Good morning! It's Paul & Jack with you today.

Agenda -

Paul's Section:

Belvoir (LON:BLV) announces it will be attending Mello in Chiswick on 25 May. Do come along too!

JD Sports Fashion (LON:JD.) - a mid-cap, but interesting because its trading update today mentions supply chains improving.

Concurrent Technologies (LON:CNC) - good results for 2021, blunted by an increased tax charge. Fantastic balance sheet, very strong indeed. Component shortages seem likely to delay product deliveries, impacting H1 2022 results. Overall therefore, I'm happy to sit on the sidelines.

Superdry (LON:SDRY) - (I hold) a not very helpful trading update, but I found the IMC webinar this morning much more informative. It sounds like the company is near enough to market expectations, so no profit warning. Subjectively, I discuss the reasons why I think the turnaround here could be working. Obviously macro headwinds are a sector-wide worry.

Quick comments (no sections below) -

Empresaria (LON:EMR) (I hold) - Unchanged at 69p - mkt cap £34m

A solid update today for FY 12/2022 today -

The Group has had an encouraging start to 2022, continuing the progress made in 2021 by delivering strong growth in net fee income. The Group remains on track to meet market expectations for the full year.

Singers has 8.8p forecast EPS for this year, so that’s a PER of 7.8 - cheap, but the whole sector has sold off (again) recently.

I think we tend to prefer Robert Walters (LON:RWA) and SThree (LON:STEM) here at the SCVR. But EMR is also worth considering - performing well, and cheap.

Jack's section:

Character (LON:CCT) - revenue up 22% but the mix (more FOB and US sales) means gross margin has fallen. Profit is down year on year but is up if you strip out last year’s property sale. The company is buying back stock and paying out dividends, so it has its attractions for investors, but there are also a few headwinds in the short term.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Belvoir (LON:BLV)

241p

Market cap £90m

Presenting at Mello 2022 Investor Conference

This is a non-regulatory (“RNS Reach”) announcement, which I want to flag -

Belvoir Group PLC (AIM: BLV), a leading UK property franchise and financial services Group, is pleased to announce that the Company will be presenting and exhibiting at the Mello2022 Investor Conference on Wednesday, 25 May 2022. Dorian Gonsalves, CEO, will be presenting to delegates.

The event will take place at Clayton Hotel Chiswick, Chiswick High Road, London W4 5RY. For further information on the Mello2022 conference, please visit the event website: https://melloevents.com/mello2022/

The Company is committed to ensuring that there are appropriate communication structures for all of its shareholder base so that its strategy, business model and performance are clearly available and understood.

David and the team at Mello have taken a risk, in organising a live physical investor event, following a long gap due to the pandemic. Tickets are selling well, David tells me, but he is finding reluctance from some companies to attend, because they prefer doing online presentations.

Online webinars are fantastic, and long may they continue, but there’s no substitute for meeting management in person, and have a live presentation, and face-to-face Q&A.

I’m looking forward to meeting Belvoir’s management in person for the first time. I’ve really admired the way this lettings business has steadily grown, improved its finances, and demonstrated resilience in downturns. BLV shares have held up very well in the current bear market.

We're hoping to meet some SCVR readers at Mello too - even people who are occasionally prickly in the comments sections here, are always absolutely charming in real life. Something strange can happen when we get behind a keyboard! (guilty as charged).

Anyway, at every previous Mello I’ve met some lovely people from all backgrounds, which is the nice thing about investing - nobody cares who you are, or where you’re from, the only thing that matters is whether you come up with good investment ideas!

We definitely need more women to get involved in investing too. Investing shouldn’t just be a boys club.

.

.

JD Sports Fashion (LON:JD.)

119.4p

Mkt cap £6.1bn

Trading update, interesting for possible read-across to other retailers & re supply chains more generally.

14 weeks to 7 May 2022 - FY 1/2023 - trading well. “At least” in line with expectations.

Profit guidance is £940m, at least equal to last year.

Like-for-like sales (LFL) up >5%.

Global supply chains expected to improve gradually this year (important point!).

My opinion - JD's share price has halved this year. That seems bonkers to me. The fwd PER is now only 10.1, which is irresistible, so I’ll buy a few. The fundamental value of the business has not halved, has it? Even if demand softens due to cost of living squeeze, that’s a temporary factor, so we’re being given an opportunity to buy a great business at a bargain price, in my view.

