Good morning, it's Paul & Roland here today. Today's report is now finished.

Agenda -

Paul's Section:

Beeks Financial Cloud (LON:BKS) (I hold) - another big (for the small size of company) contract win. This quarter has now delivered record contract wins, of 3 times the previous record quarter. Something big is happening here, so despite it being difficult to value, BKS is becoming a top conviction holding for me, as a long-term investment.

Surface Transforms (LON:SCE) - a large increase in its contract with (possibly) Tesla, for ceramic brakes. This looks like a genuine game-changer for the company, although at nearly £100m market cap, a lot of the upside is already priced-in. In more bullish market conditions, I could see this share going higher. Execution risk is considerable, going from negligible revenues, to mass production.

Mccoll's Retail (LON:MCLS) - as mentioned before, I think existing equity is now almost certainly worth nothing. Departure of the CEO today looks like it's imminently game over for existing shareholders. The business looks likely to survive, but with new owners, and reduced debt, I imagine. Please don't buy these shares, imagining it might multibag! You'll almost certainly lose all your money within days or weeks.

Activeops (LON:AOM) - my first look at an AIM float from H1 of 2021 (a terrible period for over-priced, opportunistic floats). Today's trading update for FY 3/2022 looks OK, in line with expectations. The 17% drop in share price seems harsh, with only a couple of minor negative comments from the company. Trouble is, it floated at a gross over-valuation. So I think it's likely to continue falling, because the starting point was so high. A loss-making, moderate growth company, valued at £70m, is not going to appeal to many people right now.

Roland's Section:

Sopheon (LON:SPE) - Software group Sopheon has delivered another year of revenue growth and reports some promising KPIs. But profits continue to fall despite strong cash generation. I’m not convinced the pace of growth justifies the valuation here.

Kin And Carta (LON:KCT) - strong organic growth, with half-year revenue up 59% like-for-like. However, this pace is expected to moderate in future years and I have concerns over the quality of profits and cash generation. I’m struggling to see much value here.

Spring Statement & Market Comment (from Paul)

I quickly looked through the detail of the Chancellor's Spring Statement from yesterday. It seems to alleviate only some of the squeeze on household incomes. A big rise in the NIC starting threshold seems to offset about half of the total cost of increased NIC rates previously announced. 5p off fuel helps a bit too. Although with inflation + higher taxes now looking to increase household spending by say 8-10%, and incomes only rising say 3-5% (depending on peoples' circumstances), there's no doubt that millions of households are heading into a period where disposable income is squeezed hard. That's why consumer-facing shares have dropped so much. Does it then trigger a downturn in business confidence, and even a recession? It's possible, for sure. It seems strange to me that Sunak did such massive intervention to prop up the economy (very successfully) during the pandemic, yet now seems almost blase about letting the economy wilt - which of course runs the risk of tax revenues drying up, making the situation worse. A reputation for competence seems to be ebbing away.

Anyway, how should that affect our investing? I feel that many of my small caps have fallen so much already, that it's probably too late to think about selling. I'd rather push through, and await a recovery for my core holdings. That means accepting the risk of further losses, which for me personally is fine, as I take a long-term view, and am happy collecting in divis. Others however tend to be much more short-term, and less able to cope with financial pain. So people need to make difficult decisions on whether to continue holding, or to run for cover and see how things pan out. Your money, your decision.

There was an interesting bar chart shown by the BBC news last night, indicating that the squeeze on real incomes this year (with inflation way above rises in wages/benefits) is the worst for 30 or 40 years. However, what struck me is that all the previous negative bars only lasted one year, and then saw big positive bars either side. Hence this is a temporary issue. So should we really be pulverising share prices just because a company is likely to have one bad year, due to temporary factors? Probably not, but markets look to be driven by fear & flow of money at the moment, so are not necessarily making logical prices. At some stage that market mentality suddenly changes, and investors snap up cheap shares with a view to recovery. I've no idea when that change in sentiment will happen. That creates lots of buying opportunities for investors with strong stomachs, who can tolerate short term losses. Or if you think you can time the market, and buy back in at the optimum time (which will be before the economy actually recovers, remember markets anticipate events that are likely), then sitting in cash is not a bad idea, if it's only for a few months.

