Good morning, it's Paul here. Today's report is now finished.

Agenda:

Paul's Section:

Empresaria (LON:EMR) (I hold) - a positive trading update, saying it is "well" or "materially" ahead of market expectations. Combine that with a lowly PER, and a weak share price, and I think there's upside here. Sector read-across could make this an interesting area for fresh buys possibly?

Gulf Marine Services (LON:GMS) (I no longer hold) - news of 2 contract wins, at (unquantified) higher daily rates, confirms the bull case. EBITDA guidance is unchanged. Positive outlook also confirmed from higher daily rates, and higher utilisation. Limited capacity in this capital-intensive sector. Lots of tailwinds here, which should enable the company to pay down its vast debt pile. High risk, but an interesting special situation.

Titon Holdings (LON:TON) - brief comment (no section below) - only £12m mkt cap. Results for FY 09/2021 are quite good - £1.1m profit vs breakeven LY. Very strong balance sheet, with £4.8m net cash. Outlook - supply chain issues & costs rising (passing these on to customers). Korea remains subdued. It's too small to interest me, but looks one of the most sensible micro cap investments I've seen lately - so could be worth investigating further if you delve down this low in market caps.

Instem (LON:INS) - brief comment (no section below) - H2 China market update - contract wins, but no figures provided. Many thanks to subscribers Michael Tee and BnB who have left helpful comments below, in the comments section. I had a quick look too there, and concluded that this looks a potentially interesting (although not cheap) share.

Brief market comment from Paul

This morning looks like the opposite of yesterday, because futures are up strongly due to a big rally in the US overnight, so the FTSE 100 is forecast to open up 88 points (writing this at 07:00).

I've raised a small cash war chest, and will be deploying the whole lot (with some gearing on top) first thing this morning. My reasoning being that all the evidence seems to be pointing towards an imminent climax of covid cases (omicron being so contagious), then herd immunity within just a few weeks - which is seemingly what's happening in South Africa, who seem to be about a month ahead of us, with cases having peaked. and hospitalisations starting to fall sharply in the last week.

I reckon that could cause a large, and rapid improvement in UK small cap investor sentiment, once punters realise that the bad news is already priced in, and then upside recovery is now the thing to focus on.

There are bargains galore right now in my opinion, with many perfectly good companies having dropped in price by 20-30% recently. Although in many cases, the valuations had got a bit toppy earlier this year, so I see a general pullback/correction as being healthy.

The next big move seems more likely to be up, than down, for UK small caps, in my opinion, although as always nobody can predict short term market sentiment with any reliability, as it can turn on a dime depending on newsflow.

I could end up looking a complete fool, but we're here to give opinions (not advice), and my current view is that I think we could have reached a turning point where the recent extensive, and often irrational selling in UK small caps may be about to reverse into a recovery. Famous last words!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Empresaria (LON:EMR) (I hold)

69p (pre market open) - mkt cap £35m

Empresaria, the global specialist staffing group, provides the market with an update on trading for the current financial year ending 31 December 2021.

2021 well ahead of market expectations

Short and sweet, here is today’s full update -

We are pleased to report that Empresaria has continued to deliver a strong trading performance across multiple sectors in the final quarter of 2021. As a result, profit before tax for the year ending 31 December 2021 ("FY21") is now expected to be materially ahead of current market forecasts.

The Group expects to provide a more detailed update on FY21 trading on 27 January 2022.

There’s no footnote on what market expectations are, nor any figures. However, this is just a flash note, to give us a flavour for how trading is going, with more detailed numbers to follow in late January, once the accounts department has had a chance to go through the numbers with a fine toothcomb.

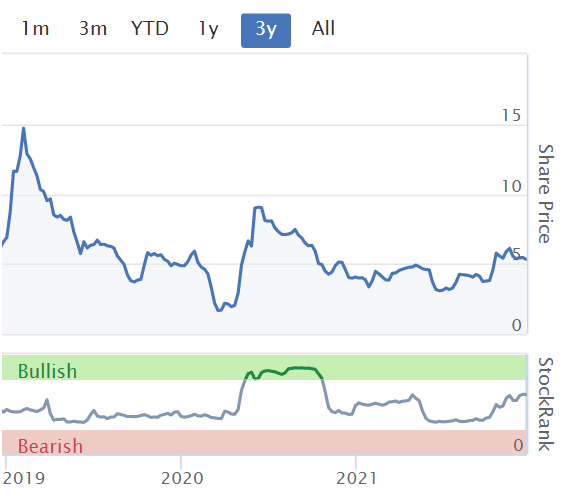

Stockopedia is showing a lovely upward trend in market expectations for forecast EPS, see graph below. So to be “materially ahead” is the cherry on top, in a year that has shown a decent recovery.

.

Valuation - if we assume say 8-9p EPS (my guess for what materially ahead of 7.5p existing forecast might look like) for FY 12/2021, then at 69p the PER is probably only between 7.7 to 8.6 - which looks good value.

Both Singers and Allenby cover EMR, and kindly publish their notes on Research Tree, so I expect something might come through from them later.

