Good morning, it's Paul & Jack here with the SCVR for Weds.

The futures are indicating a rebound day today. The big question is whether the market is starting to form a bottom, or whether it's just a bounce in the downtrend. We've got no idea at this stage, so answers on a postcard please. I'll (Paul) be getting my chequebook out, with some early purchases of bargains on my watchlist. Selectively, I think there are some really attractive buying opportunities out there right now.

Agenda -

Paul's Section:

A brief comment on 3 takeover deals which have recently failed.

Somero Enterprises Inc (LON:SOM) (I hold) - superb 2021 results, in line with the update in Jan 2022. Lots to like here, and shares seem irrationally cheap.

Headlam (LON:HEAD) - briefly covered yesterday as looking a bargain, the price has moved up today on publication of excellent 2021 results, a solid outlook, bulletproof balance sheet, and news of both a special divi & buyback. This is right up my street, an excellent value share in my view.

Gfinity (LON:GFIN) - looks very wobbly, down 50% today on news of revenues falling short, and that it's run out of cash. Fundraising imminent, so expect considerable dilution. Uninvestable for me.

Jack's Section:

Stv (LON:STVG) - strong FY21 results and a confident outlook for FY22. This remains an intriguing property - Scotland’s most popular television channel and the fastest growing UK broadcaster video on demand service - but the operating enterprise is dwarfed by its pension schemes, which could be a deal breaker for investors.

.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Takeover offers

This is interesting as it looks like several deals may be collapsing in current chaotic conditions.

Oxford Instruments (LON:OXIG) - It’s outside our area here, but I noticed the price of OXIG shot up on a bid approach recently, from Spectris. That collapsed on 7 March, with Spectris pulling out, specifically blaming uncertainty created by Russia’s invasion of Ukraine.

John Menzies (LON:MNZS) - the Kuwaiti company offering 608p cash has not yet made it a formal offer. The PUSU deadline was extended yesterday 8 March. The share price has dropped to 488p, 20% below the indicated potential bid price, clearly showing the market thinks there’s a good chance the deal might collapse.

Photo-me International (LON:PHTM) - the ungenerous 75p takeover deal from the major shareholder has failed today, due to a very small level of acceptances from shareholders. The 36.5% major shareholder only managed to increase acceptances to 45.1% including its own holding, insufficient to achieve the required 50% threshold. It seems strange that the bidder went ahead with a poor offer price, without apparently having secured agreement privately with enough institutions to be sure the deal would succeed.

I wonder whether takeover deals generally are now off the table? Personally I doubt it. Valuations have dropped so much, that I reckon we’re likely to see plenty more takeover approaches, with acquirers looking to take advantage of low share prices and jittery shareholders perhaps happy to be provided with an exit.

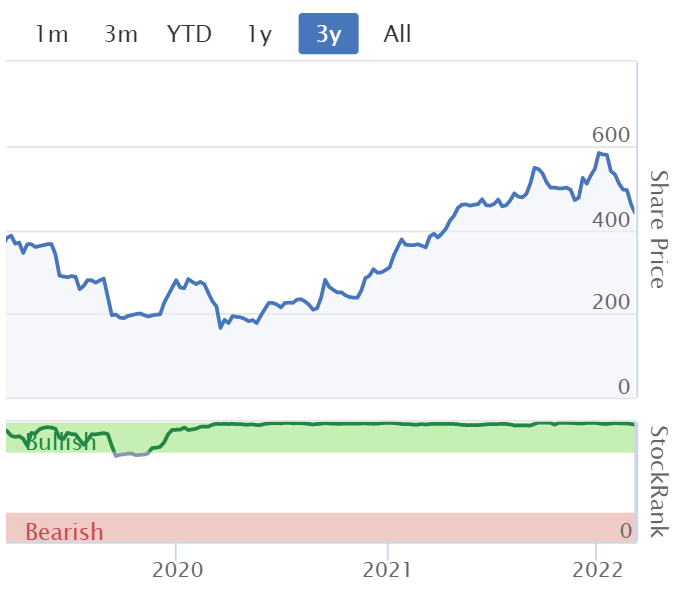

Somero Enterprises Inc (LON:SOM) (I hold)

450p (yesterday’s close) - market cap £252m

Somero makes & supports concrete laying machines, which are laser-guided, to achieve perfectly flat floors.

Stellar results for 2021, as expected and previously guided in the last trading update on 22 Jan 2022, which I reviewed here.

Actual results out today are in line with that guidance:

Revenue $133.3m (guidance $133m)

Adj EBITDA $47.8m (guidance $48m)

Diluted adjusted EPS: $0.61 = 46.5p (again, in line with guidance)

Net cash $42.1m (guidance $42m)

So everything’s fine there.

