly, the Board is confident that the Group will remain profitable at the EBITDA level in the current year. The Board also reiterates that, after further thorough review, it is confident that the Group can meet its working capital requirements and repay its borrowings as they fall due providing that the Nobiskrug situation is resolved before 31 December 2021, which the Board fully expects.

On this basis, the Board does not believe that the Company will need to seek additional funding from shareholders in the foreseeable future to maintain operations or to meet its obligations.

In this type of situation, investors need to know chapter & verse - how much money is owed (if any) by the customer that has gone bust? What impact on profit, cashflow, and cash, will there be? This latest update from GYG is far too vague. To be fair, there are probably good commercial reasons for that. You don’t want to publicly disclose sensitive commercial information on the RNS, that the other side will read and take advantage of. Therefore I can see why investors are being kept partially in the dark.

However, our job at the SCVR is to attempt to unpick and make sense of company updates. In this case it’s just not possible at this stage, and we don’t like guesswork, so we can only watch & wait.

The trouble with Harwood Capital, Christopher Mills operation, is that they’re incredibly shrewd investors who have been known to take their best ideas private, whipping away the upside from small shareholders. So why would I want to follow them, knowing that they’ll take GYG private if the upside case looks likely? They’ll pay the minimum premium necessary, that’s the problem. So Harwood’s involvement caps the upside to a level that doesn’t excite me. They did this with Essenden a few years ago, and I have a long memory. Hence why I admire, but tend to steer clear of, anything with a big Harwood Capital shareholding. They shift risk:reward too much in their own favour, the way I see it. Whereas personally, I want open-ended upside, not a major shareholder poised to grab the upside for itself & leave me with some crumbs.

.

.

Renold (LON:RNO) (I hold)

33.5p (up 8% at 10:09) - mkt cap £75m

Renold (AIM: RNO), a leading international supplier of industrial chains and related power transmission products, announces its interim results for the six month period ended 30 September 2021.

Significant revenue growth…Record orderbook…Strong cash generation

I’ve had a quick skim through these interim results, and am very pleased with the company’s progress. The company was overly-indebted in the past, and has a huge pension deficit, so many investors ignored this share. Under the surface though, a decent turnaround has been underway, something we spotted and have been flagging up to SCVR readers for quite a while.

It’s now financially secure, and performing well.

Revenues up 17% to £95.3m, which is back to almost pre-pandemic levels

H1 adj operating profit of £8.2m

Adj EPS very good at 2.3p (H1 LY: 1.1p)

Strong order intake of £113m, which is more than H1 revenues, so the closing order book has risen to a record high of £72.1m

One-offs boosted profit by £1.2m, mainly US Govt support (loan forgiveness)

Net debt of £13.9m is now quite modest, at only 0.6x adj EBITDA, so I don’t have any solvency concerns at all, the finances have been fixed.

Balance sheet overall has NAV of £3.3m, less intangible assets of £28.5m, so NTAV is negative at £25.2m - not ideal, but it’s the £77.8m (after tax) pension deficit which is the big drag on the balance sheet - it’s a manageable long-term liability, so annoying rather than dangerous.

The pension scheme is an annual cash drain of about £5.5m, and the company has been able to pay this without diluting shareholders, although it obviously does absorb cash that could otherwise be used to pay divis.

No interim divi, due to uncertainties over costs, supply chain risk, etc.

Outlook - no specific outlook section. The company expects continuing pressure on materials, energy & transport costs in H2 - no surprises there.

Price rises - encouragingly, Renold says it has successfully passed on increased costs to customers. That’s a key positive. The strong order book is encouraging in this regard - it’s easier to pass on price rises when capacity is already booked up with existing work. Renold’s products are best in class, and sell for premium prices.

Broker forecasts - thanks to Finncap for reinstating forecasts today. It has pencilled in 3.3p EPS for FY 3/2022 which looks beatable, given 2.3p has already been done in H1. That means the share is on a high single digit PER - cheap, although remember the big pension scheme deficit is part of the reason for the PER being low.

Acquisitions are mooted, which would be a great way to gradually dilute the pension scheme into a larger group. Norcros (LON:NXR) has done that very successfully, as an example.

