Good morning, it's Paul & Jack here with the SCVR for Monday. Today's report is now finished.

End of week SCVR podcast

On Friday last week, we trialled a SCVR summary podcast. As it was an unplanned thing, I published the audio file on my personal website here. Jack & I managed to cover 29 companies in 31 minutes, so it's a quick rattle through everything that we looked at during the week in the SCVRs. On the same page, I also typed up a written summary of all those companies which we reported on - mostly trading updates, but a few accounts as well, which you might find useful, colour-coded to show profit warnings & distressed financial situations in red, and out-performing trading updates in green. It's quite good I think, so do take a look.

If people find the podcast & written weekly summary useful, then we'll keep doing more of them. If not, then we'll drop the idea, which is extra work on a Friday afternoon, when I would normally be winding down for the weekend.

Thank you also to the people who kindly left donations towards admin costs on my website. I'll pass those on to ZANE, and will try to change the donate button's function so that it sends any donations direct to ZANE, as I'd prefer any kind donations go to charity, rather than for my admin costs, which are not very much, and I can absorb those myself. EDIT: that's now fixed, the donate button on my website now pays donations direct to ZANE, and I've paid over the money already received to ZANE.

Agenda

Paul's Section:

Hostmore (LON:MORE) (I hold) - a positive end of year trading update ( "well ahead" of mkt exps). This share looks the wrong price to me, much cheaper than listed peers.

Pebble (LON:PEBB) - a positive trading update, but given the premium PER, it needs to be. Profitability has now returned to pre-pandemic level. Quite aggressive accounting, capitalising some costs into intangibles. Doesn't appeal to me.

Brighton Pier (LON:PIER) - a positive-sounding update, but it's only "comfortably in line", so not madly exciting. Forecasts out from Cenkos today make it look attractively valued. Could be worth a closer look.

Access Intelligence (LON:ACC) - profit warning, shares down 25%. Finncap drops forecasts by a lot, and it's still loss-making. Looks precarious, and I think this share could drop much further.

Jack's Section:

Centralnic (LON:CNIC) - I hold - revenue and adjusted EBITDA guidance raised again. It’s been a good year for CentralNic and management has said this is not due to Covid but rather the company’s own actions. That has been said by others before, though… Nevertheless, the group has repeatedly flagged strong operating momentum and its business model is supported by recurring revenue and high levels of cash conversion. Edited to include notes from call with management.

H & T (LON:HAT) - solid results and H2 sees business recovering to pre-pandemic levels. It’s a good mix of quality and value here, with a track record of dividend payments and a strong balance sheet. The share price hasn’t really gone anywhere for quite a long time though, so perhaps more attractive for its income.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Hostmore (LON:MORE) (I hold)

110p (Friday’s close) - mkt cap £138m

Hostmore plc, the hospitality business focused on American-themed casual dining brand, 'Fridays', and the cocktail-led bar and restaurant brand, '63rd+1st', is pleased to announce a trading update for the financial year ending 2 January 2022.

As of 17 January 2022, Hostmore operates 88 restaurants in the United Kingdom and Jersey, a majority of which are in high footfall locations, including retail parks, shopping centres and city centres.

Hostmore is a new listing, having demerged from Electra Private Equity, with MORE shares becoming a standalone company, with a main market listing from 2 Nov 2021.

So far, the demerger has been a flop, due to a mismatch between exiting shareholders (some selling for technical reasons - unable to hold single company shares), and a lack of buyers, because the story hasn’t been explained properly yet.

In my opinion, and based on forecasts published by Edison, this has created a clear value opportunity, where the company looks significantly under-valued compared with its listed peers. So I view this share very positively, for that reason of under-valuation.

Today’s trading update

Odd wording here -

… pleased to report that the trading for the month of December 2021 was ahead of early-month expectations.

It’s not clear if this is like-for-like, or affected (up or down) by store openings/closures?

Revenue for December was 8.3% lower than the comparable period in 2019.

We know that Dec 2021 was disrupted by changes in behaviour re omicron, because other hospitality companies have indicated that the last 2 weeks in Dec 2021 in particular, were disrupted. This sounds encouraging though -

Whilst an increased level of guest reservation cancellations became evident as December progressed, and was in line with Government guidance relating to the new Omicron variant, this was more than offset by a combination of new reservations and walk-in demand which reflected the short-term nature of customer decision making while the uncertainty prevailed.

If cancellations were “more than offset” by new customers, then why was revenue down 8.3% compared with pre-pandemic? That doesn’t make sense to me.

Profitability - “well ahead” is clearly good -

Given the strength of December performance, the Board expects EBITDA (pre-IFRS) for the year ending 2 January 2022 to be well ahead of the market consensus of £18.6m.

