Good morning, it's Paul & Jack here with the SCVR for Thursday. Today's report is now finished.

Agenda -

Paul's Section:

Nwf (LON:NWF) - another positive trading update, significantly ahead of expectations. This follows on from a similar upgrade at the start of March. It's benefiting from a supply shortage of oil, so is clearly able to raise prices & profit margins. This looks a good company, with a noteworthy long-term track record of paying reliable, and rising divis. Boring, but sometimes boring is good!

Eleco (LON:ELCO) - final results are out, with profit flat, and EPS lower, due to increased tax charge. Balance sheet looks adequate. It's a nice company, but the valuation still looks too rich to me.

Xeros Technology (LON:XSG) - more bad news from this serial disappointer, jam tomorrow company. It won't now reach breakeven in 2023, and only has enough cash to last for another year. It's tempting to punt on things like this, but they rarely end well.

Pressure Technologies (LON:PRES) - I responded to a reader comment from Camtab and have copied it into the main report. Results look OK, but maybe the recent c.50% rebound in share price might be worth a top slice?

Gattaca (LON:GATC) - poor interim results, as previously flagged in a profit warning in mid-January. The shares have plunged so far, that I wonder if it might be a turnaround at some point, under new management? An apparently sound balance sheet, means that dilution/solvency risk seems low.

Quickies -

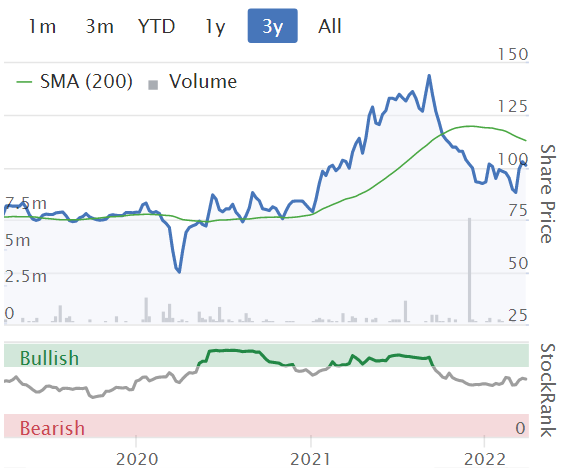

Brewin Dolphin Holdings (LON:BRW) - party time for shareholders, with a knockout 61% premium takeover bid from the Royal Bank of Canada. The valuation metrics on the StockReport for yesterday do look attractive: fwd PER of 12.6, and a divi yield of 5.4%, for an impressive business with a good long-term track record. Are there other bargains in this sector I wonder? It's a recommended, all cash deal.

Polarean Imaging (LON:POLX) - up 25% today, to 65p, on news of it resubmitting a regulatory application to the USA's FDA. Shares plummeted when the original application was declined. Shareholders now have a nail-biting 6 month wait, to hope that this time the application gets approved. This does look an interesting company, but all rather binary. It chewed me up, and spat me out - I sold right at the low, for about 42p.

Brand Architekts (LON:BAR) is acquiring Innovaderma (LON:IDP) for 7p cash + 0.3818 new BAR shares for each existing IDP share. Both share prices have moved significantly today, with BAR down 17%, and IDP up 24%, so it's clear what the market thinks of this deal (that IDP shareholders have done well). Although the water is muddied by BAR also issuing poor interim results today. The £17.3m cash pile at BAR is the main interesting thing. There must be a lot of duplicated costs, from both companies being listed, so the combined entity could make more sense than 2 tiny separately listed companies.

Altitude (LON:ALT) - a positive trading update. It's expecting adj operating profit of £1.0m for FY 3/2022. Cash looks tight at >£1.0m. A new $0.7m bank facility has been agreed. Market cap of £24m isn't cheap, given the poor track record. However, I think there might be something of interest here, longer term, it's not clear yet.

