Good morning, it's Paul & Jack here with Thursday's SCVR. Today's report is now finished.

Agenda -

Paul's Section:

De La Rue (LON:DLAR) (I hold) - I have a good dig into this bank note & authentication group. Trading update for FY 3/2022 is in line with (lowered in Jan 2022) expectations. The pension scheme is a reduced, but still large drain on cashflow. Facilities are being upgraded, so heavy capex too. It's not the easiest share to analyse, but I think there's possibly good long-term risk:reward here.

Anexo (LON:ANX) - an in line update from this credit hire, and legal services group. PER is low, but that's usual for this sector, which can be quite high risk, due to regulatory changes, and danger of bad debts building up on the balance sheet. Today's update does sound positive though, with all parts of the business seemingly doing well. Why are the divis so small?

Attraqt (LON:ATQT) - 2021 results show continued losses, and cash is getting low. Outlook seems more positive though, with a strong Q1 2022 for new orders. This looks an interesting SaaS business, with potential, but it needs to scale up faster. In the meantime, £60m market cap looks too high. It's going on my watchlist.

Adept Technology (LON:ADT) - a broadly in line trading update. Positive-sounding commentary, but for me the weak, overly-indebted balance sheet rules it out.

Jack's section:

Robert Walters (LON:RWA) - strong trading continues in Q1, with group net fee income up 30% and growth across geographic regions and all forms of recruitment. Headcount has increased by 9% since the end of FY21. Wider market conditions might change at some point, but this continues to be one of the better picks in this space and the valuation remains fairly undemanding.

Tracsis (LON:TRCS) - remains an interesting prospect with growth opportunities in its existing UK market and a post-period acquisition opening up the US. This is transport software with potentially long sales cycles, but if Tracsis can keep building momentum and winning contracts (as it is doing) then that same market inertia could prove to be a barrier to entry.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

De La Rue (LON:DLAR) (I hold)

107p (up 2% at 09:57)

Market cap £208m

This is a strikingly brief trading update, it doesn’t even give a description of the group’s activities, so let me remedy that. Here’s a description & my potted recent history of DLAR -

DLAR’s main activity is printing banknotes, its currency division, which supplies -

“over half the central banks and issuing authorities around the world”.

The smaller authentication division provides -

“modular software solutions, physical security labels and documents for a wide variety of commercial and government applications.”

Examples are cigarettes, and other goods that need to be carefully traced & authenticated, to collect taxes and avoid counterfeit goods.

DLAR previously held the contract for printing UK passports, but lost that a while ago.

My immediate thought is that this business must have strategic value to an acquirer.

Historically a highly profitable business, DLAR ran into trouble in 2018/19, and had to do an emergency fundraising early in the pandemic, in June-July 2020, which resulted in dilution - share count rising from c.114m shares, to 195m shares now.

New management were brought in, have stripped out £36m of annualised costs (per FY 3/2021 results), and restored good levels of profitability, so a decent turnaround so far.

More recently, Jack reported here on the Jan 2022 profit warning - profit guidance reduced by 20% (to £36-40m operating profit, still pretty good), due to cost headwinds, supply chain & covid disruption. That's understandably put a cloud over the share price.

In March 2022 there was excellent news on a big reduction in pension scheme funding requirements of £57m from 2023 to 2029. Amazingly, the stock market completely ignored this positive development, which was the trigger for me to buy a small opening position in DLAR shares.

Good that’s brought us up to speed.

Today’s update for FY 3/2022 -

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the "Company") today announces a trading update on the Financial Year ending 26 March 2022.

The Company expects full year adjusted operating profits to be in line with market expectations(1).

(1). Market expectations are based on the average of published notes from Investec and Numis Securities.

Net debt is expected to be slightly better than the market expectations of £75 million.

De La Rue plans to announce its results for the full year ending 26 March 2022 on 25 May 2022.

The problem with that, is Investec & Numis tend to largely ignore the private investor segment of the market, which is a problem because DLAR is now a small cap - so PIs are absolutely key to creating the market liquidity, and it’s our frequent, smaller trades that set the share price. Maybe time for DLAR to forget its delusions of grandeur, and switch to a broker that will address the market for its shares - us!

It’s all the more annoying that Numis & Investec withhold forecasts & research notes from private investors, despite being paid by DLAR to produce research, which is then only selectively distributed, e.g. to their own clients and institutions. No wonder the share price is on the floor, because the people who would pull the price up (PI buyers) are haughtily excluded from seeing any research by the brokers! DLAR needs to kick some broker ass, and get research out to PIs, where it’s needed.