Everything’s also fine on the balance sheet, which looks terrific, and has pots of cash, which the company pays out in ordinary & supplemental divis, above what it needs to keep. I love businesses that keep throwing off surplus cash, and pay it out to shareholders.

Expanding capacity by 35%

International - Australia expanding fast from a low base - could this be the right model to expand in other overseas markets, where growth has been generally poor in the long-term? 80% of revenues are from USA.

New products contributing to growth, with more to come.

Russia negligible.

Very high profit margins.

Dividends - very striking, how cash generative this company is, and that it rewards shareholders so well, so for 2021 we have:

Interim divi 9.0 cents (paid Oct 2021)

Final divi 22.02 cents (payable 6 May 2022)

Supplemental divi 19.7 cents (also payable 6 May 2022)

That’s a total relating to FY 12/2021 of 50.72 cents, or 38.6p, a yield of 8.6%

The big unknown is to what extent this performance is sustainable, or possibly a cyclical high? We don’t know.

Outlook - modest growth is expected in 2022, with higher overheads, so EBITDA is anticipated to be flat in 2022 vs 2021. Management guidance tends to be cautious, and they said something similar this time last year, but then went on to smash forecasts.

Importantly, mgt says today that confidence in the outlook is based on feedback from customers, which have strong order backlogs from their clients. So there’s substance to the positive outlook for 2022, not just a wing & a prayer.

We need to consider the macro picture. There’s the risk that the higher oil price & general inflation might trigger a slowdown, or even a recession in the USA, SOM’s main market, but who knows? If Ukraine gets resolved, and oil reduces again, then the economy could continue booming. We don’t know, and anyone who claims they do know the future with certainty, is just guessing, whilst trying to sound clever.

My opinion - I reckon it makes sense to value SOM on c.50p EPS for 2022. I would put it on a PER of at least 15, so that’s 750p price target.

Hence the current share price of 455p just looks wrong - i.e. too low. How does a PER of 9 make any sense at all? That said, SOM has always looked cheap, all the way up. People have been factoring in a recession for years, whilst its earnings keep rising. Could it be that the growth is structural, as more clients require perfectly flat floors for new warehouses?

Anyway, it’s a nice problem to have - wondering why a share is so cheap, when it keeps performing superbly, with remarkably high quality scores. To achieve such high margins, SOM clearly has considerable pricing power, and dominates this niche. The shareholder list is fragmented, so I wonder if a larger group might make a bid for SOM?

.

.

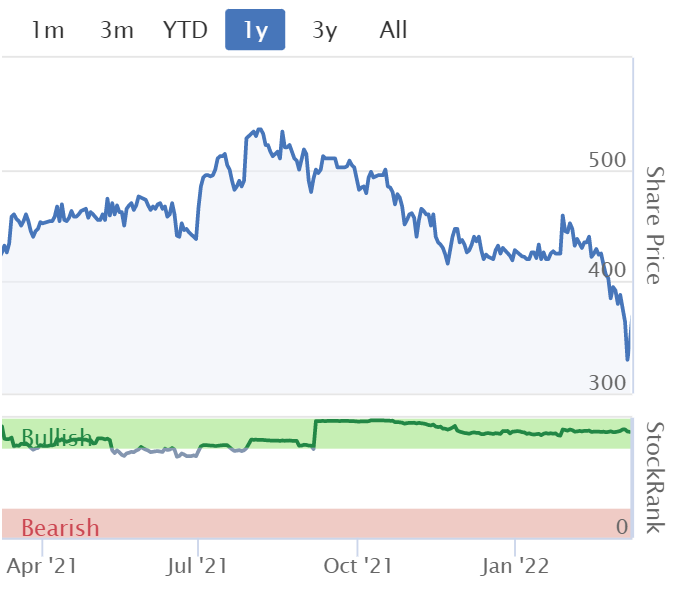

Headlam (LON:HEAD)

369p (up 7%, at 09:47) - market cap £315m

I had a quick look at this share yesterday, when a trading update was buried within an RNS entitled “Board Changes”. It just shows, what we should always read every RNS for companies of interest, just in case there’s additional information in there. The company really should have called the RNS something like this: Board Changes and Trading Update.

My conclusion yesterday was that the share looked a bargain at 330p, after recent indiscriminate falls. It confirmed yesterday that trading in 2022 “continued to be in line with plan”.

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, today announces its final results for the year ended 31 December 2021, and update since the year-end.

2021 a very positive year

I’m impressed with these numbers.

Adj EPS has risen from 13.7p in 2020 (hit by the pandemic), to 31.1p for 2021.

Revenues up 15.4% to £667.2m, so a decent sized business.

The underlying operating profit margin is rising nicely, from 3.0% in 2020, to 5.6% in 2021, and a target for 2023 of 7.5% - that’s an important point, as it could drive re-rating of the shares, if achieved.

There was a £9m benefit from furlough grants, but I see that as pass-through money, since it’s paid to idled employees.

