Good morning.

Tungsten (LON:TUNG)

Share price: 161p

No. shares: 103.5m

Market Cap: £166.6m

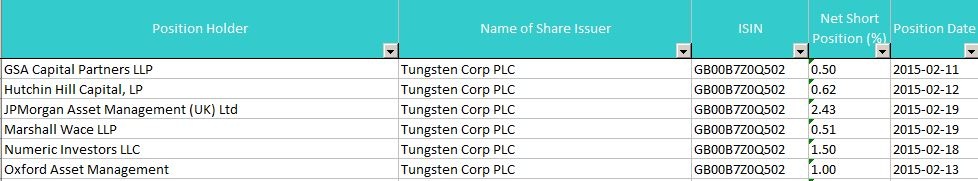

Bear raid - there is not an RNS, but the link to the left is to Matt Earl's blog, where he published yesterday a second critical article about Tungsten. More importantly, data from the FCA re short selling shows that between 11-19 Feb 2015, a substantial number of new short positions were opened (see table below, source: FCA), totalling 5.56% of the company, plus another existing short position of 1.0%.

With 103.5m shares in issue, that means 5.75m Tungsten shares have been dumped on the market by short sellers in the last couple of weeks. Which explains why the share price has been so weak.

UPDATE: a friend in the City has just phoned me to point out that he believes the shorters named above are mainly quant funds (or at least they are firms which contain some quant funds, which he believes are probably the shorters here - i.e. they opened the short positions mainly because the share price had already fallen a lot. Therefore, this opens up the possibility that what we are seeing today could be a large spike down, with those quant funds becoming large buyers of Tungsten shares at some point to cover their shorts. So, if you like the stock, there is the possibility this could be a buying opportunity, who knows?! Although personally my confidence in the business model has been shaken too much for me to consider going back in just yet.

There are two ways of dealing with short sellers. You can either get angry, and demonise them. Or you can engage your brain, and listen to what they've got to say, think about it, and make a rational choice - whether to sell up and watch from the sidelines, or whether to stand in the way of the short sellers, and accept that you might incur short term losses.

Short sellers don't pick companies at random. They select companies which are over-hyped, and where they believe there is something fundamentally wrong with the company. The short sellers are usually (but not always) right too - because they are generally more experienced & sophisticated investors. Loss-making & low turnover companies are often chosen by shorters, as they are very difficult to value, and the valuation is often based on hype & hope, rather than more solid valuation metrics.

I don't have any problem with shorting at all - in fact I think it's healthy for a market, keeping prices grounded, and providing buying opportunities when prices are forced down too low. Providing people speak the truth as they see it, and give supporting evidence, then bearish arguments on a share are to be welcomed, not shouted down (as you usually find on bulletin boards, sadly).

The whole of the City is geared up to encouraging us to buy shares, and push share prices relentlessly higher. This is dangerous, as it sucks investors (especially inexperienced ones) into story stocks, which become wildly overpriced, eventually leading to the price crashing.

So I would rather see a share price deflate under pressure from short sellers, rather than rocket to the moon, only to collapse and everyone loses their shirts.

My opinion - I'm sorry to say, that my confidence in Tungsten appears to have been misplaced, at least in the short term. As with many other people, I got carried away with the future potential lucidly explained by flamboyant CEO Edi Truell. However, I think cracks are starting to show. I wasn't thrilled with the recent results webcast - he seems too fond of throwing around highly impressive numbers in billions and trillions, with respect to the market opportunity, and invoice throughput, but we need to see more concrete figures on what penetration Tungsten is achieving on the invoice discounting side - and what margins they are making.

Matt Earl makes some good points (although I think his points on historic stuff are irrelevant now), questioning how much suppliers will actually use the invoice discounting facility. I think he's right that suppliers might just use it occasionally, to get through cashflow blips, rather than using it continuously. We just don't know yet.

When I first read the bear attacks on the company, I dismissed them, as I could see that they hadn't fully "got" the business model. However, thinking about it some more, I realised that my rebuttal of the bear argument was driven more by my own emotional instincts to defend a stock where I was long. When I thought more deeply about the sharpened bear attacks more recently, it dawned on me that they had actually made some interesting points that were worth listening to.