Remember that this year will have been heavily disrupted by lockdowns & disruption in H1, and boosted by Govt support schemes. So not a clean set of numbers yet - same for the whole sector.

Current trading -

Trading since 3 January 2022 has been more in line with expectations and reflects what is usually a quieter period post the festive season.

Landlords - hoping to reach agreements with “remaining landlords” on rent concessions. Note that the company has previously indicated it is in pole position for new sites, as a favoured new tenant, because it handled landlords well during the pandemic - paying rents, and doing deals collaboratively. That’s an important point for the future.

Outlook - general comments only, but clearly positive in tone.

Wage inflation in particular is obviously going to be a headwind for everyone in the sector.

Expansion - Hostmore is a roll-out of 2 brands (Fridays, and the new 63rd+1st format). 5 new sites are opening this year, with more in the pipeline. Once the market twigs that this is a roll-out, then I think that’s a catalyst for a re-rating.

My opinion - it’s just too cheap, in my view. So I’m happy to continue holding. There’s been a lot of work done during the pandemic to improve menus & operations, and guest satisfaction scores are rising.

Edison’s last note (9 Dec 2021) shows forecast 10.2p EPS for FY 12/2022. That’s effectively the company’s forecast, and I would expect them to be setting the bar at a level they can beat.

Hence the share price of 110p is likely to be a PER under 11. That’s way cheaper than listed competitors Fulham Shore (LON:FUL) and Restaurant (LON:RTN)

Hence I expect MORE to re-rate to maybe 150-200p over the medium term, as more investors spot the company, and see the under-valuation. That’s assuming nothing goes wrong of course, which you can never be certain about, for any share.

.

Pebble (LON:PEBB)

125p (up 5% at 09:17) - mkt cap £211m

There’s a very wide quoted spread here, at 120p bid/ 130p offer, not something you expect from a £211m market cap company. Real prices are often inside the quoted spread of course, but there doesn’t seem much interest in this company.

I’ve only looked at Pebble once, a year ago here, and wasn’t particularly impressed.

The company sells branded, promotional products.

The Board of The Pebble Group, a leading provider of technology, services and products to the global promotional products industry, is pleased to announce that following a strong close to the year, the Company's results for the year ending 31 December 2021 ("FY 21"), which will be announced on Tuesday 22 March 2022, will exceed market expectations.

There’s no footnote to explain what market expectations are, and I can’t find any up-to-date broker notes.

Stockopedia is showing broker consensus at 3.9p EPS, for a PER of a whopping 32 times, so at that high rating, I would expect an out-perform update, just to maintain the current share price.

Guidance - this is useful, specific guidance, even if it is adj EBITDA, not proper profits. Note that PEBB capitalises costs into intangible assets, rendering EBITDA meaningless -

As detailed in the trading update announced on 7 December 2021, both Facilisgroup and Brand Addition traded well throughout FY 21.

Group revenue for FY 21 will be circa £115m (FY 20: £82.4m, FY 19: £107.2m), generating Adjusted EBITDA of not less than £15m (FY 20: £9.8m, FY 19: £15.2m).

Stockopedia has £112m consensus revenue forecast, so this is £3m ahead, +2.7% vs forecast.

Looking back at previous results, this is the trend for adj EBITDA, adj PBT, and adj EPS:

FY 12/2019: £15.2m adj EBITDA, £7.6m adj PBT, 2.81p adj EPS

FY 12/2020: £9.8m adj EBITDA, £6.1m adj PBT, 2.96p adj EPS

FY 12/2021: >£15.0m adj EBITDA (guidance given today)

That looks OK, with the company back to similar profitability as in 2019, pre-pandemic.

Dilution - the share count has remained roughly static over this period, at c.167m, so the EPS figures are comparable.

Looking at the progression of those numbers, it suggests to me that 12/2021 EPS should be nearer to 3.0p, than the 3.9p broker consensus shown on the StockReport, so a question mark hangs over that 3.9p forecast EPS. If that’s right, then the PER would be even higher, at over 40.

Outlook - it’s clear that this share is priced to assume considerable growth in earnings in future, which does make some sense as the economy returns to normal, which seems likely as things currently stand re covid.

Looking ahead, client contracts won in FY 21 have now been implemented and are expected to contribute to revenue growth in FY 22…

The Group has a focused strategy to invest into accelerating the scaling of Facilisgroup revenue alongside the continued attraction and retention of major contracts at Brand Addition. We remain confident in delivering upon our strategy and look forward to updating stakeholders further on the announcement of our FY 21 Final Results on 22 March 2022.