Bombed out retail shares are looking increasingly interesting to value investors. Remember that supply chain & expensive freight really kicked in last autumn. Hence we're coming up to annualising those problems, with companies having taken action to get stock in earlier, freight rates coming down, etc. So I think we could see less supply chain disruption as this year progresses, who knows? These factors could soften the blow from consumer spending coming under pressure.

.

Concurrent Technologies (LON:CNC)

76p (down c.12% at 08:55)

Market cap £56m

It seems very late to be publishing 2021 results.

There was a reassuring trading update on 5 Jan 2022, which said -

Based on its unaudited management accounts for 2021, the Company expects to report revenues and profitability slightly ahead of market expectations despite the ongoing challenges that the worldwide component supply chain is experiencing.

Whilst the component issues are ongoing, the Company enters 2022 with a robust order book and an exciting pipeline of innovative product releases to grow our customer base and revenues in 2022 and beyond…. [RNS from 5 Jan 2022]

FY 12/2021 Results

Concurrent Technologies Plc (AIM: CNC), a world leading specialist in high-end embedded computer products for critical applications, announces results for the year to 31 December 2021.

Key numbers & my comments -

Revenue £20.5m (down 3% on LY), “slightly ahead of market expectations”

Profit before tax up 22% to £3.5m - note the decent profit margin of 17%

EPS up 3.5% to 3.88p - PER of 19.6, at 76p per share

Dividend flat at 2.55p (yield of 3.4%, not bad)

Cash pile of £11.8m - impressive

New CEO & management

Restricted supply of components - particularly affecting the IT sector at present

Outlook - a bit mixed -

Outlook

· The Group is targeting eight new product releases in 2022. Delivery on this objective has begun, with a Position, Navigation and Timing plug in card announced in January 2022 and a 100 Gigabit Ethernet Processor Plug in Card announced in February 2022, simultaneously with the new Intel chip on which it is based.

· Strong bookings with order book increased to £16.2m as 31 March 2022 from £13.2m at 31 December 2021.

· Component shortage represents challenge to ship product in 2022, particularly in H1 with order delivery expected to be delayed and revenues recognised over a longer period than during normal market conditions….

"Despite growing demand for our products and an increased order book, we do expect short-term supply challenges will result in delivery of it being more protracted than is normal for the Group.

However, we are robustly managing this issue and have a very strong balance sheet and so, rather than damage the business through cost cutting exercises, we will focus on continuing to grow the order book and on creating an even stronger business capable of taking advantage of a number of identified, exciting prospects. We are already seeing increased market interest in our renewed product portfolio, and I am confident in our mid-to-long term profitable growth."

That last point seems to be indicating that H1 figures are not likely to be good, which puts me off buying the shares now, because the stock market is so short-term focused at the moment, and is punishing companies twice - in advance, with a mark down on caution, then again when the expected negative impact on results comes out.

Taxation - note that a much higher tax charge vs LY (£638k vs £98k) is the reason why EPS only grew 3.5%, when PBT rose 22%.

Balance sheet - very strong. There’s a big surplus in working capital, with current assets of £21.6m (includes £11.8m cash), and current liabilities of only £4.2m. Hence the company is bulletproof, and has scope to do something with the cash pile - e.g. an acquisition, or a special divi. I’d like to know what new management plan to do with the cash, instead of just sitting on it. Although with interest rates now moving up, at least the company should be able to generate c.£200k p.a. in interest receivable, something we’ve not seen for many years!

Cashflow statement - note that £2.1m of development costs was capitalised, hence rendering EBITDA meaningless. Working capital increased, absorbing about £1.2m in cash. The other big item is £1.9m in dividends paid (in both 2021 and 2020). The cash pile barely changed, so the group’s cash generation was effectively all paid out to shareholders in 2021.

Note 2 - re auditing 2021 accounts. I don’t know what this means, but it sounds worrying, so I need clarification of this point -

The auditors have reported on 2021 accounts; their report includes a disclaimer of opinion

I’ve googled this bit, and it’s positive -

… did not contain statements under section 498(2) or (3) of the Companies Act 2006.

Taken from the Companies Act -

Statements under those sections of the companies act are only required in these negative circumstances (below). Therefore their absence is a good thing -

(2) If the auditor is of the opinion—

(a) that adequate accounting records have not been kept, or that returns adequate for their audit have not been received from branches not visited by him, or

(b) that the company's individual accounts are not in agreement with the accounting records and returns, or

(c) in the case of a quoted company [F2or unquoted traded company], that the auditable part of its directors' remuneration report is not in agreement with the accounting records and returns, the auditor shall state that fact in his report.

