Hello! I bet you thought I wouldn't circle back and complete Monday's missing report, but my dedication to the cause is such that I've set aside a couple of hours on the following Sunday to fill in the gaps. As it's the day of rest, these comments will be a bit more concise than usual.

YouGov (LON:YOU)

Share price: 126.5p

No. shares: 102.7m

Market Cap: £129.9m

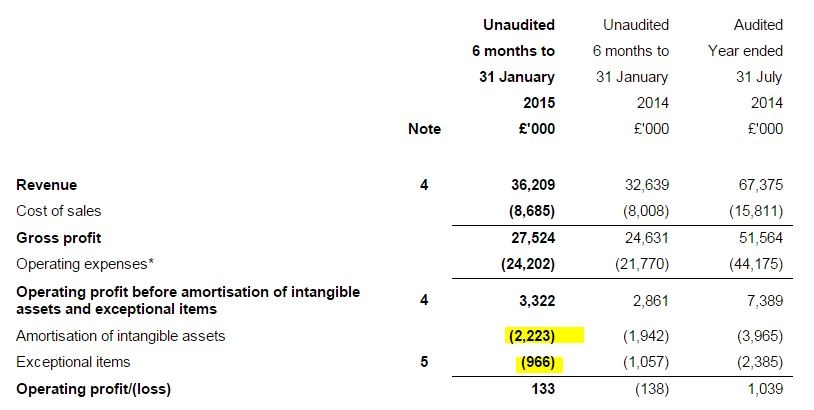

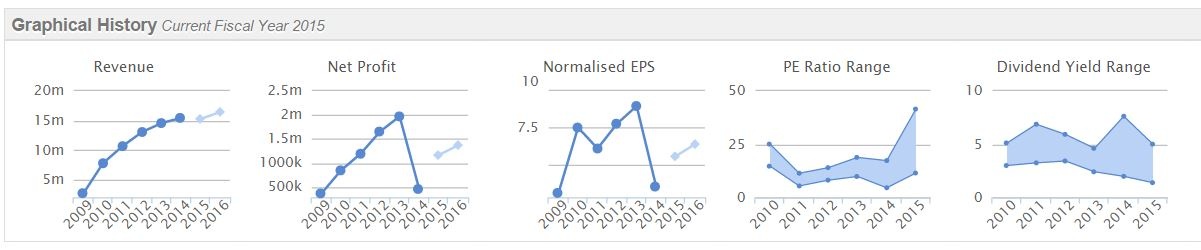

Interim results - covering the six months to 31 Jan 2015 - another set of uninspiring figures from YouGov. Whilst turnover increased 10.9% to £36.2m for the period, the company remained barely profitable - an operating profit of only £133k was made, a small improvement against the £138k loss last H1. There seems to be an H2-weighted seasonality to the year, as the company made an £1,039k operating profit for the full year.

I am referring above to the statutory numbers on the P&L. However, YouGov dramatically inflates its adjusted profits by capitalising some internal costs (and ignoring the amortisation charge), and has recurring exceptional costs every year.

Here is the table showing the dramatic impact on profit of the amortisation charge being ignored, and calling some things exceptional (despite them happening every year);

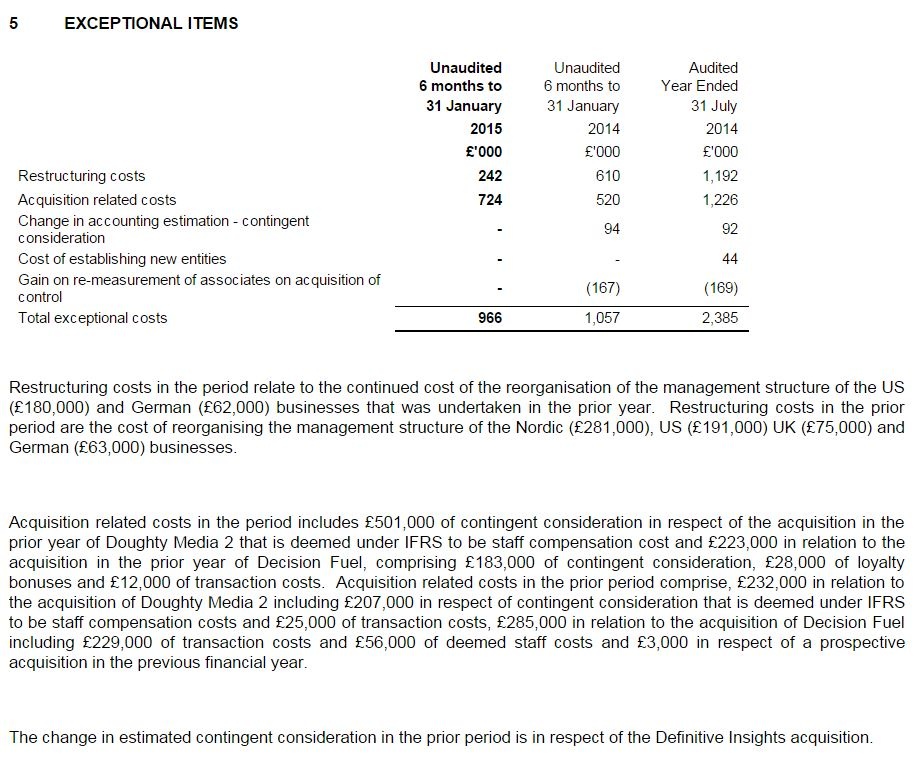

Here are the exceptional costs (see below). Perhaps you could allow the acquisition related costs, but restructuring seems to be ongoing. The company does however give a fairly detailed explanation of each item below the figures, which is good. So readers can at least make up their own mind.

