Good morning! We've just seen yet another V-shaped recovery in the US market, following the same pattern that has been going on for several years now. The chart looks astonishing - every time there has been a dip, the market has immediately recovered. So "buying the dips" in the US market (which is the main influence on the UK market) has been a fantastic strategy over the last 2+ years, see below;

The trouble is, maybe this pattern has become self-reinforcing, as it's so obvious now that everyone must be buying the dips. What worries me is this - what happens when that strategy stops working? Since people have by that stage been disregarding valuation, and instead just buying the dips, regardless of valuation, then surely this could be sowing the seeds for a market crash?

This got me thinking, that the trend in UK small caps has been very different - 2014 was a difficult year, after both 2012 and 2013 being stonkingly good. So here is a comparison chart, showing how UK small caps got ahead of the trend in the US market in 2013, but has since undershot in 2014. AIM has been a disaster, as you can see from the bottom line, where it has scrubbed off all the gains in 2013.

There are differences of course, but it's interesting to see the trends compared. Remember that small caps indices cannot be bet on by speculators, unlike the main indices. So they are "clean" in terms of showing the real trend based on what buyers & sellers of the underlying shares are actually doing.

Naibu Global International Co (LON:NBU)

As I've repeatedly said here, Chinese stocks on AIM are too risky to go near with a bargepole. The accounts are usually ridiculous, and the view I have formed (for numerous reasons) over the last couple of years, is that some of these stocks have been listed on AIM with the primary purpose being to relieve British investors of our money.

Think about it. What do you actually get when you buy shares in a Chinese company listed on AIM? You're just getting a piece of paper (or electronic equivalent) which purports to give you part ownership of a business in China that you've never seen, and can't even verify exists! The accounts will often be a work of fiction, and hardly any of them pay reliable dividends.

Insiders are usually dumping stock like there's no tomorrow - I've lost count of the number of times that there have been cheap lines of stock in Chinese companies made available to brokers - it's always insiders dumping. Why would insiders dump stock in a company that supposedly is rated on a PER as low as 1?! Simple answer - because the E in PER is completely bogus! The profits aren't real, and I doubt very much that the cash is real also. You won't ever see a penny of the cash claimed to be on most Chinese companies' Balance Sheets, therefore you should write it down to nil when looking at their accounts. In fact, I wouldn't even bother looking at their accounts, do something more useful and enjoyable with your time!

It all stinks to high heaven, and as I've said before loads of times, the inevitable end game for most of these Chinese stocks on AIM, is that they will de-list, then disappear without trace. Gullible shareholders will lose 100% of their money.

Shares suspended - there are two announcements concerning Naibu this morning. The more important one says;

Interesting to note that it's the Non-Execs who suspended the shares. This follows an announcement a week ago that the CFO had resigned wef. 31 Dec 2014. So worth noting - if the CFO leaves a problem company (especially an overseas one), then I would suggest it's probably wise to hit the sell button first, and ask questions later.

I'll be amazed if these shares ever come back from suspension, but I suppose it is possible.

Anyone holding shares in any other small, AIM listed Chinese stock, frankly needs their head examining, in my opinion. Although I suppose the counter-argument is that if you have found an incredibly cheap Chinese stock which actually turns out to be genuine, then you could have a multi-bagger on your hands. So if the shares are bought with a view that they are probably worth nothing, but there's a chance of a (say) 500% gain, then I can see why someone might do that.

The one that will be very interesting to monitor is Tinci Holdings (LON:TNCI) - where the major shareholder has offered minority shareholders an inexplicably generous 20p per share (when they were trading at 4p per share previously). Let's see if he comes up with the actual cash though! Crunch date is 15 Jan 2015. I wouldn't bet on the deal completing, but there again I've learned the hard way to be ultra-cynical about overseas AIM stocks.

The systemic problem with AIM is that regulation is weak, and what regulation there is, isn't enforced - i.e. nobody is punished for wrongdoing. Therefore I see it as being effectively an unregulated market. That is bound to attract wrong 'uns! It will be a magnet for them! Ask yourself why companies on the other side of the world would choose to list on an effectively unregulated market in London. Then avoid the shares like the plague!!!

