Good morning, it's Paul & Jack here with Monday's SCVR.

Agenda -

Paul's Section:

Tristel (LON:TSTL) - I reviewed interim results from a week ago, over the weekend. Despite halving in share price, I still don't see this share as a bargain.

Mccoll's Retail (LON:MCLS) - Ominous press coverage over the weekend suggests to me that this share is probably worth zero, with insolvency looming. Too much debt, and supply chain problems look set to overwhelm equity, leaving debt holders in the driving seat, and equity holders probably wiped out in an imminent administration. I would get out while you still can, at any price that's high enough to cover the stockbroker's selling fees.

Onthemarket (LON:OTMP) (I hold) - a reassuring (in line) trading update for FY 1/2022. It's profitable, and has cash in the bank. It remains to be seen if the updated strategy of CEO Jason Tebb will work.

Made Tech (LON:MTEC) - my first look at this IT company addressing the public sector. Stellar growth, but I wonder if it might be expanding too fast, and struggling to control its staffing costs? Today's interim results come with a profit warning due to increased costs, shares down by a third. Overall, I don't know enough about it, so will sit on the fence.

Jack's section:

Centralnic (LON:CNIC) - I hold - final results and another acquisition announced. Organic momentum is strong and this has continued into the new financial year. The group remains loss-making on a reported basis though and, while revenue and profits are up impressively, the per share improvement is more muted. The rate of acquisition activity here suggests an ambitious company, but one that remains tricky for investors to pin down.

Safestyle Uk (LON:SFE) - trading update and cyber attack. H1 earnings are expected to materially reduce as a result. The group retains its second half guidance though, and says that the operational recovery is underway. Momentum had been promising here, but this remains a turnaround and sentiment has taken a knock, with increased short term uncertainty.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Mccoll's Retail (LON:MCLS)

7p (pre market open) - mkt cap £20m

Weekend press

Very ominous press reports over the weekend, suggesting that this convenience store chain is on the edge of going bust, with equity now probably worth nothing.

Sky says that some of McColls bank debt has been sold to hedge funds. It also says Morrisons is monitoring the situation closely, with a view to possibly acquiring some Morrison branded stores out of insolvency.

An excerpt from the Sky article says -

Retail industry sources said that McColl's shares were now effectively "worthless" and that a pre-pack administration or other forms of insolvency increasingly looked like the most likely outcome.

People close to the company expressed hope this weekend that a solvent solution could yet be found.

An article from ThisIsMoney says that Morrisons might bid for McColls.

My opinion - we’ve been long term negative on McColls shares here, due to the excessive bank debt, poor performance, and wafer thin margins.

However, the refinancing last August did look as if there might be a speculative chance of a turnaround, with the CEO putting in £3m of his own money looking a strong move.

The newsflow deteriorated later last year though, with supply chain problems worsening.

These latest press reports suggest that equity is probably now worth nothing. The creditors look to be in control, and that suggests a very high likelihood of equity holders being wiped out.

Hence for shareholders, selling quickly looks the most sensible move, to salvage anything you can.

With more difficult economic conditions at the moment, and the likelihood of interest rate rises, and withdrawal of Govt support, then I think highly indebted companies are looking a lot more risky. Investors who ignore balance sheet risk look set to get a rude awakening this year. It’s so difficult to predict these things though, because some highly indebted companies seem to sail through, whilst others collapse.

It’s worth remembering that, as outside shareholders, none of us really know for sure what’s going on at any company we invest in.

MCLS as just issued a statement this morning -

Ongoing discussions with banks.

Note the use of the words "stakeholders" and "partners" - often a warning sign that shareholders are now irrelevant -

The Group continues to believe that a financing solution will be found that involves its existing partners and stakeholders.

Working capital headroom has now gone, due to planned capex, and a poor H2 for FY 11/2021.

Guidance for FY 11/2021 results: in line with expectations (£1.11bn revenues, and £20m pre-IFRS 16 adj EBITDA)

Omicron impacted Xmas trading

Recent trading - improved gross margin, and improved product availability

Morrisons Daily store conversions delivering >20% LFL sales growth.

FY 11/2022 guidance - slightly behind expectations.

Net debt expected to remain flat, at £100m at end of this year.

Outlook -

As previously stated, the Group continues to believe that a financing solution will be found that involves its existing partners and stakeholders. However, there are also other options available to it. The Group confirms that it recently received an approach for the whole business, which has subsequently been withdrawn and there are no further discussions with that party or any other party in relation to an offer for the whole business. In addition, the Group has also received indications of interest for parts of the business. The Board will consider all options with the aim of maximising value for all stakeholders.

