Good morning! I'm running slightly late broadly in line with previously advised timescales today. Profit warning of the day seems to be from Pressure Technologies (LON:PRES) which we were only discussing yesterday. Let's have a gander (please refresh this page regularly, as I will be updating between noon and 3pm).

Pressure Technologies (LON:PRES)

Share price: 267p (down 29% today)

No. shares: 14.4m

Market Cap: £38.4m

Profit warning - being a group of companies mainly serving the oil & gas sector, this company was obviously going to warn on profit, and it has done today. I think this is probably a buying opportunity, because the price had already factored in the (inevitable) profit warning, so the sharp drop today is double-counting, in my view.

You would have to have been living on a different planet not to realise that oil services companies would have reduced profit this year (and probably next year too). Therefore, as you can see from the two year chart below, the price of PRES had already dropped dramatically, in anticipation of a steep fall in profits in the short term. So it's bizarre to see another steep drop this morning when the company simply confirms the inevitable. Anyone selling today must be seriously myopic to have not seen this coming, which makes it all the more illogical for the price to be down so much today.

Markets are meant to anticipate obvious things like this, and then barely move on the actual news.

Looking at the detail of the profit warning, I think they have handled this badly. The announcement today is far too long-winded, yet contains hardly any specifics. What they should have done is said something like this: due to the collapse in the price of oil, we are likely to have a period of poor trading in 2015, and probably in 2016 too. We anticipate that profit in 2015 will be £x, and that profit in 2016 will be between £y and £z. We will update the market every three months on any changes to this guidance. The company has more than adequate cash resources to weather the downturn in our markets. Business should return to normal when oil prices return to normal.

Instead, today's announcement is long-winded, but light on specifics. The tone is wrong too, sounding almost as if the company is surprised that business is deteriorating, when it should be glaringly obvious to everyone that the whole sector is struggling in the short term.

My opinion - good companies with sound balance sheets will survive and prosper in the long term. That's how I see this company. I suspect that buyers at this level could end up looking smug in a couple of years' time, but should be prepared to look daft in the shorter term!

Wincanton (LON:WIN)

Share price: 166p (down 6% today)

No. shares: 121.7m

Market Cap: £202.0m

Trading update - if you've never heard of a balance sheet, or have no idea what they are for, then this is the share for you! The company says that it continues to trade in line with expectations. It notes some new contract wins, and mentions that the fall in the price of fuel has had no material impact on profits, due to it being a pass-through cost to clients.

My translation of that would be: we remain marooned in a rather smelly creek, and are still looking for a means of propulsion.

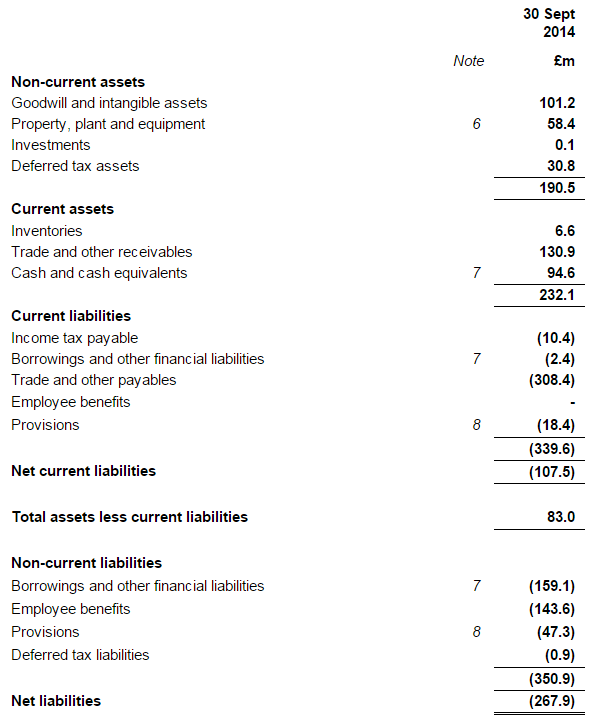

Here is the last reported balance sheet, it's so bad I just have to copy it here in full.

The current ratio is very poor, at 0.68 (I don't normally invest in companies where the current ratio is below 1.2).

There is also a mountain of long-term liabilities, at £350.9m, mainly bank debt, and a large pension deficit.

Overall, instead of having net assets, it has net liabilities of a gigantic £267.9m.

Strip out intangibles, and that worsens to an appalling net liabilities position of £369.1m.

So this is very much a zombie company which can only continue operating because its bank and customers continue to support it with generous cash advances. Dividends stopped in 2011, and it's difficult to imagine the company ever being able to safely resume them.

I cannot understand why anyone in their right mind would buy these shares, when the company is in such a dire financial position.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.