Good morning from Paul & Graham! All done for today, see you tomorrow!

Agenda

Paul's Section:

As usual for this time of year, I'm going to focus on the first retailer trading updates, which are mid caps - this is to test the water, and give us something to benchmark the smaller companies against, when they report. So today I'll be reporting here on -

Next (LON:NXT) - an excellent update, with strong sales over Christmas (helped by cold weather driving demand for outerwear). Profit guidance is raised, but higher corporation tax takes a hefty bite out of guidance for FY 1/2024. Inflationary pressures beginning to ease for H2 of calendar 2023 has positive read-across for many sectors. Lots of interesting stuff in here, so I go through it in a fair bit of detail below. Thumbs up for a great quality business, although forward PER of 13.2 is probably a fair valuation right now, given that it's a mature business.

Greggs (LON:GRG) - in line with expectations update for FY 12/2022. But within the detail, there's a lot of positive stuff. It's coping with inflationary pressures, and clearly gaining market share, with very strong LFL sales growth. I'll give it a thumbs up for the quality of the business, and good growth potential, although the valuation is looking stretched after a strong recent run. More detail below.

B&M European Value Retail SA (LON:BME) - a positive Q3 (Oct-Dec 2022) update, and FY 3/2023 EBITDA guidance is raised. I continue to like this share, which seems reasonably priced, and has a particularly strong 8.3% dividend yield, when you include special divis. Thumbs up from me. More detail below.

This is in addition to our reporting on small caps, not instead of!

Dignity (LON:DTY) - bid approach is announced, almost 3 months after discussions started, which is an outrage I think, and has resulted in a false market in the shares, causing losses to sellers who were not told that takeover talks were underway. The regulations on disclosures of takeover approaches are appalling, in my view - we need to press for regulatory changes. More detail below.

Angle (LON:AGL) - profit warning, shares down 31%. I run through the detail below, but whilst it sounds an interesting project, the timescales are now extended out even further, and the cash pile looks set to run out in 2024. This type of share rarely pays off, other than as a speculation in a bull market. So it has to be a thumbs down as an investment idea I'm afraid, because I don't think they'll be able to commercialise it before the cash runs out.

Graham's Section:

Mattioli Woods (LON:MTW) (£324m) - this financial services provider releases an H1 update that is in line with expectations. We don’t cover this stock often, but I’m impressed by what I’ve seen from it today. Its asset management businesses enjoyed net inflows despite the very poor investor sentiment during the period and while organic revenue growth was modest, the company’s string of recent acquisitions have helped to boost the top line. This is a founder-led business with a strong cash position that is positioned to benefit from a bounce in asset prices. It all looks very credible to me and so I think this one is worth researching in further detail.

Glenveagh Properties (LON:GLV) (€584m) - this Irish homebuilder posts a profit warning for 2023, as 20% of the suburban housing units it planned to deliver this year are still trapped in the planning process. Despite that bad news, and the fact that it now has a small net debt position, the company plans to carry out a fresh buyback for up to 10% of its outstanding shares. It’s a sign of confidence in its cash generation abilities and also its determination to achieve an ROE target of 15% in 2024 (one surefire way to boost ROE is to reduce your equity!). I find this stock interesting: if the planning system can speed up and if Glenveagh can still afford to fund their growth plans, their shareholders could see very nice results from 2024 onwards.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Dignity (LON:DTY)

535p (up 26% yesterday)

Market cap £268m

Advanced discussions regarding a potential recommended cash offer

This was announced shortly before the market close last night.

Two major shareholders, Castelnau and SPWOne (who together hold 29.7% of DTY via Phoenix Asset Mgt) want to take DTY private in a cash bid priced at 525p.

It discloses that this 525p offer was made to DTY ages ago, on 13 November 2022. That followed previous takeover proposals at 475p (on 13 October 2022), then improved to 500p, 510p, and finally 525p.

Yet none of this was disclosed to the market until yesterday, 4 January 2023. This is outrageous, and is a glaring flaw in UK regulation. To my mind, there has, since 13 October, effectively been a false market in DTY shares. Crucial price-sensitive information (that a premium priced takeover bid had been proposed by a consortium of the 2 largest shareholders) was being discussed with management, yet nothing was disclosed to the market. So people selling their shares between October 2022 and yesterday, were selling at a falsely low price, unaware of the active takeover proposals. This is wrong!