Net debt at c.£75m is up from £43.9m at H1 period end. The group has been spending heavily on capex, which is probably the reason for the rise in net debt, and it was clearly a planned increase, so no cause for alarm. Production facilities in Malta are being doubled in size, for example. A snippet about this from the last interim results -

The new facility will be larger, more modern and more energy efficient than our current facility, while improving the capability, flexibility and efficiency of De La Rue's overall footprint. In line with the growth expectations of the Turnaround Plan and beyond, it will double the capacity for tax stamps and Brand protection labels for the Group's Authentication division and grow our capability and production capacity for the Group's Currency division. It will also enable De La Rue's manufacturing to be fully integrated with the Company's traceability software platforms.

Balance sheet - I’ve double-checked the last reported balance sheet, as at Sept 2021, and it’s fine overall. Although note that under the ridiculous accounting rules for pension schemes, a pension surplus is reported at £0.3m asset, yet the actuarial deficit of £119.5m is sucking out £15m p.a. in cashflows to repair the real world deficit! Yet the actuarial deficit is not shown on the balance sheet at all! This really is scandalous - a blatant mismatch between reality, and what accounting standards require. It’s not DLAR’s fault, as its accounts follow accounting standards. But do bear in mind, that a real world liability of £119.5m (actuarial deficit on pension scheme as reported in RNS on 3 March 2022) is completely missing from the balance sheet.

Even adjusting for that, I think the balance sheet looks OK, so dilution/insolvency risks look low, or negligible probably.

Valuation - the broker consensus numbers on Stockopedia do seem to have picked up some forecasts, and as you can see, consensus was lowered in Jan 2022 when the profit warning was issued -

.

This results in a forward PER of only 7.7, per the StockReport.

We need to adjust this figure for the £15m annual pension cash outflows, which (again maddeningly) are not taken into account in profits/EPS. Pension contributions come out of after-tax earnings, like dividends, rather than being charged as a cost in the P&L - a very important point to remember. This is why companies with big pension scheme deficits tend to be rated on a low PER.

For example, the StockReport shows “Net Profit” (i.e. profit after corp tax) for DLAR as £22.8m for FY 3/2022, but of that, £15m is going into the pension scheme, that’s two thirds of the earnings consumed by the pension scheme. Which if we adjust for that in the PER, would take the PER from 7.7 to 23.1 - not cheap after all!

However, the hope is that pension deficits may continue shrinking, as bond yields rise. Although higher inflation/wages presumably would increase scheme liabilities? There are lots of moving parts, and pension scheme revaluations can be surprising, unless you’re an expert actuary, and understand how all the moving parts work for each individual scheme. As I’m not an expert, I tend to regard pension deficits as increasing my risk, and would rather avoid companies altogether with pension schemes, making a few exceptions if the investment case looks compelling enough.

My opinion - confused! Trying to simplify it, the share price is bombed out despite a reasonably successful turnaround having happened (with a minor setback in Jan 2022). Also the financial position is solid, with no need for another placing. The big capex should bring increased production capacity, and greater efficiency.

There’s limited competition in banknote printing, because it’s so security critical, as a result the margins are pretty good.

Taking a high level, long-term overview, it seems to me that a chequered past has been sorted out by new management. I’m not buying the past, I’m buying the future.

This seems a lot of company, in a very specialised area, for just £208m market cap.

Therefore, I’ll probably be adding to my position in DLAR shares, risk:reward strikes me as pretty good at 107p per share. As always, just one person’s opinion, based on the facts available today - I’ve got no idea what the future holds for any company.

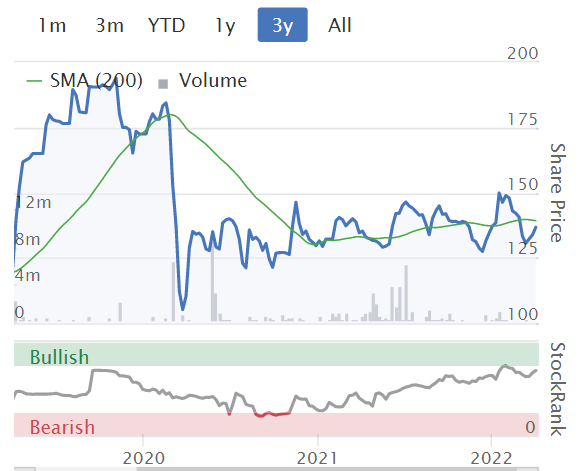

What do the non-emotional StockRank computers think? This looks rather encouraging, all it needs is some momentum to build (share price and profitability feed into that score), and we could end up with a high StockRank in future maybe? -

.

