Good morning, it's Paul & Jack here with the SCVR. Today's report is now finished.

Agenda -

Paul's section:

M&c Saatchi (LON:SAA) - a rather disappointing announcement, that Vin Murria wants to "merge" her listed cash shell Advancedadvt (LON:ADVT) with SAA in a paper deal. I can't see why SAA would be keen to surrender control to her? Let's await their response (since published, article updated).

Judges Scientific (LON:JDG) - a strong year end trading update, with profit guidance ahead of expectations. 2 brokers have upped forecast earnings by about 10%. Not cheap, but the stunning long-term track record justifies a premium price.

Sdi (LON:SDI) - a small acquisition is made, and an important repeat order is received, resulting in a significant 22% increase in Finncap's forecast for next year FY 4/2023. SDI has a fantastic track record of creating shareholder value, so it's toppy valuation looks justified.

Lookers (LON:LOOK) - yet another out-perform update. It seems car dealers are still enjoying booming profits, driven by a shortage of new and used cars. I very much like this sector, and think it's still far too cheap - even when you adjust for earnings normalising. More takeover bids look likely.

A quick review of yesterday's larger cap retailers updates;

Greggs (LON:GRG) - slightly ahead of forecasts. Too expensive.

Next (LON:NXT) - trading well, ups guidance. Cheap on a PER of 14

B&m European Value Retail Sa (LON:BME) - also trading well, looks good value on a PER of about 14.8 by my calcs.

Just FYI, I'm planning on looking at the following updates as this morning progresses: LOOK, Churchill China

Jack's section:

Air Partner (LON:AIR) - I hold - another materially ahead update, just three or so weeks after the last. Vaccine freight demand continues to drive business. This will revert at some point but could also last for longer than anticipated, which could potentially lead to FY22 upgrades. Assuming it does revert, the group has diversified its operations in recent years and is well-funded for further investment / acquisitions.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

M&c Saatchi (LON:SAA)

210p (closing price y’day) - mkt cap £257m

There’s an interesting twist in this story. The key thing to note is that the announcement this morning of a Potential Merger has been issued by Vin Murria’s acquisition vehicle, listed cash shell Advancedadvt (LON:ADVT) . As yet there has not been a response from SAA.

ADVT says that it wants to acquire (“merge”) SAA via a share exchange. I don’t like this at all. Why would SAA shareholders want to swap their SAA shares for shares in a cash shell? If SAA needs cash, which I don’t think it does, then it could do a placing.

The key question is whether Vin Murria taking control of SAA would result in a better outcome? If this bid approach fails, then her position on the Board of SAA would seem awkward, at best, and possibly untenable.

I’ve had a look at the last accounts for Advancedadvt (LON:ADVT) here, key points -

- Company was incorporated in BVI (British Virgin Islands) in July 2020

- £130m raised in a fundraising in Mar 2021, at 100p per share

- Seeking acquisitions in software sector

- First acquisition target fell through, in software sector (aborted costs of £1.85m)

- Company is a cash shell, with no operating business as yet, with £129.2m cash at 30 June 2021

ADVT has since utilised some of its cash buying shares in SAA, 12m shares at 200p = £24m, hence ADVT would have around £105m cash remaining. The idea is this could be used to enlarge the acquired SAA business, through acquisitions, and settling the previously problematic options arrangements.

That doesn’t strike me as a compelling reason for SAA shareholders to effectively give up control of the business.

Plus of course the clock is ticking for ADVT to do a deal, as there are now time limits on cash shells doing something.

My opinion - I think this is a disappointing development, and if I held SAA shares I would reject an all-share deal, and want to retain my SAA shares.

I’ve just looked at the share price, and the market has reacted negatively too, with SAA shares currently down 16p in early trading, to 192/196p bid/offer price (although you can usually deal within the quoted spread, as with most shares).

Maybe ADVT might buy more shares in the market, as it’s got the cash? I think the current situation is that Vin Murria’s personal shares would be seen as a concert party with ADVT’s holding - so 12.0m (ADVT) plus 15.2m (Vin Murria) = 27.2m, with 122.3m shares in issue (see at the bottom of the StockReport) = 22.2%

Will she be able to strong-arm, or persuade the other big shareholders in SAA to accept ADVT shares for their SAA shares, and effectively give up control to ADVT? I’d be surprised if they do, but you never know.

The other question, is what theoretical valuation any all-paper deal puts on SAA? That remains to be seen.

I shall follow developments with interest, but so far, this looks a bit messy. Lots of talk about digital strategy, etc, from ADVT, but SAA is already doing that, and trading well, so I’m not convinced “merging” with ADVT would necessarily be a good deal for SAA.