Also, are we seriously meant to believe that a takeover approach can be negotiated over almost 3 months, and nobody did any insider dealing? There must have been hundreds of people involved in some form, who knew about this price sensitive information, and somebody somewhere will probably have quietly tipped off a friend, or relative. Hardly anyone gets prosecuted for insider dealing of course, but the victim is the person selling their shares at an under-valuation, unaware that there’s going to be a surge in share price from a takeover bid. Whilst the insider dealer makes free money, and as long as there’s no paper trail, and no obvious connection to an insider, can plausibly deny any wrongdoing.

This is an outrage, and we need to lobby harder to get the rules changed for takeover bids.

I suggest that we all write to the Takeover Panel, and our MPs, to make it clear that the rules have to change, as they’re glaringly, obviously unfair and unreasonable at the moment. I'm sure that everyone who sold their DTY shares in the last 3 months will be motivated to write, and should do so, as they've been fleeced!

I’ve myself written to the Takeover Panel already on this topic, but will do so again. Their response was dismissive, saying that companies receive takeover approaches all the time, and they only have to disclose something if it’s leaked to the press! How pathetic is that?!

ShareSoc and Lord Lee have been campaigning on this issue, and I urge anyone concerned about this grotesquely unfair situation, to get involved.

In my view, companies should be obliged to immediately inform the market whenever they receive a credible takeover approach. Such an announcement should indicate what stage the proposals are at, and have the usual warnings that an offer may or may not occur. Why is it voluntary for companies to disclose (or not) such crucial information?

Statement from the (possible) bidder - also issued last night, and confirmed that it has approached DTY with a bid proposal (not yet firm).

It’s very interesting actually, and outlines why it thinks DTY could be better developed in private ownership - with better access to long-term capital, and less public scrutiny.

This is another example of where low valuations, and regulatory costs & hassle are making public markets less & less appealing. Hence I think we’re in a new era where the number of public companies is likely to considerably shrink, as the best (and the worst) companies leave the public markets, through either takeover bids, or going bust/delisting due to lack of follow-on capital.

That should provide plenty of opportunities to make money from takeover bids, if you can identify probable bid targets in advance - much easier said than done!

DTY has had an unhappy time as a listed company. My view is that financial engineers tried to be too clever, loaded the company up with excessive debt, and tried to exploit vulnerable people (bereaved families). Then it was hit with regulatory action by Govt (good!). So it's one of the last companies that I would have imagined would interest a buyer, but who knows what they're planning to do with it once the glare of the public markets has been removed? There's obviously some angle that the buyers think can be lucrative, otherwise they wouldn't be trying to buy it.

.

Next (LON:NXT)

6600p (up 8% at 08:39)

Market cap £8.5bn

Amazingly, this share is up 51% from the recent low (in Oct 2022). It’s obviously the sector leader in terms of being so well managed, and providing the best and most timely guidance to the market. I always report on it here, so we have a benchmark to measure the small cap retailers against, and to provide ammunition to ridicule all their excuses for poor performance!

Next seems to have an uncanny ability to serenely navigate any macro conditions, no matter how bad.

Key points -

Christmas period sales “better than we anticipated”.

Profit guidance raised by £20m to £860m for FY 1/2023 (up 4.5% vs LY)

FY 1/2023 EPS guidance 567p (up 6.9% vs LY) - PER of 11.6 (at 6600p per share) - looks good value.

Cautious outlook - initial guidance for FY 1/2024 is PBT £795m (down 7.6% on this year)

EPS guidance for FY 1/2024 is down 11.7% to 501p (PER of 13.2, at 6600p per share) - with higher corporation tax being a significant impact - something we need to factor in at other companies (and check that broker forecasts have done so).

Sales growth came from the shops (+12.5% in Q4), not online (which was flat) - the opposite of the usual trend for online powering growth.

Strikingly strong sales growth in the cold weather in December (which drives demand for coats, etc)

Overstocked, so more had to be cleared at discounts in the end of season sale.

