Good morning! It's Paul & Jack here with the last SCVR for this week.

Agenda -

Paul's Section:

Backlog items from yesterday -

AO World (LON:AO.) - closure of German business makes sense, due to continuing losses. I remain sceptical about AO's business model and ultimate viability even. One to avoid, I reckon.

DFS Furniture (LON:DFS) - profit warning. Just as I was warming to this share, recent conditions have deteriorated, as consumers cut back a bit. Maybe we've seen peak earnings for now? Guidance reduced to just below original "low scenario" profit for FY 6/2022. Customers cash deposits have been spent on divis & buybacks, which I find reckless.

Norcros (LON:NXR) - strong results beat expectations. Pension deficit only a minor issue now. Balance sheet sound. Big recent acquisition post year end has raised debt though. Looks one of the cheapest, decent companies on the market. Solid current trading too. An attractively cheap, well run, growing (by acquisition) group.

On to today's news -

Netcall (LON:NET) - a really impressive, big contract win. Shares are expensive, but could it now have reached an inflexion point that justifies the premium rating?

PROCOOK (LON:PROC) - a nasty profit warning today, with profit guidance roughly halved for FY 3/2023 - the perils of operational gearing being once again demonstrated. It's starting to look interesting now, and seems a fundamentally sound business. It's going on my watch list.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

AO World (LON:AO.)

71p (down 3% yesterday)

Market cap £341m

The strategic review has decided to close AO’s German operations, which it says is currently about 10% of group revenue. That’s shrunk, because it was 13.6% of group revenues for FY 3/2021, and more recently 13.0% of group revenues in H1 to Mar 2022.

Germany was loss-making previously, so with shrinking revenues, and higher costs, the losses must have got to a point where management had no option than to pull the plug. Clearly nobody wanted to buy it.

The last reported (H1) gross margin in Germany was only 7.6%, so they’re selling at barely more than cost price - absolutely hopeless.

There are well documented problems in this sector, with supply chain constraints, higher distribution and digital marketing costs, and intensifying competition.

As I’ve mentioned lots of times before, AO has a lousy business model, and operates in a fiercely competitive market.

UK operations are doing OK though -

... the Group's UK business continues to trade in line with the Board's expectations for FY23.

My opinion - this share price still looks irrationally high, for a not very good business, that might not even survive a recession.

Exiting Germany seems a sensible, and inevitable decision, and stops the losses.

I really don’t like AO’s reliance on selling extended warranties, which have big balance sheet entries for this. So there’s a risk of mis-selling type claims & compensation, maybe? Some people argue that AO’s business model is to sell appliances cheaply, and then try to sell customers high profit warranties. I don’t like that.

For me, I just wouldn’t go near this share. Although exiting from the problem German division seems an improvement. Cash costs of £0-15m is a perplexing range! Why so wide? The pandemic brought a short-lived boom in business, now we have the hangover.

.

.

Webinar - there's a webinar for competitor £MRK today starting at 10:30 - login details here. I'll watch that, and report back if anything interesting is said.

DFS Furniture (LON:DFS)

163p (down 12% yesterday)

Market cap £421m

Trading Update (profit warning)

Ahead of its financial year end on 26 June 2022, DFS Furniture plc ("DFS" or "the Group"), the UK's leading retailer of living room furniture, provides the following update on recent trading through to 5 June 2022.

Share in furniture retailers have been poor performers in the last year, peaking last summer, as households splurged pandemic savings on home improvements. Now we’re experiencing the hangover, with consumer spending data already having flagged that people are responding to higher inflation by cutting back on buying furniture, and some other items of discretionary spending.

Brokers seem to be very slow to reduce forecasts, which is a problem we always seem to see when the economy changes direction either way.

It’s encouraging that we’re seeing more muted market reactions to profit warnings at the moment - DFS down 12% yesterday is not bad at all, suggesting to me that we might be getting close to a market low in cyclical shares, where the downside on earnings has been anticipated by much lower share prices. Also, with so much market doom, if people haven’t sold their shares by now, then how many more sellers are left? Not many, I imagine.

