Good morning! It's Paul & Jack here with the SCVR for Thursday. Today's report is now finished.

Agenda -

Paul's section:

Naked Wines (LON:WINE) - shares have been clobbered today, on publication of interim results which show the growth story has shuddered to a halt. Full year guidance is cut. The bull case for this share really doesn't stack up any more in my opinion.

Finsbury Food (LON:FIF) (I hold) - AGM trading update is a bit light on specifics, but says the business continues to trade well, and is mitigating supply chain & cost pressures. Looks very good value, for a decent quality business.

Eagle Eye Solutions (LON:EYE) - an impressive trading update, with the growth rate accelerating, and EBITDA comfortably ahead (no figures given though). Although the growth is being recycled into higher costs. I like the company, but the valuation seems toppy - so it's up to you to decide if that's justified or not.

Begbies Traynor (LON:BEG) (I hold) - good growth in H1 profits, mainly from acquisitions. On track to meet full year expectations. I see potential upside here, as insolvencies are likely to increase as Govt support measures are phased out. Still reasonably priced. Looks good.

Jack's section:

Finncap (LON:FCAP) - many will know finnCap due to its retail investor-friendly equity research policies. The interim update today is predictably good given the conditions, although there are some signs of moderation. The shares are cheap on a trailing twelve month basis, but performance over the medium term is harder to gauge. Cyclicality is a risk, and the shares are not overly liquid, but trading continues to be strong, there's scope for upgrades, and a near 5% dividend is useful.

Asa International (LON:ASAI) - high risk microfinance provider to low-income female entrepreneurs in developing markets. Covid and lockdowns are still disrupting business, so the situation remains volatile. If the group can navigate these conditions it might be worth assessing the longer term prospects at some point, but more due diligence required.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's section

Naked Wines (LON:WINE)

560p (down 17%, at 09:07) - mkt cap £411m

Half Year Results for the 26 weeks ending 27 September 2021

Disruptive business model continues to drive growth as the largest direct-to-consumer wine business in the world with 947k Angels

The Netflix of the wine world, or just an online wine retailer in a fairly crowded space? I recently rejoined Naked Wines as a customer, and it struck me that the original “Angels” concept of sponsoring small producers of wine, then later receiving exclusive wine produced by them, seems to have been heavily watered down. This time, it didn't feel any different to ordering wine from Virgin Wines Uk (LON:VINO) .

My introductory case of wine half price wines from WINE might have been good, but by the time I arrived in my London household (several days after ordering the wine) it had all been consumed. The labels looked nice anyway, which is my usual method of choosing supermarket wine.

Today’s interims from WINE strike me as pretty awful. The company has always been creative with how it reports profit - supposedly huge profits from repeat customers, which is then used to fund growth via heavy marketing spend & introductory offers.

There’s a big problem with that story today - there’s no growth to speak of. In the key USA market, revenues actually fell 3% to £74.4m in H1, despite spending £13.4m in “investment in new customers”.

Bulls might point out that the company is now up against the toughest prior year comparatives, which benefited greatly from the first wave of covid, as we’ve seen from many eCommerce companies. Last year’s boom is this year’s tough comparative.

Other problems that WINE reports today include: supply chain issues, impacting product availability, delivery issues, and higher cost of customer acquisition - which seems to be a big problem for online companies, e.g. higher online marketing costs clobbered the profits at Best Of The Best (LON:BOTB) recently (I hold).

Total H1 revenues are £159.3m, up only 1.4% on H1 LY (or +6% at constant currency) - despite all that marketing spending. That really makes me question the business model. If the company has to spend heavily on marketing & introductory offers just to stand still, then the growth story is not credible to me.

H1 adjusted profit before tax is only £1.7m - improved from a loss of £(2.7)m in H1 LY (last year), with a higher gross margin, and reduced advertising spending looking as the main reasons for the improvement in profitability. It’s still negligible profit though, for a company valued at £411m.

Adjustments to profit were large last year, but small this year, so the adjustments only boost profit by c.£400k in the latest H1 numbers, so no issues there.

Full year guidance - has been reduced.

There’s an admirable level of detail provided, but for me the key numbers are that FY 03/2022 revenue growth is now expected to be only 2-7% (at constant currency) - which translates to almost nothing in reported currency.

So negligible growth, despite spending £35-45m (guidance) on new customer acquisition.

