Good morning!

McColl's Retail (LON:MCLS)

Share price: 181p

No. shares: 104.7m

Market Cap: £189.5m

Trading update - this convenience store group updates for the six weeks to 11 Jan 2015. It describes trade as "resilient", but LFL sales were actually down, at -0.9%. OK that's not much, but bear in mind that retailers have general cost inflation running at maybe 1-2%, so they need to generate a small positive sales growth each year just to stand still in profit terms.

Total sales were up 4.7%, which suggests that they've opened a fair number of new stores in the last year, or enlarged existing ones.

It's interesting to note that McColls says they do not experience strong seasonal fluctuations in trading, as they are used for top-up purchases throughout the year, rather than a main shop.

Post Offices are key to this business, I seem to recall, from last time I looked at it.

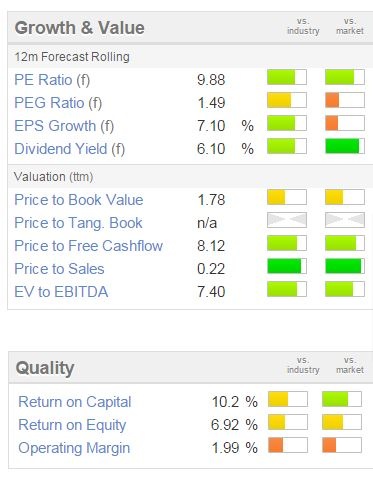

Value metrics look quite good (especially the divi yield), but quality measures less so.

Note also that the free cashflow isn't bad.

My opinion - I think it's dangerous to chase a high dividend yield, and end up buying not very good quality businesses that might not be able to pay generous divis forever. This is a very low margin business, in a highly competitive sector, and I've seen in my local area how existing convenience stores find it impossible to compete as soon as Tesco, Sainsburys, etc, open a convenience store nearby.

For that reason, I would only dabble in this share if it was on a PER of about 6 - to me that's the right price for a not very good quality business in a very competitive sector. Feel free to disagree, it's only my opinion.

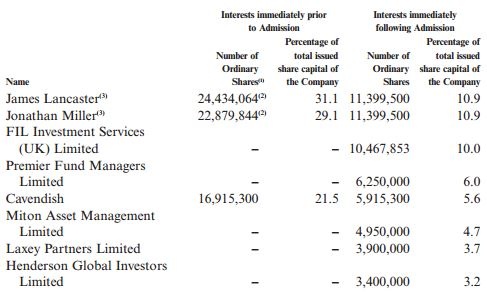

Also, I am always highly sceptical of all IPOs. After all, if the business was so great, why do they want to sell? Here is table B6 from their Admission Document, showing the shareholdings of the previous owners, and how they reduced in the IPO - the majority of the IPO proceeds went to the previous owners.

Essenden (LON:ESS)

Share price: 70p (up 2p today)

No. shares: 50.1m

Market Cap: £35.1m

Trading update - the company cleverly mentions full year LFL sales first, which are up 6.6% for the 52 weeks ending 28 Dec 2014. Sounds great, but if you check back to the last trading update, LFL sales were up 9.2% year-to-date when reported on 18 Sep 2014.

The trend has therefore been a deceleration of sales growth, indeed it was only marginal, at 0.1% for the four weeks to 11 Jan 2015. That suggests to me that the low-hanging fruit of the turnaround has probably been bagged, with the company now up against much tougher comparatives.

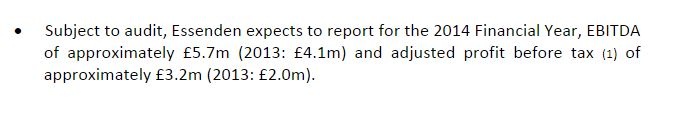

Nevertheless, the EBITDA and adjusted profit figures for 2014 look good;

Net cash (excl. finance leases - on equipment presumably) was £2.3m.