It’s only a matter of time before investors start looking ahead to recovering earnings maybe in 2023 and beyond, but it doesn’t feel like we’re quite there yet.

Yesterday’s update from DFS - key points -

Q3 (Jan-Mar) - good order intake, double digit up on pre-pandemic level.

Q3 - significant cost inflation, which has been mitigated by selling price rises.

Q4 (Apr-Jun) - fall in demand reported by Barclaycard data (down 2.1% in transaction volumes) - DFS has seen a similar fall, but has maintained market share.

This seems garbled to me, and seems to contradict itself - but it sounds negative -

While we have increased our weekly production and delivered revenues progressively over Half 2, to record levels in the fourth quarter, the ongoing Covid linked supply-chain disruption, combined with lower order intake since April has led to lower levels of production and deliveries relative to our previous expectations.

Revised guidance - it would have been helpful to include a table of new vs old guidance, but instead we just get revised guidance with no indication of how much it has changed -

Subject to any variations in the rate of deliveries of the final weeks, we now expect UK & ROI full year revenues of approximately £1,150-1,160m and underlying profit before tax and brand amortisation of £57-£62m, which compares to pre-pandemic FY19 pro forma 52 week revenues of £996.2m and profit before tax of £50.2m.

Looking back to my report here on 23 Sept 2021, I was impressed with strong results for FY 6/2021, and initial guidance for FY 6/2022 from the company was PBT between £66-96m (low, medium to high scenarios).

Therefore the latest guidance of £57-62m, is a little below the original “Low Scenario” for this year. Hardly surprising, given that a cost of living crisis has emerged, when last autumn most people assumed that higher inflation would only be transitory, when it now looks like it’ll be around for some time.

Guidance on debt - I feel DFS operates on a reckless basis, having spent all the customer deposits, and paying out special divis & buybacks, funded by debt. The contrast between DFS (reckless, weak balance sheet), and SCS (which hoards cash) couldn’t be starker. I did a video explaining this & comparing SCS vs DFS last year, but can't find the link.

DFS is clearly a better business, but if the economy does fall off a cliff, then DFS might have to come back to the market for fresh equity, which is what happened during the pandemic, whereas SCS didn’t & won’t need an equity raise, due to its huge cash pile.

Outlook - doesn’t sound alarming -

We now expect to close the financial year with an order bank that is elevated by c. £30m or c. 2.5% of annual revenues relative to pre-pandemic levels, which will provide some resilience going into our 2023 Financial Year ("FY23").

It is difficult to forecast consumer behaviour over the next twelve months, but should the trends observed in April and May continue across FY23, this would broadly balance the volume benefit from the elevated opening order bank. Following the growth of the Group in volume terms relative to pre-pandemic levels, we also believe that we have the opportunity to drive further cost efficiencies from our scale.

However, our trading history shows that the Group has gained market share during periods of furniture market decline, and we believe that we will remain well-positioned against the market, given our scale, brand strength and our integrated retail strategy.

My opinion - this seems a fairly mild profit warning, and anyone surprised that orders have slowed in recent months just wasn’t paying attention to macro factors!

Although DFS has an attractive yield, it really shouldn’t be paying out divis & doing buybacks at the moment, given its weak balance sheet. So I wouldn’t rely on the divis continuing, if the economic situation gets worse.

How much did furniture retailers benefit from pandemic surplus cash spending?

It’s so difficult to anticipate where the future is heading. I thought the fundamentals were improving nicely at DFS, last autumn, but am not so sure now.

Tricky one, so I’d say with forecasts likely to come down, it might be best to watch from the sidelines for now.

.

.

Norcros (LON:NXR)

249p (up 4% yesterday)

Market cap £222m

Norcros, a market leading supplier of high quality and innovative bathroom and kitchen products, today announces its results for the year ended 31 March 2022.

PR headline -

Record underlying operating profit and strong financial position

Key figures -

Revenue £396.3m (up 22% on LY, and up 16% on pre-pandemic)

Underlying profit before tax £39.3m (up 28% on LY, and up 36.5% on pre-pandemic) - an impressive performance.

