Good morning! I spent a couple of hours yesterday afternoon catching up on a report I'd missed last Monday. Didn't get as far as I liked, but it covers two companies results, YouGov (LON:YOU) and Spaceandpeople (LON:SAL). So the link to that report is here, for anyone interested.

Cenkos Securities (LON:CNKS)

Share price: 185p

No. shares: 58.0m

Market Cap: £107.3m

(at the time of writing I hold a long position in this share)

Final results - for calendar 2014. As expected, these numbers are excellent. Revenue was up 72% on prior year, at £88.5m, and profit before tax came in at £27.0m, up 152%. Basic EPS was up 148% to 35.2p, which is ahead of broker consensus estimate of 33.4p. Although diluted EPS is lower at 32.0p, so I'm not sure which measure the broker consensus is based on.

These are superb P&L numbers, which just goes to show how lucrative institutional broking is, in the good years when lots of fundraisings and IPOs are going on. Cenkos seem to be going from strength to strength, and raised 15% of all funds on AIM in 2014. It's also doing increasingly large deals too, such as the float of the AA in 2014, and a more recent big deal which I mentioned in last Friday's report, raising just over £1bn for Haversham.

Dividends - total divis for 2014 are 17p, for a remarkable yield of 9.2%. Important to remember that this is probably not sustainable, but at least it shows the company does pay out a decent amount in the good years.

The company also points out that 9% of its shares were bought back in Jan 2015, a material amount.

Outlook - sounds good;

Balance sheet - is very strong. The current ratio was 2.41 at 31 Dec 2014, including £32.9m of net cash (some of which will have since been used for the share buyback).

My opinion - I fully appreciate that profits at this level are probably not sustainable for the long term, as their business is so cyclical & unpredictable. But 2015 is likely to be another bumper year, due partly to the Haversham deal. So I suspect that broker forecast for 2015 earnings could be revised up considerably, as current estimates show EPS roughly halving in 2015.

I like this share, at this price. The share has a very high StockRank of 95 too. The key issue will be timing one's exit at the right time, but I see potentially good upside from here.

Bioventix (LON:BVXP)

Share price: 900p (up 5% today)

No. shares: 5.1m

Market Cap: £45.9m

Interim results - for the six months to 31 Dec 2014. As usual, the figures look very good - turnover up 27.7% to just over £1.9m, but note the huge profit margin - profit before tax of £1,256k, so I make that a remarkably high net profit margin of 65.2%! So the company has exceptionally high quality scores. Diluted EPS was up nearly 30% to 20.79p for the six month period.

There doesn't seem to be an outlook statement, unless I've missed it, but the narrative sounds generally upbeat.

Valuation - you could argue that the company looks fully valued, especially since it is such a small company, dependent on the expertise of a handful of people. On the other hand, it seems to have a lucrative niche, with barriers to entry (the time taken, and specialist knowledge to develop its products), and has delivered a compound growth rate in EPS of 25% over the last few years. So if this strong performance and growth can continue, then the valuation is justified.

Dividends - are quite good, and growing at a rate of about 10% p.a. currently.

Balance sheet - is very strong, and the current ratio is .... drum roll please ... 20.5! Basically there are hardly any creditors (£266k), and a £3.8m cash pile, plus other current assets. The only long term creditor is £17k deferred tax.

My opinion - a very interesting company. It's not for me, as it's too small, but I completely understand why some investors like it. Hopefully the company will be able to continue making exceptionally high profits from its niche, and continuing to grow.

Hayward Tyler (LON:HAYT)

Trading update - a quick comment on this engineering company's update. It's been a while since I last looked at this engineering company. It seems to be doing well;

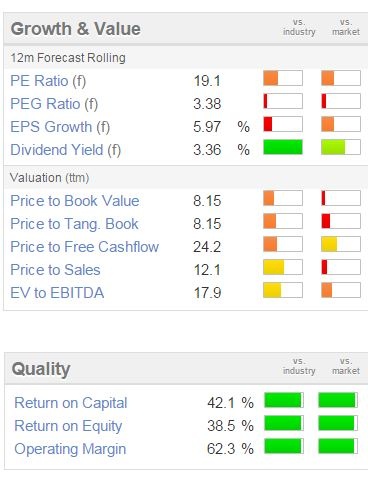

Valuation - this looks quite reasonable at first glance. Also, note the quality scores are positive too;

Dividends - have been resumed recently, which is a positive sign.

My opinion - this share looks potentially interesting, although the last balance sheet was not great - there's a bit too much debt for my liking, and a small pension deficit. Although neither look to be insurmountable problems, especially if it carries on trading well.

Outsourcery (LON:OUT)

Share price: 26p (down 15% today)

No. shares: 47.3m

Market Cap: £12.3m

Preliminary results - for calendar 2014. I'm getting quite cross reading these results, as the upbeat narrative just doesn't seem to bear any relation at all to the dire figures. It's highly misleading commentary, in my view, which for me means that management are not backable, as they seem incapable of giving an honest appraisal of the situation.

