Good morning from Paul & Graham!

Today's report is now finished.

Podcast - covering last week's SCVRs went up on Saturday morning, here (and on podcast platforms). I'll type up a separate article about the macro news/views section of my podcast, but for the individual companies, all you need to do is refer to my weekly summary spreadsheet (I'll put the link in at the end of this report, and if of interest, please bookmark it).

12 more value/GARP shares ideas for 2023 - I published this new article last night, as a follow up to my previous article from 8 Jan 2023, listing my favourite 20 value/GARP shares. Readers seemed to like this format, hence why I wrote another article - we do like to give you more of what you vote for with your online thumbs ups. Incidentally, wasn't it a great idea to remove the thumbs down facility - the site's so much better without all that negative energy, and the kerfuffle it used to trigger!

In a similar vein, Graham wrote up his best ideas for 2023 here on 16 Jan 2023, in case you missed it. As always, we've just flagging up share ideas for you to properly research. As we covered 533 companies in the SCVRs last year, it stands to reason that we can't possibly do all the research into every one - please remember our reports are just initial reviews, so you need to always do your own, much more detailed research. That's what we firmly believe, it's not just a disclaimer.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

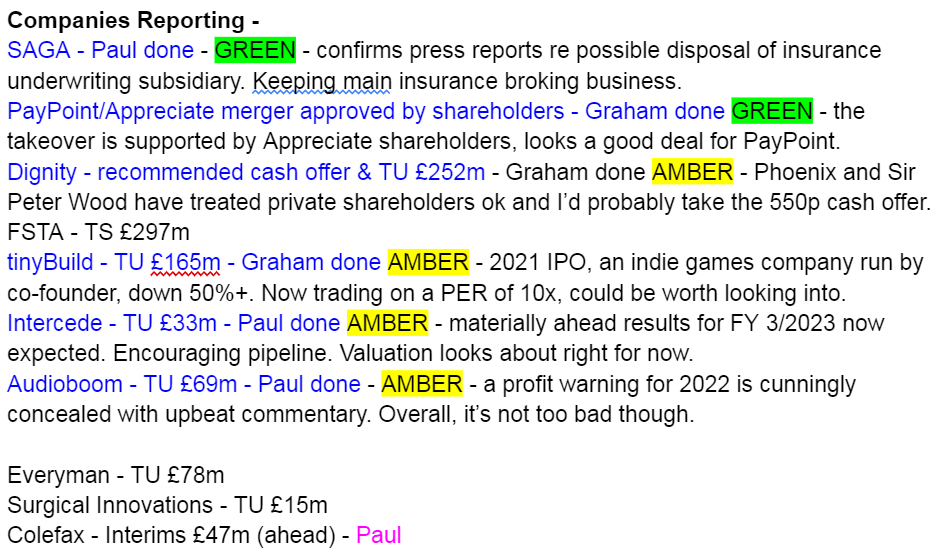

Agenda/Summaries

We didn't manage to cover everything today, but I'll circle back to Colefax tomorrow, as we like that share.

As always, do let us know in the comments, if we've missed anything significant. We don't always cover "in line" updates, as they're not price-sensitive.

Paul’s Section:

Saga (LON:SAGA)

150p (pre market) £211m mkt cap

The weekend press (Times) reported that Saga was trying to find a buyer for its insurance underwriting business (which is smaller, and less important than its retail insurance broking business, remember).

Saga responds today - confirming that it is in discussions for this disposal, which if it goes ahead would, it says: reduce debt, crystallise value, and enhance long-term returns.

My opinion - most of the insurance division profits come from the retail broking part, which is being kept. I’d be happy to see risk reduced by getting rid of the underwriting business. This news doesn’t strike me as particularly price sensitive, and if they can get a decent price (I think the Times mooted c.£90m) then that would take a nice chunk out of the net debt, which some investors find excessive (and mgt has previously said it wants to reduce debt from cashflows).

Intercede (LON:IGP)

71p (up 25% at 08:36) - mkt cap £41m

A strong rise in share price today for a positive trading update from this interesting company that specialises in digital identities for mainly blue chip & Govt organisations.

Positive momentum has continued, and it now expects to report FY 3/2023 results with revenue 5-8% of market forecast (£11.3m, so new guidance is £11.9m to £12.2m.)

Adj EBITDA is expected to be “materially ahead” of £0.6m forecast.

H1 revenues were £6.1m (up 24% on H1 LY), so it looks as if H2 is on track to be about the same as H1.