(3) If the auditor fails to obtain all the information and explanations which, to the best of his knowledge and belief, are necessary for the purposes of his audit, he shall state that fact in his report.

[Source: https://www.legislation.gov.uk/ukpga/2006/46/section/498 ]

My opinion - sorry if this upsets the bulls here, but I can’t see anything particularly exciting about the business, or the valuation. A PER of nearly 20, when there are ongoing supply chain shortages, hence raised risk of a profit warning, strikes me as too high.

Long term holders might be happy to look through the supply chain issues, but personally it puts me off wanting to make a new purchase here. If the PER was say 10, then I would take the risk possibly, which would imply a target buy price of around 38p.

On the upside, I like the new CEO’s plan to accelerate new product launches, the strong order book appeals, and there could be upside from the cash pile being used to do something that releases shareholder value.

Overall, it’s not cheap, so doesn’t interest me at this stage, although the business looks quite good, and we’ll keep an eye on how things progress. Once the supply chain issues are smoothing out, then I can see this share could do well, with strong demand, and new product launches happening.

.

Superdry (LON:SDRY) (I hold)

149p (down c.4% at 09:41)

Market cap £123m

This relates to FY 4/2022.

SDRY trading updates are frustrating, because they contain probably too much detail on sales, with complicated tables, but no indication is given on what we actually need to know - which is whether the company is trading (i.e. profitability) above, in line with, or below market expectations (with a footnote saying what expectations are). That information is completely ignored, so how on earth are private investors meant to judge how the company is performing?! It’s ridiculous really, and I’ve already lodged a complaint with the company, via the InvestorMeetCompany platform, where there’s been a really interesting webinar, that it needs to simplify its trading updates, and focus primarily on profit vs expectations.

Performing in line? I didn’t quite catch the wording, but the CFO gave the impression in the webinar a moment ago that trading is broadly in line, but in a different shape - i.e. lower sales, but higher gross margin, due to focusing on full price sales. Hence no profit warning, which has to be seen as a positive right now, and especially with the share price so bombed out.

Looking at the various sales channels, and trying to make sense of today’s update -

Sales by channel for FY 4/2022 -

Stores (220 run by the company) - £224.5m revenues, 37% of total group revenues. Up very strongly (+60%) on LY, but down 22% on largely pre-pandemic FY 4/2020. The CFO indicated they’re expecting continued, gradual improvement in store sales, settling at 10% below pre-pandemic levels. This is OK, because the company is securing large rent reductions averaging 50% (70 sites done already, 70 more being done in next year, so that will be about two thirds of the store portfolio on 50% lower rents) - a big cost-saving, that was heavily emphasised in the webinar today.

New store fit-outs, and layouts for product, have been very successful, so this will be rolled out, but capex limited in next 2 years.

Gross margin in stores - dramatically improved, up 590bps for the year (or possibly Q4, it’s not clear which). This is key to the strategy - moving from permanently discounting, to getting the product designs right, and only selling for full price.

eCommerce - revenues £155.7m for FY 4/2022, 26% of total revenues - hence an important channel. It’s a concern that this fell 23% vs LY, and is only slightly ahead (3%) of the pre-pandemic year.

Reasons given for this poor eCommerce performance are - some sales moved back into the physical stores, as they re-opened. Prior year growth came from lockdowns and discounting online, which has now been curtailed. Although a quick look at SDRY website shows that there’s still plenty of discounted product, at up to 50% off, but it’s not given prominence, instead being under a separate heading “Outlet”.

The webinar heavily emphasised improvements to the online offering as it transitions imminently to a new platform called “Micro services”. This is supposed to be more flexible, and will enable SDRY to catch up with the competition, doing things that are proven to work, which the current platform can’t do.

Therefore, the reality seems to be that SDRY’s existing online offering hasn’t been good enough, but they’re putting that right shortly. So hopefully we might see online growth resuming?

Wholesale - revenues £226.3m (37% of group total) - so another very important channel. Obviously wholesaling is lower gross margin, but with much lower operational costs for SDRY. I think this would also include the sales going to franchise partners, operating 475 sites in over 50 countries.

This channel saw revenues up 6% vs LY, but is still 15% below pre-pandemic levels.