For that reason I have sold all my shares, for a loss unfortunately. I don't hold any ill will towards the bears at all. In the short term anyway, I think they've called it right. I'm happy to sit on the sidelines and watch for the time being, as I still very much like the concept of what Tungsten is trying to do, but I want to see more tangible proof that the product is taking off, before going back into the shares.

I suspect Tungsten will need to raise more cash too, although that has been done with ease in the past, so may not necessarily be a problem.

Apologies to readers here if you were influenced by my (with hindsight) excessive bullishness on this stock. Although as we constantly emphasise here, we NEVER give recommendations on stocks, we just give personal opinions for people to ponder & then do their own research, and take ownership of their own decisions.

What do others think? Have I sold near the bottom? Remember that today's short sellers are tomorrow's forced buyers, so the price could recover if there is a bear squeeze. Who knows what will happen next?

Mar City (LON:MAR)

Share price: 45.5p

No. shares: 110.3m

Market Cap: £50.2m

Director dealing - from one car crash to another. After market hours last night, this troubled housebuilder announced a bizarre deal whereby the controlling Directors (Tony & Maggie Ryan) have pledged 47.7m shares in MAR (which is 43.2% of the entire company!) to HSBC, to secure a £10m loan. This is the money that they last week committed to paying to MAR, to reduce their £29.5m indebtedness to the company (which I explained in more detail in my report here of 20 Feb 2015).

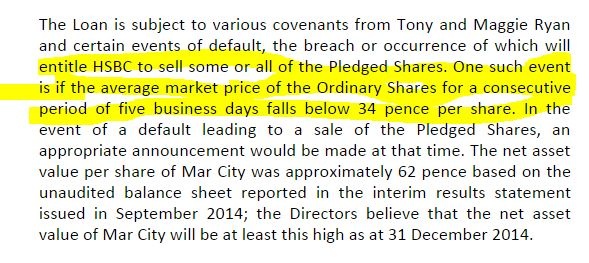

The big problem is that they have also disclosed that the bank is likely to become a forced seller of the shares, if they drop to 34p:

My opinion - this seems to me just the latest foolish move, in a series of foolish moves. The problem is that the Directors have now issued a public invitation to short the shares. If a hedge fund comes along and aggressively shorts these shares below 34p, then they know in advance that there is very likely to be a forced seller prepared to sell them cheap stock in order to close out the short position.

Overall this share will become a case study in why large related party transactions between a listed company and its Directors are best avoided. The conflicts of interest are too great. The advisers never should have allowed this situation to be created in the first place.

Also, the Directors need to get that HSBC loan repaid asap, to remove the potential threat of a shorting attack designed to trigger a covenant breach. It's a bit like somebody placing a long spread bet for 43% of an entire company, and then publishing what level they've put their stop loss at! That just gives shorters a target to aim for.

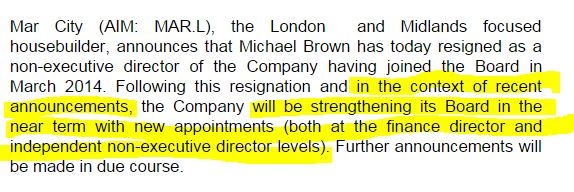

Director change - it's just been announced at 1:45pm today that the Henderson NED on the board has resigned, a wise move I would say. This update from the company is added;

Crawshaw (LON:CRAW)

Share price: 43p

No. shares: 79.6m

Market Cap: £34.2m

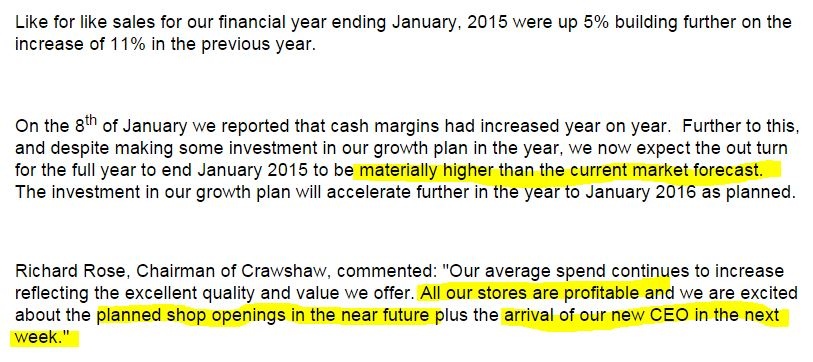

Trading update - this small chain of butchers+ (I call them that because they also do hot food, as well as a conventional butcher offering) reports today on the year ended 31 Jan 2015, and it's good news;

Valuation - current market forecast is for £1.0m profit, or 1.1p EPS. So what does "materially higher" mean? Materiality is usually seen as at least 10% higher, but I think the word is usually used in trading updates when it's a good bit more than 10%. Guesstimate here, perhaps 1.3p EPS? That would put the shares on an expensive PER of 33 times - which on the face of it looks bonkers.