Cautionary note says that FY 1/2023 outcome is “almost exactly in line” with original guidance given in Jan 2022. So NXT says don’t assume guidance for FY 1/2024 is too cautious (which people apparently did a year earlier).

“Not anticipating a collapse in demand or any increase in bad debt…”, due to full employment.

Obvious headwinds to customer demand mentioned - inflation (esp energy), rising mortgage costs, and passing on its own higher costs.

Inflation outlook for NEXT products - peaking at c.8% in spring/summer 2023, then expected to fall to a maximum of +6% in H2. That’s encouraging, as previous guidance was for higher inflation in H2. “Cost pressures are now easing…” due to -

- Lower freight costs

- Lower factory gate prices (benefit from recent weaker dollar)

- Commodity prices lower (e.g. cotton, polyester)

- Surplus capacity in factories, due to slowdown in global demand

- New (cheaper) sources of supply.

That’s all confirming what we already suspected - that inflation has probably peaked, and is likely to fall in 2023. NXT says that the underlying reason for 2023 inflation is dollar strength, with a table showing the adverse forex movements compared with the prior year - remember that there’s a time lag, due to hedging.

Outlook for inflation in 2024 is a further move downwards, if the recovery of the pound vs dollar persists, and factory gate prices remain subdued.

Clearly all of this has widespread read-across to many other sectors, and is encouraging news.

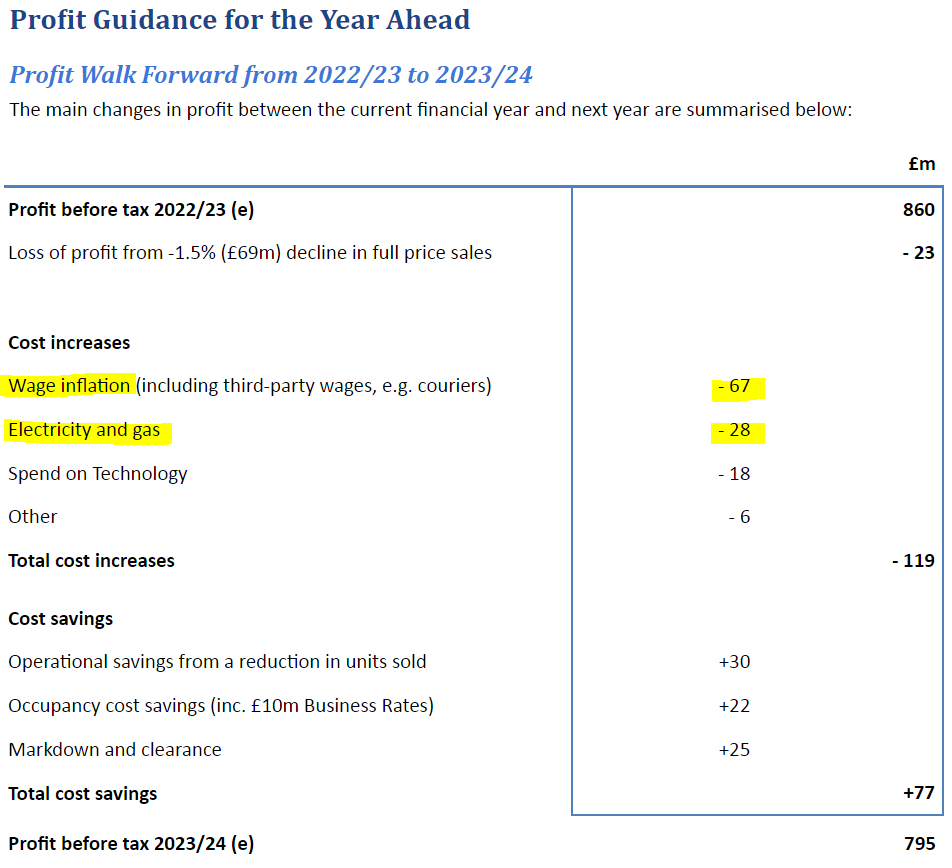

Inflation for overheads - wage inflation and energy costs are mentioned as the main problems, no surprises there. Energy is fully hedged for FY 1/2024, but “at rates significantly higher than the current year”. A superb profit bridge shows all the moving parts anticipated - isn't this fantastic, and it just shows what superb control management has over the business, to guide at this level of detail for the year ahead -

.

