Good morning from Paul & Graham.

Sorry we didn't get round to looking at Equals (LON:EQLS) or Quiz (LON:QUIZ) (I hold) yesterday, as both look interesting. We'll try to cover those later this week.

Agenda -

Paul's Section:

AO World (LON:AO.) (£225m) - Fundraise - a £40m placing is announced, at 43p. This should shore up the finances, and I like the simplified strategy, intending to strip out £25m of excess costs. Looks investable again, now that solvency risk has been addressed. Although I still don't think it's a good business.

Zoo Digital (LON:ZOO) (£92m) - [No section below] Results for FY 3/2022 were scheduled for release today, but instead there's an RNS saying the "auditors have been unable to meet the pre-agreed timetable...", and that "the company has been informed by its auditors that it should be in a position to sign its results for the year ended 31 March 2022 shortly". A webinar scheduled for today is being rescheduled for next week. This doesn't sound serious to me, based on what the company says, but it does introduce a little doubt.

Cerillion (LON:CER) (£289m) - [No section below] - "Major contract win worth £15m" - more good news from this excellent little company, which offers billing software for the telecoms sector. It's the increased size, and stickiness of contracts that really impresses. This one is for 10 years and "... helps to underpin existing market forecasts...", so not earth-shattering in itself, but still good news. This share looks expensive, but I think the superb track record, high margins, growth, and quality of contract wins, do justify the high price. Well done to holders, I think you're onto a winner here.

Robert Walters (LON:RWA) (£401m) - a positive Q2 update. Staffing companies are doing well, due to skills shortages. RWA is mainly international. Looks modestly priced, but it depends on your view of the economic outlook. If there's a deep & prolonged recession on the way, then staffing companies' profits could wilt.

Ten Entertainment (LON:TEG) - a fantastic trading update. Ahead of market expectations. Shares look cheap. Although I question whether this outstanding level of performance is sustainable, or benefiting from pent-up demand? Consumers still seem happy to spend on discretionary, leisure activities.

Graham's Section:

Argentex (LON:AGFX) (£90m) - Excellent revenue and profits growth at this forex broker. The company is growing internationally and developing its online platform, and these efforts are showing in improved financial results. The stock is beaten down but offers a dividend and a single-digit forward PE multiple to those who are willing to take the plunge. It is rare to have the opportunity to buy growth this cheaply - until the recent sell-off, that is!

Numis (LON:NUM) (£290m) [No section below] – Q3 update from this investment bank. The outlook for the full year remains in line with market expectations. These expectations are for full-year revenues of £145.8m and pre-tax profits of £25.1m. It’s a cyclical industry: these estimates are enormous reductions from the bumper year 2021, and are also worse than 2020. The decline in UK small-caps and mid-caps had, as you would expect, a big impact on trading revenues.

The good news is that the company sees a strong M&A pipeline and continues to focus its efforts on growing its M&A business. It will expand in the EU through a new Dublin office.

My view – I would get very interested in this if the stock price dipped closer to book value. For now, it retains a 55% premium over book, reflecting the company’s strong franchise and diversified product offering. I suspect that fair value is around current levels.

PROCOOK (LON:PROC) (£44m) - This recent listing (with a tiny free float) is down by 70% in less than a year. It’s a kitchenware brand with 55 stores and excellent reviews on Trustpilot. Unfortunately, shareholders have to put up with huge IPO-related employee bonuses, and profits for the new financial year are forecast to fall by up to 50% or even more (before the cost of employee bonuses). The company is reliant on borrowing facilities. I will certainly be giving this one a wide berth.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

AO World (LON:AO.)

47p (at close yesterday)

Market cap £225m

Proposed Placing & PrimaryBid Offer

As we suspected, AO needed to do a fundraise, we’ve been discussing this earlier this week, but I didn’t expect any announcement this quickly.

It takes a few weeks to organise a placing, and have all the meetings with the big investors who are invited to participate.

It seems crazy to me that the shares continue trading, in what is essentially a false market. The system needs to be reformed, so that shares are immediately suspended when a placing is decided upon, then a fast, electronic method, open to all, should be developed.

The current system is awful - cloak & dagger, with many people (probably hundreds) made insiders, so of course the news leaks out a bit, and insider trading goes on.

The Sunday Times article will have probably caused the placing price to be lowered, so there won't be many fans of them at AO HQ!

Key details-

Price 43p.

£40m (before fees) is being targeted.

Jefferies & Numis are the joint bookrunners.

Strategy - I like this bit, which sounds obvious, and common sense -

.

Medium-term targets -

o Average revenue growth of 10+% per annum

o EBITDA margin of 5+%

o Improved cash generation with FY23 capex expected to be c. £5m

Current trading - this largely reiterates what the company said in Monday’s response to market speculation -

Current trading and financial performance through the first quarter is materially in-line with the Board's expectations as set out in the trading statement of 29 April 2022.