Diluted u/l EPS 38.2p - a PER of just 6.5 times - very cheap, providing this level of earnings is sustainable.

Looks like an earnings beat, with 38.2p actual EPS ahead of broker consensus of 35.9p

Dividend 10.0p yielding 4.0%, and covered almost 4 times.

Pension scheme - this has previously been a big drag on the share price, as it’s a large scheme, which means movements in assumptions can change the deficit considerably. Norcros’s strategy has been to grow the business through acquisitions, which in turn dilutes the pension deficit’s overall significance to a larger group. That seems to be working a treat. The latest figures are an accounting surplus of £19.6m, compared with a deficit of £18.3m a year earlier. Excellent news, and driven by higher bond yields, which reduces the valuation of future liabilities.

The more important actuarial calculations result in the latest pension deficit being £35.8m. An agreed payment plan for the deficit is £3.8m p.a. from 2022 to 2027. That’s now only a small amount relative to profits & cashflow, so the pension scheme now seems only a minor issue. Although there’s always the risk that in future assumptions could change adversely, so it’s worth keeping an eye on.

South Africa - Norcros has significant operations in S. Africa, which have performed well in FY 3/2022. Revenue of £139.6m is 35% of the group total.

Underlying operating profit was £10.9m, up £4m on last year, and 26% of the group total profit.

We always mention political & economic risk with S.Africa, which might lead some investors to apply a discount to these earnings

Outlook - I was worried that companies supplying building & home improvement goods might have benefited from a spike up in demand during the pandemic - when a lot of people who couldn’t go on holiday or eat out, opted instead for home improvements.

No sign of that here though, it sounds like demand remains robust, for now anyway -

Group revenue in the two months to the end of May 2022 was marginally ahead of the strong prior year comparator by approximately 1% and significantly ahead of the pre-pandemic comparator of the two months ended May 2019 by approximately 25%.

Whilst market conditions are likely to remain uncertain, the Board believes that the Group's proven business model and leading customer service proposition will continue to drive outperformance leading to further progress and market share gains, in line with its expectations, for the year to 31 March 2023.

Big acquisition made post year end, of Grant Westfield - at a reasonable price of 7.9x adj EBITDA. Broker consensus forecast does not yet seem to have included an >10% uplift in earnings from this acquisition.

An equity placing of just under 8.1m shares were issued at 230p.

Balance sheet - NAV is £200.3m. I would adjust that to remove intangible assets (goodwill,etc) of £90.3m. Also I would remove the pension surplus of £19.6m, and replace it with the real world deficit of £35.8m, so an adjustment of -£55.4m there. Also I would remove the deferred tax liability of £9.4m.

That arrives at my adjusted NTAV of £64m - which looks fine. Although the latest acquisition is big, and will greatly reduce NTAV to not much above zero, I reckon.

Working capital is healthy, with current assets (including cash of £27.4m) totaling £200.7m, versus current liabilities of £110.8m, a very healthy current ratio of 1.81

There is £18.8m in long term bank borrowings, which is more than offset by cash of £27.4m, so a net cash position of £8.6m - more than satisfactory.

However, note that bank borrowings have shot up since the year end, with the big acquisition (£80-92m, dependent on earn-out) being funded mostly by debt, plus a 10% expansion of the share count from 81.0m to 89.2m recently.

Cashflow statement - not so good this year, because adverse working capital changes have sucked in a fair bit of cash - mostly into higher inventories, although that doesn’t worry me, because many companies have raised inventories in order to mitigate supply chain problems, which NXR says it has done in the commentary. Hence it’s not a worry, and could unwind next year, if supply chain pressures have eased.

Inflation - the main issue of the day. NXR seems to be coping OK -

Whilst overheads were carefully managed as we emerged from the disruption of the previous year, we experienced unprecedented raw material, freight, and energy cost increases. These cost increases were largely recovered through price increases to our customers and margins continue to be closely monitored.