Corporation tax increase is obviously quite significant, and is expected to dent EPS by -6.8% for FY 1/2024, more than offsetting the +2.7% benefit of share buybacks.

My opinion - an excellent update, but we should now be valuing NXT shares on the lower 501p EPS guidance for FY 1/2024. The PER is 13.2, and I’m struggling to see why the valuation should be much higher than that, given the current macro position.

Also bear in mind that, despite being the best in class operator, NEXT is a mature business, and profitability is only really going sideways.

Therefore, I give the business overall a thumbs up, but in terms of valuation, it’s probably about right for now - maybe some traders might want to bank the big recent % gains?

An interesting angle on this, is whether online fashion has now peaked? NXT says its shops are recovering nicely, and I am wondering if consumers are getting tired of online shopping, and are more eager to return to physical shopping? Only anecdotally, but I had some interesting chats with family over Christmas, where the younger generation said they’re tiring of online shopping for clothes, and having to return so many items, one describing it as a “faff” compared with conventional clothes shopping, where you try things on, so usually don’t need to return things. Plus they think it’s more enjoyable, and more social, to actually physically visit shops. This theory seems to be backed up by the bombed out share prices of the whole eCommerce sector.

OR, are eCommerce shares oversold, and due a recovery? Who knows.

A final thought, I wonder if NXT could be a takeover target? It's a highly cash generative business, which financial buyers tend to like, so that's a possibility I'd guess.

EDIT: I see the strong update from NXT has given a boost to Sosandar (LON:SOS) which is a top-5 supplier to Next's third party brands online business. That doesn't make sense to me, since NXT said the growth has come from in-store, not online! Also I see Superdry (LON:SDRY) has also bounced today. SDRY is only operating a whisker above breakeven, so is highly geared to changes in demand.

Greggs (LON:GRG)

2450p (up <1% at 11:12)

Market cap £2.5bn

Let’s finish off my mid-cap early bird retailers reviews with a big fat pasty & a doughnut!

Greggs is a leading UK food-on-the-go retailer, with around 2,300 retail outlets throughout the country

Strong quarter ends a year of encouraging strategic progress

Robust financial position supports growth plans

Profit guidance - it’s as expected, in line with expectations -

Given our strong trading in the year, together with careful cost control, we anticipate reporting a full year outcome for FY22 in line with our previous expectations when we report our preliminary results for 2022 on 7 March 2023.

There’s no footnote to say what expectations are, and no research available on Research Tree. So using Stockopedia’s broker consensus of 118p (only slightly above LY actual), gives us a PER of 20.8x which looks punchy (as it nearly always does with this share).

Little change in EPS is currently expected by brokers, with it rising only slightly to 122p in FY 12/2023 - not very exciting, and not justifying a PER of just over 20, in my view. So shareholders must be expecting it to beat current forecasts.

Having said that, the update today is full of bullish points -

Superb LFL sales growth of +17.8% for FY 12/2022 - that’s the highest sales growth I’ve seen for any retailer so far. We’re not told the split between price rises, and volume changes. But it’s clearly showing that Greggs must be gaining market share, as it should, as pretty much the only remaining affordable fast food outlet out there. That’s a big competitive advantage. Places like Pret have become so expensive, that I’ve switched to Greggs myself, and I bet plenty of other people have (although Pret is launching a new value range of sandwiches, I see in the news today)

Store roll-out - it already has 2,328 shops, but is planning on opening c.150 net new stores in 2023, so there’s growth coming from there. I wonder what the maximum market size is?

Growth from online app, delivery services, later opening, and broadening product ranges, growth in veggie/vegan products, etc.

Absorbing inflationary cost pressures it seems, with the strong revenue growth compensating.

Shrugged off rail strikes and bad weather in Dec 2022.

It’s all about value for money - we’re seeing this with BME above, SHOE, and others - retailers that provide value for money products are doing fine, as customers trade down.

Cash of £191m is good, and last balance sheet is OK (not especially strong) in my view.