My opinion - ominous use of "stakeholders" suggests to me they're fighting to keep the business trading, rather than necessarily being able to salvage any value in the equity.

There's a glimmer of hope in the above, but I'd say it's looking >90% likely (my guess) that existing shares end up worth zero, or very close to zero if there's a debt for equity swap, as one possibility.

Tristel (LON:TSTL)

325p - mkt cap £153m

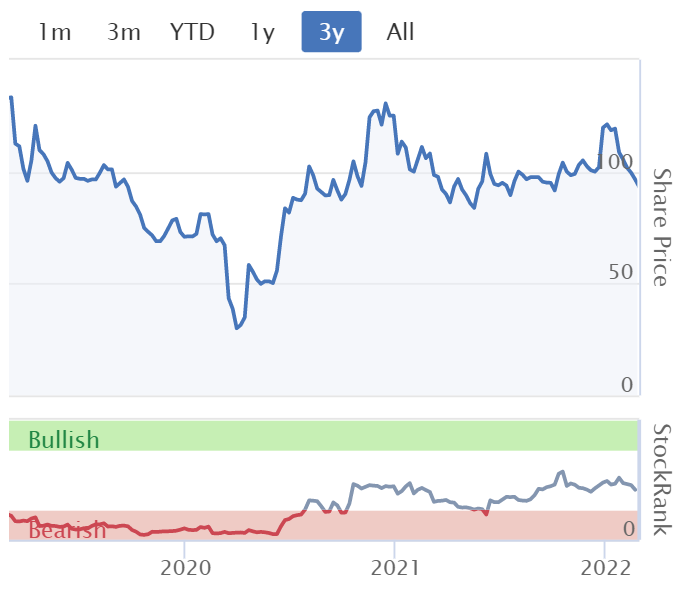

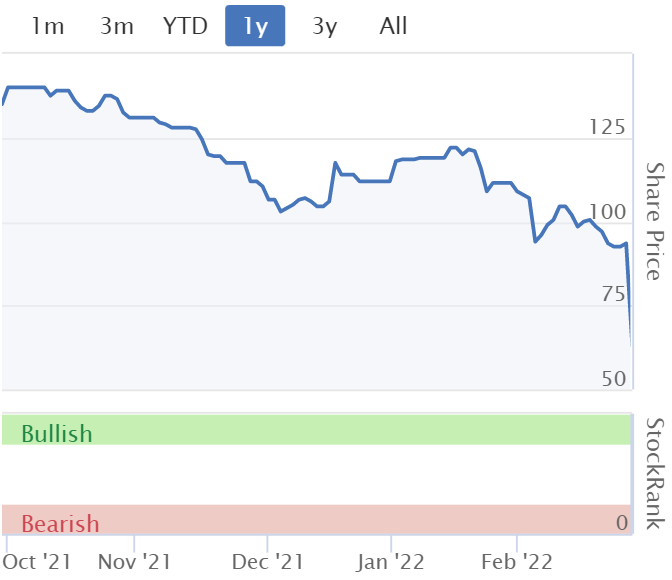

The share price of this seller of infection prevention products, has been hit hard in the current small caps bear market. We’ve been flagging here for a long time, that the valuation of Tristel shares was looking stretched in the big bull run from 2019 to 2021.

So I’m interested to see if, having halved in price, the shares might now look attractively valued as a possible purchase?

.

.

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products utilising proprietary chlorine dioxide technology, announces unaudited interim results for the six months to 31 December 2021.

Company’s PR summary -

Product rationalisation to deliver faster top-line growth and higher profitability

Continued progress towards commercial launch in North America

These interim results are tricky to interpret. It all depends what emphasis you put on the company’s adjustments.

The statutory numbers show a 7% fall in H1 revenues to £13.6m, and a big fall in reported PBT from £2.4m last year H1, to £1.0m in H1 this time.

How much of this poor performance is due to the continued impact of covid? As Tristel says in the commentary, we see on the news constantly how much elective surgery has been delayed by the pandemic, which suggests an upturn in business could be imminent, as elective surgery comes back. That’s a bull point for Tristel shares. Also the long awaited US approval could boost sales.

Throughout the first half, COVID-19 has put enormous pressure on healthcare provision in all our markets. However, there are signs that hospitals are returning to pre-pandemic levels of service, although this improvement is neither uniform nor consistent. Whilst we expect this "start-stop-start" pattern to continue through the second half, the number of diagnostic procedures that generate demand for our products is reviving globally.

We anticipate that second half revenue from Continuing operations will be higher than first half revenue.