EDIT: Here is the response from M&c Saatchi (LON:SAA) itself.

Statement regarding possible offer

This looks a very sensible response from SAA's independent Directors -

The directors of the Company other than Vin Murria (the "Independent Directors") have now received an initial non-binding indication of interest (the "Proposal") from AdvT, whereby AdvT would offer each M&C Saatchi shareholder 1.86 new AdvT ordinary shares for each M&C Saatchi ordinary share. The Proposal is conditional, inter alia, on the recommendation of the Independent Directors.

The Independent Directors' initial opinion is that this all share proposal does not articulate an alternative strategy for the benefit of the Company's stakeholders beyond an initial change of control of M&C Saatchi. Furthermore, the Proposal does not reflect the value of the business and its future prospects and would disproportionately transfer equity value from M&C Saatchi shareholders to AdvT shareholders.

M&C Saatchi's current strategy has been in place since Q1 2021, and has resulted in a number of positive trading updates. Meaningful new client wins include Uber, Google, Tiktok and Tinder as well as new assignments from existing clients including the UK Governmerice nt, Pepsico, Reckitt and Lexus. It is not clear to the Independent Directors how shareholders and other stakeholders would benefit from ownership dilution and a change in board leadership of the Company.

Price - in offering 1.86 new ADVT shares for each SAA share, this values SAA at 98p * 1.86 = 182.3p - not an attractive price, given that ADVT paid 200p in the open market recently for its 12m share stake. Which makes me wonder if this bid approach might fall foul of the regulations. I thought a bidder had to offer at least the highest price they have paid in the market, which would be 200p?

My opinion - this looks an unsatisfactory proposal, and seems a strange thing to have done, without apparently securing the support of SAA's Board. It now hinges on what the institutional shareholders in SAA decide. I 'd be amazed if they support Vin's proposal, which looks to have gone off half-cocked.

Judges Scientific (LON:JDG)

8470p (up 4% at 09:17) - mkt cap £538m

The Board of Judges Scientific plc, a group focused on acquiring and developing companies in the scientific instrument sector, provides the following update on the Group's trading performance for the financial year ended 31 December 2021.

My summary -

- Order intake is good (organic) - up 25% on 2020, and up 8.5% vs previous high in 2019

- “Order intake remains the main driver of performance and consequently the recovery in orders resulted in good progress in revenues.”

- Starting 2022 with strong order book (22.5 weeks revenues)

- Good performance from recently acquired businesses

- Organic revenue was +5% in H1, accelerated in H2, in double digits for the full year

- Diary date: 23 March, for FY 12/2021 results publication

Profit guidance - ahead of expectations, and we get a footnote too, which quotes EPS - the best figure for me, as I can quickly work out valuation from that. Marvellous -

As a result of the positive performance of the Group, the Board now anticipates that Adjusted3 Earnings Per Share for the full year ended 31 December 2021 will be ahead of market expectations4.

4. Market consensus Adjusted Earnings Per Share of 209.7p.

Broker updates - many thanks to WH Ireland which has issued updated forecasts available on Research Tree, for 229.5p adj EPS, and upgrade of 10%, on top of a previous 10% upgrade in Sept 2021). That gives a 2021 PER of 36.9 - a very full valuation, but reflecting the strong recovery from covid impact I suppose.

WHI’s FY 12/2022 forecast is only marginally higher at 236.5p, which strikes me as far to cautious, given the strong starting order book. Maybe we could push the boat out, and imagine that profits might recover to something like 300p EPS? That would reduce the PER to 28.2 times - still pretty punchy. So there’s considerable out-performance already baked into the share price.

Thanks also to Liberum, which has issued similarly upward revised forecasts today, again available on Research Tree.

My opinion - it’s not cheap by any means, but I wouldn’t expect it to be cheap, given strong performance.

Skill at making value-adding acquisitions justifies a premium rating.

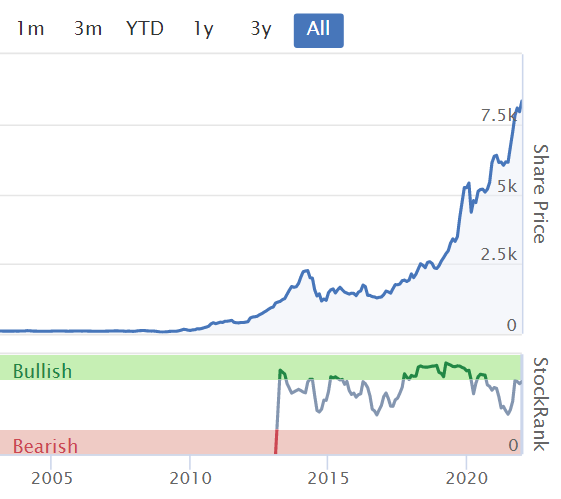

Stunning long term shareholder value creation - a 100-bagger in 12 years. Hence I certainly wouldn’t bet against it.