My opinion - this update sounds really good. There sounds continued growth potential at Greggs, and it really has very little direct competition - selling quite nice product, at very competitive prices. I think that’s clearly a winning formula, so there is an argument for over-paying for the shares, to get a slice of that delicious, calorie-laden pie.

So from me it’s a thumbs up for the business, but the valuation is at the top end of what I’d consider reasonable. Hence it’s going on my watchlist, not my buy list.

B&M European Value Retail SA (LON:BME)

447p (up <1% today at 10:34)

Market cap £4.5bn

That’s an impactful title for the announcement!

I last briefly reviewed this mid-cap value products retailer here in Nov 2022, on a solid H1 trading update. It had a tough Q1 (Apr-Jun 2022), but things improved in Q2.

What I find attractive about this share is - strong long-term growth, reasonable valuation, and quite good divis. Also selling value products from large sheds should be a resilient area of retail in tough macro times.

This is what it says today, for Q3 (13 weeks ended 24 Dec 2022) -

Q3 revenue up 12.3% vs Q3 LY

UK like-for-like (LFL) revenue up 6.4% at B&M stores (main part of the business)

France trading well, but not clear if +25% revenue growth has been helped by new store openings or not?

Heron Foods - similar thing, +23% revenue, but no info on LFL performance. Why not?

Supply chains flexible, and “executed well” in Q3.

Special dividend of 20p declared - that’s significant, at a 4.5% yield, and when you include the 5p interim, and maybe c.12p final (my guess, based on a small uplift on LY), that would be a total divi yield of 8.3% - terrific for income investors. Although I’m not sure what to make of this footnote -

The dividend declaration is subject to completion of Luxembourg regulatory procedures and will be subject to a deduction of Luxembourg withholding tax of 15%.

Profit guidance for FY 3/2023 is raised -

FY23 Group adjusted EBITDA4 (on a pre-IFRS16 basis) now expected to be in the range of £560m to £580m, ahead of current analysts' consensus estimate of £557m

My opinion - thumbs up from me. This seems a good growth business, reasonably priced. It did enjoy a boom during the pandemic period, but seems to have held on to most of those gains. Note that the forecast divis don’t include specials, which more than doubles the actual yield to over 8%. Hence very attractive to income seekers. It should also be able to continue growing, and I think value products will never go out of fashion.

I must do a mystery shop of my local store, that’s going on my to do list.

Angle (LON:AGL)

33p (down 31% at 12:23)

Market cap £86m

Business Update (profit warning)

ANGLE plc (AIM:AGL OTCQX:ANPCY), a world-leading liquid biopsy company, is pleased to provide a review of business progress, an unaudited trading update for 2022 and prospects for 2023.

Bad luck to holders today, with £39m wiped off the market cap in a 31% fall, triggered by this disappointing update. I try to report on all profit warnings, so we have a record of what happened, and sometimes there can be spectacular gains from the low points.

It starts off by reiterating the positives of this development project (it’s still largely pre-revenues, and heavily cash-burning).

A fundraise of £18.9m (net of fees), and cost-cutting, means it claims today to have enough cash to last until H2 2024.

R&D has been centralised in the UK, with Canadian operations closed, due to favourable UK R&D tax credits.

Decision to outsource some analysis to third party platforms (to save money).

Cost-cutting will save £2.6m in 2023, and £4.0m pa thereafter - not enough to make that much difference.

“Impact of wider market conditions” has slowed down commercialisation, although it now has FDA clearance (which took over 6 years to achieve).

2023 sounds like it will be another year of preparation for growth, rather than actual growth!

Cash at end 2022 in line with expectations at £32m, with no debt. Not bad for an £86m market cap company, but bear in mind the cash is all likely to be spent in 2023 and 2024.

Heavy loss of £22m expected for 2022.

Revenue for 2022 below expectations, as some sales were delayed, but this is immaterial overall, as only £2.0m revenues were expected in 2022.

Demand - has softened as macro conditions mean customers are being cautious.

Revenue for 2023 - strong growth expected, “but likely to be materially below current market expectations” (which are only £5.9m, so revenues likely to be very modest again in 2023, and continuing heavy losses & cash burn).

Growth opportunities are explained in some detail, which I won’t repeat here.