Obviously I'm kicking myself for not moving into cash myself, when things were spectacularly rosy in my portfolio last autumn, what a missed opportunity. Another one to chalk down to experience, not that I ever seem to learn from experience - making the same mistakes over & over again. Although as mentioned in my last annual portfolio review, I don't have the right personality to manage money. It's the analysis of individual companies that I enjoy, and over the long term do at least manage to make a decent living from my portfolio, and the long-term returns aren't bad too.

Although year-to-date so far in 2022, my SIPP is down 22%, and my geared accounts a lot more - as I didn't reduce my gearing enough, or fast enough, and my hedging strategies failed. So if you're having a bad year, hopefully it might reassure you that most of us are in the same boat, or doing even worse.

What to do? I think it's key to put emotions to one side, and just try to make rational decisions as things stand today. We can't wind back the clock, or change anything in the past, so best to just accept the current situation, and manage it as logically as we can. Markets always recover, if you're invested in decent businesses with good management.

.

Paul’s Section:

Beeks Financial Cloud (LON:BKS) (I hold)

146p (y’days close) - market cap £83m

£4.4m Private Cloud Contract Win

- 5 year contract total £4.4m

- European tier 1 client

- Won via a partner

- Q3 (Jan-Mar 2022) contract wins now c.$15m (3 times previous record quarter)

The latest contract is testament to the strong sales momentum across the Group, now successfully targeting the world's largest financial services organisations and exchanges. Both the Private Cloud and Proximity Cloud Offerings have significantly contributed to Beeks' record third quarter of trading, with c. $15 million in total contracted value during the period, representing a three-fold uplift on our previous record quarter of Q1 FY22.

Gordon McArthur, CEO of Beeks Financial Cloud commented:

"Successfully securing a further contract of such significance reinforces our belief that the prospects for Beeks have never been stronger, as financial services organisations accelerate their cloud strategies.

Alongside other recent wins we have announced, this latest contract contributes towards underpinning our FY23 expectations.

A substantial pipeline continues to build across our Private Cloud and Proximity Cloud offerings, and we are confident in our ability to further increase our market share."

My opinion - another very encouraging contract win. It’s becoming increasingly obvious that BKS has passed a tipping point, where its cloud-based connection services for financial markets are being more rapidly taken up by big clients, globally.

Therefore an exciting future is on the horizon, as those recurring revenues build.

I reviewed Beeks interim results earlier this week here. Although the numbers at this stage are barely above breakeven, that’s missing the point. It’s the very rapid organic growth, of recurring revenues, which is laying the groundwork for a much bigger, and potentially highly profitable company in future.

This is generally a bad time to be investing in growth companies, so there is that strong market headwind, but when growth is this strong, with big contracts rolling in faster than ever before, it’s time to sit up and take notice.

For that reason, and despite it being difficult to value, BKS is fast becoming a high, maybe even highest, conviction holding for me. I need to just ignore market sentiment, and buy more (as a long-term hold).

I think this is probably the best reasonably-priced, high organic growth company on the UK market right now.

InvestorMeetCompany webinar from Beeks is today at noon.

.

.

