Good morning! It's good to be back, after the long weekend.

Cheshire investor evening

I'm still in Cheshire, visiting family, and have decided that it would be fun to do an investor evening up here, featuring a local listed company giving a presentation, drinks & networking, and a meal afterwards. So I'm trying to sound out potential interest. Therefore if you would be interested in coming to a Mello-type evening in Cheshire (I've found a venue not far from the M6, a large pub, with outstandingly good food, in Winsford (CW7 3AA), and have capacity for about 30 people.

If you would be interested in coming, pls let me know either by a comment below, or emailing me, or through Twitter. If there's enough interest, then I'll go ahead with it. People moan that everything is London-centric, so I thought it would be nice to do something a bit further north.

Somero Enterprises Inc (LON:SOM)

Share price: 121.5p (up 5% today)

No. shares: 56.2m

Market Cap: £68.3m

(at the time of writing, I have a long position in this company)

Final results - for calendar 2014. These figures look strikingly good. I've had my eye on this company for a while. It seems to be the market leader in making machines which level concrete floors, using high precision laser-guided technology. This creates extremely flat floors for warehouses & factories. I was a bit worried that the company's growth might not be sustainable, but the figures out today, together with strong outlook comments, have blown away those concerns.

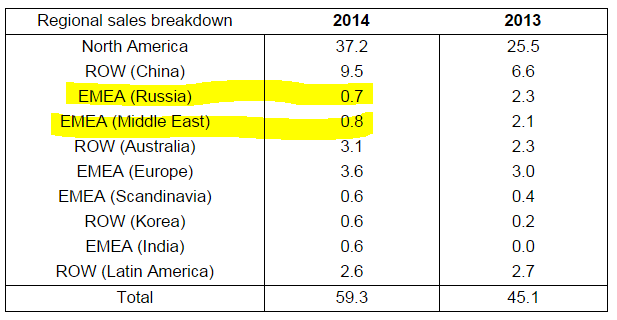

Turnover rose 31.5% to $59.3m, and operating profit almost doubled, from $6.4m to $12.6m (note that the company reports in US$). As far as I can tell, the growth seems to be be all organic, which is very impressive.

As you can see from the table on the above right, sales in Russia and the M.East dropped sharply, but strong growth in all other regions offset those falls several times over.

Taxation - note that 2014 contained a one-off benefit from a negative tax charge, so this has inflated earnings, and hence needs to be adjusted out when valuing the company. The group charged tax of 16.6% to the P&L in 2013, and that reversed round to a tax credit of -17.3% in 2014.

Note also that the number of diluted shares has fallen a useful amount, due to a reduction in potential dilution from options, and something called "restricted stock units" (RSUs). I'm not familiar with this term, it must be an American thing. So having done some googling, the wikipedia entry for restricted stock units is here. They seem to effectively be similar to stock options which only vest when certain conditions have been met, particularly used for employee compensation - so e.g. the restricted stock will only vest, i.e. become unrestricted and hence treated as normal shares, when an employee has completed x years of service, etc.

Note 14 to today's accounts gives more detail on the RSUs, and it seems that some were settled in cash, thus reducing potential dilution, as I have highlighted below;

Overall, this look alright, with the level of potential dilution not being excessive at all. Employees/Directors have done well from this scheme though, but I don't suppose shareholders would particularly mind, since the share price has done alright too, and divis are rising, so everyone is sharing in the benefits of growth.

Earnings - basic EPS shot up from $0.10 to $0.26, but personally I would want to normalise the tax credit to a tax charge that was the same as 2013. By my calculations, that comes to $10.34m in earnings, or $0.184 normalised (for tax) EPS.

Valuation - with the shares at 121.5p, and converting $0.184 normalised EPS at £1=$1.49, I come to 12.3p EPS (on a normalised tax charge). So assuming my calculations are correct, then this stock looks an absolute bargain, on a PER of about 10. Although that is assuming that this level of profitability is sustainable of course - we'll come onto that in a minute.

Dividends - you can't argue with a 150% increase!

So 5.5 US cents is about 3.7p, which gives a useful yield of about 3.0%. Given the very rapid growth in the divi, then if the company continues trading well, there could be scope for that to go higher.

Balance sheet - absolutely fine, it passes all my tests with flying colors. Net cash was $6.6m at 31 Dec 2014, so a very healthy position.

Outlook - there's quite a lot of detail given about potential for various markets, so I'll just show the bits that caught my eye. It all sounds rather exciting, and suggests there is scope for continued increases in sales & profits;

Also, I like the sound of the potential market in China, and this staggering statistic of China using 30 times as much concrete as the USA in 2014!

