Good morning from Paul & Graham. Today's report is now finished.

Agenda -

Paul's Section:

Love Hemp (OFEX:LIFE) shares are suspended on the Aquis junior stock market. It has been fined £70k by Aquis, after an investigation into important information not being reported to the market. So it looks as if Aquis has a reasonable regulatory system.

Macfarlane (LON:MACF) - solid interim numbers are out today. Full year expectations for FY 12/2022 are confirmed. Balance sheet & cashflow look OK. I particularly like that MACF is passing on higher costs to its customers. That should mean solid profits, even in a tough economy, and long-term inflation protection for investors too. Divi of 3.1%, and a PER of 9.9 make this a sound vale share. Thumbs up from me.

Hunting (LON:HTG) - interim results show a recovery from heavy losses in 2021, to breakeven in H1. Outlook for H2, and 2023 is more upbeat, with a strong order book, and obvious macro tailwinds. Superb balance sheet, and a reasonable dividend yield add to the attractions. Worth a closer look, for people who understand the sector.

Graham's Section:

Argo Blockchain (LON:ARB) (£196m) - Interim results from this bitcoin miner with operations in Canada and Texas. The reduced price of bitcoin has resulted in red ink all over this report as the company reports a very large pre-tax loss. It has also resulted in the company slowing down its growth aspirations for this year. I’ve always found this company quite interesting but never had any desire to invest in it, and the latest balance sheet confirms my view that management are pursuing an extremely high-risk financial strategy with the assumption that bitcoin prices will rise in perpetuity and that it will always be possible to refinance their borrowings.

Scholium (LON:SCHO) (£6m) (+7%) [no section below] - this is an oddity: a Mayfair bookshop specialising in rare books, plus related operations dealing in rare works. It has never been entirely clear why it is listed, given its size and lack of growth. The shareholders must have a keen interest in trading with each other, to put up with the costs of being listed every year! Well-known investor Peter Gyllenhammar owns a 13% stake.

Today’s full-year results show revenues up strongly to £8.1m (post-Covid bounce) with an improved gross margin of 38% and a pre-tax profit of £177k. Net asset value per share is fully tangible and stands at 69p (versus the latest share price 45p). The company has a new CEO who reports that trading in the first four months of the new financial year (beginning in April) is in line with expectations. Profits in FY 2022 were impacted by £240k of exceptional costs so perhaps pre-tax profits can move in the direction of £500k in the current financial year? If I could put up with the delisting risk and illiquidity, I’d find this an entertaining deep value play, with the hope that it could eventually trade at or above its balance sheet value.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Love Hemp (OFEX:LIFE)

Share suspended

Love Hemp (OFEX:LIFE) shares are listed on the Aquis Exchange, the sub-AIM independent stock market, which has been through several previous incarnations, including OFEX, and Plus Markets. Aquis shares are themselves listed on AIM under the ticker Aquis Exchange (LON:AQX) . I did check out its accounts a while back, and didn’t really understand where the profit was coming from (especially given that previous versions of this junior exchange had always been heavily loss-making), so went away not keen.

This is an interesting situation which caught my eye this morning -

Love Hemp (LIFE) is listed on Aquis, and this announcement today explains how the company failed to inform the market that an investor failed to produce the £1.2m agreed investment in the company.

LIFE withheld this information for almost 2 months. When it informed its corporate adviser (Peterhouse), they resigned, and its shares were suspended.

Finally LIFE then announced the failure of the investor to deliver the funds due.

So a rather sorry tale.

Today this is all announced by Aquis, along with the imposition of a £70k fine on LIFE.

The disciplinary notice also sets out the various rules that have been broken. So it looks as if Aquis has a fairly decent structure of rules, with consequences when wrongdoing is discovered. That seems reassuring as a potential investor, seeing that there do seem to be sensible rules in place, and action taken when they are broken.

LIFE itself announces that it has reached a settlement with Aquis, and hopes to resume trading of its shares, once a new adviser has been appointed (which sounds like the equivalent of a NOMAD on AIM).

My opinion - there are a couple of shares on Aquis which I’ve always quite liked, and information is available on Stockopedia too - Daniel Thwaites (OFEX:THW) and Chapel Down (OFEX:CDGP) . Also I looked at Samarkand (OFEX:SMK) a while ago, and thought it looked quite interesting.

My broker told me that liquidity is very poor on Aquis though, so I didn’t end up buying any of those.

It’s encouraging to see Aquis take proper action against LIFE, after investigating wrongdoing. So I’ll keep an eye on things, and report back when Aquis publishes its next accounts. It would take a lot to convince me that another stock market, junior to AIM, is viable though.

Macfarlane (LON:MACF)

114p (pre market open)

Market cap £181m

This group, headquartered in Glasgow, makes & distributes packaging products.