Below, note the high volume (grey bars along the X-axis) recently - are sellers being cleared out? That might set the scene for a share price recovery, if buyers outweigh the sellers maybe? Impossible to know at this stage.

Anexo (LON:ANX)

Up 2% to 139p

Market cap £162m

This is a credit hire, legal services business - a bit like a smaller version of Redde Northgate (LON:REDD) (but without its van hire division).

Trading update today says that it continues to trade in line with expectations.

Focusing on higher quality cases, hence reduced fleet size recently, of 1,955 vehicles.

Legal division - cash collections at record levels.

“Very positive” prospects for new Housing Disrepair division.

ANX is involved in the class action against VW over emissions.

Bank facilities are being increased.

My opinion - I’m not keen on the sector, so it’s not for me.

However, the profit margins are very high, and the forward PER of 7.0 looks cheap, albeit in a sector that usually has low PERs, due to all the risks.

I would go for Redde Northgate (LON:REDD) in preference to this, because it pays out great divis, and is larger and lower risk, also half that business is white van hire, the merged Northgate business.

ANX only pays out 1.7% divi yield in comparison, and being smaller, is higher risk.

Historically there have been some blow-ups in this area, e.g. I got caught on Accident Exchange years ago. Plus other ambulance-chasing type companies have fallen foul of regulatory changes, and fraudulent accounting (e.g. Quindell) with dubious characters sometimes being attracted to these type of activities.

In terms of numbers, the main risk in uncollectable debtors, so investors need to watch the receivables line on the balance sheet like a hawk.

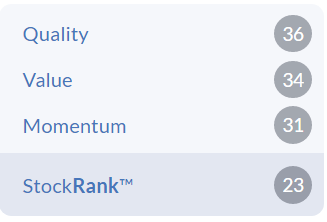

I'm no expert, but this chart looks quite good to me - seems to be building a base, despite very bearish market conditions -

.

.

Attraqt (LON:ATQT)

30p (down 2% at 11:02)

Market cap £60m

This is a software company which specialises in an add-on for eCommerce businesses, which improves customer search results, hence converting more web visits into sales. It is used by some big name eCommerce businesses, so the product clearly works.

I’ve had a quick skim of the FY 12/2021 numbers, here are my notes -

Bull points

- Growing (but not stellar, at 9% revenue growth to £22.9m, for 2021)

- Mostly recurring, SaaS revenues of £20.9m - should provide good visibility & lower risk of profit warnings than a software company that relies on licence wins

- Interesting niche software (improves search results for online retailers)

- Impressive client list

- Positive outlook comments, including “strong” new bookings in Q1 2022

- Tax losses will help, if it does achieve profitability

Bear points

- Loss-making £3.5m after tax (negative tax charge)

- EBITDA needs to be adjusted for £2.0m capitalised development spend

- Cash of £3.5m doesn’t look comfortable - another placing likely I’d say, but company reckons it’s on track to be cash neutral in 2022

- Balance sheet not the best, with negative NTAV

- Hasn’t yet achieved scale.

- Valuation - it’s too expensive for a small, loss-making, sub-scale business.

My opinion - quite an interesting business, which I’ve tended to dismiss in the past, but which could develop into something more interesting, if management is able to accelerate growth.

For the moment though, in a bear market for small caps, £60m market cap is way too high for something that’s still losing significant amounts of money, and may need another placing.

I’ll add ATQT to my watchlist though. What I’m looking for is a tipping point, where new orders start rapidly accelerating because customers are beating down the door, trying to buy a product or service that meets their needs. ATQT doesn’t seem to be there yet, but I’ll read all future trading updates for any signs that growth is taking off. Until then, it’s a bit of an uncertain punt, so £60m market cap doesn’t seem justified to me. Drop that by two thirds, and I’d start to get interested!

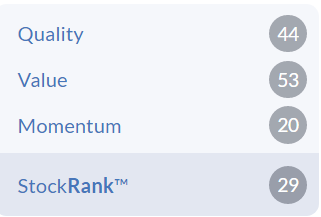

.