My opinion - this share looks excellent value, with a very low PER of 6.5, and decent divi yield of c.4%, covered almost 4 times.

The pension deficit is now only a small issue, so there’s a chance this share could re-rate maybe to a PER of 9-10, as investors realise they no longer need to apply a deep discount for the pension deficit - they key point being that pension deficit payments do not go through the P&L as a cost, so this has to be adjusted for, with a lower PER. It’s surprising how many investors don’t realise this.

Another positive thing is that the stock market has not given NXR any credit for management expertise at making a string of successful, sensibly priced acquisitions. Although this has seen the share count rise from 63m to 89.2m in the last 6 years - not ideal, given that NXR shares are lowly rated, so it could end up making acquisitions at a higher rating than its own shares’ rating, which is the wrong way around! Acquisitive groups need to get onto a high PER, then issuing more equity to fund acquisitions adds value. NXR looks to me a successful consolidator in a fragmented sector, so the business model looks good to me.

The big question is where the economy is likely to go next? If you think that the economy is likely to tank, then we could have already seen peak earnings, and EPS might drop to say half the current level (remember operational gearing). But that’s already priced in! If EPS were to almost halve to c.20p, then the 249p current share price looks about right, at a PER of 12.5

Therefore, the downside risk looks priced-in already, and if earnings can be sustained at or around the current level, then the share price seems attractively low.

Overall, I think risk:reward looks good, and with patience, this share should do well.

Or, if the economy does badly, then we could revisit the c.150p pandemic lows, who can say which it will be? Longer term though, NXR shareholders should do well, and receive nice divis along the way.

High StockRank of 88 -

.

.

Netcall (LON:NET)

65p (pre market open) - now (at 08:17) up 28% to 83p in early trades

Market cap £97m (EDIT: up to £124m by 08:17)

This looks a big contract win, as the $19m (£15.2m at £:$ of 1:1.25) revenue is spread over 3 years. Hence about £5.2m extra revenues p.a. for NET, which is 19% extra on FY 6/2021 revenues - so a big contract indeed.

Dollar earnings are useful at the moment, given that sterling has weakened.

Profit from this contract is “...expected to generate similar margins to Netcall’s overall group margin…”

EBITDA will be “significantly ahead of its previous expectations” for FY 6/2023 (no footnote included, annoyingly).

The client is a global financial services group, and initially trialled NET software in N.America & Europe, now expanding it globally. That’s a very impressive contract win & reference for possible future contracts.

My opinion - I’ve followed Netcall for years, and never been madly impressed with it. Growth was steady, rather than exciting, and profitability bumped around between breakeven and just over £1m p.a. - performance which never seemed to justify its lofty valuation.

That could be changing now, as this “landmark contract” should boost forecast profit considerably, coming on top of strong H1, and forecasts raised earlier this year.

Looks interesting - if the company has reached an inflexion point, then earnings could now be on a strong upward trajectory. Taking a previous forecast of 1.7p EPS for FY 6/2022, and adding 20% to it, would be 2.05p EPS - so a PER of 32 times (EDIT: more like 40 times, after the 27% share price rise today, at 08:19) - not cheap by any means, especially now tech valuations generally have plunged. However, if NET is now on a roll, and more big contracts are won, then the valuation could be justified, and even increase further, who knows? Could it be a takeover target too? Growing software companies are often taken out at perplexingly high valuations.