Mears (LON:MER) - not a sector that interests me, but the StockReport shows a forward PER of 10.5, and good yield of 4.1%. Final results today look OK - bouncing back into profit, but a wafer thin profit margin. Reports average daily cash, as well as period end cash/debt, which is excellent, all companies should do this. Current trading in line. Good visibility. Most contracts have annual uplift for inflation - an important point. Margins are too low to interest me.

Time Out (LON:TMO) - I've never liked the business model here, nor understood the high valuation. Interim results today show a reduced, but still large loss of £(10.5)m before tax, on £32.0m revenues. The balance sheet is reliant on debt, and the going concern statement flags a material uncertainty over debt expiring in Nov 2022 (but expected to be extended). Looks over-priced, and risky to me.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Nwf (LON:NWF)

223p (y’day’s close)

Market cap £110m

NWF Group plc ('NWF' or 'the Group'), the specialist distributor of fuel, food and feed across the UK, today announces a further trading update for the current year ending 31 May 2022.

I last looked at NWF here on 8 March, when it issued a “significantly ahead” trading update. I was also impressed that it said cost inflation had been “recovered”, whereas most companies are using the word “mitigated” (i.e. only partially recovered).

Today we get another positive trading update, although note that this seems one-off in nature, and due to “exceptional circumstances”, so is likely to only have limited benefit to the share price -

Following the positive trading update announced on 8 March 2022, which noted the Board's increased expectations for the full year, the Group has continued to outperform and as a result the Board now anticipates full year results will be significantly ahead of the revised expectations.

This has been led by the Fuels business as a result of exceptional circumstances, with the very significant short-term volatility in oil prices and a supply constrained UK fuel market.

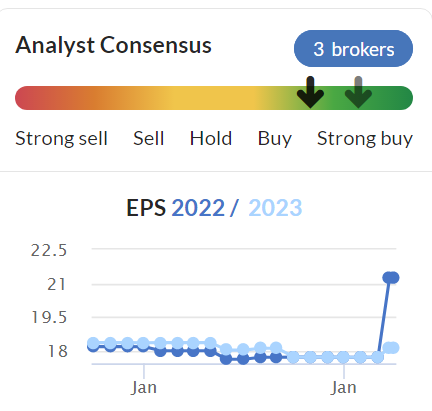

Valuation - I can’t find any broker notes, but it looks as if the broker consensus chart has found some, because you can see below that FY 5/2022 EPS forecast rose from 17.7p to 21.2p when the last positive trading update was published.

The same wording is used today, so I’m guessing that a similar sized upgrade of 3.5p might be on the cards. That would take EPS to 24.7p. That would give us a PER of 9.0 - with the caveat that the company is making one-off bumper profits due to a supply shortage. It might damage customer goodwill if NWF is seen as profiteering.

I would tend to value this share on next year’s EPS, of 18.1p - a PER of 12.3 - still quite cheap.

My opinion - even allowing for the likelihood that bumper profits for FY 5/2022 might not repeat, this share still looks modestly valued, given that its track record of growing profits and paying out decent divis looks strong over the last 6 years, as you can see -

.

Overall, this share looks a good long-term hold to me. It’s the sort of share which might appeal to income seekers, how about this for a dividend track record! -

.

Eleco (LON:ELCO)

102p (up 2%, at 08:40)

Market cap £85m

Eleco is a provider of software to blue chip companies in the construction and built environment sectors

[from company website]

The Board of Eleco plc (AIM: ELCO) is pleased to announce its results for the year ended 31 December 2021.

Revenue for 2021 was £27.3m, up 8.4% (£15.4m is recurring revenue)

Gross margin is very high, as is usual at software companies. Gross profit rose 8.3% to £24.6m

All the benefit of the higher gross profit was consumed by increased administrative costs, so profit before tax only rose 1% to £3.9m

Tax - note that this considerably increased, so that PAT fell from £3.16m in 2020, to £2.73m in 2021. Hence why EPS fell from 3.9p to 3.3p - a PER of 30.9 times, which looks too expensive to me. Unless you think EPS could rise a lot in future, which might justify the rich rating.