My opinion - so far, so good! I’m very happy to continue holding for another 6 months, and then review it again. This is a decent business, which has been restructured over a number of years, and is now beginning to shine. Factories have been modernised with heavy capex, the pension scheme burden has been managed. Therefore we should see divis resume at some stage, plus there’s scope for bolt on acquisitions too.

It’s going well, I’m happy with progress so far. We could receive a takeover bid at some stage too, possibly?

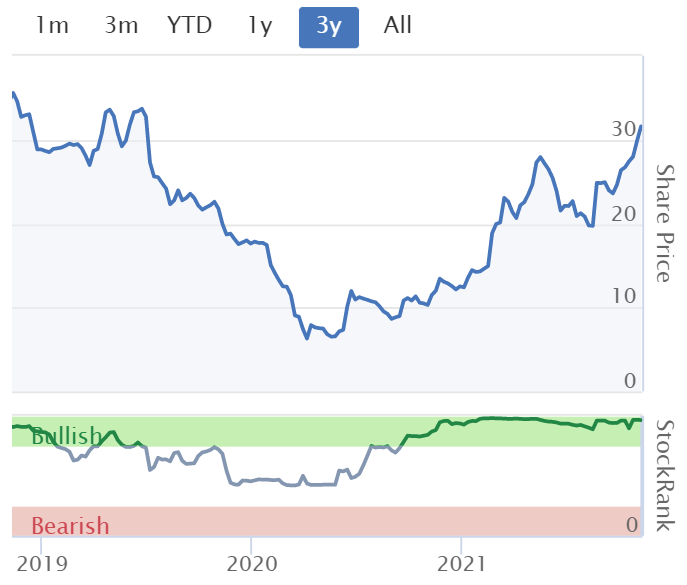

Note below that the StockRank system seems to have got wind of the turnaround early on.

.

.

Jack’s section

Tracsis (LON:TRCS)

Share price: 970p (+3.74%)

Shares in issue: 29,350,067

Market cap: £284.7m

Tracsis is a leading provider of software, hardware, data analytics/GIS and services for the rail, traffic data and wider transport industries

Half of the business is software for the railway industry, which is expected to grow double digits over the long term with plenty of opportunities. The other half is transport-related data analysis to do with traffic etc. Obviously business here dried up over lockdowns.

The new management team is focused on better integration across the group (which was formed by a series of acquisitions) complemented by a couple of additional purchases.

Shares have more or less doubled over the past year and are now well above pre-Covid highs, so the investment case rests firmly on the group’s growth prospects.

Highlights:

- Revenue +4.6% to £50.2m with growth in the higher margin Rail Technology & Services Division and in Data Analytics/GIS,

- Revenue grew by £3m (+12.7%) in Rail Technology & Services Division

- Revenue -3% in Covid-impacted Data, Analytics, Consultancy & Events Division,

- Adjusted EBITDA +23.8% to £13m driven by software revenue growth and cost reductions,

- Profit before tax +12.2% to £4.6m,

- Diluted earnings per share are down from 9.67p to 7.82p as a result of a larger tax bill,

- Cash balance up from £17.9m to £25.4m,

- Dividends to be reinstated in the upcoming financial year.

The business has performed well despite Covid challenges and should bounce back as lockdowns ease. A large, multi-year RailHub enterprise software contract win in the UK will double the user base to over 30,000 individuals, and Tracsis has continued to implement various TRACS Enterprise rail contracts that were won in previous years.

The pipeline has grown, with additional multi-year rail contract opportunities, the recent acquisition of Flash Forward Consulting (FFC) strengthens Tracsis’ transport insight offering, and the group continues to invest in integration, management, processes, and systems.

This business was acquired in February for up to £2m.

Post year-end, Tracsis has seen a rebound in Events and Traffic Data ‘with both markets expected to recover to full activity levels through the course of the coming year’. There has also been another acquisition - Icon - which will enhance the group’s Data Analytics/GIS capabilities. Q1 trading is in line with board expectations.

Rail Technology and Services - the biggest segment, with revenue up from £23.4m to £26.4m, adjusted EBITDA up from £8.6m to £9.1m, and PBT up from £8.1m to £8.3m. Annual recurring and routinely repeating revenue was c70% of the segment total. Underlying organic revenue growth excluding acquisitions grew by 10.9%.

Revenue for Rail Operations & Planning increased from £10.5m to £10.9m; Digital Railway & Infrastructure sales rose from £11m to £13m; and Customer experience revenue increased from £2m to £2.5m.