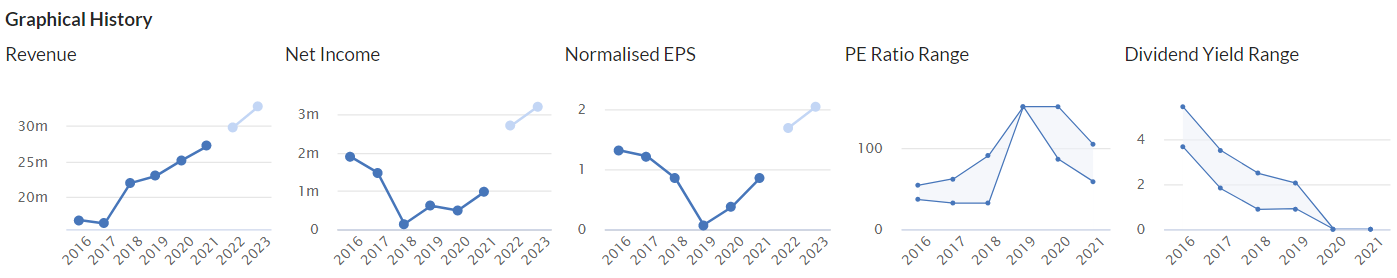

Bear in mind also that the lighter blobs below are forecasts, which will be raised considerably after today's news, creating revenue & EPS trends that look to be going parabolic!

.

Long-term shareholders have been very patient - and only received small divis along the way -

.

.

PROCOOK (LON:PROC)

46.7p (down c.40% at 08:20)

Market cap £51m

Down 40%, that’s a harsh market reaction, so must be a pretty bad profit warning at a guess, let’s find out.

Background - I’ve only looked once at this retail/ecommerce business selling kitchenware, here on 22 April 2022. I liked the business, but concluded the valuation was too high.

It floated on the main market in Nov 2021, at 145p. It’s now 47p. Family shareholders cashed out £40m at the IPO - nice timing for them. Although to be fair, the founding family are still by far the largest shareholders, collectively. The free float is tiny.

H1 revenues rose strongly, but the operating profit margin dropped heavily, from 19.0% to 10.4%, so there were already some warning signs that things were not going well.

Guidance for FY 3/2022 was £10.0m PBT, in the Q4 trading update published on 22 April 2022.

On to today’s update -

Trading Update (profit warning)

ProCook Group plc ("ProCook" or "the Group"), the UK's leading direct-to-consumer specialist kitchenware brand, today updates on trading in the financial year to date ("FY23") and its outlook for the full year.

It’s early in the financial year, which ends 3/2023.

Key points -

Recent trading impacted by “increasingly challenging market conditions”, and consumer caution.

Q1 (Apr-Jun) - up against “exceptionally strong” prior year comparatives. Like-for-like sales have weakened in all sales channels (no figures provided).

Revenues still “significantly higher” than pre-pandemic.

Outlook/Guidance - this is useful, being detailed & specific - for FY 3/2023 -

- Revenue - c.flat vs LY (£69.2m)

- Gross margins c.flat vs LY too.

- Costs to be “managed carefully” - rather vague.

- Adj profit before tax (PBT) expected to be £4-6m - that’s way down on previous guidance from April, of £10.0m PBT - another reminder of how nasty operational gearing is being right now, when demand softens at lots of companies.

Valuation - I can’t find any broker notes, but see the consensus figures on the StockReport are for £81.9m revenues for FY 3/2023. That’s now revised down to c.£69m, a drop of 16% in expected revenues. That seems a big forecast drop. But I suppose it makes sense, given that new kitchen utensils are not even remotely a necessity, hence consumers cutting back on discretionary spending.

Crunching the numbers myself, £4-6m PBT would turn into c. £3-4.5m profit after tax (PAT) if we assume the now higher corporation tax rate of 25%.

Divide that range by 109.0m shares in issue, arrives at EPS of 2.75p to 4.1p

The share price is moving around, but currently (09:05) is 49p mid-price.

This gives a PER range for FY 3/2023 of 12.0 to 17.8 - hardly a bargain, despite the share price having crashed from 145p IPO price, to just 49p now, a drop of 66%.

There's not a lot of asset backing, with NTAV last reported at £10.6m - adequate only.

My opinion - the big question is what level of earnings is the business likely to achieve longer term? At the moment, the stock market is being incredibly short-sighted, and only looking at current earnings. Yet future earnings could recover considerably, and this year might turn out to be an unusually poor year. So if you believe in the long-term prospects of a company, then buying shares cheaply this year could turn out to be a very good decision long-term.