Company’s summary crams in a lot of information into one sentence! -

Expectations for the full year unchanged; managing inflationary environment; slowdown in e-commerce; progress in Europe

A few numbers -

H1 revenue up 14.0% to £139.2m

Gross profit £47.1m (33.8% margin, slightly down from 34.2% margin H1 LY)

Distribution costs up 32% to £5.17m

Profit before tax of £8.9m, up 3.2% - I’d say that’s a reasonable performance, given that we know there must be considerable cost pressures, due to macro factors.

Labels division has been sold (Dec 2021), so is stripped out of the above figures. It seems to have been generating small losses.

2 acquisitions have boosted the numbers.

Softer demand from eCommerce customers.

Key point - successfully passed on cost increases to customers.

Net bank debt £9.7m (“well within” £30m facility, to Dec 2025)

Pension scheme - showing an accounting surplus, but the cashflow statement shows a £1.3m cash outflow in H1, so caution needed here. See note 12 for more info.

Balance sheet - NAV £97.8m, less intangible assets of £79.4m, gives NTAV of £18.4m.

Other adjustments I would make, is to remove the £8.8m pension surplus, which looks an anomaly (as we often find with unrealistic pension scheme accounting, showing deficits as surpluses). It should probably be replaced with the more realistic actuarial deficit number, but I can’t find that figure, so just eliminating the £8.8m bogus surplus is enough. That takes NTAV down to £9.6m - which looks OK, at least it’s positive.

Receivables seem quite high at £60.8m, indicating that the company may not be collecting in payment for its invoices tightly enough. I make that payment terms of 66 days, although it could be a bit less than that, as usually there are other sundry items (e.g. prepayments) within receivables. So it might be more like 60 days average payment terms by customers, which is at the top end of what’s acceptable. It’s important not to let customers use you as a bank, so I think some tightening up of credit control might a be a good idea. After all, MACF is having to pay interest on its bank borrowings, which could be eliminated if it accelerated customer payments to say 45 days instead of 60 days. That’s worth mentioning if anyone talks to management. Customers paying slowly also increases the risk of bad debts.

Overall, the balance sheet looks OK, although I would prefer them to raise some fresh equity, if they do any more acquisitions.

Cashflow statement - looks clean, i.e. this is a genuinely cash generative business, which is being used to pay modest divis, but mainly for acquisitions (£9.3m outflow for acquisitions in H1, and £12.2m last full year).

Outlook -

We expect to experience a continuing challenging environment with inflationary pressure on our operating costs and slower demand from our e-commerce customers. Overall, the Group is confident that the effectiveness of our strategy, the diversity of the customers and sectors we serve, the quality of our people, and the resilience of our business model will ensure 2022 will be another year of growth for Macfarlane.

Our expectations for the full year 2022 are unchanged.

My opinion - this looks a good, solid business.

We know that macro conditions are deteriorating, but so far MACF has demonstrated it can cope with higher inflation, by passing on the costs to its customers. Therefore, I imagine this share would probably be a fairly safe haven in a tougher economy.

That you can buy a decent quality business like this for a forward PER of only 9.9, looks a good long-term buying opportunity to me.

There’s a 3.1% dividend yield to keep you amused too.

Another key point to consider, is that businesses like this, which can prove they are able to pass on inflationary cost increases, could turn out to be very good ways to protect yourself from inflation. Sure, profits might dip in the short term, but inflation means that the business is getting bigger. Hence, over time, logically the share price should also rise.

Whereas bonds & cash are terrible places to invest, in a high inflation environment, for any extended period of time anyway (cash has done nicely in avoiding plunging equity prices in the short term, but that effect is inevitably going to reverse at some point, no idea when though).

EDIT: Thanks to Effortless Cool who reminds us in the comments section below that MACF expenses its amortisation charges relating to acquisitions. Whereas practically all other companies adjust out this charge, thus boosting their EPS. So comparatively, MACF understates its profits by not presenting adjusted numbers. That's a positive from an investment point of view, as it hides some of the value in the share. I remember now covering this in a previous SCVR, but had forgotten about it, so a useful reminder, many thanks! End of edit.

Overall then, a thumbs up for MACF from me, and the StockRank system -

.

.

Hunting (LON:HTG)

256p (up 13% at 09:03)

Market cap £421m

Nearly £50m added to the market cap this morning, so these numbers must be good.

I last looked at this energy services group here in June 2022, with a very confusing update which sounded positive, but was actually a profit warning, triggering an 18% share price fall. The problem was that existing forecasts were too high, so were brought down.

Strange that they’ve issued 2 separate announcements, normally companies include a current trading section within interim results. Also you have to click through to 2 further pdfs for the detail, so HTG has managed to scatter its interims into 4 different sections!

I’ll look at the interim results first.

Hunting PLC (LSE:HTG), the international energy services group, today announces its results for the six months to 30 June 2022.