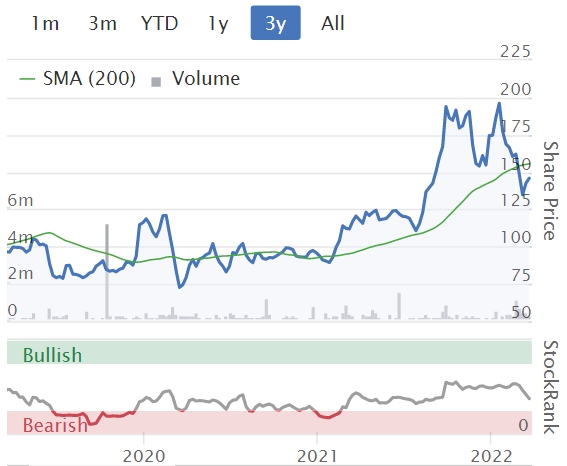

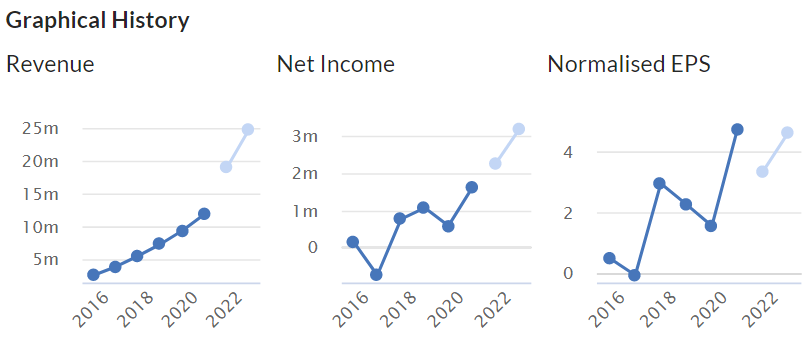

The share price over three years has not properly reflected the acceleration in growth you can see below. Although bear in mind the company is not chasing profitability at this stage, but instead re-investing revenue growth into further expansion.

.

Surface Transforms (LON:SCE)

51.0p (up 21% at 08:21) - market cap £99m

SCE produces specialist brakes, made from carbon ceramic, for high end sports cars.

This follows on nicely from Beeks above, in that SCE is another small company which seems to have reached an inflection point, after many years of losses and negligible revenues, is now transforming with big contract wins, into something that could be exciting. Providing management can execute well, and turn contract wins into real profit & cashflow, which is not always as easy as it sounds. There are so many micro caps which always seem on the cusp of great things, but never quite get there.

Capital Market Day - the company is providing a tour of its facility in Liverpool on 27 April. Do we have any subscribers in the area who could maybe ask if they can join the meeting? It doesn’t sound as if private investors would be excluded, which we often are for this type of meeting -

… for investors, media, analysts and other interested parties

Some big numbers here, this looks really impressive -

Surface Transforms plc (AIM:SCE) is pleased to announce that it has signed a new contract with its existing customer, OEM 8 with a contract value of approximately £100m. This contract replaces the previously announced contract from September 2020 which was valued at approximately £27.5m. This increased contract value of over £70m is driven by both significantly increased demand for this particular model of OEM 8 and the contract being extended to 2027.

The contract remains priced in pounds sterling and increases the Company's sales forecast by £4m in 2023, £11m in both 2024 and 2025 and by £20m in both 2026 and 2027, taking the Company's overall lifetime order book to over £180m.

Delayed production hasn’t started yet, but sounds imminent (“now scheduled for spring 2022”), but orders for the vehicle (Tesla, people seem to think) are ahead of plan, hence this contract being revised up.

SCE needs to increase its overheads by £2.5m this year FY 12/2022 to cope with the extra demand & production.

My opinion - this looks very interesting indeed. There’s still execution risk, and it remains to be seen what profits will be generated. However, I particularly like the massive % increase in contracted revenues. Let’s hope the company can cope, and is able to deliver such a large increase in production/delivery without hitches.

Zeus (many thanks for an update note today) reckons the company might make a 20% margin on £38m of revenues by 2025, so about £7m.

That means the current market cap of almost £100m is probably pricing in the next 3 years’ growth already.

Hence investors have to hope that SCE can win a load more contracts, and scale up into a much bigger business. Or that a bigger automotive group might buy it.

Given that we’re in a bear market for small caps, this might struggle to go a lot higher for the time being, despite the good news, simply because it’s already priced-in.

If markets become more bullish again, then at some stage this is the sort of share that people might chase up to a higher valuation. So it could be interesting. Certainly it seems a lot more credible now, than it has done at any point over the last 20 years that I’ve been following its progress as a listed company!

The automotive and health sectors are both areas where innovative small caps often find it a painfully long process to commercialise new ideas, if they manage it at all. Remember Torotrak, whose gearboxes were meant to be the next big thing, but never got anywhere beyond lawnmowers!

Then of course there’s Seeing Machines (LON:SEE) which has raised money so many times, that it now has billions of shares in issue, diluting away the commercial progress (and it’s still loss-making).

