Good morning, Paul & Jack here with Tuesday's SCVR.

Agenda -

Paul's Section:

Joules (LON:JOUL) (I hold) - see the comments section below, where I put up my initial thoughts on the (delayed) interim results out this morning. Share price looks to have seriously overshot on the downside, so I think there's a buying opportunity here, if you think (as I do) that profits should recover as supply chains ease at some point. Going concern note is better than I was expecting too - possible breach of facilities in downside scenario, but plenty of mitigating actions they could take if that scenario plays out. So shouldn't be a problem. 52p strikes me as a ludicrous under-valuation (mkt cap £58m).

Update at 11:57 - main section on Joules is now up.

Beeks Financial Cloud (LON:BKS) (I hold) - another contract win. This niche IT services company seems to be making excellent progress. It's won a £2.5m, 3 year contract extension with an existing client, to go into a new territory. Hence a record quarter for contract signings. When you look at the potential size of its markets, globally, this company could be a multibagger I reckon. BUT, it has to be seen as high risk, due to the market cap already looking expensive - worth it, for the growth potential, in my opinion. (no section below).

Avon Protection (LON:AVON) - a contract win from the US armed forces, for helmets. Sounds good, but the minimum & maximum contract sizes are wide apart, so it's not immediately obvious what financial benefit this contract is likely to bring. Still, it could help shares stabilise, after a disastrous recent history for this group.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Avon Protection (LON:AVON)

1180p (+7% at 08:25) - mkt cap £366m

US Defense Logistics Agency helmet contract

The contract has a maximum value of $204 million over a five-year duration, being a one-year base period with a maximum value of $46 million plus four further one-year extension options. The base year has a minimum value of $7 million.

Initial revenues are expected in our 2024 financial year, following completion of First Article Testing in 2023.

That's a wide range of outcomes, from $7m in year 1, to a maximum of $204m in total.

It's actually the gross profit made on each unit that matters more than revenues, but companies rarely disclose this, as it's commercially sensitive.

My opinion - none, it's not a company I follow closely. The next step for anyone interested is probably to look up the research notes from Edison (commissioned research, so in effect it's the company's guidance). This is for 85.1 US cents earnings this year FY 9/2022, rising to 116.3 US cents next year.

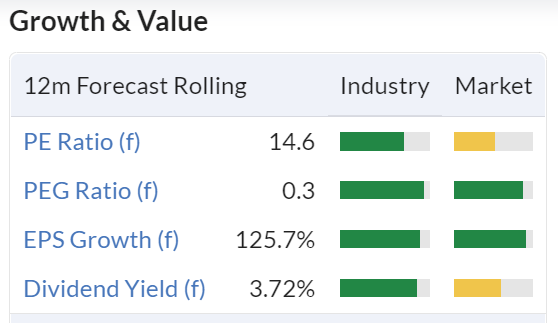

Stockopedia shows this share as being reasonably priced on forward PER & yield, if you're happy that forecasts are likely to be achieved.

.

Joules (LON:JOUL) (I hold)

53p (up 2% at 09:59) - mkt cap £59m

These numbers were delayed by a week, due to putting together a going concern note. Understandably, that must have caused a panic with some investors last week when the accounts delay was announced (together with another profit warning on 2 Feb). Hence why we’ve seen what seems to me a wildly excessive downward move in the share price. Although with 2 profit warnings in Dec & Jan, perhaps it’s no surprise that some investors have had enough & want to move on. I think it’s very considerably oversold now.

The main thing that has changed today is the going concern note, and this is what I headed for at 7am this morning, to scrutinise it carefully. Any solvency risk, and I would also be off, but there isn’t anything to worry about in my view -

GOING CONCERN

As at 28th November 2021, the date of the interim financial statements, the Group had net debt of £5.4m and liquidity headroom of £28.1m.

As reported in the trading update on 1st February 2022, trading in the first two months of the second half was below expectations and liquidity headroom had reduced to £11.5m as at 31st January 2022. The reduction in liquidity headroom is consistent with normal seasonal working capital fluctuations, although the reduction was greater than anticipated due to the timing of sales over Black Friday and revenue shortfall in January.

The Directors have taken account of this position when considering forecasts to support their going concern conclusion. The following have been considered:

· Base Case cash flow forecast to May 2023

· Downside cash flow forecast to May 2023

· Mitigating actions available

What does surprise me from the above, is that the modest net debt of £5.4m at 28 Nov 2021 rose so considerably to £21.5m net debt as reported last week, at 31 Jan 2022. The company says this is a normal seasonal movement, OK we have to take their word for that, but it strikes me as odd. I remember Dec & Jan as being cash generative, not cash consuming months, but my retailing experience is now 20+ years old, so things might have changed.

To summarise the rest of the section, in the 3 scenarios above -

Base case - latest guidance is for >£5m profit for FY 5/2022. Result is fine - group stays within its bank facilities, and meets covenant tests.