A while back the company did a roadshow, explaining all the business improvements it was implementing. After reading a huge slide deck, I came away with the impression that the business seemed a bit of a shambles! That said, sorting out lots of basics that have gone wrong, is a nice catalyst for earnings to rise, which is what seems to be happening. Hence I’m working on the basis that HEAD should be able to achieve say 40-50p EPS in future. Put that on a PER of say 15, and the upside case could be very nice: 600-750p per share, versus 369p per share now. Plus it’s a generous dividend payer, so we’re paid to wait.

Balance sheet - a positive, stand-out feature of this share. NAV of £232.1m, deduct £18.1m intangible assets, and NTAV is £214m NTAV. This includes over £100m of freehold property, and £53.7m of net cash at end Dec 2021. This is exceptionally good for the size of company.

As regulars here know, I very much favour strong balance sheets with surplus assets, as it provides hidden upside (in for free very often, as it is here).

Also note that, due to this financial strength, HEAD did not need a refinancing during the pandemic, indeed the share count has remained static at around 84-85m shares in issue since 2015. It’s set to come down now, with a buyback.

Surplus capital distribution - a very strong move here. HEAD has more cash than it needs, so it’s declared a 17.7p special divi, on top of 16.4p total divis for 2021.

Above that, there’s a £15m share buyback announced today, which at 369p per share, would be just under 5% of the issued share capital - so that would give a boost to EPS in future years.

The company still has net cash after all that, and it’s a proven cash generative business, so it should be able to continue paying ongoing divis of maybe a 5%+ dividend yield - highly attractive in these more inflationary times.

My opinion - this looks a really solid value share, it’s right up my street, as a long-term hold.

It’s true that the residential property division would have benefited from people revamping their homes during 2020 and 2021. However, that was offset by a reduction in commercial. So as we come out of the pandemic, maybe that might reverse somewhat?

Another issue is the shortage of carpet fitters, which could be positive for ongoing demand continuing, from people having to defer replacement of carpets? Who knows. The crunch on household disposable incomes this year could be a downside risk, again who knows?

Overall, with a forward PER under 10, and a dividend yield of 5%+, on the back of a bulletproof balance sheet, this looks a very attractive share to me. Especially after the recent market-wide panic sell-off. I’ll be buying, as soon as funds permit, the current price looks a very good entry point to me.

.

.

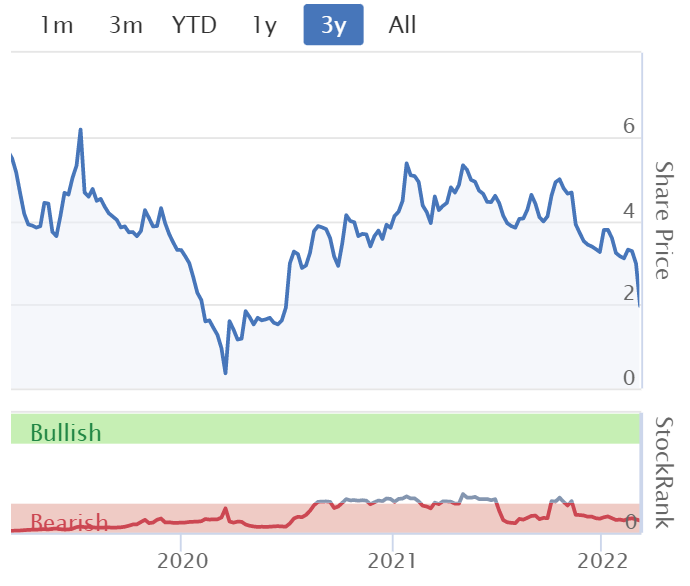

Gfinity (LON:GFIN)

1.2p (down 50%, at 10:44) - market cap £13m

H1 (6m to 31 Dec 2021) saw revenues of £3.3m

Growth only 8% vs H1 LY (or adjusted up to 24% by excluding a one-off)

Still loss-making

Full year revenues likely to fall short of market expectations.

It’s almost run out of cash - £1.5m at end Dec 2021, now down to £0.8m

Fundraising now required, key shareholders said to be supportive. Any fundraise would be (hoped for) minimum of £1m, and include additional potential dilution from warrants.

My opinion - uninvestable for me, as existing holders are likely to be heavily diluted in the imminent emergency fundraising.

This is the type of speculative share that can do well in a roaring bull market. The trouble is, running out of cash, deep into a small caps bear market, is the worst case scenario.

I think the company needs a lot more than £1m fundraising.

It’s not yet clear whether it has a viable business model either.

Looks very high risk, so I wouldn’t go near it personally.

.

.