That’s just not good business is it? It suggests to me that the customer lifetime value (LTV) looks much worse than the previously reported numbers. Customer churn must be quite high, if WINE is having to spend so much on customer acquisition, just to stand still.

Balance sheet - looks fine. The £57.1m cash pile is really customer cash, note the larger offsetting £76.4m creditor for “Angel” deferred income. A business model where customers give cash to the company in advance of receiving the goods, is good business.

The other noteworthy point is that inventories has shot up to £127m, which looks very high, given that these are recorded at cost. Applying a 42% gross margin (actual in H1) translates inventories into £219m at the revenues line. That’s about 8 months sales, which looks like very slow stock turn. This could indicate problems, if this very high level of inventories contains slow moving stock, that might require heavy discounts to shift it. I hope this slow-moving wine doesn’t end up in the Christmas wine package I recently ordered!

The company says it deliberately chose to increase inventories, to secure product availability, but to my mind buying 8 months worth of product in advance seems excessive. So a possible problem here.

My opinion - I’ve always been sceptical about Naked Wines, because of the creative accounting - showing huge profits from repeat customers. Nobody else reports numbers like that, of the other eCommerce businesses I follow. It’s just accepted that heavy marketing spend is necessary to maintain and grow the business. For me the key point is that WINE isn’t growing much, if at all, despite continued heavy spending. That indicates a big problem to me, and I see these numbers very negatively.

Personally, I wouldn’t touch this share, because the growth story looks to be broken - the company’s now having to run to stand still, in what is a highly competitive market. I don’t believe that WINE has invented a disruptive business model. But opinions may differ on that, so if you’re still bullish on WINE shares, do please share your thoughts in the comments section - we like to hear a range of opinions.

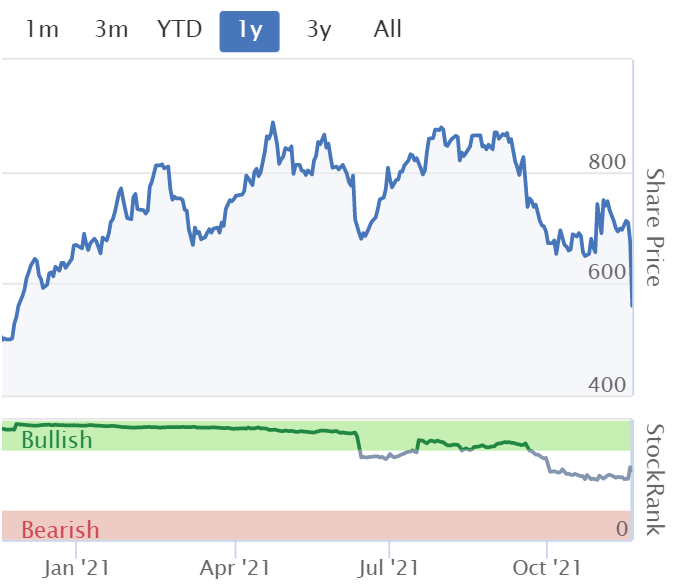

Shareholders have taken a lot of pain in the last few months, similar to holders of many other eCommerce businesses.

.

Finsbury Food (LON:FIF) (I hold)

99.5p (up 1.5%, at 11:22) - mkt cap £130m

Finsbury Food Group Plc (AIM: FIF), a leading UK speciality bakery manufacturer of cake, bread and morning goods for both the retail and foodservice channels...

The current financial year is FY 06/2022.

The resilient performance of the previous financial year has continued into the current financial year. Sales for the first four months of FY22 grew by 8.3% to £106.2m, driven by a stable performance in UK retail, continued robust recovery of foodservice and a very strong overseas performance.

Supply chain & inflationary pressures -

We have responded quickly to mitigate much of the impact of these challenges through commercial negotiation and other initiatives.

Outlook -

Finsbury continues to make excellent progress in becoming a more efficient group with increasing synergies and scale benefits. We will continue to manage industry headwinds while driving the business forward and look forward to updating the market again in January."

My opinion - a reassuring update, but it doesn’t tell us how the business is performing against market expectations. I think investors much prefer it when this is stated specifically. We’re left to assume that trading must be in line with expectations, but there’s always some doubt, if it’s not directly confirmed.