My opinion - Angle has always struck me as a plausible-sounding project, not that I’m fit to judge, having no medical knowledge.

The trouble with this type of share, is that development takes many years, and cash burn is a recurring problem. Thankfully AGL got a fundraise away just before the window was slammed shut by Mr Market. So it’s OK for the time being, but realistically, it’s likely to be looking for more money in about a year, in preparation for running out of cash again in 2024.

So risk just got considerably worse, after today’s news that commercialisation is not happening any time soon.

This looks risky to me, but there’s always the remote chance it might do well. People have been saying that ever since it listed in 2004, and all that’s happened so far is massive dilution from repeated fundraises, and losses that seem to worsen every year.

The problem with this type of share, is if it does hit the jackpot commercially, someone will just come in and buy it, taking away the upside. So we have to take all the risk, and fund the project over a huge timeframe, but someone else gets the benefit if it does work. Maybe I’m too cynical about this type of share, but they can make good speculations in a bull market, but the long-term holders are rarely rewarded, because the dilution has eroded so much of the upside along the way.

Almost 20 years this has been listed!

Graham’s Section

Mattioli Woods (LON:MTW)

Share price: 632.2p (+0.3%)

Market cap: £324m

This is a “specialist wealth management and asset management business”. It offers a wide range of services across retirement accounts, business planning, employee schemes, insurance, etc.

We don’t usually cover it in this report. However, it has a very high QualityRank, so perhaps we should? Let’s take a closer look.

Today brings an in line with expectations H1 update for the period ending November 2022. Key points:

2% fall in client assets.

Organic revenue growth 2%.

Total revenue +10% (due to acquisitions) to £54.9m.

Organic revenue growth that’s below inflation is never very encouraging, but we have to bear in mind the effect of falling stock markets on a company like this. Mattioli earns both fixed fees for the advice and services it provides, and asset-based fees that are a function of its clients’ portfolio values. So when markets are falling, Mattioli shares in the pain.

The outlook for H2 revenue is better: there’s usually a seasonal H2 weighting as clients organise their affairs and need extra help around the end of the tax year (H2 ends in May).

The company also indicates that its management fees will be higher in H2 thanks to “market value improvement”, which I guess refers to an increase in average asset prices compared to H1.

The full-year revenue estimate is £116.5m, i.e. H2 revenues are expected to come in at £61.6m. This forecast is left unchanged by the analysts at Singer, whose latest note I’ve managed to get a copy of today.

Reasons for optimism

There are several points in this trading update that strike me as positive:

The company’s “discretionary” AUM fell 4% in the period but this was due to falling asset prices, not clients moving their money out. The company enjoyed net inflows from clients during the period, as inflows were slightly higher than outflows.

Acquisitions are performing “in-line or ahead of budget”.

Strong cash position of £38m. No borrowings.

CEO comment

The outlook for bottom line profitability seems resilient, as the CEO confirms that Mattioli ”maintained profit margins through prudent cost management and in realising further operational efficiencies”.

The adjusted PBT estimate for the current year is £30.8m, a 5% increase on last year.

My view

I’ve repeatedly pointed to the fund management companies as a nice sector in which to bet on a stock market recovery. Perhaps Mattioli, despite being involved with many other activities in addition to asset management, could also offer decent upside when markets recover?

For example, Mattioli owns 49% of Edinburgh-based Amati Global Investors, the boutique fund manager.

Amati is a small-cap investor whose £700m ”UK Listed Smaller Companies Fund” has fallen 23% over the past year. Top holdings include Osb (LON:OSB) , accesso Technology (LON:ACSO) and Craneware (LON:CRW) . I would expect this fund to participate in a small-cap rally, whenever it arrives!

I’m also encouraged by Mattioli’s track record when it comes to M&A: it has reportedly made nine acquisitions in the last 2.5 years, and all of them are doing well, and all of them “delivered earnings to support full payment of any contingent consideration, building upon our track record of 34 successful acquisitions to date”. Sounds good!

The company is still led by its co-founder Ian Mattioli, who retains a 6% stake. According to Stockopedia, Mr. Mattioli is still only 59 years old. It’s always nice to see a successful, founder-led business on AIM.