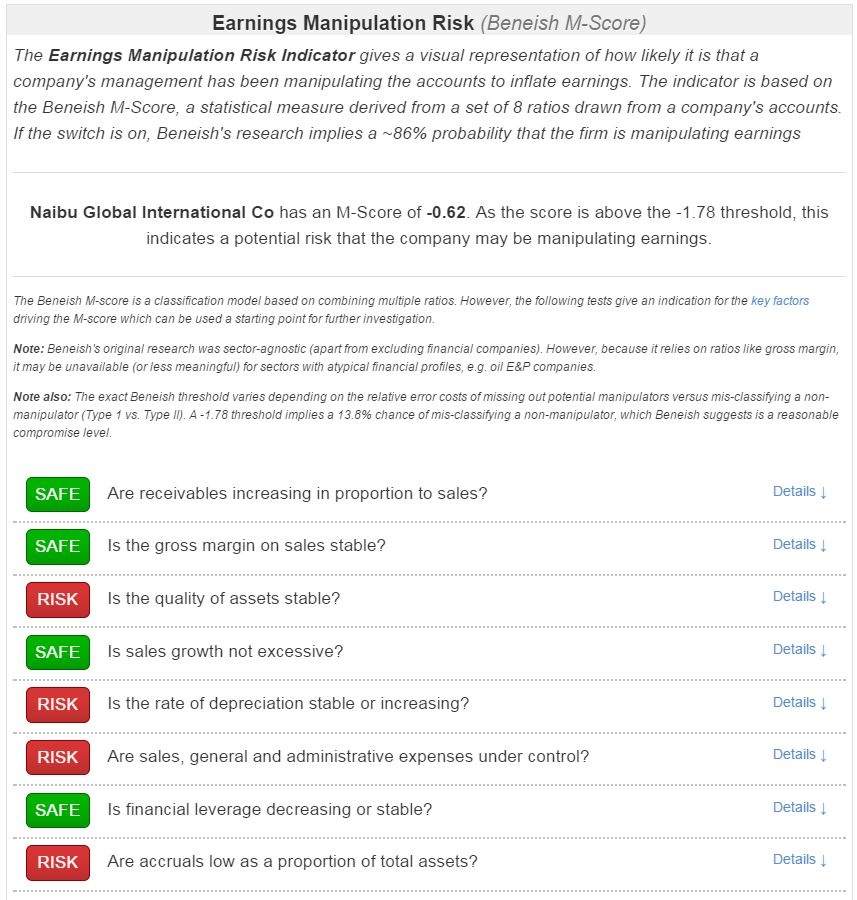

It's worth pointing out, without wishing to bite the hand that feeds me, that data systems often won't pick up on the red flags that shrewd investors pick up on. So the Stockopedia valuation & quality scores are a sea of green. However, note that Stockopedia did ring one alarm, namely the "Earnings manipulation risk" indicator was on for Naibu. So this is something we should probably all be paying a lot more attention to. It is based on the Beneish M-score, and ;

I think this is an area where we need to think about improving the red flags on Stockopedia to pick up more warning signs, such as extreme extended debtors, and even stocks which are irrationally cheap - rather than flagging them as cheap, the system should be putting a big question mark over them, saying that the market is telling you something is wrong with that stock, because it's TOO cheap.

I'll have a chat with Ed & Dave about this.

Boohoo.Com (LON:BOO)

Share price: 23.1p

No. shares: 1,123.1m

Market Cap: £259.4m

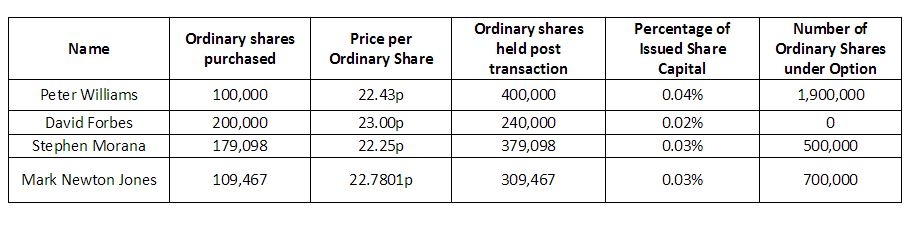

Director buying - an announcement today says that 4 Directors at BooHoo bought shares yesterday, after the share price plunged on a profit warning. See my report yesterday for my take on the profit warning.

I'm normally not a fan of orchestrated Director buying - because its intention is usually to prop up the share price. It looks especially bad when a Director with a huge shareholding adds a relatively small amount to that.

However, in this case I note that the buys come only from the Non-Execs, including the Chairman. That's a bit different. It is a vote of confidence from them, and as you can see from the table below, it does materially add to their existing (very small) shareholdings. Although the total amount spent, about £135k, between 4 people of (presumably) comfortable finances, is not enough to make you really sit up and take notice.

So on balance, I think this is neutral to very slightly positive. Nothing to get excited about. Some people like Director buys like this more than I do though, so maybe they might see it more positively. Personally I prefer to let the financial results do the talking.

I bought into BooHoo yesterday, quite heavily, as I think it's a very good business, and now reasonably priced, if you look at the latest, more realistic broker forecasts. It also has loads of cash on the Bal Sheet now, £60m, as reported yesterday, although that will be a seasonal high point.

Watching the trades yesterday and today, there is heavy two-way volume. Two announcements yesterday of Instis reducing their stakes, confirm my theory - that the Instis who bought in the IPO at 50p are hacked off that the company is not growing as fast as planned, so are dumping some or all of their shares. The buyers however are people like me, who have seen the growth at reasonable price characteristics of the share now, and don't really care whether the people who bought at IPO overpaid, based on over-egged forecasts driving a toppy valuation.