Although at over £500m market cap, it might be more difficult to find cheap acquisitions that move the dial much, which is what drove previous gains. Feast your eyes on the long-term chart below!

.

.

Sdi (LON:SDI)

210p (+5% at 11:15) - mkt cap £210m

Acquisition, and Further Atik Cameras Order

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing control applications…

This follows on nicely from JDG, since SDI has a very similar business model, in a different niche - building a group from reasonably-priced acquisitions.

So far, the long-term chart of SDI looks remarkable similar to the chart of JDG too, although SDI has only 20-bagged, not 100-bagged!

.

.

The main problem with SDI recently, has been the (fully disclosed) one-off nature of some large orders, hence why brokers are forecasting that FY 4/2023 earnings might fall from bumper FY 4/2022 earnings.

I reported on the interim results from SDI here in Dec 2021. The longer I’ve followed SDI, the more impressed I’ve become with it, and want to buy some for my long term portfolio at some point. Uncertainty over contracts, and the high valuation are the only things currently putting me off from buying.

Acquisition - SDI is buying Scientific Vacuum Systems Ltd, just a small deal, at £4.9m (total consideration, including earnout). That’s just 2.3% of SDI’s market cap, so doesn’t move the dial much. It bolts on £2.5m revenues, and £0.7m EBIT (operating profit). Sounds good, but we have to be mindful that private companies often pay Directors via dividends for tax reasons (to avoid NICs), which is below the operating profit line. So once they become part of a listed company, then that element of remuneration moves up the P&L, and hence reduces EBIT.

Actually, forget that point, because I’ve checked SVS’s accounts at Companies House (co. no. 02538608), and it’s fine - there are only 2 Directors, who were paid £272k (9/2020) and £275k (9/2019), and dividends of only £36k were paid each year.

Profits: SVS made £280k EBIT in 9/2019, just £2k in 9/2020 (lockdown 1 year), so the £0.7m mentioned today for EBIT in 9/2021 is a big jump - what caused that jump in profits, and is it sustainable?

FY 9/2021 accounts have not yet been filed at Companies House (they have until June 2022, 9 months, to file them).

There was a useful £190k R&D tax reclaim in 2020 (2019: nil)

SVS's fixed assets are only £56k, being mostly fully depreciated, old equipment. Does the company need capex to replace fixed assets I wonder? It has cash, so probably would have done so, if necessary.

The acquisition is earnings enhancing, unsurprisingly, since SDI is highly rated (a forward PER of 34.7, from the StockReport here). Hence it’s in that lovely position where it can buy companies on a cheaper rating, thus creating instant shareholder value, as the larger group is rated more highly than the acquisitions. That’s exactly what JDG has done so successfully. As long as the stock market keeps the acquirer on a high rating, then it’s just rinse & repeat with more cheap acquisitions, don’t make any mistakes, and the shares keep going up. What a terrific business model! I like it a lot. SDI’s Board has a lot acquisition experience too, which reduces the risk of them slipping up with a bad deal(s).

Repeat order - more important than the small acquisition is this news today -

Further Atik Cameras Order

The Company also announces that its Atik Cameras division has received a further firm order for cameras to be used in PCR machines, for delivery in the year ending 30 April 2023, extending the series of orders related to the COVID-19 pandemic.

The way I look at it, that defers the problem of falling profitability, rather than eliminating it. But we’re not given any figures, so I can’t quantify it. Thankfully we have 2 broker note updates to guide us today, Finncap & Progressive.

Finncap will have spoken to the company no doubt, so its forecast increase should be reliable. We now have 6.9p EPS for FY 4/2022, and a 22% increase in FY 4/2023 EPS to 6.4p - note that it’s still 7% down on the current year though.

That’s a very high PER still at 32.8 times for FY 4/2023 - a really punchy rating considering earnings are still forecast to fall, so I don’t think I can bring myself to pay that much.

My opinion - I like SDI more, now the cliff edge on earnings from expiry of one-off contracts has been pushed out another year. That reduces the shorter term risk to the share price.

I think the bull case with SDI is to look at the great long-term track record, and forget about short term valuation. I’m slowly persuading myself to bite the bullet and buy some, but am not quite there yet!

FYI, the StockReport contains an error, saying that 2 brokers rate SDI as a strong sell. That’s wrong. I’ve just raised a green blob, to ask Stocko HQ to contact the data provider again, and get this corrected.