So these innovative companies are tricky to invest in, as they nearly always take far longer, and consume way more cash, than originally planned.

That said, SCE is clearly now in a potentially very good position, with this huge revised order. So it certainly looks an interesting share, with a decent bull case. If the company executes well, then the valuation would be justified, and I could see it potentially doubling in a bull market, maybe more, who knows?

.

.

£MCLS **Warning**

c.1.9p - market cap £5m

The CEO has stepped down, with the Chairman taking over in the short term.

The purpose of this brief comment is to try to dissuade readers from punting on this share, imagining that it might recover.

As I mentioned here on 28 Feb 2022, the signs are very clear now that the existing equity is almost certainly worthless. A clear distinction has to be drawn between the survival of the business (which is quite likely, once a deal has been done with banks & other creditors), and what happens to existing equity. Due to the perilous financial position, lenders will now be calling the shots, hence existing equity has little to no say in what happens next, unless they’re prepared to stump up a lot of fresh equity, which would result in massive dilution to existing holders, probably at a huge discount. It's too late for that, I think.

In all likelihood, in this type of situation, the holding company goes into administration, then the business is sold off quickly to a buyer, with a deal being done with the debt holders maybe taking a partial haircut.

Today’s news that the CEO has gone, who was trying his best to find a solvent solution, and had injected c.£3m of his own cash into last year’s equity raise at 20p, suggests to me that we might now only be days away from administration. Hence shares almost certainly worth 0p. Please don’t buy any, imagining that they might multibag, because the chances of that happening are pretty much zero.

Note this wording today, which again talks about “stakeholders”, and doesn’t mention shareholders -

The Group remains in ongoing dialogue with its lenders towards a longer-term agreement in relation to the balance of its existing facility and continues to believe that a financing solution will be found that involves its existing partners and stakeholders. As previously announced, a further update will be made as and when these discussions conclude.

The outgoing CEO does mention his personal shareholding, but I imagine he’ll probably now be more interested in funding newco, rather than pouring more money down the drain into oldco (but that’s guesswork on my part of course) -

"I remain a significant shareholder, and I leave confident that, with its clearly defined, convenience-led strategy and strong partnership with Morrisons, McColl's will continue to play a vital role at the heart of local communities across the UK."

My opinion - super high risk - almost certainly going to zero, probably imminently.

.

Activeops (LON:AOM)

97p (down 17%, at 10:36) - market cap £70m

This is a new company to me. Jack wrote a useful briefing on the company here in Oct 2021, questioning the valuation, and pointing out this SaaS company is still loss-making.

Jack also reviewed interim results here in Nov 2021, and again questioned the high valuation. Since then the share price has almost halved, so is this now a buying opportunity? Probably not, because AOM was floated on AIM in H1 of 2021, which seems to have been peak tech mania, when all sorts of wildly overvalued companies were floated. A lot of which have not only turned out to be over-priced, but also opportunistic, as rather poor businesses hit a growth spurt due to lockdowns, and persuaded fund managers to extrapolate out that growth forever.

It might sound like I’m being a smart Alec after the event, but we’ve always been sceptical about IPOs here at the SCVR. Not only because they’re usually over-priced, and opportunistically timed, but also because brokers execute new floats so badly - bagging their excessive fees for the least amount of work, which results in a large, lumpy shareholder base, and little aftermarket liquidity - which begs the question, why bother floating, if there’s no market liquidity? All too often it's so controlling shareholders can cash out at an inflated price.

It’s much better to reverse into a cash shell, with a ready-made small shareholder base, which results in much better market liquidity, in my experience.

On to today’s update -

ActiveOps plc (AIM: AOM), a leading provider of Management Process Automation (MPA) software for running hybrid and global back-office operations, today provides an update on trading as it approaches its financial year end on 31 March 2022.

A year of growth and positive outlook

Shares are down 17% today, so the market doesn’t share the PR person’s sunny disposition.

It starts off well -

The Board is pleased to confirm that trading is in line with previously upwardly revised management expectations…

This is more mixed, so can be read either way, but overall sounds OK to me -

Trading has been particularly strong across EMEIA and Australia versus management expectations, offsetting slower than anticipated US growth and some softening of retention rates, reflecting the ongoing impact of COVID-19. The US region is however, the fastest growing region versus the prior year with a strong and growing pipeline.