Cash - strong cash generation, with £12.1m net cash (excl. lease liabilities) at end Dec 2021. The last balance sheet looks OK.

My opinion - neutral. I don’t know enough about the company or its business model to form a view. Valuation looks too high to make me want to dig any deeper.

PEBB floated on AIM in late 2019.

.

.

Brighton Pier (LON:PIER)

81p (up 10%, at 11:00) - mkt cap £30m

Brighton Pier Group PLC, a diversified UK entertainment business…

The following sounds upbeat, but the last paragraph summarises it with only “comfortably in line with market expectations”.

… is pleased to announce a positive trading update for the 26-week period ended 26 December 2021. The period started strongly and the businesses have continued to deliver an extremely robust performance. Whilst there was some impact in December due to the restrictions, over New Year the bars recovered their momentum, trading 9 % up on 2019.

The Group expects total sales of £22.7 million, up 177% on the same period in 2020 and up 31% against the same (pre-Covid) period in 2019. On a divisional basis:

· Brighton Palace Pier like for like sales are up 15% on 2019

· The Golf Division's like for like sales are up 33% on 2019

· Bars like for like sales (for 23 weeks, division re-opened from end of July) are up 27% on 2019

· Lightwater Valley theme park acquired in June 2021 continues to trade ahead of expectations

Strong cash flow generation is expected to enable the Group to pay down £7.7 million of debt, reducing borrowings 38 % by the end of June 2022.

This represents an excellent performance during challenging times, underlining the attractions of a diversified asset base of experiential venues and bars well-positioned to benefit from growth in the UK entertainment sector. Management believe the Group is in a strong position to deliver a good result for the year, comfortably in line with market expectations.

Valuation - with so many moving parts (lockdowns, Govt support measures, etc) it’s very difficult to value retail/hospitality/leisure companies at the moment.

Cenkos to the rescue, who have kindly shared forecasts on Research Tree, showing 11.9p EPS for FY 06/2022. That should be a good time period, as it is post the early 2021 lockdown, and would benefit from very strong pent-up demand in the summer & autumn of 2021. Also some benefit from business rates relief, and possibly other taxpayer support measures?

At 81p per share, assuming 11.9p forecast EPS is achieved, then I make that a PER of 6.8 - which looks an attractive valuation, if that level of earnings can be maintained or beaten long term.

Cenkos forecasts for the balance sheet & cashflow also show a reasonably attractive position.

My opinion - worth considering, because the valuation does look attractive. Cashflows, and substantial reduction in debt, are impressive, although its assets (especially the pier) could be a can of worms in terms of big maintenance capex. It's surveyed regularly, but there's always the risk of a bombshell repair bill with a large, old pier.

Although PIER is difficult to value, because pent up demand could wane over time, as people begin spending more money on going abroad?

On balance though, the numbers are looking a lot more attractive than I can remember in the past.

.

Access Intelligence (LON:ACC)

115p (down 25%, at 11:32) - mkt cap £147m

I’m not very familiar with this company, having mostly dismissed it in the past, due to being continuously loss-making, and expensive.

Access Intelligence (AIM: ACC), the technology innovator delivering Software-as-a-Service (SaaS) solutions for the global marketing and communications industries, announces an update on trading for the year ended 30 November 2021.

Finncap’s forecasts (revised today, down, a lot) show continued heavy losses, at the adj PBT level, of £(4.7)m for FY 11/2021, and £(6.3)m in FY 11/2022.

So why is it still valued at £147m?

I think this is a really bad time to be investing in loss-making jam tomorrow shares. These are the shares that have been savaged in price in US markets, and where the US goes, the UK tends to follow.

Hence I’m completely ignoring the commentary from the company, and just focusing on the forecast numbers.

This is not of any interest to me at all, and I imagine the shares could drop a lot further in a bearish market for jam tomorrow.

The interim results showed a balance sheet that has enough cash for now, but if it continues burning cash, that won't last forever.

I wonder if this will end up being a "Grand Old Duke of York" share, as Jack calls them - where it ends up back where it started? that looks quite likely to me, based on the poor fundamentals.

.

.

Jack’s section

Centralnic (LON:CNIC)

Share price: 141p (+8.88%)

Shares in issue: 251,160,084

Market cap: £354.1m

(I hold)

This is an internet platform company that derives recurring revenues selling online presence and marketing services. Cash conversion is regularly above 100%, the group knows how to make acquisitions, and its markets are growing. Possible legislation and technological disruption in these relatively new markets, but so far CentralNic has arguably been a beneficiary of such changes.