Data, Analytics, Consultancy & Events - Revenue down slightly from £24.6m to £23.8m, with adjusted EBITDA of £3.9m (2020: £1.8m) and PBT of £3m (2020: £0.5m) thanks to cost reductions. Activity levels have been progressively recovering here as restrictions have been lifted.

Data Analytics/GIS revenue was up from £5.4m to £5.7m; Transport Insights was more or less flat at £3.5m (2020: £3.4m); Traffic Data revenue was £1m lower at £7.7m; and Event Transport Planning & Management was stable at £6.9m (2020: £7m).

Outlook -

The Group has a clear growth strategy and has a strong balance sheet to support its delivery. We continue to implement a number of large multi year enterprise software contracts and have a record pipeline of future opportunities. Whilst the timing of these remains difficult to predict, the Directors believe they establish a strong foundation for future growth. In addition to delivering organic growth, M&A remains a core part of our strategy. We also recognise the need to continue to enhance integration and collaboration across our businesses, increase senior management bandwidth and talent, and improve our systems and processes as we prepare for scalable growth. We have made good progress in the year and will continue to invest in this area.

The Board believes that the Group is well positioned to deliver further growth in the coming financial year and beyond.

Balance sheet - as a software company, perhaps it’s to be expected but more than 60% of £93.5m in total assets comes from intangibles. Cash is the second largest line, up from £17.9m to £25.4m. This covers the £23.4m of current liabilities and there’s no debt.

Tracisis is reliably cash generative. Free cash flow of around £9m is notably higher than the reported profit after tax of £2.5m.

Conclusion

The valuation is quite high here, to be expected from a growing software company. Tracsis also looks to be recovering in its Data business, so if everything plays out well then the momentum could end up quite strong here.

This looks like a good company to me, worth a closer look - in fact I’m going to publish what I’ve written up so far as I’m about to hop on a call with management. I’ll post the notes once that’s finished.

Notes from call with management:

Scuppered slightly by a poor connection, but still enough positives to invest some time into considering whether or not there's enough growth potential for the company to kick on from its current valuation.

Spin out from Leeds uni in 2004, listed in 2007. It originated from the Computer Science department as a solution to complex optimisation capability. That’s things like shift scheduling and work patterns, which can become surprisingly complex in industries such as Rail.

After listing, the group operated an impressive buy and build strategy. A total of sixteen acquisitions have been made, with five of those falling under the current CEO’s tenure. The focus has shifted slightly more recently towards a more complete integration of previously acquired businesses.

Half the business is in rail tech, which is higher margin (c35% EBITDA) and preferred by investors. The other half is more data and services, which is 12-13% EBITDA margin, but there’s an opportunity to make more of this side of the company. It’s essentially two quite different models and the group is currently working on integrating them.

Loads of white space to go for, confident of taking market share. There’s not many (if any) companies out there doing what Tracsis does.

They have looked at more than 200 companies in the US to analyse the competitive landscape there. Nobody is doing what Tracsis does. That’s good as it’s a market share opp but means they can’t buy like for like. Instead they will look to acquire someone with a different product but the right routes to market. This is perhaps the kind of acquisition we can expect - not another Tracsis, but something that opens the door in a new geography.

The US was the only international company discussed, but management says there is plenty of remaining opportunity in the UK as well. Total addressable market is about £100m for Tracsis in UK Rail - but this is a tailored figure and very much represents what the company can go after now as opposed to simply saying ‘the UK Rail market is worth so many billions of pounds’. The company would be happy if, in five years time, they had £50m-£75m of UK Rail revenue and can’t see why this couldn’t happen.

The UK rail market is very political with a lot of apathy. It’s not like the car market for example, which is much more commercial. That means procurement cycles are longer but, on the flip side, there are switching costs once you’re in. Some of the group’s products are things like Enterprise Resource Planning, which require onboarding, but again, once the customer is won that creates switching costs. Sticky revenue and recurring business. So there are some attractive characteristics.

Zoo Digital (LON:ZOO)

Share price: 130.84p (+1.04%)

Shares in issue: 87,651,594

Market cap: £114.7m

ZOO Digital supports Hollywood studios and streaming services to globalise their content by providing localisation and media services. Anyone who has watched Squid Games recently (which is referenced in today’s update) will be aware of the increasing demand and ability to consume content from around the world.