Cash is "comfortably ahead" of mgt exps (no figure provided)

AOM claims to have a strong balance sheet, which is an amber flag to me, so I’ll have to check now… it’s OK actually, NTAV of £4.4m is adequate for a software company, because they get paid up-front by customers. Hence the £10.9m cash pile is actually almost entirely represented by customer advance payments (see note 8 to interims, showing £10.6m deferred income creditor). So it’s not as strong as management seem to think, but not a cause for concern either.

Outlook -

Looking forward, the Board is confident in the Company's outlook, as a clearly defined list of target customers feed into an existing and robust pipeline. The impact of COVID-19 on global operations and the still evolving requirements for hybrid working is driving new levels of demand for better data and operational control. The value of sales opportunities in the Group's pipeline at formal proposal stage or later is 60 per cent. higher than in February 2021.

ActiveOps product release pipeline is equally strong with a number of major advances in AI and data driven management process automation due for release this year. Adoption of ControliQ is accelerating clients' capabilities to evolve and adapt new hybrid operating approaches, providing managers with the data to control and releasing time to implement agile operations post COVID-19.

Our high levels of recurring revenue and gross margin provide us with a strong basis as we look ahead, and while we see some ongoing disruption in the US market from COVID-19, the successes in EMEIA and Australia, combined with a considerably elevated sales pipeline, provide us with confidence in our ability to successfully execute on our growth strategy."

My opinion - it’s not a bad update by any means. Also the pipeline suggests growth should continue.

The trouble is, this share was floated near the peak of a tech/small caps boom (as we now know), and the market has since turned markedly bearish. Hence this share was bound to drop, largely regardless of newsflow & performance.

Performance for FY 3/2022 is in line, and they say expectations were previously upgraded. So we’re being offered shares in the same company, which has performed OK, at about half the previous peak price. Is that an attractive proposition? It doesn’t float my boat personally, as I’d need to see performance at or near breakeven, and much faster organic growth (which for a similar market cap, I can get at Beeks Financial Cloud (LON:BKS) [I hold]).

Another issue we have to consider, is that small cap fund managers who buy these new floats, may be seeing investors wanting to pull their funds out, due to poor performance of pretty much all small cap funds, unless they’re heavily overweight in sectors like natural resources, which are doing well at the moment.

Therefore, the knock-on impact of fund inflows turning into fund outflows, could worsen and prolong this small caps bear market, as some fund managers are likely to be sellers of their lower conviction holdings, in order to raise cash to meet redemptions. Also, they might want to get their mistakes off the books, especially over-priced IPOs. But with little market liquidity (as mentioned above), who will the buyers be? There could be an absolute gulf between what new buyers are prepared to pay, and the current market price, leaving shares like this to continuously drift down until there’s a catalyst to bring in lots of buyers.

I remember back in the bear market of 2000-2003, how a lot of newly floated tech junk (and it was real junk back then, a lot of it total blue sky, zero turnover rubbish) kept falling in price, and many shares lost 90% of their value over time. Then it got worse! Before long, there were plenty of small caps down 99%, falling to well below their own cash balances, if they were loss-making and had little prospect of commercial success.

Hence it seems to me to be too early to catch the falling knives, unless they’re proper businesses, making profits/cashflow, cheaply priced, and preferably paying divis.

AOM is a proper business, with recurring revenues, and real services, big clients, etc. How do you value it though, given that it’s still loss-making? I would say forget about multiple of sales, or EBITDA - those are silly, top of the bull market valuation metrics. To entice me into any share, I want to see at least the prospect of decent profits, and cashflows. AOM is not at that stage, so it’s not much more than a punt at the moment. So maybe 20-30p might be the share price level where I’d be tempted to have a small punt, but I cannot see any reason to even consider it, at 97p per share (£70m market cap). Growth is pedestrian, and it’s loss-making. So it’s not worth anything like £70m to me.

The market is being brutal at the moment, and throwing lots of babies out with the bathwater, so we can be really picky. If something still looks expensive on fundamentals, then why chase the price down? I'd rather sit back and wait for it to get ludicrously cheap, and only then consider buying.