.

The low StockRank is a useful reminder that this type of jam tomorrow share usually make bad investments, but the odd one can be a multibagger, hence why we look at them! Also ATQT is a proper business, with decent recurring revenues. It just hasn't yet reached sufficient scale to make any profit.

.

.

Adept Technology (LON:ADT)

165p (unchaned at 13:26)

Market cap £41m

AdEPT (AIM: ADT), one of the UK's leading independent providers of managed services for cloud, digital platforms, unified communications, and connectivity solutions, is pleased to announce a trading and strategy update.

It finished FY 3/2022 slightly behind forecasts -

The Board is pleased to report a strong finish to the financial year ended 31 March 2022 ("FY22" or the "Period"), in terms of order intake, and that it expects the Group revenue and adjusted EBITDA for the Period to be broadly in line with current market forecasts.

There’s a lot more detail in this update, about its markets & strategy, which I won’t repeat here.

Supply chain shortages - this is the second IT company in a week which has said that chip shortages are creating much longer lead times. So whilst container freight charges might be reducing, it seems that supply bottlenecks (in particular chips, and new China covid shutdowns) are not improving, maybe even getting worse? That could impact a lot of manufacturers, and distributors/retailers that sell electronics maybe?

One IT company (Beeks) told me that lead times on some networking products & servers were extending out to a year, hence why they’re now stockpiling in advance of expected orders, hence the £15m placing being necessary.

The commentary sounds quite upbeat at Adept.

New customer wins sound impressive.

However, I’ve looked back at the last results (interims), and the weak balance sheet rules out this share for me - it’s got too much debt (£29.3m net debt at 31 March), and when you write off intangible assets, there’s a large deficit on NTAV.

An earn-out of £4 -4.8m is yet to be paid, which would worsen net debt further.

With the macro picture looking difficult & uncertain, I definitely don’t want to own highly indebted companies with a negative NTAV base.

For that reason, it’s not of any interest to me. One for risk-takers only.

Form your own view of the company on a forthcoming webinar, on IMC - 13:30 on 11 April.

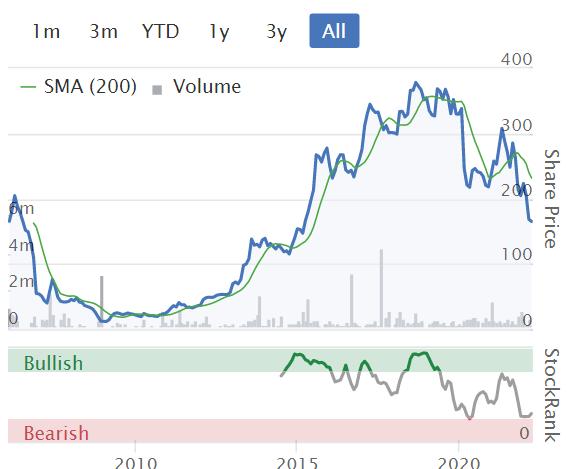

An interesting long-term chart!

.

Stockopedia isn't impressed either -

.

Jack's section

Robert Walters (LON:RWA)

Share price: 716p (+5.6%)

Shares in issue: 76,871,360

Market cap: £550.4m

Q1 trading update for the three months to 31 March 2022

It looks like another strong quarter for Robert Walters, with net fee income up across all regions and up 30% for the group. Asia Pacific is up 37% to £43.9m, Europe +40% to £29.5m, UK +4% to £17.9m, and Other International +30% to £7.1m. Encouragingly, the quarter ended strongly, with a ‘record March performance’.

CEO Robert Walters comments:

We have continued to invest in additional headcount to ensure we are able to take advantage of the demand for talent that exists across all of our markets and specialist disciplines with staff numbers increasing by a further 9% since the end of 2021. Current trading remains in line with Board expectations.

The Q2 update will be published on 6 July 2022.

Conclusion

Just a short Q1 update today, but one that confirms positive trading momentum. With some recruiters, the durability of earnings growth is a concern but RWA continues to come across as one of the better operators in the space, with a founder/CEO and growing international operations.

The shares have recovered slightly from the Q1 AIM sell off but still represent reasonable value, in my view.

A 12.2x forecast PER is probably anticipating some kind of deterioration in trading conditions at some point. If RWA can continue along its current trajectory though, investing in headcount and growing not just due to a strong market but due to market share gains and growth investment, then the shares continue to be of interest.