Debt/liquidity - frustratingly, nothing is said about this in today’s update. Information that was provided in the year end update last year. Do they think it doesn’t matter, or are they hiding bad news? We’ll have to wait for the full accounts to be published, but when important information is omitted, it naturally makes some investors wary, especially in a bear market when people are in paranoid mode, and seeing the glass half empty.

Outlook - fairly generic stuff really -

“We continue to execute our strategy of returning the Superdry brand to a premium position and I am excited by the progress we are making. Despite the ongoing tough trading conditions and turmoil in the market, our focus on full price trading will deliver a strong gross margin improvement for FY22.

We are conscious of the cost-of-living pressures on consumers, meaning that now, more than ever, we must continue to deliver product that stands for what is important to them: quality, style and sustainability at great value.

As we head into FY23 we remain cautious on the macroeconomic outlook and the impact of inflation but are confident that our strategy is positioning the brand for future success.”

I would love to sit down with management, and explain to them what investors need to be told in trading updates, as they’re missing the mark at the moment. But the openness in the webinars is great, and I think management enjoy talking directly to investors on webinars. It gives a great feel for the people behind the business too. In particular I like Julian Dunkerton a lot, he reminds me a bit of my old boss at Pilot in the 1990s - full of energy & flair, and very focused. That type of leader tends to motivate the people around them very well, and I sense that’s the case at SDRY.

Key points from the webinar Q&A -

Dividends? Dunkerton: Not on the table. I want to build up a cash pile before divis are paid.

Where are you with turnaround progress? Dunkerton: pandemic put a brake on things. Just at the start I’d say, lots of positive things happening now (e.g. micro services launch - new web platform). Building the brand again, we’re at an inflexion point. So much opportunity everywhere - esp. USA, but also Germany, and China. This will be a big, international business in future. Targeting a broad range of customers now (i.e. not just yoof - my description not his!)

Has customer behaviour changed re cost of living squeeze? It’s too early to say.

Inflation? It’s being managed. Some prices rising “slightly” this autumn, more for spring 2023. We remain the best value brand out there (really?! I don’t agree! But I think he’s comparing SDRY product with fashion brands, as opposed to normal retailers, which are much cheaper in some cases).

What do you think about the bombed out share price? (sighs) it’s sector-wide, and macro worries are weighing on it, we can’t control share price. We just have to accept this, I don’t worry too much about external events. I’m a long-term investor, and we’re feeling really positive here.

Why is Singers forecast showing negative cashflow? CFO - we think Singers are wrong! Need to go through the figures with the analyst to see why his model is giving this result.

My opinion - I need to see the full figures, as there are gaps in today’s update.

Also bear in mind that Dunkerton is always super-bullish on everything! It’s great to have that enthusiasm & dynamism, and lots of areas within the business are clearly being improved.

I’ve already dipped my toe in, with a small initial purchase, which I subsequently added to, averaging down. Not that it matters, but my average buy price is about 170p. It’s now 146p, which looks attractive to me.

Above all, I think Dunkerton is hugely motivated to turn this thing around, being the founder, and having run the business for many years, then inexplicably handing it over to the clueless Euan Sutherland. Why put someone who knows nothing about brands, fashion & retail, in charge? He did a lot of damage I think, but that’s being put right. So I’m a cheerful member of Team Dunkerton, I think he’s doing the right things, but you never really know as an outsider.

I have no idea what the share price likely to do, but today’s update & webinar give me a generally positive feeling, that the business seems to be under control, and mgt are doing the right things.

Obviously we know about the disposable income squeeze, and inflation, that’s why the share price has collapsed already. The big question is whether profitability can be restored, against such headwinds.

It seems to me this is a lot of business for a market cap of £123m. If things work out well, then we could be on to a multibagger. The downside risk has reduced, because physical stores are now only 37% of total revenues, and the big fixed cost (rent) is falling by 50% as leases re renegotiated, a big cost saving. Other parts of the business (online and wholesale) have lower fixed costs, so there’s downside protection there compared with other retailers.

Overall, I think risk:reward could be attractive with SDRY shares, as the turnaround develops. In the short-term though, anyone buying now needs to have a strong constitution, as it’s entirely possible the share price could continue in a downtrend. I don’t know what the future holds, as always investing is educated guesswork!

If I can get more confident about the turnaround, and the macro picture, then I could see this share becoming one of my top positions. I’m not sure if that’s a good thing. As one friend recently quipped to me, rather unkindly I thought, but during an argument, “Given how badly you’re doing at the moment, every time you get an urge to do something in the markets, then just do the opposite!” He’s got a point, to be fair.