Jack’s section

Stv (LON:STVG)

Share price: 332p (+5.4%)

Shares in issue: 46,722,499

Market cap: £155.1m

Results for the year to 31 December 2021

STV has fallen by 15% or so along with the rest of the market despite previous positive updates. It would be of interest, but the glaring issue here is a large pension fund - it could be that a rising interest rate environment helps here, but so far it has prevented me from taking this one further.

That’s a shame, because the valuation is attractive and the group, as Scotland’s largest broadcaster, is potentially quite an appealing prospect.

For FY21, STV reports its highest ever revenue (up 35% to £144.5m) and adjusted operating profit (up 39% to £25.2m) ever. Adjusted earnings per share grew by 32% to 45.6p and the group paid out an 11p dividend, meaning the shares trade on just 6.9x FY21 earnings and yielded 3.5% in dividends.

Adjusted results are before exceptional items (of £0.8m) and include High-End Television tax credits (of £1.9m). The latter is an incentive to support creative industries and ‘is a critical factor when assessing the viability of investment decisions in the production of high-end drama programmes’.

The company continues to diversify, with 36% of adjusted operating profit now from Digital and Studios, and management says it is on track to reach 3-year growth targets in 2023.

Those targets are to:

- Double digital viewing, users and revenue (to £20m)

- Quadruple Studios revenue (to £40m)

- Achieve at least 50% of operating profit from outside traditional broadcasting

STV notes a ‘resurgent’ advertising market, with regional advertising up 22% and video on demand (VOD) advertising up 38%. Studios revenue trebled to £27m and cash generation was robust, with cash from operations +55% to £34.8m.

Outlook

Sounds positive.

The group has its ‘strongest ever’ content line-up for 2022, both on TV and online. Content cost guidance remains unchanged (a 3-year £30m investment plan to fund Digital & Studios growth, and national programming costs linked to advertising revenues under a long-term agreement).

Q1 FY22 total advertising revenue (TAR) is expected to be around +20%, with January +21%, February +26% and March +10-15%. April TAR is expected to be up +10-15%, although comparators get tougher from Q2. Studios has made 11 new commissions so far this year.

Pension and financial health

This is the bit that has put me off in the past. The pension scheme is much larger than the STV market cap (£440m of plan assets & £519m of PV obligations compared to a market cap of c£150m).

Agreement of the triennial valuations for the Group's defined benefit schemes was reached in October, based on a combined scheme funding deficit of £116m and a recovery plan running to October 2030. The Schedule of Contributions remains at the same level as the previous settlement with the contingent cash mechanism also in place.

The IAS 19 accounting deficit across the schemes was £79.4m (2020: £70.3m). The increase in the liability is primarily driven by an update to the mortality assumptions used, as well as reflecting the latest membership data following completion of the triennial valuation. These increases were partially offset by the gain derived from the higher discount rate and the benefit of contributions paid by the Group.

Anecdotally, I feel as though more companies have been reporting reductions in pension scheme liabilities, so it’s a shame STV’s remains stubbornly high.

Pension contributions were £9.3m in the year, so still a substantial chunk of the £34.8m cash from operations, although the proportion has fallen from last year. If you think of it as a sort of ‘interest cover’, then the ratio of cash from operations to pension contributions has increased from 2.33x to 3.74x, so a substantial improvement. If STV can continue to grow its cash flows, then the pension payments will become less of a concern.

However, a contingent cash mechanism also remains in place.

Contingent funding payments equivalent to 20% of any outperformance above a benchmark of available cash will be paid to the schemes.

One positive point is that the group is now in a net cash position of £0.3m, compared to net debt of £17.5m.

Conclusion

Operationally, STV appears to be in fine fettle. The group’s all-time viewing share is the highest it’s been since 2008, at 19.6% (up from 19.2%) and it remains the most-watched peaktime channel in Scotland (with a share of 22.2%).

It also reports the highest viewing share gain of any commercial channel in the UK over the past year, and STV Player remains the fastest growing UK broadcaster VOD service.

Is it worth taking on the financial risk of the pension deficit? It’s something I have done before, with Premier Foods (LON:PFD) , which ended up a profitable investment as the company slowly turned around, supported by underlying cash generation. But I remember the feeling well, of potential stakeholder conflict, increased uncertainty, and the equity holder’s diminished standing in the pecking order. It’s not a particularly comfortable position and at times can feel like more of a binary gamble on external outcomes.

My view is that pension trustees need the operating company to remain healthy as it depends on its cash flows. But that’s no guarantee of safety, and it remains a considerable risk that will understandably put many off. STV’s trading is encouraging but the pension scheme dwarfs the operating business, with assets of £440m and present value obligations of £519m. So small changes in assumptions can have a material impact on results. You can’t consider the stock without considering the pension scheme.

If STV can continue to grow, then this should become less of a problem. But if things start to go backwards, or if interest rates fall again, then those contributions could begin to hurt. This is another positive update though, so hopefully the former comes to pass.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.