The Board remains mindful of the ongoing volatile and challenging macroeconomic environment and continuing supply chain disruption.

The MDA [Paul: major domestic appliances] market is stabilising around levels seen in April and May 2022, underpinned by the distressed purchase model for white goods.

Consumer behaviour is evolving as the step change in online consumer buying trends varies by category and the Board will continue to monitor this closely and react as necessary.

Dilution - I can’t see any workings on dilution (possible it’s buried somewhere in the extensive text, which I’ve only skimmed through, due to time constraints), but we can work it out ourselves:

£40m (gross) at 43p per share is 93.0m new shares.

There are 479.5m existing shares, so that is enlargement of 19.4%, at a low price. I would describe that as unwelcome for existing holders, but not a disaster.

It’s better to hold a smaller percentage of £225m (market cap pre-placing), than a bigger percentage of nothing! (if it went into administration).

My opinion - I expect we’ll get a further announcement later today, because when placings are announced, they’re usually a done deal. Management are participating, apparently.

Overall, this is clearly a positive development, as it addresses concerns about liquidity and solvency.

I like the sound of the more focused strategy, to strip out costs. That’s the way companies in this sector need to be run - as efficiently as possible, and on a shoestring wherever possible. That’s what smaller rival Marks Electrical (LON:MRK) seems to do. Whereas in the past, I think mgt at AO World (LON:AO.) (especially the founder) got carried away with tech market mania, and chased revenues instead of profits. That era looks over now, and investors want profits & divis again, not growth and fancy talk. To be fair, it sounds like AO has realised that, and is restructuring accordingly.

Current forecast is for only c. breakeven for FY 3/2023, so unless it can beat that meaningfully, then it doesn’t interest me, especially in a consumer downturn.

For a more upbeat assessment, subscriber Bully15 posted this excellent comment yesterday, thanks for that.

I imagine shares are likely to bounce today on the placing news. There’s also likely to be some buying from short-covering.

Overall then, disaster averted, and hence my view on this share is now less negative, with the finances now a lot healthier once the placing completes. This might stop the rot, in terms of plunging share price. What a pity they didn't fix the roof when the sun was shining - which I suspect will be a sentiment felt in many boardrooms in the coming months.

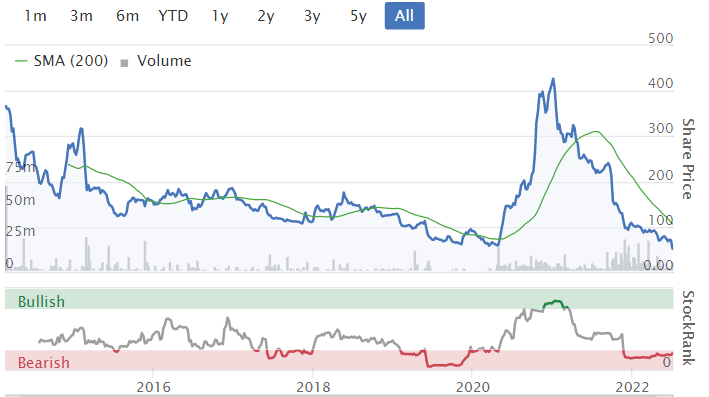

Here's the chart below for AO since it listed in 2014. Thanks to my friend Mark, who messaged me to say he'd dug out the original prospectus, and the founders cashed out £348m in the original float. Smart cookies!

.

Robert Walters (LON:RWA)

528p (up 4% at 08:30

Market cap £406m

We like this decent quality staffing business here at the SCVR, along with SThree (LON:STEM) - both of which look attractively cheap at the moment. No doubt that’s because investors are anticipating a recession. For the time being though, we have a very buoyant employment market, with shortages of good people in many sectors, and with wages going up. Ideal conditions for staffing companies, hence the sector generally posting good trading updates.

Q2 Trading Update - RECORD QUARTER

No subtlety here, with an RNS title that shouts from the rooftop about strong performance! Why not though, it certainly drew my attention to this update.

Main points -

Q2 net fee income up 26% (25% at constant currency) - impressive.

Slowest growth is +13% in the UK, which is only 18% of total revenues, so this is a mainly international group - could be useful, if you’re bearish on the UK economy/currency.

Net cash of £81.6m at end June 2022, down a fair bit from £112.8m a year earlier, but still very good.

Balance sheet - last reported at 31 Dec 2021 - it looks strong to me, with a healthy working capital position, and ample net cash. This group should be fine re solvency, even in a recession, so nothing to worry about here, and no need to dilute with a placing.

Profit guidance -

"This continued strong performance means that profit for the full year is now expected to be slightly ahead of current market expectations."