OR, the other way of looking at it, is that particularly companies which floated on the stock market on the back of strong growth from the pandemic, were over-priced, on the back of unsustainably high earnings. That’s definitely the case now, for many companies which floated in the last 2 years. Everyone seemed to assume that growth was permanent & structural, whereas a lot of it now seems to have been a one-off boost from the pandemic.

Hence it’s almost impossible to value some companies right now, buying is a leap in the dark.

The market cap here of £51m, is looking quite attractive to me, for a business with a long track record, under family ownership mainly still, that has a very high gross margin (67.8% last reported). I imagine the returns rate from online sales is probably low, as products are not fashion items which need to fit different body shapes!

I don’t know what level the shares bottom out at. There’s always the risk of another profit warning too. Hence it feels too early to be buying. Although I’ve added it to my watchlist. Maybe it makes sense to wait a while, to see a bottoming-out pattern emerge? I don’t yet see it as crushingly cheap, where it’s just worth throwing caution to the wind and buying regardless. Some decent sized Director buying might be needed to calm the market's ruffled feathers?

.

.

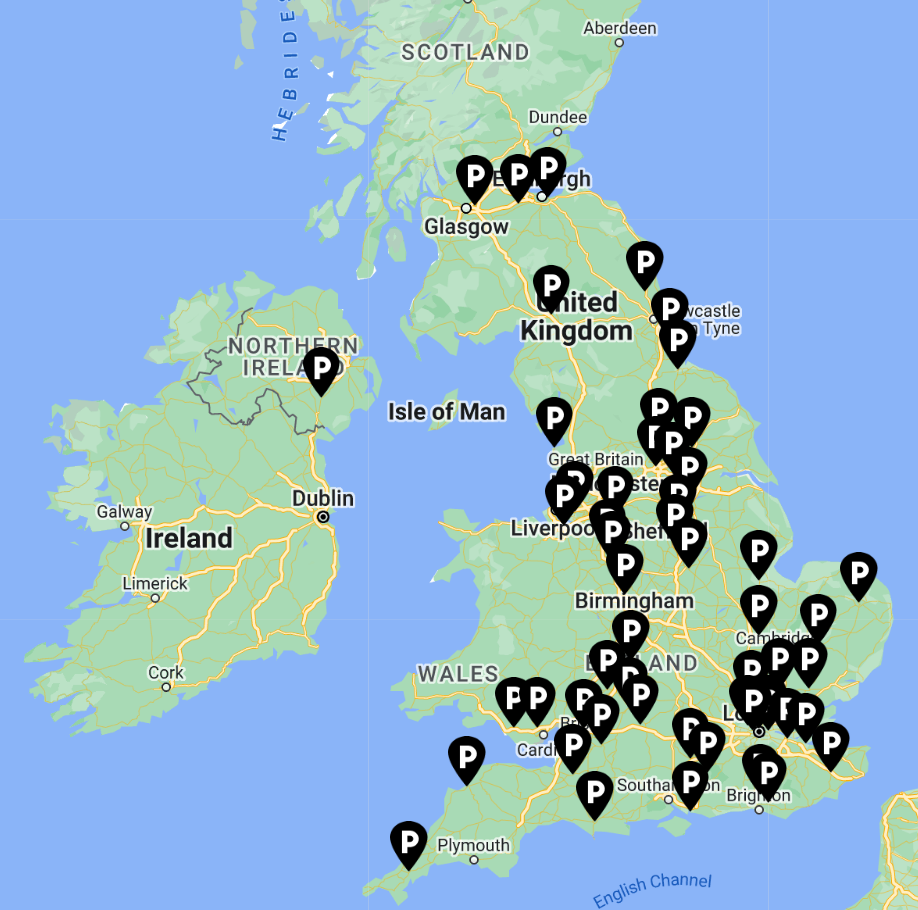

Googling some pictures of its c.55 UK stores, I recognise a lot of the names as being factory outlet villages. Also, the UK market could clearly have capacity for many more sites, if the site economics are good, and favourable deals available currently.

The store design looks unappealing to me. Competitors might include Robert Dyas.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.