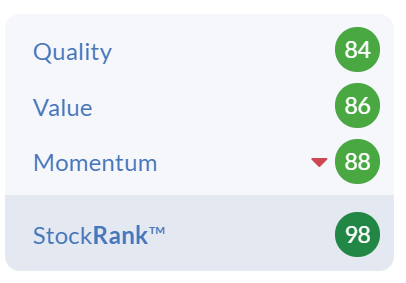

As the Stockopedia graphics below show, this looks a decent quality business, at a very modest valuation. It’s reassuring that supply chain problems and inflation seem to be under control.

This share seems obviously under-valued, in my view, and I think a more rational valuation would be maybe 120-150p - which leaves room for a takeover bid to offer a decent premium, if it catches the eye of a larger group, possibly.

.

Stockopedia's emotionless computers also give it a thumbs up - not a guarantee of success of course, but it improves the odds -

.

Eagle Eye Solutions (LON:EYE)

602p (up 5.6%, at 10:42) - mkt cap £157m

Eagle Eye, a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions and gift services...

Expanding customer relationships deliver revenue and EBITDA growth

The current financial year end 06/2022.

This update sounds very good - here’s my summary of the main points -

Q1 revenue growth rate of 35% vs Q1 LY

Acceleration in growth rate from +27% in the previous quarter

Guidance raised for FY 6/2022, but no figures provided - “comfortably ahead of management expectations”

Costs (payroll) will rise “to support future growth”

Continued to win new contracts, name drops some big clients

New 3 year, £5m loan agreed (helpful in avoiding dilution)

Sales pipeline continues to grow internationally, and is at record level

My opinion - I like the business, although it’s small, and not making any significant profit. So it’s all about the growth, and high quality client list.

How to value it? As a value/GARP investor, the current price looks multiples of what I would personally value the company at. Therefore, this share is for people who like the story, the growth, the big name clients, recurring revenues, but don’t really care about profitability or valuation. There’s nothing wrong in that, it’s an approach which has been a very lucrative area for many years in tech shares. It’s risky though, as an inflated valuation can quickly unravel if growth slows. No sign of that here though, the company looks to be growing strongly, and there is a lot to like about this company - just not the high valuation!

.

.

Begbies Traynor (LON:BEG) (I hold)

139p (flat, at 12:28) - mkt cap £211m

Begbies Traynor Group plc ("the group"), the business recovery, financial advisory and property services consultancy, announces an update on trading for the six months ended 31 October 2021. All figures are unaudited.

Decent numbers in H1 -

The group is pleased to report a strong financial performance in the six months. Group revenue increased to c.£52m (2020: £37.5m), with adjusted profit before tax growing to c.£8m (2020: £5.0m), principally reflecting the benefit of acquisitions completed since January 2021.

Net cash of £1.2m at 31 Oct 2021 - not bad, considering insolvency practitioners have a lot of working capital tied up in extended receivables (they often get paid at the completion of a job). Significant headroom on bank facilities.

Outlook -

As previously guided, we expect our results will have a second half weighting as we anticipate an increase in insolvency activity over the remainder of our financial year (to 30 April 2022). Overall, we remain confident of delivering market expectations* for the full year, which will represent a year of significant growth.

* current range of analyst forecasts for adjusted PBT of £17.0m-£18.5m (as compiled by the group)

Thank you for the helpful footnote.

Valuation - I’ve checked a couple of broker notes from Sept 2021, available on Research Tree, which pencil in 8.5p and 9.1p for EPS this year, FY 04/2022. Stockopedia is showing 8.8p broker consensus, which ties in with the broker notes.

At 139p that gives a current year PER of 15.8.

I’m comfortable to value BEG on next year’s forecast of 10.0p, so a PER of 14

Also, there could be earnings upside on next year’s forecast, due to the withdrawal of Govt support measures, which is likely to result in increased case numbers for insolvency practitioners, as zombie companies collapse in due course.

My opinion - Begbies looks reasonably-priced, and is probably about to enter a period of increased activity, with a largely fixed cost base. That could prove lucrative, so I still see an opportunity with this share.

.

.

Jack’s section

Finncap (LON:FCAP)

Share price: 37.4p (+2.47%)

Shares in issue: 177,851,680

Market cap: £66.5m

(I hold)

finnCap is building an advisory service business ‘focused on the business of tomorrow’.

It currently provides strategic advice, capital raising and related services to corporate and institutional clients and high net worth investors. The group has a PI-friendly equity research policy and conducts a number of activities including: equity advice and fund-raisings, public and private M&A, debt arrangement and advice, and NOMAD services.

