Good morning! I'm heading into London for a meeting this lunchtime, so will get through as many announcements as there is time for this morning.

Produce Investments (LON:PIL)

Share price: 137.5p

No. shares: 26.6m

Market Cap: £36.6m

Profit warning - and it's a bad one too, with the key bit saying;

"...the Company now expects the Group's pre-tax profit for the full year to 27 June 2015 to be substantially below current market expectations."

The reasons given are both over-supply, due to a bumper crop, and lower consumption. Plus of course supermarkets squeezing prices;

"In order to compete with the discounters the big four retailers have had to invest significantly in lower retail price points for key staples, potatoes included, and this has led to price pressure down the whole supply chain."

Hardly a surprise, is it? This is why I am trying my best to avoid holding shares in any company that supplies supermarkets - because they are accidents waiting to happen. It amuses me the way modern terminology for cutting prices, has become "investing in lower price points"!

Valuation - this stock kept cropping up on my value filters, but the extremely low forward PER of just over 4, is too low - something is usually wrong if a PER gets that low, so if there hasn't been one issued recently, then personally I would always wait for the next trading update before making a buying decision, because chances are it's going to be bad (that's why people in the know are selling the shares).

There's a fair bit of debt on the balance sheet here, which increases risk when trading is poor. If profitability can return to previous levels, then the shares could be a steal at this price. However, I'm not sure how likely that is, given the unrelenting pressure the company will be under from supermarkets buying its produce.

The divi yield will be good by now, but the question is, can the divis be maintained, given that trading is poor?

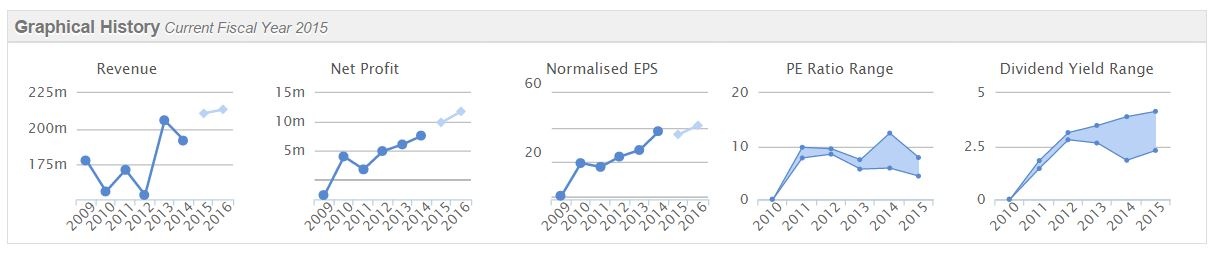

Haynes Publishing (LON:HYNS)

Share price: 117p

No. shares: 15.1m

Market Cap: £17.7m

Interim results - for the six months to 30 Nov 2014 are out this morning. Checking the archive, I last reported on this company when it warned on H1 profits on 22 Dec 2014, concluding that at 155p the shares were not tempting, since the company seems to be in long term, structural decline. It also has a pension fund issue which seems to be getting worse.

That said, the company does have unique IP, and its products (DIY repair manuals for cars) should remain in demand for as long as people want to service their own cars - which is likely to be forever, as even electric, self-driving cars will need their brake pads replacing, and various other things. Although the amount of items needing servicing on cars of the future will be a lot less, as so much maintenance at the moment is related to internal combustion engines, and they are likely to disappear over the next (say) 20 years.

Profitability - has fallen dramatically, with H1 seeing an operating profit of only £0.3m (£1.3m prior year H1).

Outlook - the forward-looking comments sound a bit more encouraging though;

Our second half of the financial year is historically stronger and early indications are that replenishment orders are returning to more normal levels. HaynesPro continues to perform in line with expectations.

It will not be possible to recover the revenue and profit shortfall from the first half of the year. However, in light of the factors above and if the early signs of improvement in trading experienced during the first few weeks of the third quarter continues, the Board believes that the performance of the business can return to more normal levels during the second half of the year.

Pension deficit - has increased to £14.9m (prior year £11.2m).

Net cash - minimal at £0.4m, but at least it's positive.

Dividends - the interim divi of 3.5p has been maintained. If trading does recover in H2, and the full year divi is also maintained, then this could be a good opportunity to lock in a very good yield. Is it sustainable long-term though?

Share capital - this has been knawing away at me - I vaguely recalled there were two classes of shares here. So I've checked the last Annual Report. There are 9m A shares in issue, and 7.352m Ordinary shares. The only difference is that A shares can only be transferred to family members - so it's a mechanism to lock in family control. However, they don't seem to have any other additional rights, so whilst this type of arrangement is generally frowned upon these days, it's not a deal-breaker for me. It's a family controlled company, so you either accept that, or you avoid the shares altogether.

Note that 1.24m shares are held in Treasury, so the 15.1m figure quoted above is net of treasury shares, so is the correct figure to use to value the company.

My opinion - I'm in two minds about this share. It's fallen a lot on a poor H1, so might now be a bargain. That said, the business is surely in long term structural decline. Will it be able to support the pension fund and pay decent divis in future? Who knows? I'm tempted to pick up a few at this level, but on balance probably won't.

Avon Rubber (LON:AVON)

An in line with expectations Q1 trading udpate is issued today.

Net cash has risen to £6.4m at 31 Dec 2014.

ITE (LON:ITE)

Says that Q1 was in line with management expectations, and "largely unaffected by the current economic slowdown in Russia", which is surprising.

easyHotel (LON:EZH)

Is also trading in line with expectations, and seeking new sites.

Daniel Stewart Securities (LON:DAN)

Lives to fight another day, with a small fundraising.

Toumaz (LON:TMZ)

Trading update - turnover is up, but still very heavily loss-making.

It's got enough cash for this year, by the looks of it, so another Placing later this year possibly/probably?

Next Fifteen Communications (LON:NFC)

Puts out a strong trading update, and does a small Placing. Could be worth a look, I've liked this company in the past.

Aukett Swanke (LON:AUK)

Headline results figures look very good - may be worth a look.

Angle (LON:AGL)

Interim results are out today. Still very blue sky, with negligible turnover, and continued losses. Not much cash in the kitty, so another Placing will be on the way no doubt.

Sorry, this has been a bit of a mad rush, need to rush for this train (missing trains is my speciality!)

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. Plus the other bit of the disclaimer)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.