The figures are absolutely terrible. Although turnover rose 42.3% to £7.4m for 2014, and this is good quality, recurring revenue, the problem is that the company is burning cash at a prodigious rate, and is almost out of cash (again). Adjusted EBITDA (which is the most flattering, ie. least bad profit measure) was negative to the tune of £4.6m. Better than 2013, when it was -£7.2m, but still a very long way from breakeven.

Moreover, ARR (annualised recurring revenue) is not rising anywhere near rapidly enough. I can tolerate heavy short term losses, if there is triple digit % ARR growth (e.g. at £SNTY). But here, ARR had only risen from £7.0m at the end of 2013, to £8.4m at end 2014. That's not anywhere near enough growth to make this a viable business, in my view.

The company has debt too, of £5.2m, being loans of £2.3m, and finance leases of £2.9m.

Balance sheet - it's almost out of cash again, and the situation looks very precarious. Another fundraising is probably being organised as I type this. There was £2.5m in cash at end Dec 2014, but creditors look stretched, and of course there's the £5.2m in debt mentioned above.

Will shareholders be willing to keep pouring more money into this? I suspect they will keep raising little scraps, as has been the case in 2014, but it's difficult to see why anyone would put money into such a high risk, cash burning venture.

My opinion - I think this company is probably very close to going bust, unless it's able to do a more sizeable fundraising. The going concern note in today's statement, saying that they have enough cash, simply doesn't sound true to me - because the figures are shouting that it's almost bust. So it looks like a very optimistic forecast has been run past the auditors to persuade them to sign off the accounts.

It's staying on my bargepole list.

Cloudbuy (LON:CBUY)

Share price: 21p (down 10.6% today)

No. shares: 121.2m

Market Cap: £25.5m

Preliminary results - for 2014 are out. This is a company that likes to bandy around huge numbers in its trading updates, but when the results come out they're always terrible. Today is no exception - these are really dreadful numbers. Turnover has gone down, from £3.0m to £2.1m, and the loss has ballooned from £930k in 2013 to £4.6m at the operating level for 2014.

The outlook statement says improved results are expected in 2015. I should hope so.

Balance sheet - there's enough cash in the bank for another year, so I would expect the hat to be coming round for another Placing, with more promises of jam tomorrow, probably late 2015 or early 2016.

My opinion - based on performance so far, I can't see any evidence at all that there is a viable business here, so won't waste any more time on it.

Everyman Media (LON:EMAN)

Share price: 92p

No. shares: 36.3m

Market Cap: £33.4m

Preliminary results - for calendar 2014. This is a new company to me, which listed in Nov 2014. It's a small chain (22 sites) of upmarket cinemas. The concept looks good, but unfortunately there is not, as yet, any sign of this being a business model that works.

Things I like

- Clever concept - something different to multiplex cinemas - focused on customer service

- The Kays (serial restauranteurs) are investors/Directors here

- Economies of scale might kick in as more sites added

- Restaurant offering at 4 sites, which could build, given Kays' experience

- Takeover potential once it has reached scale, from 4 large rivals

- £6.4m cash on balance sheet, but current ratio 1.37, suggesting some cash may be needed to pay creditors?

- Straightforward accounts, with no funnies

Things I don't like

- Capex hungry, as sites like this require constant refurbishment & extras (e.g. H+S requirements, etc)

- Only made £557k underlying profit on £14.1m sales

- Are they rolling out a format that is not really commercially viable?

- Director salaries are modest - boosting profits - so with proper salaries, maybe it would only be at around breakeven

- Small free float, and micro cap, so will be very illiquid

- No freeholds - all leasehold property

My opinion - I like the concept, but the figures don't impress. So for me, the £33.4m market cap is way too high for where the company has currently got to. I would only take a punt at well under half that level, or if profitability improved considerably.

I would be interested to find out what contribution to profit is made at each individual site. If new sites are adding considerable additional profit, diluting a fixed central cost base, then it could be more viable than it looks? That information is not made public though unfortunately.

Learning Technologies (LON:LTG)

Final results - I've had a very quick look at these, and have to say the £79m market cap (at 22.25p per share) looks extremely aggressive. Turnover was only £14.9m for 2014, and the operating profit was just £327k. Although our attention is drawn to £2,065k EBITDA. I can't see any valid reason why depreciation of £171k should be ignored, nor why £583k of share based payments is anything other than remuneration for staff and Directors.

The company is growing by acquisition.

Stockopedia shows it to be on a fwd PER of 38.5, which looks far too high to interest me.

That's me done. See you in the morning!

Regards, Paul.

(as mentioned above, Paul has a long position in CNKS, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.