However, it's no bonkers, because the company raised about £8m in cash to do a roll-out, so they already have enough cash to roughly double the size of the business. The new CEO is a big hitter from Lidl, so understands roll-outs, and discount retailing very well.

My opinion - today's announcement has given me enough confidence to dip my toe in the water here with a modest initial purchase. It's not cheap, and I do have concerns about competition from the supermarkets. However, I particularly like the comment that all their stores are profitable - that's a very good indicator that a retail concept works well, and is worthy of a roll-out.

I don't see any immediate upside potential from this valuation, so I'm approaching this as something to tuck away for a couple of years, and hopefully if the roll-out has gone well, then it could have further upside potential, and by that time the roll-out could have become self-funding (i.e. profits from existing stores are enough to finance new stores capex).

VP (LON:VP.)

Share price: 626p (up 6% today)

No. shares: 40.2m

Market Cap: £251.7m

Trading update - I started reading this, and thought it starts OK, then goes a bit wobbly when they mention the oil & gas sector weakness, but then management stick a great big cherry on top and come out with an "ahead of current market expectations" finale. Well done!

That is also the closest yet that my use of the highlighter tool has come to a straight line!

My opinion - the valuation looks reasonable, on a PER of about 12 (but bear in mind there is debt too). Divi yield OK at 2.7%. Looks priced about right to me.

dotDigital (LON:DOTD)

Share price: 35.0p

No. shares: 285.2m

Market Cap: £99.8m

Interim results - for the six months to 31 Dec 2014. They look good to me - organic growth has continued at a slightly faster trajectory to last year - continuing ops revenue is up an impressive 32% - all organic, I think.

74% of revenues are monthly recurring fees paid by customers, for SaaS email products - which is obviously good - as it means revenues are sticky, predictable, with few chances of any surprises. The client list, and client wins are very impressive, as is the emerging growth in the USA - not easy for a UK company to succeed at.

The CEO is transitioning, and Simone Barratt is now confirmed as proper CEO (having been formerly CEO Designate), so the management succession planning appears to be going smoothly from what I can tell.

Balance Sheet - is lovely! I see all the cash of £9.5m as being surplus, so about 10% of the market cap is a cash pile that they don't really need, so a bit of an investment buffer there. I am not keen on the plan to buy back up to 3m shares, whilst only paying a tiny dividend yield of under 1%. I think that's the wrong strategy. Companies on a warm PER should not be buying back their own shares. Instead there should be a decent dividend, if they can't find anything commercially useful to do with the cash.

I feel sure there must be far better uses for the cash pile, in perhaps making some kind of complementary acquisition in the digital marketing space perhaps? This is a strong growth area after all, so there's perhaps a little lack of imagination here, given that they have a good opportunity to build a much bigger group.

My opinion - I think this company could become a bid target, for a larger software group. They are trying to balance up profitability and investing more for growth. Personally, for a company with excess cash, I like to see a more aggressive growth strategy. If you have a great product, then get out there & sell it! If that means absorbing some short terms extra costs, then so be it - if the payback is going to be worth it, then it should be done.

It looks expensive on the current numbers, but the forward PER is actually quite reasonable for y/e 30 Jun 2016, with a PER of about 16, which is not expensive at all for a decent quality growth company like this. I like this company quite a lot actually, with a 1-3 year view.

Although you do have to wonder if something better might come along from a competitor, and take away their customers at some point. That's always the risk with all SaaS companies, especially ones like this where email marketing software is not going to be business-critical for most companies - i.e. it's relatively easy to switch to a competing product.

So far, so good though.

Outlook - sounds good to me;

this article is being updated throughout the day, so pls refresh this page from time to time.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.