Adjustments - there are three layers to this -

Firstly, some lower margin products are being discontinued. So the company presents these (falling) sales separately, which makes continuing business look more positive.

Secondly, one table moves £0.9m of sales related to Brexit stocking-up, from H1 last year into H1 this year, which is stretching things a bit, in order to turn a negative trend into a positive adjusted trend!

Thirdly, there’s a £2.4m write-off related to intangibles for discontinued operations. Taking that into account, the total loss after tax for H1 is £(982)k.

Note that share based payments look excessive (not for the first time at Tristel) of £884k in H1.

Also note H1 this year benefits from a negative tax charge.

Pricing power - a key issue at the moment, with higher input costs and pay rises.

This sounds reassuring -

We are experiencing labour cost increases and component and raw material price increases across the Group and are increasing prices this year to match them.

Balance sheet - absolutely fine, very strong, with plenty of working capital, including £8.8m net cash.

Cashflow statement - is still good, despite profits falling. So the dividend paying capacity of the company still looks good. The forecast yield doesn’t excite me, at 2.0%.

The interim divi is held at 2.62p.

Outlook - talks about recovery potential after covid -

As the impact of the pandemic recedes and the number of endoscopies, ultrasound scans and other diagnostic procedures return to their pre-COVID-19 levels, we are confident that we will return to the growth trajectory we were on before 2020. The backlog for these procedures is front page news in all countries.

We have simplified the business and sharpened our focus on the hospital and our proprietary chlorine dioxide chemistry. We are better placed than before COVID-19 to capitalise upon a return to normal service in global healthcare. We look forward to growing our two core brands - Tristel and Cache - and expanding our global reach.

Valuation - forecast EPS has been falling, quite a lot -

.

Accordingly, even though the share price has halved, earnings forecasts have fallen a similar amount. So the PER still looks high - Stockopedia shows the forward PER of 42.5.

My opinion - it still doesn’t look cheap to me.

I wouldn’t pay a PER of 42.5, for a company where the upside is still quite tricky to forecast.

As always, this is just a personal view, but to pay that kind of rating, in a bear market for small caps, I would want to see a much clearer upside case.

Tristel is quite a decent company, making solid profits at high gross margins. It’s got an excellent balance sheet. But it’s always struck me as a bit too niche, only generating small sales, in lots of countries. For a growth company rating, I much prefer to see exponential growth, with huge market potential. That’s not obviously the case with Tristel. So it’s not for me, but good luck to holders.

.

Onthemarket (LON:OTMP) (I hold)

92.5p (unchanged, at 08:56) - mkt cap £69m

Trading Update (post year-end)

OnTheMarket plc (AIM: OTMP), the majority agent-owned company which operates the OnTheMarket.com property portal, is pleased to announce an update on trading for the year to 31 January 2022 (FY22).

It’s another reassuring update -

the Group expects to report for FY22:

· Revenues of approximately £30.8m (FY21: £23.0m); and

· Adjusted operating profit for the year of approximately £2.6m (FY21: £2.4m).

Liquidity looks fine -

net cash at 31 January 2022 of £8.4m and no borrowings.

Outlook - no numbers, but upbeat commentary -

With the new website and brand launch in December 2021, and an increasing range of commercial partnerships successfully established, the transformation of OnTheMarket to create a tech-enabled property business across the broader property ecosystem is accelerating.

The new website, and initiatives such as 'Only With Us', continue to attract serious property-seekers and connect them with our advertisers.

The strategic steps the Group has taken, alongside the support of our agent customers and shareholders, provide the Group with the confidence that it has a platform from which to drive long-term profitable growth.

"We are delighted to have achieved a year of further financial and operational progress. But there is much more to come. We have received great feedback from our customers regarding our new strategy and enhanced suite of product and service offerings. We look forward to continuing to deliver greater value to both advertisers and consumers during the year ahead."

My opinion - it’s profitable, and has cash in the bank.

I don’t know if the added tech services strategy under newish CEO Jason Tebb will work or not, we’ll just have to wait and see.

.

.

Made Tech (LON:MTEC)

62.5p (down 33% at 09:37) - mkt cap £92m

Major new contract with NHS digital

Made Tech Group plc, a leading provider of digital, data and technology services to the UK public sector, is delighted to announce that a consortium including Made Tech has been awarded a two-year contract worth up to £37.5m with the Health and Social Care Information Centre ("NHS Digital").

MTEC’s share is about half, so c.£19m, and the contract has already started.

“Significantly enhances revenue visibility” for FY 5/2023 & FY 5/2024.

