Good morning. 2014 year end trading reports continue to be published thick & fast. I'm conscious of the fact that the volume is too high for me to cover all of them. I usually read them all, but just comment on the ones that interest me the most, i.e. the ones which are triggering price movements in particular.

Pennant International (LON:PEN)

Share price: 91p

No. shares: 26.5m

Market Cap: £24.1m

Trading update - this small group supplies a range of niche products & services to mainly the armed forces, and transport sectors - e.g. software & equipment for training & simulators.

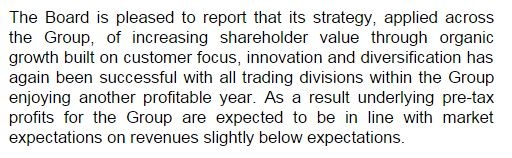

Today's update reads positively. As always, the phrase that pays, is "in line with market expectations" - that's the key point, together with the outlook statement.

R&D tax credits - good news is delivered on this front - the company has received £645k in repaid tax, relating to claims made for R&D tax credits for 2012 and 2013. A further £833k tax loss has been carried forward (so will be offset against future taxable profits). Together with another claim in 2014, this means that no Corporation Tax should be payable for 2014 profits. Clearly this is good news. Investors will need to remember to normalise tax calculations in future, once the backlog of tax credits has been utilised. Broker notes in future should adjust for this, but the short term EPS figures will be boosted. The market cap is only £24.1m, so these numbers are distinctly helpful.

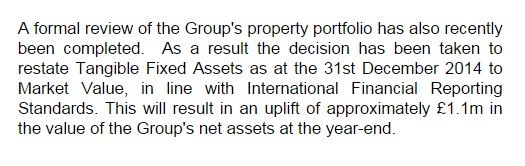

Property revaluation - I like this bit too;

Clearly a boost to the balance sheet is helpful. I wonder if there is read-across to other companies with freehold property that is worth considerably more than cost? Sounds like there might be. I firmly believe that all companies should show freehold property at its approximate market value, not at historic cost, on the balance sheet. Investors want to know how much it's worth, not how much it cost. That is particularly important for an asset that doesn't depreciate, such as land.

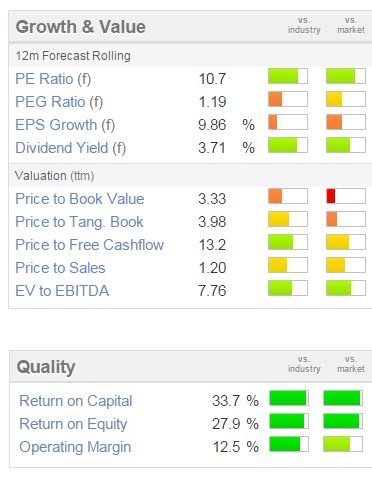

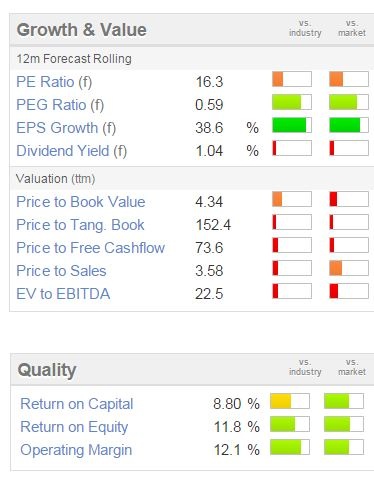

Valuation - this valuation looks undemanding to me, and note the high quality scores too;

The divi yield is pretty good, and the company has a sound balance sheet. So it ticks all my main boxes.

My opinion - the one box it doesn't tick, is predictability of earnings. A small company like this, doing quite large individual contracts, is always going to be vulnerable to a profit warning at some point. I also worry about the potential impact of defence spending cuts.

For that reason, a PER of 10.7 is probably about right. I don't feel it's possible to predict how the company might perform in the future, so it's almost impossible to value really.

The shares have done very well - I've extended the chart from my usual two years, to three years, as it had a very strong rise in 2012 and 2013. It would probably need a considerable increase in profitability to propel the shares sustainably over 100p, so it's the type of share where much more in-depth research on their markets, and potential future profits, would be necessary before considering a purchase.

It reminds me a bit of Cohort. Perhaps it might be better if some of these smaller companies merged into a group, to create a larger, more stable group, and a more liquid share. There must be a lot of duplicated costs too, e.g. costs of listing, Non-Execs, etc.

Empresaria (LON:EMR)

Share price: 43p (up 3p today)

Share price: 44.6m

Market Cap: £19.2m

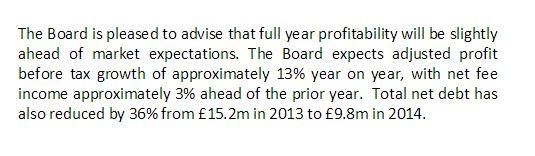

Trading update - I see the shares of this small staffing group have put on a 3p spurt this morning, so the market must like this update. This reads positively to me too:

Slightly ahead of expectations is good news.

Considering the market cap is only £19.2m, I'm quite surprised that the company has operations in other countries, indeed it has opened new offices in Hong Kong, Malaysia, Chile, and Mexico, and has invested in another firm in Dubai. I wonder if they are possibly spreading themselves too thinly?

Net debt - in the past I've been highly critical of this company for reporting an under-stated net debt figure in their results headlines. In fairness to them, they did also show the full net debt position (including non-recourse invoice financing), here is the table from their 2013 results;

So the true net debt was really £15.2m at 31 Dec 2013, and not the misleading £5.8m reported net debt. Clearly that's a massive difference in how you value a company with a market cap of £19.2m. This is the reason the PER is always low at Empresaria, because companies with a lot of debt should be on a low PER - something that is often overlooked by novice investors.