.

.

Roland’s section

Sopheon (LON:SPE)

Share price: 650p (pre-open)

Shares in issue: 10.6m

Market cap: £69m

“Revenue ahead of market expectations”

Sopheon is an international provider of software and services for Enterprise Innovation Management solutions. This includes solutions to help manage corporate processes, products portfolios and internal planning. Market sectors covered include aerospace and defence, automotive, chemicals and consumer goods.

Today’s results cover the year to 31 December 2021.

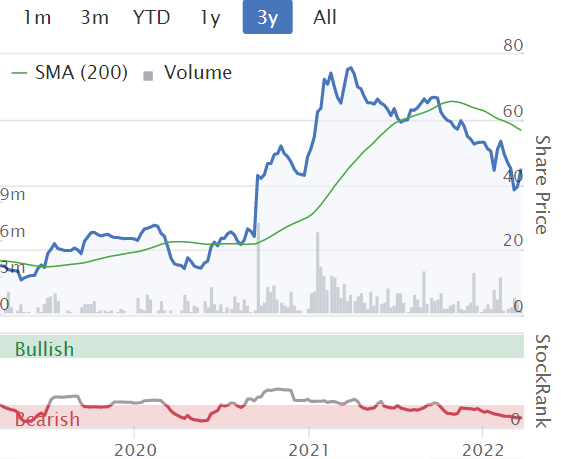

Sopheon has been a big faller this year, losing more than 30% since the start of January. However, today’s results strike a positive note and appear to be ahead of broker forecasts. So is there hope of a recovery?

Let’s take a look.

Financial highlights

The company has delivered revenue growth “in the face of continued COVID challenges” but did not manage to increase its profitability. However, a strong balance sheet removes any near-term concerns.

- Revenue: +15% to $34.4m (2020: $30.0m)

- Annualised recurring revenue (ARR): +15% to $20.7m

- Gross [revenue?] retention: 95% (2020: 91.5%)

- Adjusted EBITDA: +5.1% to $6.2m

- Pre-tax profit: -29% to $1.2m

- Earnings per share: -47% to 7.83 cents (2020: 14.68 cents)

- Net cash: $24.2m (2020: $21.7m) - no debt

- Dividend maintained at 3.25p per share

Today’s results are consistent with the upgraded guidance provided in January, when management said that revenue would exceed $34m and adjusted EBITDA would be over $6m.

Forward revenue visibility for the current year has also improved since January, rising from $23.4m to $25.1m today. However, profits have fallen once again, continuing the trend of recent years:

Increased spend: Sopheon’s management say that lower profits are the result of increased spending on R&D and marketing, along with “higher amortisation and share based payments”.

The income statement shows us that operating costs rose by 23% to $23.6m last year:

Cash flow: Reassuringly, cash generation remains strong. My sums suggest free cash flow of $3.9m last year, up from $2.6m in 2020.

Balance sheet: Net cash increased from $21.7m to $24.2m last year, which seems to support my view on free cash flow.

Operational highlights

Management reported 10 new customer wins in 2021, of which nine were SaaS( software as a service), so will contribute to ongoing growth in annualised recurring revenue. This is the holy grail for Sopheon and most other software businesses these days. No one wants to sell licences anymore.

The new customer pipeline is said to be “approaching 90% SaaS”, suggesting that this transition will continue.

One attraction of the SaaS model is that it should provide terrific operating leverage. Incremental sales cost very little to fulfil, so as revenue rises, operating margin should also rise.

Clearly that’s not happening yet at Sopheon, making me question the group’s scale and pace of growth.

However, the company says it saw an increased volume of smaller new orders last year. Management says this supports the view that Sopheon’s products are gaining traction and should provide upselling opportunities in the future.

Outlook

Today’s outlook statement is positive but vague. However, brokers FinnCap have provided an updated note today that’s available through Research Tree.

FinnCap’s analysts expect to see revenue climb 7.5% to $37m this year, but are forecasting a further decline in profits before a return to earnings growth in 2023.