Sam Smith CEO and Richard Snow CFO will provide a presentation later today on Investor Meet Company: https://www.investormeetcompany.com/finnCap-group-plc/register-investor

- Total revenue +55% to £31.7m,

- Capital Markets revenue down from £16.3m to £15.6m,

- Cavendish revenue +283% to £16.1m,

- Adjusted PBT +67% to £7.2m; statutory PBT +75% to £6.3m,

- Adjusted EPS +62% to 3.54p,

- Cash balances up from £20.4m to £22.6m.

Overall equity issuance on AIM in H1 was broadly stable at c.£3.0bn (H121: £2.9bn) with a number of larger transactions. finnCap market share was c.6% (AIM fundraisings greater than £5m) (H121: 7%) reflecting slightly lower deal activity in its client base which had been boosted by COVID-19 related deal flow in the previous year.

Market trading activity has been lower since Summer. The group believes this was influenced by lower retail trading in AIM stocks following a return to work. I’ve had a similar hunch over recent months, with many previously popular ‘lockdown’ stocks derating and generally tougher conditions for many private investors, so it’s interesting to hear finnCap say this.

The M&A market saw a continuation of the strong activity levels from Q4 of last year, with several high-quality mandates already under execution.

Total Deal and Advisory fees grew by 75% to £24.9m, with 39 transactions completed in the period. These include £250m of equity raised through 14 placings and an IPO, 13 private M&A transactions advised on with an aggregate value of c£1bn, another three public M&A transactions (aggregate value of c£500m), and six completed debt financing mandates raising c£250m. finnCap continues to invest in headcount across the business.

Current Trading - Q3 started well with a further placing for Genedrive (LON:GDR) , the completed sales of GCSEPod and Intelling, and the IPO of Eneraqua raising £20m (due to complete in the next few days). The deal pipeline is ‘solid’ with further potential IPOs, equity fund raisings, and private M&A transactions to complete in the coming months.

The group recently upgraded its FY22 outlook in October. No new upgrades are announced today, but the previously revised figures are for full year revenue of £45m-£50m, with staff costs of between 58-62% and non-staff costs of around £10m.

The equity market is quieter in terms of trading volumes than at this time last year. The issuance market remains solid although, with higher institutional sensitivity to valuations, ‘getting deals done is comparatively more difficult’.

Activity in the M&A market remains favourable, but the group does not expect to match the H1 revenue performance in H2.

For finnCap Capital Markets, the group says: ‘delivering H2 revenue at levels similar to H1 (of £15.6m) would be an excellent outcome for the Capital Markets team.’ Regarding Cavendish, it adds ‘Activity levels are now lower than in H1, but the finnCap Cavendish team has already completed a further two deals since the half year end and we expect the team to deliver a good full year result with revenue above £20m.’

Commenting on the results, Sam Smith, CEO, said:

Today's results show that our strategy of building a broader financial advisory firm - focused on servicing the needs of the business of tomorrow - is working. We will continue to invest across all areas of the business to broaden our offering and ensure that we can help our clients drive their growth, capitalise on opportunity and deliver their ambition.

This performance, together with our strong balance sheet position, has given us confidence to increase our dividend plans for FY22 as part of our long-term commitment to give shareholders an attractive payout which increases over time. We now expect to pay shareholders a total of not less than 1.75p for FY22 with 0.6p at the half year.

That would be a dividend yield of at least 4.7%.

Conclusion

The key question for cyclical investment banking industry companies is for how long the current favourable conditions will persist. If this is a more sustainable dynamic, then it’s not hard to see the share prices of these companies appreciate further, as there is value on offer.

There are some signs of slightly moderating conditions, but finnCap will be paying out a near 5% dividend in FY22, while shares trade on just 7.7x trailing twelve month earnings and 4.1x TTM free cash flow. It’s also investing in headcount, although the company has not been able to take market share year-on-year, which I was looking for.

Cavendish, the sell side M&A advisory business, has roared back to life and finnCap expects the division to continue performing well ‘albeit in more subdued markets’. Another aspect to consider is how much of enlarged profits go to shareholders, and how much is retained by staff. The H1 share-based payments charge has increased but profit attributable to equity shareholders is also up strongly, so for now there is enough to go round.