The group has two segments: online presence and online marketing. The former is to do with providing websites, security, and other services to customers looking to build an online presence, while the latter is connecting advertisers with websites. Both are in large and growing markets, although it is digital advertising that has the more exciting growth potential.

Management isn’t afraid to issue new shares in order to part-finance its growth strategy, so that’s something to keep an eye on.

The Company's organic growth has further accelerated during the fourth quarter of 2021, resulting in year-on-year organic revenue growth of 37% for the full year ended 31 December 2021

Full year revenue is now expected to be c$410m and adjusted EBITDA should be c$45m, both around 5% ahead of consensus estimates, and 70% and 47% ahead of FY20 figures respectively.

Cash has increased from $28.7m at the end of December to $55.6m and net debt has reduced over the same period from $85m to $76m despite spending c$19m in the year on four acquisitions (Safebrands, Wando, a Publishing Network, and NameAction). Adjusted operating cash conversion ‘continues to be well in excess of 100%’.

Ben Crawford, CEO, comments:

CentralNic's growth has continued its acceleration during the last quarter of the year with year-on-year organic growth now reaching a record 37%. The Company has comfortably exceeded the high end of market expectations for the year, which had already been revised upwards repeatedly over the course of the year.

Preliminary results will be published on the 28th of February.

Conclusion

It looks like CentralNic’s online marketing division continues to grow, with its pubTONIC product seeing a lot of demand. I’d like to see some more like-for-like figures, given the group has made four acquisitions in the past year, but perhaps more detail will be forthcoming in the preliminary results.

A risk in this area (as flagged above) is online privacy legislation issues but CentralNic has stated before that its business model does not rely on such methods, does not use cookies, and has not been affected by recent legislative changes. In fact, it appears to have benefitted as competitors adjust.

The same recurring revenue dynamic the group benefits from also means it can be hard to win new customers. But there are plenty more acquisition opportunities in the space, which could be a more effective way of adding scale. CentralNic has built up quite a strong acquisition track record in this regard.

The new chief technology officer is an experienced hire, so the management team has good experience and depth. Meanwhile its businesses have some attractive characteristics such as recurring revenue, strong cash conversion, and structural growth markets.

Net profits and margins have been volatile as the company has made acquisitions and changed shape, but we can see that operating cash flow per share has been steadily rising.

Adjusted EBITDA puts the group on an adjusted EV/EBITDA of roughly 11.6x despite delivering strong progress over the past year or so. I suspect this is less than its peers, particularly those listed in the US.

It’s a short update, with more to come on the 28th Feb, so I’ll leave it there for now. But this is a tech company on a relatively modest valuation that appears to have reached an inflection point recently, and continues to report strong trading momentum with large addressable markets to aim for. Worth keeping an eye on - management does a good job of presenting to the market via video, so you can find material on investormeetcompany.

Edit - meeting with management

I’ve just had a chat with CEO Ben Crawford, here’s a write up of the key points:

- The team appreciates the need to communicate with the market as it made quite a few acquisitions in its first few years, hence the videos explaining CentraNic’s journey so far. It’s the only company of its type listed in the UK, with the rest in the US.

- Online presence offers businesses the key services to get on the internet (web address, website, software). Online marketing connects advertisers to websites with advertising inventory.

- Both segments operate a ‘marketplace’ model (big believer in this model).

- Online Presence - CentralNic is higher up the supply chain than other web service providers like GoDaddy and Google. It is connected to country codes across the world and these are all integrated on its platform, which is quite a feat. It sells to c20,000 resellers including the biggest companies selling domain names. Reliable subscription revenue, one a year.

- Online Marketing - only three acquisitions made here so far, but ecommerce companies generated some $4 trillion in revenue last year with most of their customer acquisition coming via online marketing. More than $400bn spent here annually, growing at around 20% per annum. Reliable revenue but paid far more frequently than in Online Presence.

- Why the move into online marketing? Had been trying to buy the right online marketing company for a few years when they finally got the deal. It was the exact company they wanted. This business had some issues with the company that owned them, and was a fantastic purchase for CNIC. The group has spent $90m on acquiring companies in online marketing and has banked over $250m in revenues from them already.

- This is Ben Crawford’s third rollup (the other two were private). Strategy is to maintain discipline, buy at low multiples, and invest for growth, rather than buying high and seeking to strip out costs, which is what a lot of competitors do.

- CNIC has a couple of really great advantages re. M&A. It has a working business relationship with almost all of its acquired companies due to its position high up the supply chain. This provides an ‘incredibly handy’ perspective on the sector. CNIC sees who’s growing, and most people will take their calls.