I suspect once the sellers are gone, this stock could rebound nicely, maybe to the 30p area? Any more would need a positive year end trading update on 28 Feb 2015. If they warn on profit again, then the shares would take another leg down. You pays your money, and all that!

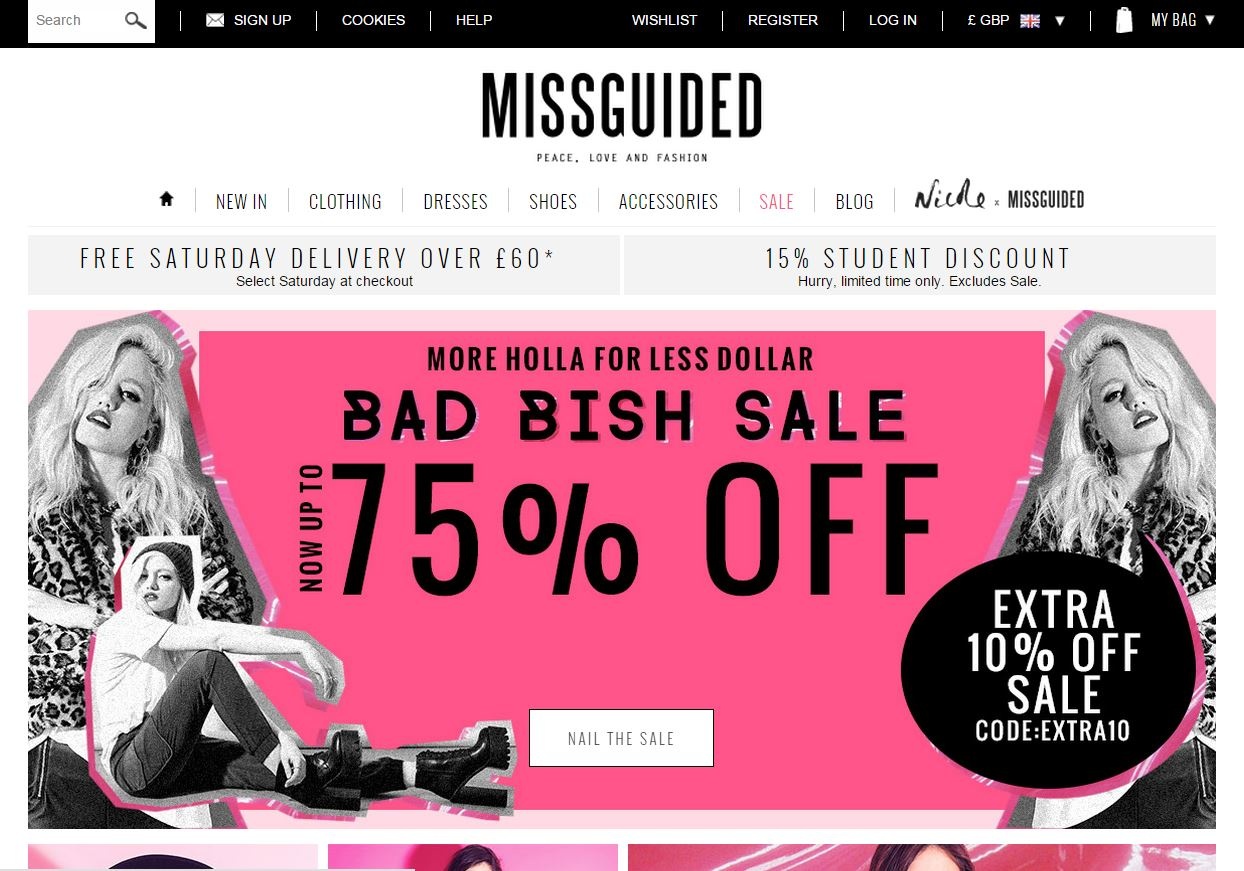

Researching it online last night, and talking to friends & relatives, BooHoo seems to be the fashion website of choice for young women, who are frequent, repeat, and happy customers (judging from many online reviews, YouTube blogs, etc). The main competitor is apparently called Missguided.co.uk which judging from their home page, looks a bit more slutty (can I say that? Not sure if it's PC or not).

I am told that BooHoo and MissGuided have successfully dominated the online fast, cheap, fashion market. This is exactly the space my previous employer (from 1993-2002) occupied, but in the High Street. In fact we bought a lot of stock from the people behind BooHoo, so I know this market well. At this valuation, and with international expansion underway, I am very keen on this stock at 23p. But as always, please DYOR, as this is just my opinion, it is NOT any kind of recommendation or advice, we don't do that here at Stockopedia - our ethos here is people having the tools to make their own informed decisions.

All done for today, and the week. Have a lovely weekend, and see you here on Monday!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BOO, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.