.

.

Character (LON:CCT)

Share price: 594 (+2.06%)

Shares in issue: 19,300,352

Market cap: £114.6m

Half-Yearly Report for the six months to 28 February 2022

Character designs, develops and distributes of toys. It appears be a well managed small cap, but there have been a couple of setbacks and currently there are some headwinds.

Results:

- Revenue +22% to £90.9m,

- Operating profit before highlighted items +6.6% to £6.5m,

- Diluted earnings per share +7.4%,

- Cash and equivalents down from £34.9m to £21.5m following £13.6m share buyback.

Statutory profit has fallen year-on-year due to last year’s £2.02m sale of property, but is up if you strip that out.

Like many others across the industry, we also continue to experience inbound shipping delays and other operational adversities due to continuing COVID-19 concerns, particularly in China. Despite these challenges, we expect the profit before tax and highlighted items for the full financial year ending 31 August 2022 to be in line with market expectations.

Character and others that operate along similar lines find themselves in a difficult operational environment right now.

Although the majority of countries where we sell or distribute our products relaxed or even eliminated COVID-19 restrictions, the strict controls applied in China, where almost all of the Group's manufacturing takes place, resulted in delays in production at factories and shipping exports to our global markets. Consequently, this led to extended lead times, uncertainty over delivery dates and significant cost increases. In the UK, the shortage of HGV driver capacity and delays at ports added to the convolutions that all these factors have presented to the business.

Quite a few headwinds, but these results are therefore reassuring. There is scope for supply chain lead times and HGV driver shortages to worsen though.

Revenue is up c22% thanks to a strong performance from FOB sales (freight on board), although this mix has negatively impacted gross margin, which has fallen from 29.2% to 24.8%. Cost increases in the Far East have also affected margin.

Balance sheet - is good, with net assets at 28 February 2022 of £35.2m after a share buyback of £13.6m. That’s substantial. There is no debt and cash of £21.5m, along with £50m of headroom in its banking facilities.

Inventory is materially higher (up from £9.1m to £17.9m) after difficulties in meeting demand in the run up to Christmas

Outlook

As we indicated earlier in this report, the momentum seen in sales in the first half is continuing, particularly in the strong performance from our international FOB business. We remain mindful, however, of the current difficult macro-economic conditions and the recent weakness of Sterling.

Conclusion

Character looks like it is on course to meet full year expectations (underlying profit before tax of £11.3m) assuming trading conditions do not worsen. But that is not certain.

It’s quite possible that material and labour costs continue to increase and, while US and FOB sales are driving growth, these are lower margin. The dividend history here is interesting - a business that looks to return cash to shareholders, but this has stopped or reduced at several points.

As such, I don’t think it warrants a particularly high valuation multiple and there are headwinds, but there are also signs of a well managed business.

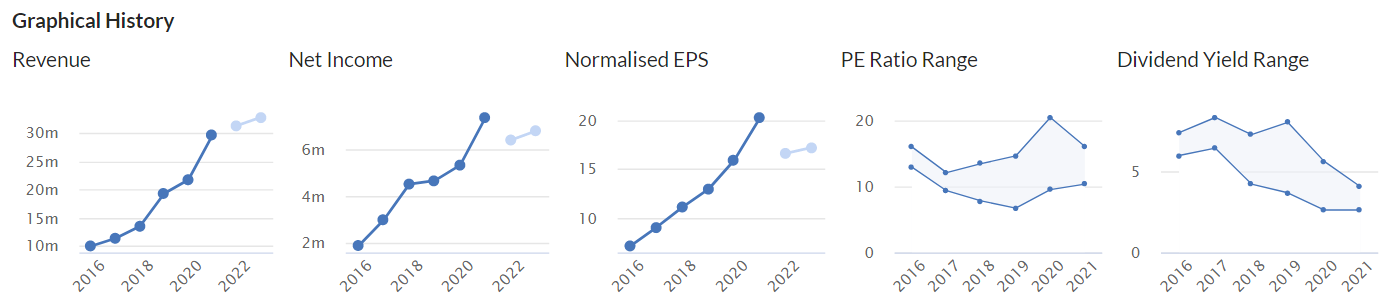

Management does tend to maintain a net cash position, and shares in issue have come down over time. Unfortunately, this chart does not capture the most recent buyback, which sees shares in issue fall to 19.3m.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.