H1 revenue $336.1m (up 38% vs H1 LY)

Heavy losses in 2021 (including big write offs of fixed assets & inventories) have improved to a near-breakeven result for H1 2022 of $(0.5)m loss before tax (2021 full year: $(85.5m) loss.

Balance sheet is large, and very strong. NAV $853m, NTAV $657m.

Working capital is strikingly good, with current assets of $496m, and current liabilities of only $121m. There are very few long-term liabilities (only $34.8m), hence this balance sheet really is bulletproof.

It has net cash of $81.7m.

Hence absolutely rock solid overall, although it does raise the question of whether this company is making efficient use of that capital? Generating only a breakeven result for H1.

If it can’t improve the return on capital, then it might make more sense to shut the company down, and distribute the capital to shareholders, but that’s probably not feasible. At the very least, the group might need a strategic review, and possible restructuring, to generate better shareholder returns?

Although with the price of oil now so much higher, and an energy crisis in full swing, the outlook could be much improved for Hunting? So perhaps low quality ratios might sort itself out if business improves?

Dividends - interim of 4.5 US cents (up 12.5% on H1 LY).The StockReport suggests a forecast yield of 3.36%, not bad, and that’s growing remember. It’s affordable too, given the balance sheet strength, and improving profitability.

Outlook - comments within the interim results statement sound upbeat - e.g.

The second half of the year is expected to see further improvement in earnings, which is supported by our forward sales order book, which now exceeds the position seen in 2019, providing a positive outlook for the remainder of the year and into 2023.

… strong progress continues to be made in building its forward sales order book, which provides further visibility on revenue and earnings for the balance of 2022 and into 2023…

The Board notes that Hunting's sales order book now exceeds c.$400 million which represents a near doubling since 31 December 2021, demonstrating that the global energy industry continues to strengthen following the COVID-19 pandemic.

Broker update - many thanks to Arden for providing an update note today, very helpful.

It has forecast $10.7m adj PBT for FY 12/2022, rising strongly to $30.3m in 2023.

Not madly exciting numbers for a £421m market cap company.

In EPS terms, that’s 5.0 US cents for 2022, and 14.2 for 2023.

Converting that at £1 = $1.18 gives us 4.2p and 12.0p (PERs of 61 and 21 times).

So to be reasonably valued, this share needs to at least achieve 2023 forecasts.

My opinion - neutral, as I don’t know enough about the sector.

Although it seems obvious that with a high oil price, and new concerns over energy security that have been ignored for years, with the dash for renewables and the foolish European reliance on Russian gas supplies, that there must be a strong macro tailwind for Hunting, and others in the sector.

I like its super strong balance sheet, dividend paying capacity, and upbeat outlook comments/order book strength. So plenty to like here, but how do we value it? That’s the tricky bit.

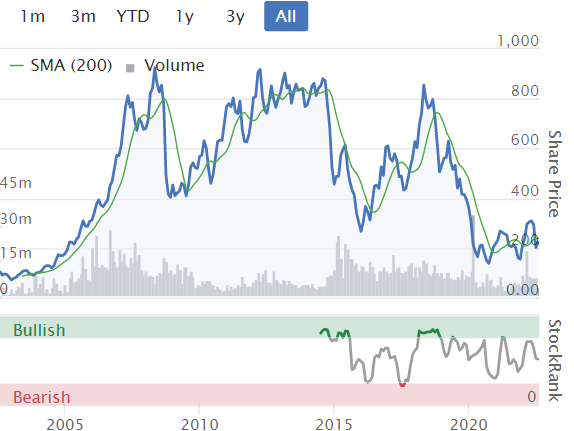

Looking at Hunting's long-term chart below, it's been volatile, but peaked at well over 3 times the current share price several times over the last 20 years. So that might indicate interesting possible upside from now? I checked back to a random RNS in 2007 to see how many shares were in issue, and it was 130m. The number now is 165m, 27% higher - not too bad at all, in 15 years. Hence theoretically, it might be possible to reach similar share prices to in the past. It looks a bit of a feast or famine, cyclical business, like so many resources sector companies. If you catch the up cycle early on, then that could be lucrative (and sell at the top of course, like everyone on Twitter claims to have done, some time later!)

.

Graham’s Section:

Argo Blockchain (LON:ARB)

Share price: 41p (pre-market)

Market cap: £196m

Let’s get up to speed with this bitcoin miner, whose shares have plummeted over the past 18 months:

Interim results highlights:

- 939 bitcoins mined, an increase of 6% compared to last year

- Revenues down 14% to £26.7m

- Adjusted EBITDA is down 28% but it’s a nonsense number for a mining company.

- Mining margin 71%, down from 81%

It’s built into the bitcoin system that the coins get progressively more difficult to mine (more difficult calculations are required of the computers mining them). So for the same amount of work, fewer bitcoins are produced.