.

The following 3 items are not small caps, but I've looked at them anyway, so might as well share my notes from yesterday.

Greggs (LON:GRG)

FY 12/2021 outcome “slightly ahead” of previous exps (although note that consensus forecast more than doubled from April 2021 onwards, from 50p to 110p)

Intending to accelerate growth in store numbers, 150 new ones in 2022 planned

Brought forward staff pay rise by 5 months

Cash of £198m

Special divi £30-40m planned

Inflationary pressures increased in 2021

My opinion - a lovely business, but I can’t get anywhere near the current valuation of 3000p (it recently peaked around 3400p, which was crazy. Forward PER of 26 is just too much, given that earnings growth could be more difficult to achieve against increased cost headwinds (e.g. Living Wage going up 6.6% in April 2022). Plus business rates coming back.

GRG product is cheap, it’s the Wetherspoons of takeaway food, so upping prices by say 5% probably wouldn’t affect demand.

I wonder how many more stores it could add, without cannibalising existing?

More people working from home in future, irrespective of covid, could be an issue too. Although GRG seems to be doing well on deliveries. I tried it out, and ended up with a big bag of lukewarm stodge! They're much better in store, fresh.

Overall then - smashing business, but too expensive for me.

.

Next (LON:NXT)

The pinnacle of reporting, as usual. Although the focus on 2-year like-for-likes is less transparent than usual.

Profit guidance for FY 1/2022 increased by £22m to £822m (530p EPS)

Profit guidance for FY 1/2023 up 4.6% to £860m, or 554p EPS (before benefit of buybacks)

Further special divi of 160p

Low inventories

Labour shortfalls hit delivery service levels

Tougher environment expected in 2022

Cost inflation expected, so raising prices

My opinion - fabulously well-run company, I remain a long-term bull on Next. Forward PER is only 14 - that’s cheap for a business of this quality.

.

B&m European Value Retail Sa (LON:BME)

Q3 (to 25 Dec 2021) was good - FY 3/2022 EBITDA expected to be £605-625m (consensus is £578m).

Applying same uplift to EPS, I get c.42p EPS. That’s a PER of 14.8 - looks good value, for a growth company. I’ve not looked at the balance sheet though, so if it’s highly indebted, that would need to be adjusted for.

.

Lookers (LON:LOOK)

72.3p (up 3% at 13:32) - mkt cap £282m

Lookers, one of the leading UK motor retail and aftersales service groups, today announces a trading update for the financial year to 31 December 2021…

Strong trading continued in Q4. As we know, the whole sector is coining it in, due to fat gross margins on new and particularly used cars, due to supply shortages. That’s obviously a short-term bonanza, so we have to be careful to value shares in this sector or normalised earnings.

Lovely clear guidance provided here - this is even better than a footnote, we’re given the market consensus figure in the key highlights section at the top of the announcement -

… expectation of record underlying profit before tax ahead of company compiled market consensus of £82m

Trading in Q4 remained strong and above the Board's expectations, principally driven by excellent new and used vehicle margins, a continued focus on tight cost control and like-for-like growth in aftersales revenues.

Throughout Q4, the ongoing global shortage of semi-conductors continued to place pressure on the supply of new and used vehicles. In Q4 like-for-like new retail unit sales increased by approximately 2.0% and used unit sales were down by approximately 14.2%. Aftersales revenues remained robust and on a like-for-like basis were approximately 7.1% ahead of last year.

Estimates have been beaten again, despite having quadrupled from original expectations for 2021.

"2021 was an exceptional year for Lookers and we now expect to beat our previous estimates with record profit for the year…

Asset backing - this is what I particularly like about the car dealers - with many of them you’re not only buying a business that is making bonanza profits, but it’s also asset backed with freehold property -

strong balance sheet, with net cash* of approximately £8.0m as at 31 December 2021 (2020: net debt £40.7m) and property with a book value of £303.9m (equivalent to 77.8p per share) as at 30 June 2021

Outlook - cautious. Profits probably only have one way to go, after such a remarkable year in 2021, i.e. downwards. But we already know that.

The Group has had an exceptional year in 2021 and is starting 2022 with an excellent new car order bank. However, given ongoing global supply chain disruptions, uncertainty as to the availability of new vehicles and the sustainability of used car margins at current levels, the Board believes it is right to remain cautious.

The Board is also conscious of general inflationary pressures and increased utilities costs, and is managing these risks through a continued focus on working capital management and tight cost control. The Board is confident that the Group remains well positioned to capitalise on the opportunities ahead and achieve its financial expectations.

Dividends - are set to resume, this is confirmed.