Tracsis (LON:TRCS)

Share price: 1,013 (+0.8%)

Shares in issue: 29,496,802

Market cap: £298.8m

Interim results for the six months to 31 January 2022

This is a provider of software, hardware, data analytics/GIS and services for the rail, traffic data and wider transport industries. It spun out from Leeds University in 2004, listed in 2007, and has grown materially since, acquiring other businesses and growing organically.

Today, half of the business is software for the railway industry (expected to grow double digits over the long term with plenty of opportunities) and the other half is transport-related data analysis to do with traffic etc.

- Revenue +31% to £29.2m,

- Adjusted EBITDA +14% to £6.2m,

- Profit before tax +16% to £1.3m,

Here’s the reconciliation between adjusted and reported results. Around £2.1m of the c£5m difference between adjusted EBITDA and PBT comes from amortisation, with roughly the same amount coming from share-based payments, exceptional items, and depreciation.

Tracsis won several multi-year contracts in the period, including its first in the rail freight sector for TRACS enterprise. The Events and Traffic Data businesses have responded quickly to a recovery in post-Covid demand, and some large TRACS Enterprise contracts won in previous years are set to go live in summer 2022. The group also completed an acquisition: Icon GEO, a geoscience company.

Post-period end has seen another acquisition, this time RailComm, which is a US based rail technology software and services provider, ‘giving direct access to the large and growing North American market’.

Back in November I talked with management here and had this in my notes:

They have looked at more than 200 companies in the US to analyse the competitive landscape there. Nobody is doing what Tracsis does. That’s good as it’s a market share opp but means they can’t buy like for like. Instead they will look to acquire someone with a different product but the right routes to market. This is perhaps the kind of acquisition we can expect - not another Tracsis, but something that opens the door in a new geography.

Current trading - Encouraging start to Q3 trading with high activity levels across large parts of the Group; Well positioned to deliver further growth in H2 and beyond.

Chris Barnes, Chief Executive Officer, comments:

The recent acquisition of RailComm is an important strategic development for Tracsis, providing a platform onto which we can start to internationally expand the Group and its rail product portfolio via direct access to the significant and growing North American rail technology market. We have received a very positive reaction across RailComm's North American client base… We are confident that there are strong growth prospects for all parts of our Group and therefore remain committed to implementing our overall strategic growth and investment plans. We will continue to pursue organic and acquisitive growth supported by a strong balance sheet.

Presentation here on Friday the 8th (tomorrow).

Conclusion

RailComm provides Tracsis with additional opportunities in its core markets of rail yard automation and computer aided dispatching, but it also gives direct access to an established sales network that can target a significant number of rail clients in North America. Beyond that, there have been additional contract wins, which suggests organic growth continues.

The sales cycle could be an issue in the short term, as Tracsis has to prove itself to large transport operators, which can be a bit ‘chicken and egg’ - like all those entry level jobs out there requiring three years of experience. Again, from my notes back in November:

The UK rail market is very political with a lot of apathy. It’s not like the car market for example, which is much more commercial. That means procurement cycles are longer but, on the flip side, there are switching costs once you’re in.

I wonder if the US is more commercial? Either way, I see Tracsis as the kind of business that could become an overnight success ten years in the making, with some kind of inflection point in the sales cycle if it can sufficiently de-risk itself in the eyes of customers. It probably does require a deeper level of research though, beyond the scope of the SCVR. For those with the time to spare, I would flag it as an intriguing growth candidate.

In terms of valuation, it seems at first like there is a lot of growth priced in with interim EPS of 2.61p against a share price of 1,013p. FinnCap gives a much higher FY22 adjusted estimate of 33.2p though, significantly higher than its forecast stated EPS of 11.8p, again suggesting more time is required in order to understand the nuances.

The balance sheet is fine, asset light as you would expect. No debt and £25m of cash, and £5.8m of net tangible assets after subtracting £53.2m of intangibles. Intangibles are harder to value and require a view on the long term cash generation ability of the group’s software. But there are attractions to the business model and RailComm provides that sought after step into the US market.

There are some signs of potential, and the group has proven its revenue growth credentials. Encouragingly, there’s been minimal equity dilution and there’s no debt, so it’s all self-funded.

I think this one comes down to long term growth prospects and Tracsis’ ability to generate high quality, durable earnings. That’s the real decider of value, beyond single-year PE multiples.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.