My view

I quite like the look of Sopheon, which seems to be making some progress under its new (2021) CEO. The balance sheet looks sound and cash generation seems good, despite disappointing profitability.

The shares look very expensive to me on c.110x 2021 earnings, given that earnings per share are expected to fall in 2022.

However, comparing the company’s £68m market cap to last year’s free cash flow gives a more reasonable multiple of 23x trailing FCF.

I can see some potential here, but I’m not yet convinced the pace of growth is fast enough to justify the stock’s high-tech valuation.

Kin And Carta (LON:KCT)

Share price: 289p (unch)

Shares in issue: 174.3m

Market cap: £504m

“On track to meet recently raised guidance for the full year”

Kin and Carta is a digital transformation company. It uses data and technology to help clients conceive and develop new digital products and services.

Today’s half-year results cover the six months to 31 January.

Checking back in the archives, Jack covered Kin and Carta in February, when the company upgraded its FY22 guidance. The shares have performed well since then, gaining around 25%, so it will be interesting to see if today’s numbers justify continued confidence.

Financial Highlights

Today’s numbers show a decent return to (adjusted) profitability after the challenges of the last year.

- Net revenue from continuing operations: +63% to £85.6m

- Adjusted pre-tax profit (continuing): +682% to £5.0m

- Adjusted operating margin: 6.7%

- Adjusted eps: +821% to 2.3p

- Interim dividend: nil

- Net cash: £5.4m (H1 FY21: net debt of £22.6m)

When I see such a heavily-adjusted set of numbers, my first instinct is usually to check out the statutory figures and reconcile the two.

Here are the equivalent set of reported figures from today’s half-year accounts:

- Revenue: +59% to £89.3m

- Pre-tax profit: -£3.1m (H1 21: -£8.1m)

- Basic earnings per share (continuing operations): –1.94p (H1 21: -3.85p)

There are a lot of adjustments here, but there are only three I think we need to consider. They’re all quite commonly seen in the accounts of services and software businesses:

The argument in favour of ignoring the amortisation of acquired intangibles is that it’s a non-cash cost that doesn’t affect cash generation, and wouldn’t be incurred if the acquired assets had been developed in-house.

That’s true, but on the other hand, the amortisation charge represents past cash outflows on acquisitions. Said differently, the amortisation charge represents capital employed by the business.

For this reason, I generally include it in calculations such as return on capital employed, so that I can gain an accurate view of the returns being generated by the business. Kin and Carta’s ROCE has been negative in five of the last six years:

Contingent consideration is also another cost I prefer to include, especially when it’s a regular occurrence - as it is here. The footnotes to today’s accounts show that Kin and Carta has up to £52.9m of outstanding commitments on past and committed acquisitions, including £23.7m in cash.

Cash generation: The other test I like to apply to adjusted profits is to compare them to a company’s free cash flow. With Sopheon (above), I found that cash generation was stronger than profits. With Kin and Carta, the picture is less encouraging, in my view.

Including £33.2m of proceeds from disposals gives a positive half-year free cash flow of £26.6m.

However, if I exclude profits from disposals and acquisition spending, my sums suggest the business saw a free cash outflow of £6.6m during the half year, due to some sizeable working capital movements.

For comparison, I’ve taken a quick look at the FY21 numbers. I estimate that Kin and Carta saw a free cash outflow of £1.5m last year, excluding disposals and acquisitions.

Outlook

Trading is said to be strong, with “robust demand and a record backlog entering H2”.

Management reiterated February’s guidance for revenue growth of 35%-40% and an adjusted operating margin of 10%-11% for the full year (ending 31 July).

This rate of growth seems to reflect a degree of pandemic recovery. Medium-term guidance is for annual revenue growth of at least 15% and incremental operating margin improvements.

My view

There are quite a lot of moving parts here, as Kin and Carta is continuing to evolve. I have some sympathy with the transformation story, but I’m concerned by the weak cash generation and rather average profitability. This might explain the continued lack of a dividend.

Today’s results don’t include any further updates to guidance, leaving the stock trading on 40 times FY22 earnings, falling to 28x earnings for FY23.

I’m struggling to see much value here, given my concerns. After making strong gains over the last year, I’d argue that the shares are up with events.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.