My opinion - note that RWA has increased its own headcount by 7%. No doubt it’s also having to pay higher salaries/bonuses to its own staff. Although I like the fact that in this sector, pay is variable, due to bonuses in the good times, and lower payouts when it’s quiet.

Broker forecasts have been raised a lot, as you can see below, yet it’s still trading “slightly ahead”.

.

Could we be at or around peak earnings though? The market seems to think so, with a low PER of only 9.2.

If you think we’re heading for a deep, prolonged recession, then clearly this sector won’t appeal. Although as things stand now, there is full employment, and skills shortages, so decent quality staffing companies look attractive to me. They've also got built in inflation protection, because when wages go up, they can lift their fees maybe even automatically, if it's on a % basis of the workers' wages?

STEM & RWA look the best ones in my opinion, in the smaller caps staffing companies.

It’s tempting to have a nibble, but they could get cheaper still, who knows?

Attractive valuation scores below -

.

Ten Entertainment (LON:TEG)

226p (up 7% at 12:09)

Market cap £155m

This is a smaller rival to Hollywood Bowl (LON:BOWL) - both of which sold off heavily in recent market turmoil, but now look to be bouncing, on strong trading.

Ten Entertainment Group plc ("TEG" or "the Group"), a leading UK based operator of 47 bowling and family entertainment centres, today announces a trading update for the 26 weeks to 26 June 2022.

PR headline -

Strong demand continues, driving record growth

Here are my notes -

H1 update, for FY 12/2022

Net cash.

New site openings underway.

Repaying Govt CLBILS loan, so it can resume divis.

Guidance - trading ahead of expectations for this year.

LFL sales growth in H1 is remarkable, at +46% vs pre-pandemic figures from 2019.

Value for money pricing has led to a +43% increase in footfall - I particularly like this, as consumers will spend, if they perceive things to be value for money.

Profits ahead of last sequential half year, H2 2021, but no figures given (fair enough as it’s only a week after H1 period end).

Strong cashflows - self-funding roll-out of new sites & refurbs.

Proven track record of offsetting inflationary pressures.

Outlook for H2 - expected to “temper slightly”, but continued record growth expected.

Valuation - attractively priced on PER and dividend yield too (based on yesterday's forecast earnings, which is likely to rise now).

Note there’s not much asset backing though (a high Price to Tang. Book) - this ratio is better when it’s smaller.

.

My opinion - an absolutely cracking performance from TEG.

What’s confusing me at the moment is that the media is full of stories about impending recession, households incomes squeezed, etc. Yet here we have a bowling alley operator, which is totally discretionary spending, trading its socks off!

So it seems that there are plenty of households who can still afford leisure activities, and want to do them. Maybe spending is shifting more towards experiences, and less from buying objects? If that’s right, and it’s sustainable, then perhaps leisure, travel & hospitality could contain some oversold bargains?

I do wonder though, how much of the stellar growth at TEG is sustainable? People are probably still feeling pent-up desires to do the things that we were prevented from doing in the pandemic from March 2020 onwards.

For that reason, I’d prefer to value this share on say 12 times 20p EPS, which looks a sustainable level of profits. Even though this year it’s likely to smash that earnings figure on the upside.

Hence I’m coming up with a reasonable price target of 240p, which is not much above the current price of 226p. However, I think my sums here are pretty cautious, and build in some downside protection.

Overall then, this looks an attractive share, but possibly benefiting from pent-up demand, which might not be sustainable. For that reason, I’m not interested in chasing this up in price, given how wobbly markets are right now. One for the watchlist though.

.

.

Graham’s Section:

Argentex (LON:AGFX)

- Share price: 79.6p (pre-market)

- Market cap: £90m

Good morning, everyone. I’m starting with a look at this forex broker to institutions and wealthy individuals.

It listed on AIM in June 2019, so it is still a relative newcomer to the public markets.

The share price currently offers a nice discount to the issue price (106p) and the pre-Covid high (over 200p!).

After falling so far, it is now on a single-digit PE ratio, with a trailing dividend yield of 2.5%.

Let’s see its headline results for FY March 2022:

· Revenue +23% to £34.5m.

· Operating profit +33% to £10.4m (I prefer using this, rather than the adjusted measure).

· Unchanged total dividend payments for the year.

It’s surprising to see such growth momentum and profitability from a stock which has suffered such an enormous share price decline.

Analysis

The details as to how Argentex achieved these results are equally encouraging.

The number of active corporate clients is up 17%, to 1,624. Customer diversification is improving, though is still something to watch out for: the revenue from the top twenty customers falls from 41% of total to 36% of total.

Interestingly, there’s an unchanged business mix in terms of the currencies being traded and the types of trades. This means that Argentex has not needed to change what it does, in order to continue growing.