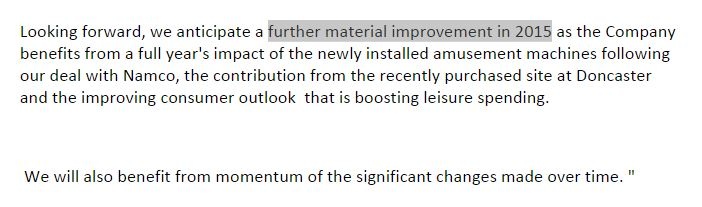

Outlook - this sounds good;

My opinion - I am an existing holder, and there's enough red meat in today's announcement to make me happy to hold for the next six months at least. These figures look ahead of broker forecast, and the valuation seems reasonable to me. I like it. Very illiquid though, and a horrible bid/offer spread sometimes. Hopefully they will start paying divis soon?

Synety (LON:SNTY)

Share price: 190p

No. shares: 8.4m

Market Cap: £16.0m

Quarterly KPIs - look good to me. The growth rate of annualised recurring revenue (the most important KPI) has accelerated in Q4.

I am hoping to speak with the company at some point, so will come back and update this section after I've queried a couple of points.

UPDATE: Right, I'm up to speed on Synety! I have copied below the KPI table published today. The most important line, in my view, is the first row, Annualised Recurring Revenue - i.e. this is the current monthly run rate of revenue, multiplied by 12. This is appropriate as a performance measure because almost all SNTY's revenue is monthly fees paid by customers, as is usual with telephony products.

Just as a quick reminder SNTY's product is a cloud telephony system which integrates into clients' CRM systems. So it places recordings of telephone calls with each customer into their client record on whatever CRM system is being used (e.g. Salesforce). SNTY integrates with about 30 different CRM systems, and more are being added all the time. It also now integrates with Google Chrome, which greatly increases the addressable market - but that's only just launched.

Growth in Q4 2014 was very strong - ARR rose from £2.22m to £3.02, in just three months! That's a remarkable growth rate.

My opinion - Synety is still loss-making, but I'm quite excited by the growth, which is being achieved organically. The product is superb (I've tried it, and it works briliantly). There is very limited competition, and SNTY has the keenest pricing. The company is on target to reach breakeven in Q1 of 2016, and has (just about) enough cash to get there. Cash isn't an issue - if they need to raise a small amount (say £1-2m) that could be done with a few phone calls, so I'm not at all concerned about cash.

I am very enthusiastic about this share, as I can see the potential for this to be a much bigger company in a few years time. The product is superb, customers love it, and client retention rates are extremely high (almost 95% of customers renew after 12 months).

It's speculative and quite early stage, so definitely not a share for widows or orphans, but FWIW, I like it and can see a lot of potential here. Very smart management too. The shares are a rollercoaster ride, as you can see from the two year chart below. However, with the share price being low, yet performance KPIs being strong, that to me seems an anomaly, hence I've been topping up today. Please DYOR as usual, this is just my opinion, definitely not a recommendation, we don't do those.

NetPlay TV (LON:NPT)

Share price: 7.4p

No. shares: 296.6m

Market Cap: £21.9m

Trading update - 2014 results are in line with expectations. However, that doesn't really matter, as the change in taxation affecting online gaming has moved the goalposts, and could heavily dent profits.

For this reason I decided a while ago to sit on the sidelines until it became clear what profit Netplay might make in future, under the new tax rules, of the point of consumption tax. On this issue, the company today says;

My opinion - given that this company (like most) tends to put a positive spin on everything, if the best they can say is that they "remain cash flow positive", for me that rings big alarm bells. That suggests to me that they are now maybe marginally loss-making, but didn't want to say so, so instead have focussed on cashflow instead - since cashflow will generally be better than profits, as non-cash charges such as depreciation and amortisation are excluded.

The company does however have a strong Balance Sheet, with plenty of cash, although I note there is no mention of the cash figure in today's announcement. They indicate that acquisitions are possible, which suggests further to me that the existing business is probably not doing very well under the PoC tax.

I'm making some suppositions above, so could be wrong. However, I'm not going to risk it, and will await full year results in early April 2015 before looking at this stock again. It's not a bargepole stock due to the cash pile, but it's certainly on my "be very sceptical & cautious" list.

Remember there was very heavy Director share selling here a while ago - so as usual, follow the money! If Directors are offloading £millions of stock, it's telling you something!

All done, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in ESS and SNTY, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.