Equity Development are showing (in a new note today) adj EPS of 4.0p for 2021. The company doesn’t seem to provide adj EPS in its results statement, which is an annoying mismatch. Using ED’s adjusted figure, the PER comes down to 25.5 - still quite high.

Strategy is to move more to SaaS rather than up-front licence fees. That tends to suppress performance for several years, as we’ve seen with lots of other software companies, so doesn’t fill me with joy.

Acquisitions - M&A is highlighted in the outlook section as something they want to do, so I would want to better understand what experience & track record management has in acquisitions, before investing in Eleco.

Outlook - general commentary, rather than anything specific, concluding -

With the foundations set in place, we are well positioned for continued growth, and increased market share through further product evolution and potential acquisition opportunities, supported by favourable market dynamics.

Balance sheet - not great actually, with only £1.7m in NTAV, but that looks adequate.

As mentioned before, software companies don’t need much capital, because they benefit from receiving cash up-front from customers. In this case, the £10.0m net cash is almost all offset by the accruals & deferred income creditor - i.e. it’s cash up-front from customers, for services not yet provided.

This means that I reckon ELCO would need to do a placing, if it wants to make any meaningful sized acquisitions.

Cashflow statement - this does look good. ELCO generated c.£7m in net cash inflow from operations, in both 2021 and 2020. About a quarter of this is spent on capitalised development spending, and the balance was mainly used to almost eliminate bank debt by £4.4m, to just £0.1m remaining bank debt at 2021 year end. There was also a trivial dividend paid, costing £493k.

My opinion - Eleco looks a decent business, with a good track record.

The trouble is that a shift to SaaS is likely to suppress performance and growth for a few years.

Personally, I’d only be interested in this share if it dropped considerably from the current level. Although software companies do attract bafflingly high takeover bids sometimes.

IT staff are expensive, and getting more expensive, so companies like ELCO need to generate decent growth just to stand still.

I see this share as in no man's land - it’s good, but not growing strongly enough to get me excited, and priced too high still, for only moderate growth. Then there’s the uncertainty of possible acquisitions, which increases execution risk, and possible dilution from a placing.

As always, I’m only reviewing the numbers, and don’t have a view of the company’s products, or the competitive landscape.

.

Xeros Technology (LON:XSG)

60p (down 32%, at 10:01)

Market cap £14m

Trading Update (profit warning)

This company is trying to commercialise a new type of washing machine, that uses little water.

It’s mostly blaming covid in China for under-performance, with the latest disappointment being -

Whilst the Board's view of the overall prospects of the Group remains unchanged, the Board has come to the view that the Group is no longer likely to reach month on month EBITDA profitability and cash breakeven in the first quarter of 2023, as previously guided. The Board now expects this to be reached in 2024.

I’d be surprised if it happens ever.

Is it going to run out of cash? Yes, but not until early 2023 - so it’s got about a year to pull something out of the hat, because I’d be surprised if investors would be keen to refinance it again, next year -

As at 28th February the Group's cash balance was £6.2m. These funds are sufficient to fund the delivery of major growth milestones through the remainder of 2022 and into the first quarter of 2023. The Board is actively evaluating several funding options to secure the remaining investment required.

That sounds like a highly dilutive equity fundraising might be on the cards. I can't see anyone being prepared to lend funds to the company.

There are also some upbeat comments about potential new business, which I won’t repeat here.

Outlook - the CEO remains upbeat, despite everything -

"Since our update in January, with the exception of China, the levels of activity by our existing partners have continued to be strong as has our engagement with prospective licensees. Our expectations are that multiple agreements will be signed this year with some fairly near term. This is against a background of increasing levels of interest from global brands in our ability to help them meet their major global environmental imperatives."

My opinion - Xeros has been a serial disappointer, and heavy consumer of investors cash, reflected in a plummeting share price.

It now looks to be in the last chance saloon, with a year of remaining cash, before it needs refinancing. In my experience, it’s very rare for situations like this to end well, but the odd one does, so we can’t rule anything out.