Downside scenario stress test - all banking covenants would still be met, but the Group would breach its current borrowing facilities limit for three months in FY23.

Mitigating actions - Joules has a lot of discretionary spending within admin costs (too much, in my opinion). So it can pull levers to reduce cash outgoings e.g. -

· reducing capital expenditure

· reducing discretionary revenue expenditure (not including performance marketing)

· rapid clearance of aged stock

There’s another wave of potential cuts, which could be implemented, if things get worse -

Such steps could include, for example, cancellation or rephasing of orders for inventory, and/or further accelerated clearance of aged stock, as well as agreeing an extension of current borrowing facilities.

Conclusion on going concern -

Having considered the forecast scenarios, including the main risks within them and the available mitigating actions described above, the Directors believe that the likelihood of the Group being in breach of its facilities over the twelve months from the date of this report is low and that mitigating actions available are sufficient to address these risks.

Therefore, there is a reasonable expectation that the Group has adequate financial resources to continue to operate for at least the next twelve months from the date of this report. Accordingly, the financial statements have been prepared under the going concern basis of accounting.

My opinion on going concern - the absolute level of bank borrowings are quite low for the size of business, and fluctuate considerably on a seasonal basis (which banks like - funding seasonal cashflows is lower risk for them).

JOUL is unusual, in having very large central overheads (e.g. £18.5m Head Office costs in H1 alone, which strikes me as too high, but it is a design-led business). The good thing is, these costs could be cut considerably, if trading worsens. Therefore I think JOUL has a lot of financial flexibility so I’m not worried about going concern.

Interim Results

Moving on to the numbers themselves, they’re actually not that bad. I would argue they’re good, for a company which is now only valued at £58m. My core view is that share price looks to have overshot on the downside by a considerable amount. You don’t have to agree with me on that, it’s only one person’s opinion.

I see the problems as fixable, and temporary. Again you may disagree, nobody knows for sure on any of this, for any company, because we’re trying to predict the future.

H1 revenues - look fine, at £127.9m. That’s +35% on LY, and +15% on 2 years ago (pre-pandemic). This has been boosted by the acquisition of Garden Trading (a successful supplier on the Friends of Joules eCommerce marketplace). It’s impressive that JOUL is still producing top line growth, something that plenty of other eCommerce-led businesses are currently struggling with. So demand is not the problem.

It’s very obvious from this table below why H1 profits have dropped so much from the pre-pandemic level of £8.4m, to £2.6m - it’s because the gross margin has fallen from 54.8% to 50.4%. Remember this is a blend of retail (higher margin) and wholesale (lower margin) sales -

.

The commentary mentions that higher freight costs have taken 2.4% off the margin, and Brexit-related costs 1.0%. That total of 3.4% off the gross margin is the equivalent of £4.3m lost gross profit, just in H1, so £8.6m annually. That headwind this year could become a tailwind (at least partially) in future years.

The analysis of costs also has a couple of lines that look really high to me, for the size of business, especially marketing, and Head Office. To be spending £18.5m in the half year on head office costs (which is likely to be mainly salaries), there must be hundreds of well-paid people at head office, which makes me wonder if it might be bloated & inefficient? Is this business being run to maximise profit? Doesn’t look like it to me. Maybe a restructuring at H.O. is needed, to generate better overall returns?

The notes do say that £3m extra H.O. costs are due to the inclusion of the Garden Trading team. So that leaves the balance similar to pre-pandemic levels.

.

Balance sheet -

NAV was £52.6m at 28 Nov 2021.

There are £31.0m in intangible assets, so NTAV is £21.6m - adequate in my view.

I normally eliminate the IFRS 16 entries, which are:

RoUA £28.3m, less liabilities of £9.8m + 28.4m. Overall = deficit of £9.9m

Hence my ex-IFRS 16 NTAV is £31.5m, which looks OK to me.

Remember the Head Office is freehold, which can be seen as offsetting the debt.

I think the risk of an equity fund raise looks low, but could happen if there’s a third profit warning in the coming months - probably not likely, because the commentary says current footfall & web activity is what they’re expecting. Also the last update said the distribution centre is now returning to normal.

My opinion - this is classic glass half empty or half full. If you focus on what’s gone wrong (supply chain problems, and 2 profit warnings), then I can see why you would want to steer clear. Or, if like me, you see temporary, external problems being fixable, then you see a value opportunity at a highly depressed share price. Your money, your choice! The group is still profitable, and should be able to improve the profit margin over time. Therefore, I see the extent of the share price fall as looking excessive.

If it was 200p per share, I wouldn't be interested. But at 56p or thereabouts, it looks an attractive valuation based on current trading, let alone once a recovery is pencilled in. I don't see solvency risk here, but there is always the risk of another profit warning, nobody can rule that out. They've got guidance badly wrong twice in succession, so it would probably be unwise to fully price-in recovery at this stage, there has to be a discount for risk.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.