My opinion - I like this whole sector very much. Valuations are still low, even if you normalise (i.e. reduce) earnings to a more sustainable level. Plus the listed car dealers have loads of freehold property (plenty with alternative use value).

The icing on the cake is takeover bidding activity - Marshalls Motors has recently sold for a nice premium, and I expect more to follow.

Global supply constraints are good for car dealers, so let's hope supply chains remain in a mess.

There seem to be new internet-only competitors cropping up all the time. I reckon they’re the most likely buyers of existing chains, as they begin to realise they’re not disrupting anything - conversion rates are tiny, because most people want to test drive, and carefully scrutinise a new car, not buy it blind on the internet. Existing dealers offer an internet-only option anyway. Plus existing dealers have better sourcing, via trade-ins of new vehicles, and relationships with manufacturers. I cannot recall ever seeing so many new entrants flock to “disrupt” a sector that is so unsuitable for disruption! Hence why I suspect internet disrupters might need to buy up existing dealers, to paper over the cracks of their wobbly business models.

There's more info in today's update about strategy & growth plans, if you're interested.

.

Jack’s section

Air Partner (LON:AIR)

Share price: 86p (pre-open)

Shares in issue: 63,562,601

Market cap: £54.7m

(I hold)

Having held for a couple of months now, Air Partner strikes me as a slightly frustrating share in that it has a habit of staying rangebound despite good news. I’m not sure what to make of that, but the group has traded well through the pandemic and has also released positive updates post-lockdown thanks to an increasingly diversified range of air travel activities.

It’s a short update, with the key paragraph below:

As a result of continued strong customer demand throughout December, the Board of Air Partner now expects that underlying profit before tax for the 12 months to 31 January 2022 will be materially ahead of market expectations at the time of the December 2021 trading update. December's performance has again been driven by high levels of Freight bookings, notably for the continued transportation of vaccines.

Revised broker forecasts as of the 17th December were for FY22 profit before tax of £7.8m and earnings per share of 8.9p.

Between the SCVR posts and user comments, we’ve probably written a book’s worth of commentary on the supply chain situation and its effect on various companies over the past year. It’s a pleasant change to write about a beneficiary although increased levels of freight due to vaccine demand sounds like a temporary rather than permanent growth opportunity.

At some point that demand will revert but there’s no let up in vaccination campaigns so far. The group’s previous update was just a fortnight or so ago and that was materially ahead too. So we’re materially ahead of materially ahead.

The cash position remains strong with net cash of £12.9m as of 31 December 2021 (31 July 2021: £9.8m), up from £12.7m on 30th November. This figure exclues customers' segregated JetCard deposits and a £1.4m provision for deferred consideration on the Kenyon acquisition.

Conclusion

I think the stock looks reasonably valued given the trading momentum. It’s on a forecast rolling PER of 10x (and likely less given today’s update) with a growing net cash position. Canaccord has proven to be very conservative in its post-Covid adjustment and looks to have increased its earnings per share forecasts four times since then. There will likely be a fifth.

If we upgrade by 10% to PBT of £8.58m and EPS of 9.79p, then that implies an FY22 PER of 8.8x or just 6.7x adjusting for net cash.

This is a transitory freight boost though. Note how forecasts for the following year have not increased in line with this year’s. But, on the other hand, it’s entirely possible that vaccine-related freight demand will persist into FY22, in which case additional upgrades are likely (holding all else equal).

In the meantime, higher earnings will translate into greater cash flows and year-end balances. Air Partner already has a solid net cash position excluding jetcard deposits, along with diversified operations (and an asset-light business model generating reasonably high returns on capital). So there’s a healthy financial platform to make further acquisitions and organic investments.

It reported in its previous update that it had handled the transition to post-lockdown well, with broad growth across its divisions, so I’m not too concerned about trading prospects once this vaccine freight dynamic has faded. Here’s the FY21 operating profit split from Cenkos. Note this includes heightened freight demand.

Dividends have taken a knock in recent years, but the sheer length of time over which cash has been returned to shareholders is notable, as are the old special dividends, although that’s from quite a while ago now.

I’m happy to hold this one given the valuation and trading momentum. Air Partner’s multiples are at low levels so there’s a chance of both earnings upgrades and multiple expansion.

GIven net cash, acquisitions etc. I think it can get back to FY19 levels of 10p or more per share at some stage. It’s worth noting that pre-Covid forecast EPS was trending at 13.2p. On 12x earnings of 10p that would be a share price of 120p, +40%, at which point I might reappraise the situation. But I think there are decent longer term prospects here too, hopefully beyond that level, so I wouldn’t necessarily be selling.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.