This announcement sounds positive, so it must be the interim results that has triggered the share price dropping by a third this morning. Let’s take a look.

Made Tech Group plc, a leading provider of digital, data and technology services to the UK public sector, is pleased to announce its interim results for the six month period ended 30 November 2021.

MTEC floated on AIM on 30 Sept 2021, it’s a new share to me, so this is just an initial review of the numbers.

Impressive growth here -

.

Skimming through the commentary, I’m struck by how fast the company is expanding, and that headcount is rising very fast - which is likely to be a challenge to control.

Profit warning - this seems to be the culprit for today’s 33% share price fall -

Despite some short-term challenges relating to IR35 and staffing of public sector contracts and increased overhead costs, which we expect to impact our trading performance in Q4 FY22 and into the first half of FY23, the Group's significant new contract bookings and robust pipeline underpin the Board's confidence in the medium term outlook. We look forward to continuing to deliver strong revenue growth in the second half of FY22 and beyond, and remain incredibly positive about the Group's long-term prospects."...

Wage inflation and the well-publicised challenges in the hiring market have made recruitment more difficult than anticipated. We've had to significantly increase our headcount within our internal Talent team and lean more heavily on external recruiters than we had originally planned. This is leading to an increase in both recruitment overheads and average staff costs, which we expect to have an impact on our full year performance. The increase in our billable staff costs has already been offset by delivering increased billable utilisation across our staff and an increase in our average billable day rate, so we're expecting our gross margin to remain broadly in-line with expectations. However, we expect it to be more challenging to offset overhead costs, though we will of course continue to look at this closely.

Rather a mixed bag there.

Is the company growing too fast? Is it winning contracts by under-pricing them? I don’t know, but am just asking the questions.

Balance sheet - looks fine. £11.1m cash, NAV £13.5m, and only £453k intangible assets, so this is a very capital-light business model, which appeals to me. Although as with any people business, the fixed assets walk out of the front door every night, and can be poached by competitors quite easily. In a time of rising salaries, that sounds like a challenge for MTEC. So rising staff costs is probably the main threat to the business.

My opinion - neutral at the moment, because this share is new to me.

Things I like -

- Extremely rapid growth in revenues, and a move into profit

- Sound balance sheet, with plenty of cash raised in the IPO late last year

- Public sector IT seems a lucrative area, as we’ve seen from Kainos (LON:KNOS) and Tpximpact Holdings (LON:TPX)

Things I’m not keen on -

- Staffing challenges & costs - is it expanding too fast?

- Profit warning today could put a cloud over the share price for a while

- Difficult to value, given it’s only just moved into profit

.

.

Centralnic (LON:CNIC)

Share price: 126.98p (-4.88%)

Shares in issue: 251,160,084

Market cap: £318.9m

(I hold)

Preliminary results for the year to 31 December 2021

- Revenue +71% to $410.5m (organic revenue +39%),

- Gross profit +58% to $118.5m,

- Operating profit up from loss of $2.1m to positive $12.4m,

- Profit before tax up from loss of $11.8m to positive $1.6m,

- Net debt down from $85m to $75m after $18.3m of acquisitions,

- Adjusted EPS +18% to 11.8c.

The shares are down this morning, possibly due to a more muted improvement in metrics at the per share level. And, stripping out adjustments, the company remains loss-making.

Adjusted EBITDA of $46.3m includes $18.3m of amortisation of intangibles, $8.7 of non-core operating expenses (primarily related to acquisitions), and $5m of share-based payments.

CentralNIC is an evolving company and some of the share value is in its growth prospects. That said, it is fair to be wary of companies that continually acquire via equity dilution.

The company purchased four businesses in the period: SafeBrands (online presence), Wando (online marketing), White & Case (online marketing), and NameAction (online presence). Deferred considerations were also paid out on Team Internet and SafeBrands (totalling $1.7m).

Operationally, management has said a few times that Big Tech’s increasing focus on privacy is suited to the group’s business lines. It continues that today, noting ‘very strong traction for the Group's privacy-safe online marketing technologies in the context of privacy-conscious policies of Big Tech’.

Meanwhile, it has invested in new management, staff and systems, which has helped to accelerate organic growth to record levels (of 39%). A new Data and AI group has also been set up to improve growth and profitability.

Online presence (essential tools for businesses to go online) - revenue grew 17% to $127.9m.

Online marketing - revenue up 133% and 65% organically.