When the bitcoin price was rising, it could outpace this feature of the system, so that the profitability of miners kept growing, too.

But if the bitcoin price stalls, then miners are destined to become less profitable as the mining margin reduces. If the bitcoin price actually falls, as it did in H1 2022, then it’s a double-whammy of negativity for miners.

Profitability - there is a pre-tax loss of £36.9m.

This is how the gross loss was calculated:

Without the £42.4m loss on digital currencies, these results would have been very different and indeed the company might have been profitable.

But Argo hoards a lot of bitcoins: it finished H1 with 1,953 of them. At today’s £18,300 price, they would be worth £35.7m. The bitcoin price has approximately halved relative to pound sterling since the end of 2021.

Operational highlights - the company continues to grow its capacity and has borrowed against its equipment and machines in order to do so.

A far safer (but slower) strategy would be to self-fund, i.e. to sell the bitcoins it mines and to buy whatever new equipment it can afford with the proceeds. Instead, it borrows to fund its growth plans.

Argo’s hashrate (computational power) is up by 38% from the end of 2021 to the end of July 2022. It plans to double computational power this year.

You would think that doubling its capacity would be an aggressive target but the company as recently as May said that it wanted to more than treble its capacity this year.

Here’s the explanation from Canada-based CEO Peter Wall on the reduced guidance for 2022. I’ve added the bold, as I think it’s a diplomatic way of saying that the company wants to slow down until the price of bitcoin recovers:

The revision to our hashrate guidance reflects our current expectations for delivery and deployment of the custom machines we are developing with ePIC Blockchain Technologies ("ePIC") that utilize the Intel® Blockscale™ ASIC chips. We have worked closely with ePIC and Intel to modify the machine design to increase total mining efficiency, which has delayed our expected deployment schedule. Further, we are preserving our optionality by reducing our overall capital spending on these machines as market conditions remain volatile.

Argo’s new facility in Texas is operational. Crypto mining has indeed migrated over the years from China to the US and specifically to Texas and other states with abundant power. So it makes sense that Argo would open its new facility there.

At the same time, I am aware of the allegations made last year by an anonymous short-seller, who said that Argo may have overpaid for the Texas land. I’ve not seen a direct refutation by the company of these allegations. (Argo issued shares worth $17.5m for land that was allegedly worth only a tiny fraction of that amount.)

Outlook

The company is trying to fix its electricity prices, which seems entirely sensible and obvious.

It has also been selling some bitcoin to help fund capex and opex, and is confident it can survive this “crypto winter”:

Argo is well positioned to weather the current downturn with its large and highly efficient mining infrastructure, runway for growth, and experienced management team, which has successfully navigated the Group through previous crypto winters.

Balance sheet

Argo’s balance sheet worries me.

The company has total assets of around £300m. Within this, £185m are data centres and mining equipment.

There are also over £80m of “mining equipment prepayments”.

So in total, almost 90% of the company’s assets are related to mining activities, with a relatively small pot of liquid assets.

That wouldn’t worry me if it was funded by equity, but there are £118m of loans and borrowings outstanding. The loans and borrowings include:

- An 8.75% bond maturing in 2026 with a face value of $25. The bond currently trades at $18.50.

- Loans secured against mining equipment with terms of 2 years to 4 years and interest rates of 8.25% to 12%. £44m of the loans are classified as “short-term loans”, i.e. potentially repayable within a year.

My view

While this share has already collapsed by around 85% from its high, I would still have doubts around the risk/reward at today’s valuation of nearly £200m.

My reasons for concern:

- The almost £200m market cap still represents a premium to balance sheet equity (when investing in miners, I’d always look for a discount to book value).

- The company’s bonds trade at a big discount to par value, and they were 8.75% bonds to begin with.

- Even secured against mining equipment, other loans are paying interest of up to 12% (I would expect that the real-life value of this equipment depreciates rapidly.)

- I’ve not seen a good explanation for the price the company paid to buy the site in Texas. Can anyone point me to such an explanation?

- The entire strategy is predicated on the price of bitcoin going up in perpetuity. As a lender or a bondholder I would expect the company to raise equity or sell its fixed assets to repay me, if necessary. But this would not work out so well for the equity holders.

To balance this, I need to try to come up with some positives.

- The company operates 100% of the mining machines it owns and has likely developed some in-house expertise.

- It launched “Argo Labs” this year, an in-house crypto investment division. This might be able to find original ways to make money by deploying the company’s crypto assets.

- Mining margin was still strongly positive in H1. If the bitcoin price stabilises, then Argo should return to profitability.

At the right price (i.e. much lower), I could consider investing in this, after its balance sheet was fixed. With the current financial strategy, at the current market cap, and with some questions unanswered, I would have to give it the bargepole treatment.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.