Analyst Progressive Equity says: ’The increased share-based payments for the year (£1,500k for the full year, compared with £832k in H1 2022 and £344k in H1 2021) will reduce our reported pre-tax profit by 8% to £7.6m (from £8.2m).’ FY22 unadjusted PBT and EPS are reduced by 8% and 10% respectively ‘reflecting the increase in share-based payments’.

A marked downturn in conditions is always a risk here too and this will happen at some point, but when is hard to say. It could be years away given that markets are supported by the weird alchemy of modern macroeconomics.

For now, finnCap looks modestly valued and is investing for future growth. A more subdued H2 is anticipated, with revenue in the range of £13.3m and £18.3m though. Business is fundamentally cyclical and the shares are not overly liquid, so there are risks to holding.

I think you can argue it both ways, and it will pay to continue monitoring market conditions, but ultimately the company is trading well.

Asa International (LON:ASAI)

Share price: 155p (+6.9%)

Shares in issue: 100,000,000

Market cap: £155m

This sounds interesting: a ‘microfinance’ provider to low-income people (more specifically female ‘micro-entrepreneurs’) in South Asia, South East Asia, East Africa, and West Africa. A commendable raison d’etre, but is it too risky for the average UK investor?

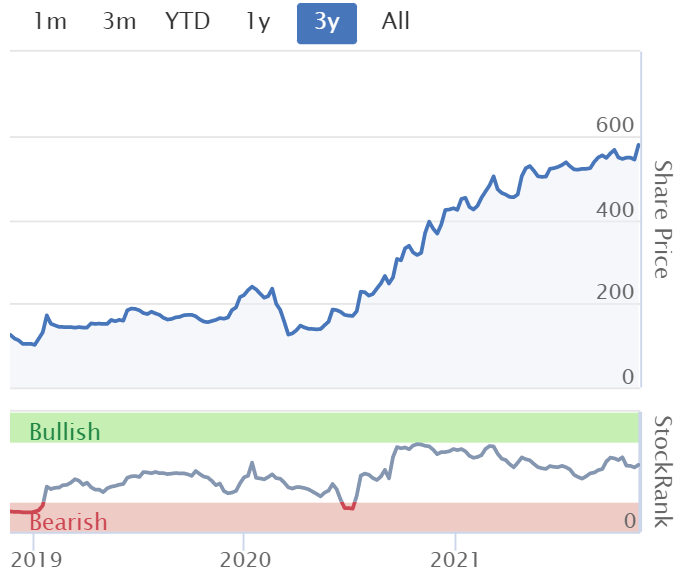

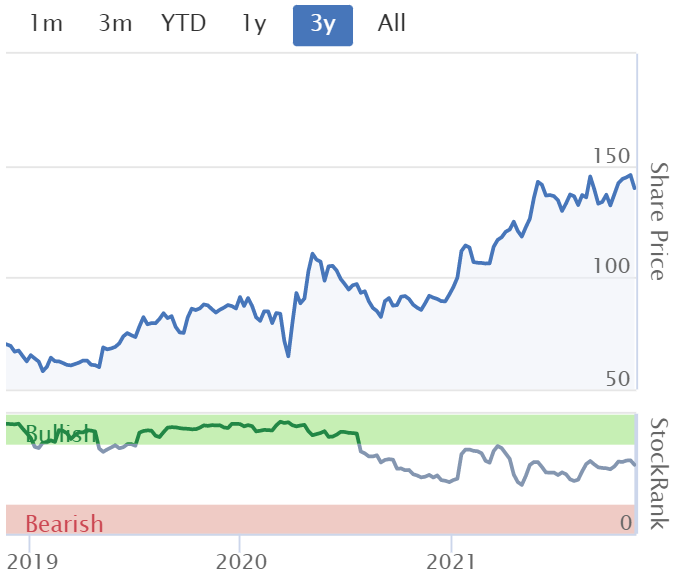

Its performance so far suggests caution is warranted, with a general decline in price beginning before Covid.

Around 1.4bn people (c25% of the global adult population) do not have an account at a formal financial institution and are therefore financially excluded. ASA believes it has an addressable market of c338m low-income female prospects across its 13 operating countries.