Finally, the company headcount has only just broken over one hundred. It’s a labour-intensive and sales-driven business, and it’s impressive that the company has reached this scale without needing even 100 employees until now. New international offices are opening, with the first of these in Amsterdam and the second in Australia.

Technology offering

Argentex says that its online platform helped the company to have its best ever month in March 2022, and is accelerating the investment in this side of the business:

Following strong initial feedback from existing clients, there will be an acceleration of investment in new products to seek to capture new customers, gain further international reach and enable improved efficiency and improved share of client wallet

I don’t think it’s right to think of Argentex as a tech-driven company today, but it does sound as if it has had a lot of success with the online platform so far. This could be a differentiating factor in the company’s success over time.

It aspires to be “a multi-product, global business” - a strong online platform will be a key asset if it is going to achieve this.

Outlook

The outlook statement is very confident – any why not, after the results they’ve just posted?

Q1 revenue is up 22%, and we have the following statements of intent:

Continued investment into people and technology expected, underpinning momentum in client base growth and accumulation of market share from incumbent banks which account for 85% of the cross-border market.

The combination of the above initiatives is expected to generate a strong return on investment in the medium term through growth in revenues, boost in profitability and improvement in quality and visibility of earnings

It’s very helpful to quantify the market share still held by mainstream banks. Unless the banks react – if they are able to – then more and more business is going to end up in the hands of Argentex and other specialist brokers.

Maybe banks aren’t interested in the FX business, if they can’t charge a horrendous spread while providing very little service?

Change of accounting date

Unfortunately, Argentex also announces the intention to change its financial year-end, from March to December.

I say unfortunate, because I often find little benefit when companies do this, and it messes up the numbers.

Argentex is doing it to “address the imbalance” caused by results being weighted to the second half, since Q4 (January to March) is its busiest quarter.

But won’t this mean that future results are weighted to the first half, since January to March will now be Q1? Is a H1 weighting better than a H2 weighting?

See what I mean about little benefit from changing the accounting date?

Balance sheet

The company has net assets of £33m, very few intangible assets, and a nice surplus of current assets over current liabilities.

My view

I’m inclined to think that this is one of those stocks which has sold off too far during the small-cap sell-off.

I can’t say with any certainty that Argentex is going to outperform its competitors in the very competitive FX broker space, but the risks are arguably priced in now, at a sub-£100m market cap.

If the company was struggling to grow, that valuation would make more sense to me. With the company showing very healthy growth and lots of ambition, I don’t see why shareholders can’t do well here.

PROCOOK (LON:PROC)

· Share price: 41.2p (+1%)

· Market cap: £44m

Only a third of this stock’s market cap is held by small shareholders, i.e. the free float is only worth about £15m. So I’ll try to keep this brief.

Procook is a recent float (November 2021) and has previously been covered by Paul. The company sells kitchenware online and through 55 stores nationwide.

The stock is down over 70% since IPO, which is quite terrible even in the context of a weak environment for small-caps.

Let’s summarise the full-year results for FY April 2022:

· Revenue +29.5% to £69.2m

· “Underlying profit before tax” +14.5% to £9.5m

· Actual result: small loss for the year.

Unfortunately, the IPO cost the company an amazing £9.4m, and these costs are excluded from underlying profits.

Included within the IPO costs are £2.47m of direct costs, and £6.7m of “IPO Share based compensation”. Bonuses to employees, in other words.

And these costs aren’t finished yet:

Expenses in relation to these IPO awards are expected to continue through relevant vesting periods to FY25, albeit these costs reduce over time.

Already, I’m not sure that I can stomach reading any more of this. The company’s entire profit for FY 2022 was lost, mostly to employee bonuses, and you have to read the footnotes and the CFO’s review to discover it.

Personally, I wouldn’t want to get involved with any company which did this. But for completeness here are some excerpts from the outlook statement. I’ve added the bold:

The rapid deterioration in the consumer and macro environment means that we have now had to adjust and re-prioritise our focus…

In line with our recent trading update on 10 June 2022, the Board expects that revenue for FY23, will be broadly in line with the last year, with underlying profit before tax of between £4-6m, reflecting ongoing investment in future growth, cost inflation and a return to a more typical seasonal second half weighting.

Remember that underlying profits exclude the cost of employee bonuses.

Balance sheet – there are £13m of net assets, but the leases are material relative to the size and profitability of the company (£2.8m in short-term lease liabilities, and £19.6m in long-term lease liabilities).

There are also borrowings of £5.5m, so the company has a net debt position of £1.8m. After year-end, the company opened a new £10m borrowing facility.

My view

Procook has excellent reviews on Trustpilot, and I like investing in direct-to-consumer brands. I also like investing in bargains. Unfortunately, the IPO bonuses have turned me off this stock and it also looks like the balance sheet carries some risk – not ideal for a kitchenware company in recessionary conditions.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.