The company was founded in 2001 and operates from hubs in LA, London, and Dubai, with a development and production centre in Sheffield, UK.

Its media services include: ZOOsubs, ZOOdubs, ZOOstudio, and the group has invested to create an end-to-end suite of services to prepare both original and catalogue content for digital distribution. Customers include Disney, NBCUniversal, HBO and ViacomCBS.

It’s been a strange period in terms of share price performance, with the group just about approaching the multi-year highs of 2018.

Flicking back through the SCVR write ups, I note that I’ve been described as a ‘Yorkshire sceptic’ on this company in the past due to volatile profitability and cash generation, but the StockRank has been improving since 2019 or so.

Companies do change and evolve, so it pays to keep an open mind and periodically reassess prospects. But Zoo is not yet dependably self-funding, which makes it riskier than other software companies that have already proven their profitability.

In August, it was reported that new projects were back to pre-pandemic levels and that TV production continues to surge. This, combined with the on-going migration of catalogue content to streaming platforms and the launch of those platforms in new territories has driven very strong sales growth in H1 of 64% over the prior year period, a trend that we expect to continue.

Highlights:

- Revenue +64% to $26.9m driven by strong growth for subtitling and media services,

- Gross profit +68% to $8.6m,

- Adjusted EBITDA +82% to $2.4m,

- Operating profit of $0.4m, up from a loss of $0.1m,

- Cash balance up from $2.1m to $8.2m following $10m placing,

- Conversion of convertible loan stock into shares, reducing borrowings and interest payments.

Media services grew by some 142% due to a high volume of work in preparing catalogue titles for release on streaming platforms. Localisation grew 30% as new productions resumed in Q2, and a global growth initiative has been launched.

Further investments have been made in the key content sourcing and distribution locations of Turkey, Korea, Thailand, India, Japan, and Malaysia. Zoo’s R&D team has also been expanded in order to increase the pace of innovation into things like AI research in speech technologies. It’s hoped that these initiatives will increase the group’s competitive advantages in future.

Outlook

- Strong order book across all service lines with good visibility for H2,

- New mastering initiative and international expansion provide two additional revenue streams,

- The board will continue to invest in expanding capacity to support an increase in market share in H2 and into FY23, which is expected to generate increased profitability in future periods.

Stuart Green, CEO declares:

This is our time. We are but one of a handful of players that can meet client needs through our market leading approach. We are confident of strong growth for the foreseeable future. We are currently building increased capacity to accelerate sales and making great strides toward our medium term target of $100 million.

Conclusion

The ‘Over-the-Top’ (OTT: film and television content platforms provided via high-speed internet connections) market was worth around $122bn in 2019 and is forecast to reach $1tn by 2027, which is a huge CAGR.

It is worth noting that Zoo is still loss-making to the tune of $1.7m over six months. Revenue has jumped by some 64%, but COGS have risen pretty much in line. Perhaps it is correctly investing in order to seize a substantial global opportunity but at some point, profits are required. Zoo is not yet reliably cash generative, so I’d want a stronger balance sheet and more of a financial cushion here, particularly given the ongoing investments for growth.

The group generated a negative $913k in net operating cash flow in the period, and then spent a further $1.3m on the purchase of PPE and intangibles. Excluding the $10m fund raise, it looks like the group would have burnt through $4.8m of cash. So with $8.2m of cash remaining, further dilution could be on the cards if the group struggles to translate revenue growth into cash generation.

On the other hand, management does say it is expecting increased profitability going forward.

The group seems confident of delivering long term growth and Progressive Equity (Zoo’s commissioned broker), is upgrading its FY22 and FY23 estimates. Interestingly, Progressive also says it expects that ‘significant investment for growth’ should be largely completed by FY23 at which point the profitability of the underlying enterprise might become clearer.

The projected revenue trajectory is impressive and the medium term target is for $100m, which the group may well be able to reach.

Ultimately though, I’m not clear what kind of profit margins a more mature Zoo might be able to command. It’s a growing market but what kind of pricing power does the company have in five years’ time, and might competition become more of a concern?

It’s an interesting space to operate in, with clear structural growth as content becomes more globally distributed. But there’s also a fair bit of good news priced in at current levels, so I’m happy to wait and watch the expansion play out a little further.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.