The group has 2,036 branches, 2.5m clients, and $440m of outstanding loans in its portfolio. Looking a little more closely at its territories shows the following split:

South Asia

- India - 409 branches

- Pakistan - 313 branches

- Sri Lanka - 66 branches

South East Asia

- The Philippines - 326 branches

- Myanmar - 96 branches

West Africa

- Nigeria - 263 branches

- Ghana - 133 branches

- Sierra Leone - 44 branches

East Africa

- Tanzania - 105 branches

- Uganda - 103 branches

- Kenya - 30 branches

- Zambia - 13 branches

The history of the group is also quite interesting, starting off with a $2m loan from the Bill and Melinda Gates Foundation back in 2007. The rest is too detailed to get into, but you can find the timeline here.

From the company:

Underlying ASA International lies the vision of the Group’s founder – Shafiqual Haque Choudhury – to improve the lives of underprivileged people and bring about social change, which ultimately led him to create the cost-efficient ASA Model in Bangladesh. ASA International has replicated the ASA Model internationally, in Asia and Africa, with the aim to further expand. The Company distinguishes itself by being a socially responsible lender in the way it treats its staff, clients and communities in which it operates.

There’s $103m of unrestricted cash and cash equivalents liquidity across the group and a pipeline of funding deals under negotiation totaling c$198m. With the exception of India and Myanmar, all other operating companies achieved collection efficiency of more than 90%.

India collections improved to 70% from 64% in September as markets recover from recent lockdowns. Collection efficiency, excluding instalments due from clients receiving the one-time loan restructuring offered by the Reserve Bank of India ('RBI'), decreased to 91%.

Sri Lanka collections resumed to 91% following the end of nationwide lockdowns.

Collections in Myanmar improved to 68% from 55% in September despite the partial lockdown imposed by the local government.

Uganda collections improved to 94% from 89% in September with fewer local lockdowns and travel restrictions across the country.

Portfolio quality remained ‘challenging’, particularly in India. However, the benchmark PAR>30 for the group, including off-book loans and excluding loans overdue more than 365 days, improved to 11.8% from 13.8% in September, and PAR>90 improved to 8.6% from 10.2% in September. Excluding all loans which have been overdue for more than 180 days and, as a result, have been fully provided for, PAR>30 improved from 5.2% in September to 4.8%.

PAR means portfolio at risk, and PAR>30 means the percentage of the gross loan portfolio for all open loans that is overdue by more than 30 days.

The group's operating subsidiaries, excluding India, the Philippines and Myanmar, collectively have been able to reduce PAR>30 to 2.0%.

The number of clients remained around 2.5m, while Gross OLP increased to $440m (1% higher than in September 2021 and 2% higher than in October 2020). Collection efficiency has remained broadly stable.

Covid - Since March 2020, the number of staff members confirmed as infected by Covid-19 increased to 443 of over 12,800 staff, with two deaths. Confirmed infections amongst 2.5m clients increased to 19,458 from 18,218 in the previous month, resulting in 676 deaths since the start of the pandemic. Of the 676 client deaths across the group, 451 are from Myanmar, with 7 of those deaths occurring in October 2021.

The group says:

Please note that, while the Company's operational performance appears to gradually normalize in most countries except for India, Myanmar, Sri Lanka and Uganda, the risk of additional challenges to our operations should not be underestimated, as we have recently seen in for instance India and Myanmar, due to (i) the still relatively high infection rates, (ii) the current lack of available vaccines in most of our operating countries, (iii) the risk of the introduction of more infectious COVID-19 variants in our operating countries as have been observed in the United Kingdom, South Africa, Brazil, the Philippines, Myanmar and India, and (iv) the associated disruption this may cause to the businesses of our clients.

Conclusion

It seems risky to me, although the group’s intentions are commendable.

Given the broad spread of emerging market micro-financing activities, Covid remains a considerable risk. India, Myanmar and Sri Lanka in particular are seeing ongoing disruptions to business activities resulting from high infection rates. That puts me quite firmly on the sidelines for now.

Other risks include jurisdiction, currency, asset/liability duration, loan quality, and financial health. The revenue chart tells a story: strong growth up until Covid, at which point the disruption has set the trajectory back.

Such an enterprise could grow quite large in time though, as I imagine there is a lot of demand for financing in its target markets.

I’m curious about the company but I can’t say I’m comfortable with it, so if anybody has done any further work or opinions to share on Asa it would be great to hear them. It’s outside my circle of competence at the best of times and right now the backdrop is particularly complex. Still, an interesting company, one possibly worth keeping tabs on over the years to see how it fares and to become more familiar with the business model.

It looks like these business updates are monthly, so there appears to be a good level of communication with the market at least.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.