Anyway, I am pleased to see that the net debt reporting in today's statement is the correct net debt figure - i.e. total net debt - so the company seems to have mended its ways on this reporting issue.

The decrease in total net debt from £15.2m to £9.8m in the year to 31 Dec 2014 is impressive. Although there could be some short term working capital timing issues in that, I doubt the whole reduction in net debt is due to permanently improved cashflow.

My opinion - overall I feel a lot more positive about this company, now that we know it's trading well, and Directorspeak sounds fairly upbeat, albeit non-specific;

Overall, it's not for me, as the balance sheet is a tad too weak for my taste, and the dividend yield is paltry at only just under 1%. However, I wouldn't be at all surprised to see these shares move up from 43p to say the 50-60p range later this year. Small recruiters are generally quite cheap at the moment, given where we are in the economic cycle. So I wouldn't be surprised to see the sector re-rated upward by maybe 1-2 extra points onto the PERs in 2015.

Director expense accounts

As an aside, not specific to Empresaria, I sometimes wonder whether overseas branches are a nice excuse for Directors to have a luxury holiday that is classified as "work"?! I've certainly come across plenty of real world examples of where that is very much the case - flat bed flights & 5 star hotels, etc.

There is no requirement for company Directors to disclose their expense accounts to investors, and I bet there are some real horror stories out there, if we were able to see how much is spent on travel at some companies. That's the next disclosure that we should be pushing for, to be included as a note in the Annual Report.

T Clarke (LON:CTO)

Share price: 68.5p (up 4.75p today)

No. shares: 41.8m

Market Cap: £28.6m

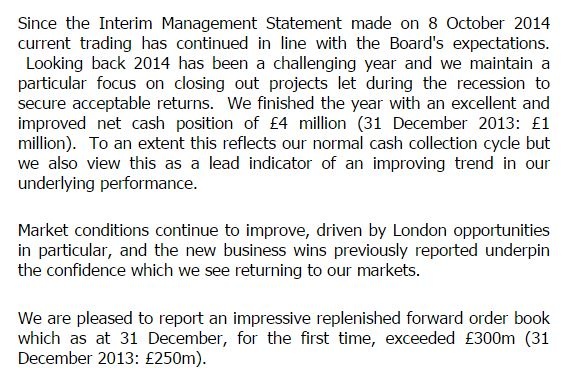

Trading update - there's a lot to like in this update - trading in line with expectations, an improved cash position (although they run net debt at other times in the year), improving markets, and a record order book.

My opinion - I've been highly critical of this company in the past, seeing it as very high risk. However, I did a complete U-turn on 13 Nov 2014 when a trading update sparked my interest, and more detailed research changed my mind, in to seeing this share as a buying opportunity at 50.75p. That's worked out well, so far, with the shares up 35% in just over two months.

I won't repeat those points here, for more detail please click on the link in the previous paragraph. It's all about operational gearing & higher margins coming through as their market (for complex electrical fit-outs for offices, etc) tightens up. In a nutshell, this company keeps on its skilled staff during downturns (and keeps them busy with low margin work), thus profits disappear. However, it then has the skills ready to go when their markets recover, typically about two years into an economic recovery, which is where we are now.

So the cycle is their friend, and that's why the shares are going up. There could be more to come in my view - I think the 2015 broker forecasts look too low, so this could be a share where an upgrade cycle drives the price up to possibly 100p+ at a guess?

The pension deficit is a £1m p.a. drag on cashflow though, and the balance sheet isn't great either. So higher risk than my usual type of thing.

Restore (LON:RST)

Trading update - this document storage & office removals (and other office services) group reports trading was in line with expectations for calendar 2014.

The Directorspeak sounds alright;

Valuation - the company isn't cheap, as you can see from the graphics below. Note particularly the lack of net tangible asset backing, poor dividend yield, and a forward PER of 16.3 which is well above the sector median PER of 12.5.

That said, Restore does have high quality recurring revenue streams from its core document storage activity. That's not going to last forever though, as offices will generate less paper in the future, although that still seems a long way away.

My opinion - it looks priced about right to me.

MySale (LON:MYSL)

Trading update - this flash online sale website has badly disappointed, with a recent profit warning. However, there was also a massive Director buy recently, and today the company reports that sales accelerated in Dec 2014, and were up 8% in H1 (the six months to 30 Jun 2015).

It expects an EBITDA loss in H1, but should move positive in H2.

Cash was £31.2m at 31 Dec 2014, which is material to its £94.2m market cap, although this is probably a seasonal high.

The company also indicates that it has withdrawn from the USA and S. Korea, in order to concentrate on its core markets, which are Aus/NZ, and the UK. This makes sense to me - the previous expansion plan looked wildly over-ambitious, which the company tacitly admits today. That's fine, you have to take risks in business, but it's also good to rein things in when you are over-extended.

I like the business model here, which is unusual in that it sells stock on consignment - i.e. the stock is owned by third parties (typically retailers and manufacturers seeking to clear excess stock), so the company has no inventory risk.

Note how the shares are now trading at just a quarter of the valuation just six months ago! I am wondering if they might be over the worst now?

Henry Boot (LON:BHY)

Trading update - this property and construction company has put out a positive update today, saying:

My opinion - I don't have one, it's not a company I'm familiar with. However, a good friend whose judgment I rate highly, rates this company highly. So it might be worth a look.

Signing off now.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in CTO and MYSL, and no short positions. A fund management company with which Paul is associated may hold stocks written about here)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.