My opinion - this looks a very reasonably priced growth stock, with a positive outlook. It seems to have a dominant product, and produces high quality scores on Stockopedia - with an impressive operating margin, as well as high ROCE and ROE scores too. The StockRank of 86 could go higher I suspect, as these strong results filter through the system, and I imagine higher broker forecasts also are likely now.

So on a PER of about 10, it looks far too cheap, in my opinion. I would say a price at least 50% higher would seem justified (a PER of 15-20 sounds a more appropriate valuation to me).

Have any readers looked at this one? I would be interested in your views, if you have. It gets a resounding thumbs up from me, and I'm scratching my head to understand why the valuation is currently so modest. Hope I haven't missed anything negative.

GB (LON:GBG)

Share price: 178p (up 6% today)

No. shares: 120.7m

Market Cap: £214.8m

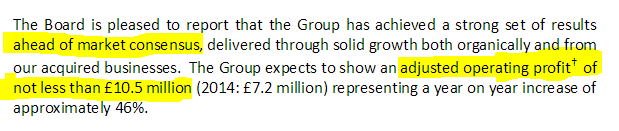

Trading update - pertaining to the year ended 31 Mar 2015, which reads positively;

I'd want to see the accounts to check what proportion of growth is coming from acquisitions. Unusually, the company says that it will put out another, more detailed update on 20 Apr, ahead of publication of the full results in the first week of Jun 2015.

It's all too easy for companies to look like a growth company, until you realise that they are buying in growth from repeated acquisitions, and their underlying business is going nowhere. I'm not suggesting that is the case here, but it needs to be checked.

Valuation - if we take the £10.5m adjusted operating profit above, and assume that the adjustments are reasonable, ignore financing costs (as the company seems to have net cash), then take off say 22% tax, that arrives at £8.2m earnings, about 6.8p per share. That's usefully ahead of broker consensus for y/e 31 Mar 2015, of 5.95p per share.

Assuming my estimate of 6.8p is correct, then that drops out at a PER of, blimey, 26.2 times. Hardly a bargain!

My opinion - I'm not interested in chasing things to valuations over 20, unless they have really exceptional organic growth prospects, and a very low chance of something going badly wrong.

Looking back at the interims, organic revenue growth was only 13%, which is not very impressive at all for a stock on such a high rating. That said, it made £3.75m adjusted operating profit in H1, so the full year being £10.5m+ suggests a very strong H2. I'm not sure what the usual seasonality is, but perhaps there is stronger growth coming through now, than was evident in H1?

The shares have done very well in the last two years, so I do wonder what more upside there is, at such a lofty PER of 26.2? That already factors in considerable further earnings growth.

Flybe (LON:FLYB)

Share price: 57.75p

No. shares: 223.1m

Market Cap: £128.8m

(at the time of writing, I hold a long position in this share)

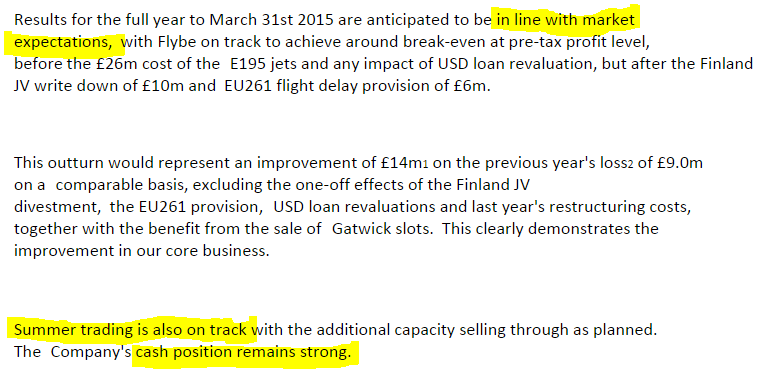

Trading update - a fair bit of detail is given, and it sounds reassuring to me, with no new nasties to add to the existing nasties, thank goodness!

As we already knew, Flybe's main problem is seven surplus E195 jet airplanes, which are not suitable for the routes it runs, but which they are struggling to dispose of. So there is an enormous cost of £26m p.a. whilst these planes remain with Flybe. However, this is also probably going to be the big catalyst for a recovery in the share price, when those planes are disposed of.

So once those planes are gone, and excluding the £10m and £6m one-off costs in 2014/15 referred to above, then it seems the underlying performance is currently a run rate of about £16m p.a. profit. That's not bad, considering how low the market cap has got now, and that there is further scope to improve profits.

The company reports good trading in Q4, with customer numbers and capacity both up 15%.

My opinion - the turnaround here is taking longer, and is less successful so far than hoped for. However, they clearly are making progress in dealing with legacy issues, and are operating in a short haul niche where most flights do not have any competition at all from other airlines. So Flybe's main competition is actually road & rail.