- It has also developed a good reputation as an acquirer, and gets good prices on acquisitions by ensuring it is seen as the preferred partner for the business in question. So it leverages its market position and reputation, with minimal input from sell-side advisers etc.

- It has the tools to grow organically at above-market rates, but acquisitions will likely continue due to sticky customer bases. In the domain space, recurring revenue was around 85% of total across the industry last year. So existing customers paying existing service providers. Only around 2% of that cohort look to switch in any one year. So acquisition is the smartest play for scale.

- This is a very good industry for acquisitions as well - recurring revenue, stable customer numbers. They’re just websites automatically billing customers. Ben Crawford was involved in a Media rollup before - this is vastly different, as Media has key person risk (editors and the like).

- Cash conversion - good as it does not give credit to customers but receives it from suppliers.

H & T (LON:HAT)

Share price: 300p (+2.56%)

Shares in issue: 39,864,077

Market cap: £119.6m

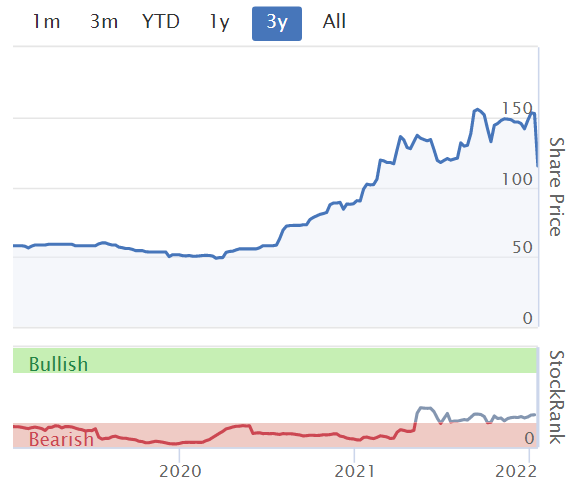

H&T forever looks cheap despite good quality metrics. It’s had high StockRanks for nearly a decade now.

Yet there’s been precious little to show for it in terms of share price progress. Perhaps investors are just lukewarm on the company’s business model, which revolves around pawnbroking.

Trading performance during the second half remained consistently strong and the Group expects to report profit before tax for the full year within the range of current market expectations

Those expectations are for profit before tax of between £9m-£10.1m, which continues to suggest good value for a c£116m market cap. Particularly if business continues to recover in the year ahead.

Demand for pledge lending has now fully recovered to pre-pandemic levels, with particularly strong demand in November and December. As at the end of December, the pledge book had grown to £67m, an increase of 39% over the prior year and up 34% since June 2021.

Retail sales have been ‘robust’, up 21% overall at improved margins, with strong demand for high quality pre-owned watches and jewellery. H2 showed a ‘full recovery to pre-pandemic levels’.

Gold purchase and foreign exchange transaction volumes improved in the fourth quarter and were in line with management expectations, but remain below pre-pandemic levels. Money transfer and cheque cashing volumes were in line with management expectations.

The personal loan book continues to reduce with repayments, recoveries, and lower impairment charges more than offsetting new lending. It stood at £2.6m as at 31 December.

The following catches my eye and requires closer inspection:

The company continues to work closely with the FCA and the appointed skilled person in respect of a review of lending processes, creditworthiness and affordability assessments undertaken within the Group's unsecured high cost short term ("HCST") loans business. A methodology for conducting the required past book review has been developed in close collaboration with the skilled person. Following initial review by the FCA, "outcomes testing" was undertaken by the skilled person. This work is under review by the FCA, and a conclusion to their review is anticipated in the near term. H&T will update the market further as soon as it is able to do so.

Perhaps someone more familiar with the situation can enlighten us in the comments? It’s something I’d want to know much more about before investing.

Cash balance of £17m as at 31 December, along with £35m in undrawn funding facilities. Strong balance sheet. Preliminary results to be reported on the 8th of March.

Conclusion

Continues to look good value, in my opinion, trading at around tangible book value but with a solid history of profits and dividend payments behind it, as well as a leading position in the UK market.

The shares have struggled to appreciate in the past. If the market tends to afford this type of business a low multiple, I’m not sure why that would change going forward. Nevertheless an attractive blend of Quality and Value, with a 4%+ yield, a strong balance sheet, and established market position.

The review into the high cost short term loans business is news to me though and is something I want more clarity on before proceeding, just to be safe.

Edit - thanks to the user flagging a new broker note over on ResearchTree. Shore Capital says ‘We remain of the view that any fines, penalties or redress costs will be manageable in the context of the group’s financial resources and should not materially impact on the investment case.’ I’d take it with a pinch of salt, as that’s the house broker, and would like to have more of a handle on the full range of potential outcomes here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.