In conclusion, I’m inclined to take a positive view on this company. As for the stock, I think it may offer an opportunity at these levels, as it has fallen 27% over the past year and now offers a healthy yield and an average earnings multiple. Remember that it has plenty of cash, too, which gives some extra comfort:

Glenveagh Properties (LON:GLV)

Share price: €0.82 (-7%)

Market cap: €584m

We’ve never discussed this one before - but why not take a quick look? Please note that despite being listed on the LSE, this one is quoted in Euros and cents.

Glenveagh is “one of Ireland's leading homebuilders… focused on delivering high quality homes in flourishing communities.” It develops suburban houses, urban apartments and other government-partnered construction projects.

Here are the highlights from today’s full-year update, which includes a profit warning for 2023.

Revenue +36% to €649m

1,354 suburban units closed, +50% higher than the number of units closed last year.

Slight reduction in gross margin from 17.4% to below 17% (input cost inflation mostly being passed onto buyers!).

Profits for 2022 are in line with expectations:

Operating profit €70m (last year: €50.6m)

EPS consistent with guidance at 7.6 cents.

Landbank value decreases to €465m, “with further reductions anticipated”.

FY 2023 update

The forward order book of 408 suburban units contracted or reserved for the current year does not sound like it offers much growth for the company this year.

Indeed, if we do a like-for-like comparison with last year’s trading statement, the company had 605 suburban units in the order book then.

The company confirms that it’s not expecting suburban unit growth this year:

…planning delays will have a near term impact on suburban unit completions for FY 2023 and in this context we now anticipate suburban unit deliveries in line with FY 2022 levels

The company had previously anticipated that suburban unit deliveries would increase to 1,700.

EPS is also now expected to stay flat in 2023. The StockReport suggests that EPS growth had previously been pencilled in:

Buybacks - the company apparently believes that it is undervalued, and that it has more cash than it needs.

It already reduced its share count from 772m at the end of 2021, down to 638m at the end of 2022, spending €145m in the process. For a company of this size, that’s a very big buyback!

Today it announces that it will buy back up to another 10% of its shares, i.e. another 64 million shares could be bought back.

Note that the company does currently have a small net debt position (“less than €15m”).

CEO comment - the CEO is clearly unsatisfied with the planning delays, describing planning policy as “dysfunctional” and calling for reform, “to solve the longer term structural supply issues”.

20% of the units which Glenveagh previously planned to deliver in 2023 are now more than 10 months late in receiving planning permission.

Outlook

The company still believes that it can deliver 2,000 suburban units in a year, and it still wants to achieve ROE of 15% by 2024 - this explains why it needs to buy back lots of shares, to reduce the denominator in the calculation!

The Group has a very healthy land portfolio and continues to have strong confidence in its capacity to achieve its 2,000 suburban unit target, as well as the continued delivery of urban projects and first revenue from its developing Partnerships business for FY 2024. We will also continue to focus on generating greater balance sheet efficiency which supports our confidence in achieving a Return on Equity of 15% by 2024.

My view

My interest has been piqued in this one. The size of last year’s buyback stands out, and the fact that the company is planning another one.

As things stand, if they aren’t investing too much in land, then they might not be overstretching themselves and taking on too much risk, and the buyback strategy could turbo-charge EPS over the next few years.

Your view on the overall property market is of course another important variable.

First-time buyer rules in Ireland have changed this month, meaning that lenders can now offer up to 4 times household income as standard (for several years, this was stuck at 3.5 times!). I think this will do a lot for homebuilder margins, as a couple on (say) €80k can now immediately increase their house buying budget by €40k.

Of course the point of the policy is not just to increase homebuilder margins. It’s also supposed to do things like increase supply! And supply depends on other variables including, as pointed out by the Glenveagh CEO, the planning process.

I’ll sit on the picket fence when it comes to Glenveagh, as I need to learn more about them. But my initial impressions are positive: they have maintained decent margins during an inflationary period, their developments are attractive, and they are focused on achieving a strong ROE (even if that means accepting some financial risk).

At a discount to tangible book value and a P/Sales multiple of 1x, according to the StockReport, I think this could be interesting.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.