The balance sheet is very strong, because remember that a £155m equity fundraising was done at 110p per share. So there's no chance of it going bust, and it's comforting to know that someone else put money into the company at 110p per share, yet I'm now able to buy those shares at almost half the price.

I'm obviously not very happy with how things have panned out so far here, but am fairly confident that, with some patience, we'll get our money back in due course. Indeed, I'd be more inclined to buy some more, than sell out.

Flybe also has unfavourable hedges on fuel, but you can't really blame them for that - hedges are to protect against a spike up in the price of fuel, and do you really want airlines speculating on what the future price of oil will do (given that they're bound to get it wrong most of the time)? Although now would probably be a good time to be loading up with future hedges on oil, with the price currently so depressed. Trouble is, people tend to do the opposite of what would work best - so they recoil from hedging when fuel is cheap, due to having suffered recent losses on earlier, more expensive hedges.

Synety (LON:SNTY)

Share price: 90.5p

No. shares: 12.1m (NB. this is after the Placing & Open Offer new shares being issued)

Market Cap: £11.0m

(at the time of writing, I hold a long position in this company)

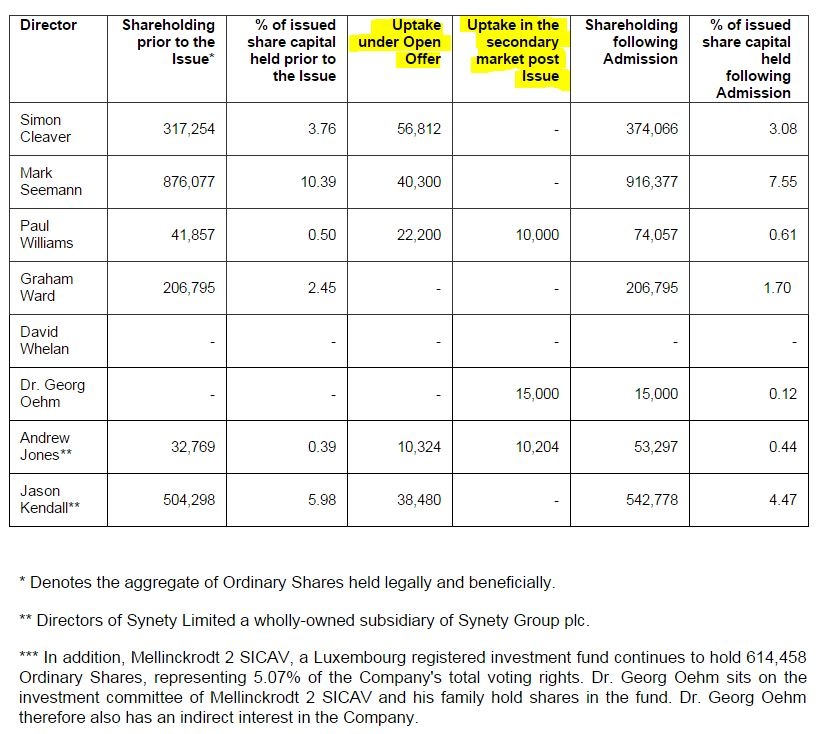

Result of Open Offer - the company has announced after hours, the results of the open offer. The company has already raised £2.8m in a Placing, and deserves praise for giving existing shareholders the opportunity to participate through an open offer at 90p.

Given that the share price has been unable to maintain a premium to the open offer price, it wasn't a terribly attractive proposition, unless you wanted a big slug of stock that you wouldn't necessarily be able to buy in the open market. So I was expecting a modest take up of the open offer.

As it happens, the result wasn't bad - 568,752 shares have been taken up in the open offer (including excess applications), of 834,028 potential shares, so a 68.2% take up, which is OK in the circumstances, in my opinion.

Encouragingly, the Directors have participated to a meaningful extent in this open offer, as shown below. I make that 168,116 shares at 90p, so £151k splashed out by Directors in the open offer alone.

This isn't the first Director buying either. The company website shows 3 pages of Director buys in the last couple of years, totalling about £750k, so there's no denying that these guys believe in what they're doing. Trouble is, at the moment, the market doesn't. So I think we need to see continued strong KPIs, and a keener focus on cost control, as I don't think the market will tolerate another fundraising after this - a point I have made directly to the company - that they now have to make do with the cash they've got, and reach breakeven come hell or high water!

Adept Telecom (LON:ADT)

Trading update - for the year ended 31 Mar 2015. This sounds OK. Turover being slightly below expectations doesn't really matter, as profit is in line;

Dividends - I particularly like the big increase in divis announced, with 4.75p for the full year, a 58% increase on last year, and ahead of broker consensus of 4.5p.

My opinion - I'll look at the figures in more detail when they are announced in early Jul 2015, but there look to be potentially interesting elements in this.

That's it for today.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SOM, FLYB, SNTY, and has no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.