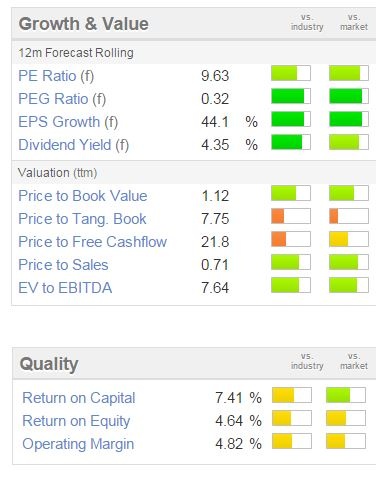

Valuation - I don't believe the adjusted profit figures are a reasonable measure of the real performance of the business. So for me, the 2.6p adjusted EPS in H1 is meaningless.

Stockopedia doesn't particularly like it either, with a StockRank of 53 (falling), and bear in mind their system doesn't challenge what brokers call normalised EPS. It scores poorly on both value and quality scores, see below;

Dividends - are miniscule, which is because the company doesn't really make very much money. The yield is under 1%.

Balance sheet - this is OK, and passes my usual tests.

My opinion - covered above really. I don't accept the adjusted profit figures. The market cap looks considerably over-valued in my opinion, for what is in reality, a not very profitable business.

Although on the positive side, bulls point to the fact that this is a unique business, with a very good brand name & reputation. So it could grow into something altogether more interesting in the future perhaps?

Spaceandpeople (LON:SAL)

Share price: 55.5p

No. shares: 19.5m

Market Cap: £10.8m

(at the time of writing, I have a long position in this share)

Preliminary results - for calendar 2014 - as we know, this company had a lousy year in 2014. They warned on profits twice, in April and September, guiding profit forecasts down to between £0.8m to £1.0m in the last profit warning (Sep 2014), and also flagging c.£300k in exceptional costs. Anticipated net cash at the year end was £750k.

The last update on 23 Jan 2015 said that trading was robust from Sep-Dec 2014, hence profits would be at the upper end of market expectations (so nearer £1.0m than £0.8m), and net cash would be higher, at £1.5m.

The actual results delivered a better than expected result - with pre-exceptional operating profit coming in ahead of revised plan at £1.14m. Net cash also came in ahead, at £1.6m.

So the Sep 2014 profit warning was the low point for profit expectations, and since then the company has exceeded forecasts for both profit and net cash. So why did the shares drop 20% on the day of these results being announced? I have absolutely no idea. I cannot see anything untoward in the figures or narrative, that wasn't already known. Perhaps there were some shareholders who were not paying attention and reading the trading updates, so didn't understand that these figures were actually better than expectations?

Valuation - the Directors have learned the lessons from 2014, and are now steering analysts towards base case forecasts - i.e. assuming no new business wins at all. Therefore we should, all being well, now see forecasts edged up throughout the year, as new business is won, rather than lurching down when planned contracts fail to materialise.

There's still a risk of losing existing clients though, so overall I much prefer the new, much more prudent basis of forecasting. Given that we are now using forecasts which should prove to be conservative, the valuation scores are looking attractive;

Outlook - this is looking encouraging. Management refer to new business opportunities in 2015, and the best bit is the successful trial of the new Mobile Promotion Kiosks. These look set to become potentially big profit generators for SAL, and in my view the market hasn't yet twigged the significance of them. Between 55-70 such MPKs are being rolled out in 2015, with more in 2016. These generate high margin additional income, and the payback period is very rapid, so I am expecting them to drive a big improvement in profitability in 2016.

Dividends - despite having a horrible year, the company is still paying a 2p divi - a yield of 3.6% - not bad at all considering so many things went wrong in 2014. The most likely movement in the divi is upwards from here, potentially quite a lot.

Board changes - positive steps here, with a new Chairman, and 2 new, highly regarded, and very relevant Non-Execs. I like that the Execs have admitted their own failings, and recognised the need to strengthen the team, and bring in experienced guidance to help them - that's a positive sign in my view.

My opinion - I'll stick my neck out here, and say that in my opinion, at 55.5p this is probably the best buying opportunity we've had to date in this share. Why? Because the market is still focused on what went wrong in 2014, but failing (so far) to grasp that the issues have been resolved, and that there's an exciting new future profit generator building up, with the MPKs.

However, tempering that enthusiasm we also need to recognise that this business is vulnerable to customers suddenly changing strategy, so existing income can fall away unexpectedly.

It had a very good track from 2009-2013, so to my mind the market has punished the shares hard for one bad year, when there are now very good signs of recovery taking place. Also bear in mind that annualised cost savings of £700k were implemented in H2 of 2014, so that will give the H1 2015 figures a flying start.

Personally I am penciling in a return to 100p+, once the MPKs are generating strong growth, so with probably about a one year timescale on that personal target price. In the meantime it will probably take a few more months, and no more slip-ups, before the market starts to see this glass as half full again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.