For people who like a gamble, the market cap of £14m isn’t outrageous, providing you’re prepared to lose the lot, for the off chance of a turnaround. Or as a trade, it might spike up on contract win announcements, which sounds imminent, possibly.

On balance though, I can’t see the point in taking on the risk here of dilution or insolvency.

Maybe this project was just too ambitious?

.

.

Pressure Technologies (LON:PRES)

89p (up 12% at 10:10)

Market cap £28m

To save me re-typing it, this is a copy of a reader comment I replied to below.

Hi Camtab, Many thanks for that nice summary of Pressure Technologies (LON:PRES)

I've had a quick look at the its trading update today, and it all reads positively. So a little perplexing that the summary is only in line with expectations, not ahead of -

As a result of an increasing order book, notwithstanding the current economic climate and cost-inflationary pressures across the Group's operations and supply chains, the Board remains confident in meeting full-year market expectations.

They're half way through the current year, FY 9/2022. Maybe PRES is now set up to issue an out-perform update later in the year?

A Singers note out today only shows £0.9m adj PBT for this year, after 2 years of losses. Presumably as a holder, you're hoping for a beat against that?

Balance sheet - last reported at 2 Oct 2021, and as you say, it's been cleaned up with most of the bank debt paid off, and almost all the intangibles written off.

The share price has shot up recently, almost 50% from the lows, so I suppose the quandary now is whether to bank some profit? I'd be tempted to top slice on this vertical rise in price, but as always, it's your money, so your call.

.

Gattaca (LON:GATC)

74p (down 6% at 11:30)

Market cap £24m

Gattaca plc ("Gattaca" or the "Group"), the specialist Engineering and Technology staffing solutions business, today announces its financial results for the six months ended 31 January 2022.

Management has made a right hash of things here, but the CEO & CFO are stepping down as Directors today (previously announced on 15 March), and leaving Gattaca at end April. Replacements have been appointed, so let’s hope they do a better job. The perplexing thing is that Gattaca operates in a sector that is booming, so how have they managed to perform so badly?

Poor results were expected, due to a profit warning, which I reviewed here on 18 Jan 2022.

It guided for breakeven in FY 7/2022. Lots more sales staff had been taken on, but were not yet contributing to increased sales.

Some key numbers for H1 -

- Net fee income £21.6m, up 5% vs H1 LY

- Loss-making in H1: £(3.1)m on a statutory basis, adjusted to £(0.2)m

- Balance sheet looks fine to me, quite good actually, with net cash of £4.8m - which should provide time for a turnaround, with little to no risk of dilution.

- No divis

Outlook - the key bit says this -

We are seeing encouraging trends across many of our sectors…

We expect continuing underlying profit before tax for its financial year ending 31 July 2022 to be around breakeven as announced in January 2022. Looking to 2023 and beyond, although the trajectory of the business has been slower than previously anticipated we expect to see the benefits of our investment in headcount and the technology platform begin to come through, delivering a return to profitable and sustainable long-term growth. This will continue to be supported by strong market demand for STEM talent, which we believe will remain scarce and in high demand.

My opinion - performance has been awful, and I’m not minded to put any reliance on forecasts. It would be easy to just slag off the company, given all the negatives.

However, everything has a price, and with the market cap now only £24m, this could be a base for a turnaround, if new management are good.

So the key issue for me, is to find out what track record new management have, and to see them present on one of the webinar platforms, so we can get a feel for who they are, what experience & track record they have? Also, how credible is their turnaround strategy?

Could there be anything nasty to come out of the woodwork when the new CFO checks all the numbers? It is a risk, and a £64m receivables book creates a lot of scope for burying some nasties in it.

NTAV is over £27m, so the risk of insolvency/dilution looks very low, unless it turns out that there’s been false or imprudent accounting.

Overall, I think you could see this either way -

Bull case -

- very low market cap,

- strong balance sheet,

- turnaround potential under new management.

Bear case -

- arguably, GATC might be viewed as a bad business, not making any profit, in buoyant market conditions.

For me, I’m on the fence right now, but will keep an eye on it, for more evidence of a potential turnaround (or not).

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.