Acquisition and placing

CentralNIC also announces a placing and open offer of £45m this morning, for the acquisition of online marketing business VLG. The transaction will value VLG at c$75m in exchange for a company that generated $55.3m in annual revenue and $10.9m in adjusted EBITDA for the year to 31 December 2021. There’s an additional earn out of up to $38m over three years ‘if the growth of VGL materially exceeds expectations’.

CentralNic expects to issue additional senior secured callable bonds for a nominal value of EUR 21 million under its existing senior secured bond. The proceeds of the bond Issue will be partly used to fund the acquisition.

It’s a sizeable transaction, but the companies CentralNIC goes for tend to be relatively easy to integrate and are quite scalable. The group has recurring revenues and cash conversion generally in excess of 100%, so it should be able to swallow this but the larger the acquisition, the higher the risk.

This will continue to be a feature for the group: 'The pipeline of future acquisition targets remains strong and we are confident in continuing our trajectory towards joining the ranks of the global leaders in our industry'.

Balance sheet - $254m of intangibles make up the bulk of the $271.8m fixed assets. The current ratio is less than 1x. All in all, I would like to see more here.

Cash flow - is better. Net CFO of $38.4m and free cash flow of $33.2m (or c$24.6m after interest) is some way above the reported statutory profit figure and may be a better indicator of where the group is at.

Conclusion

There’s a lot of news to digest today. The company has made quite a few acquisitions over the past few years and a lot of investors might understandably put CNIC in the ‘too difficult’ tray.

Management does make the effort to communicate with private investors, but ultimately I suspect people will want to see consistent positive reported earnings per share growth over a period of time. CentralNIC remains loss-making for now, although cash generation is stronger.

Repeated acquisitions can make investors wary, although management does have experience with this kind of strategy and is in an industry with suitable economics (predictable, recurring revenue, low churn, strong cash conversion). These are often just websites automatically billing credit cards, there’s no key person risk or anything like that.

And CNIC is well positioned higher up the supply chain, with great visibility over its acquisition pipeline. It can see who is growing, most targets know the company, and it is often seen as a preferred partner.

So this remains about where you think the company is heading. As the company scales up, the underlying qualities of high recurring revenues and strong cash conversion should become increasingly meaningful. The group has been through a phase of heavy investment as well, and it expects lower costs here in future.

CNIC does have to make sure it is adding sufficient value at the per share level though and, while cash generation is good, the balance sheet is not the strongest. That makes me slightly more cautious given the expectation of further acquisitions.

That said, organic momentum has been strong and this has continued into the new financial year. The new acquisition is expected to be double digits earnings enhancing and there is the ambition to build a materially larger business here in time.

Safestyle Uk (LON:SFE)

Share price: 43.21p (-9.03%)

Shares in issue: 138,615,378

Market cap: £59.9m

Trading update and cyber incident

An unfortunate update here, which sees the share price down c9% at the time of writing as a result of a cyber attack.

In terms of trading, Safestyle says:

Our sales momentum, supported by our return to TV advertising on 14 February, has remained strong and our order book has continued to build. Our balance sheet, liquidity and net cash positions remain healthy and are comparable to those levels previously communicated at the end of 2021 (net cash is currently over £12m).

However:

Order processing and customer services operations were… severely impacted by the attack and our On Time in Full ('OTIF') levels were increasingly disrupted until the relevant installations systems were successfully recovered. That recovery has now been achieved and we expect the level of disruption to markedly reduce as we return to normal business operations over the next month or so.

The incident is now mostly fixed but the resulting impact will be a c10% hit to H1 revenue and a ‘material impact’ on H1 earnings. Audited results for FY21 will also be pushed back to 21 April 2022, although guidance remains unchanged from the 26 January update.

After careful consideration, we have decided not to change our strategic investment plans in 2022, including our return to TV advertising, and we also expect, in light of the attack, to accelerate our existing multi-year IT investment plans. As a result, and in the absence of other external factors, cashflow is expected to be broadly neutral for the year.

Conclusion

Safestyle is still investigating the nature and extent of the incident. That uncertainty will be uncomfortable for shareholders, but the group is maintaining H2 guidance and is using this as an opportunity to accelerate IT investment.

The disruption should not impact second half figures, so for now it looks like a temporary setback. OTIF run rates are expected to quickly return to targeted levels and the group retains a strong order book.

Liberum has cut its H122 PBT estimate from £4.5m to £0.2m though, with gross margins for 2022 reduced due to the incident delaying planned price rises.

It’s a shame, as the turnaround here looked to be working out well with a return to profitability last September after four years of hard work. This update introduces much more uncertainty into the mix, with a material impact on H1 earnings. It may prove to be a temporary issue, but trust in a turnaround is a fragile thing.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.