EDIT: An update note from Singers has just come through (many thanks), they're upping from 7.5p to 8.4p (up 12%) for FY 12/2021. So much as I expected. There are no 2022 forecasts as yet from Singers. End of edit.

My opinion - this is a good example of an irrational sell-off, see chart below. It’s now cheap, and I think should see a decent recovery in share price. My position size here is only tiny, so I can’t justify disturbing the bunting from the cupboard where it’s been gathering dust in recent months. Note EMR shares are quite illiquid, so it might not be possible to buy in size.

What about sector read-across?

Gattaca (LON:GATC) saw a massive sell-off from its arguably irrationally high peak in June 2021, and now looks good value on a fwd PER of 7.7

Staffline (LON:STAF) doesn’t interest me at any price really, due to all the fundamental problems that surfaced in recent years

Robert Walters (LON:RWA) is a firm favourite here at the SCVR, performing well, but on a fwd PER of 15.9, not such an obvious bargain in valuation terms, although a better quality business than the smaller competition.

EDIT: Many thanks to subscriber BnB who flags in the comments below Sthree (LON:STEM) as another share in this sector that looks reasonably priced, and has fallen a lot recently. BnB sees STEM as a better quality business than EMR, which is probably correct. End of edit.

This could be a good time to nip in for some bargains in this sector - EMR is showing the ideal combination of -

- sharply falling share price,

- low valuation multiple,

- but an out-performing new trading update.

I really like that combination of factors, as the odds of making money are generally excellent, from that starting point.

.

Gulf Marine Services (LON:GMS) (I no longer hold)

5.6p (up 12% at 09:18) - mkt cap £57m

Just to clarify, I held GMS in my geared account, and got onto margin call recently, so decided to have a clear-out. I’m keen to buy back into GMS asap, and regret selling it now, because the bull case seems to be playing out as I previously explained here. The perils of gearing, eh! Just to be clear, I never ever recommend gearing, it’s often the road to ruin, if not handled with great care, so please avoid it to be on the safe side, so many people come unstuck with gearing - as I did in 2008, frequently explained here previously, so I won’t repeat that now.

Also, to clarify a recent misunderstanding here, I do not use stop losses on individual shares. For me, selling decisions always have to be carefully considered, and taken on the basis of facts & figures, not some arbitrary price level set previously. Again, that’s a personal choice, and everyone has their own way of doing things. Some people like stop losses, and if it works for you, then why not? “Keep doing more of whatever works” as my mentor told me years ago.

Bear in mind that GMS is a higher risk, special situation. Check out our archive here for my more detailed previous notes on it. Incidentally, I mentioned this share in my Nov 2021 interview with Paul Hill at Vox Markets. Someone on advfn referred to my GMS commentary as “a fact-free ramp!” which I thought was a bit harsh, and also inaccurate. The funny thing is, that (before covid) I often met this type of obnoxious keyboard warrior at investor shows, and found them to mostly be really pleasant and friendly in the flesh! Anyway, I can’t talk really, having had plenty of online meltdowns myself. Right, back to GMS -

GMS, a leading provider of advanced self-propelled, self-elevating support vessels serving the offshore oil, gas and renewables industries, is pleased to announce two new contracts both for E Class vessels.

The contracts are only 5, and 6 months, but (as is usual) have options to extend.

Daily revenues - No figures are provided, but the improvement in daily charge out rates is confirmed (this is key to the investment case, as higher daily rates feeds straight through to higher profits & cashflow) -

Our markets continue to improve with day rates on recent contract awards showing healthy increases from legacy contracts, which positions the company well for 2022 and beyond…

Fleet utilisation - another key metric, and this is a bit below what I had in the back of my mind (I thought utilisation was heading for 90-100%) -

GMS expects to end 2021 with vessel utilisation at 85%...

Guidance -

… confirm previous EBITDA guidance remains unchanged.

Outlook -

"GMS has had a solid year, delivering on expectations, including reporting a profit for the first time since 2016. Our markets continue to improve with day rates on recent contract awards showing healthy increases from legacy contracts, which positions the company well for 2022 and beyond. Given the strong pipeline of opportunities, combined with limited capacity in the market, we fully expect day rates and utilisation to improve further throughout next year."

My opinion - this announcement confirms that things are going to plan, which is reassuring. Although note that there’s no change to FY 12/2021 profit guidance, which is as I would expect, because contracts generate recurring daily revenues, rather than up-front revenues, so this late in the year new contracts would have little to no effect short term.

The forecast EBITDA is huge relative to the market cap, because GMS has excessive debt. That seems to be under control, and should reduce quite rapidly, now that fleet utilisation & daily rates are both improving. Therefore the upside could feed through entirely to equity, as debt becomes less of an issue. From a low market cap, that could be quite exciting.

Overall, I continue to believe this is an interesting special situation, and will be buying back in whenever I have available funds. On reflection, it might better suit my ungeared SIPP, where I could just park it for a year or two. Portfolio management has never been my strong point unfortunately, because my personality is too excitable. Hence mistakes occur rather often than I would like.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.