I’ve no idea why IGP quotes EBITDA, because investors usually assume this will be an inflated number, especially at software companies, because they often capitalise a ton of payroll costs. However, IGP doesn’t do this, so it would be far better off reporting profit after tax (PAT), which would show the benefit of tax credits. Also, EBITDA isn’t mentioned at all in the interim results, so it’s difficult for me to tie in today’s update with the H1 figures. I’ll email the company to point out this sub-optimal reporting!

Thankfully Finncap clarifies things with an update note today (many thanks), saying that it’s upped FY 3/2023 adj PBT from £0.2m to £0.6m. It’s also slightly raised next year from £0.6m to £0.8m adj PBT. Quite small profit numbers for a £41m market cap.

Outlook - encouraging, I’d say - because mgt tend to be quite conservative in the messaging, hence I would assume there’s a reasonably good chance these deals might close, otherwise they probably wouldn’t have been mentioned -

The pipeline of new business continues to grow, and the Group has several further contract opportunities that could close before the fiscal year end.

The integration of Authlogics (as announced on 10 October 2022) is on track and embedding well.

My opinion - Intercede has an astonishing client list of very sticky major clients. However, it's struggled to generate meaningful growth.

It invoices mainly in dollars to US customers, but costs are mainly in sterling, so I think this would have been a significant benefit in a year when sterling has mostly been weak (although recovered somewhat more recently).

In valuation terms, I think the price looks probably up with events for now. Maybe investors are anticipating another beat against forecast, if the deals mentioned are indeed closed by year end?

The bull case is that, with almost 100% gross margins, if IGP can really accelerate growth by winning big new contracts, then it could be transformative for profitability. I’d been patiently waiting 4-5 years for that element of the turnaround strategy to happen, but lost interest, so I'm just watching from the sidelines for now.

Audioboom (LON:BOOM)

405p (down 4% at 11:33) - mkt cap £66m

Audioboom (AIM: BOOM), the leading global podcast company, is pleased to provide a trading update for the 12 months ended 31 December 2022.

I’m not at all happy with the way this update has been presented. It trumpets strong growth - revenue up 25% to $75.5m, and adj EBITDA up 16% to $3.6m, but it is then revealed in a broker note from Finncap (many thanks) that this is c.10% short of previous forecast, so it’s actually a cunningly concealed profit warning!

H2 revenue is $34.6m, down 15% on H1 - they don’t flag that in the TU today, funny that!

H2 adj EBITDA is $1.6m, down 20% on H1.

So I think we’ve established that this is a heavily PR-d announcement, cherry picking figures that are up, and obscuring numbers that are down. That really puts me off from investing, as I like companies that are straight with investors, not ones that PR the announcements to obscure the truth - in this case, that it’s a disappointing outcome, below forecast.

Cash looks good though, at $8.1m (up from $3.0m a year ago), plus an undrawn $1.8m overdraft. Although note it had risen to $5.8m at the half year. I had previously flagged excessive receivables at BOOM, so it looks as if some of that might be turning into cash, which is moving in the right direction.

I covered BOOM in more detail here on 17 Oct 2022, a lot of which is still relevant.

CEO & Chairman comments are bit more realistic, including -

...but ultimately our performance was restricted by global economic headwinds which negatively impacted the wider advertising market…

We are focused on ensuring that the Company is structurally resilient, and I am pleased to report a record year-end cash position of US$8.1 million - critical during uncertain economic periods. We continue to focus on controlling costs, operating with a lean team, to ensure we can deliver maximized profits for shareholders in 2023.

Across 2023 we will restructure our sales organisation, ensuring we remain competitive at the top end of the podcast industry. Despite the continued uncertainty in the advertising market, we have made positive progress, having secured more than US$44 million in advance advertising bookings for 2023…

I am confident that the business is not just showing good resilience, but is moving forward, fully primed for further growth as the advertising market improves across 2023."

My opinion - I would have preferred a much more honest form of reporting, which should have said, look advertisers are reining in their spending due to macro factors. But, we’ll be fine because we’re low gross margin, so not much operational gearing, and we can trim our central costs. And we’ve got enough cash, so won’t need to dilute shareholders. We’ll do better when ad markets recover.

Instead, I’ve had to ignore the prominent sections of this update, refer to a broker note for the reduced guidance, and (whatever the opposite is of cherry-pick) the realistic bits out of bullish commentary, to piece together the truth. That leaves a negative impression, and only defers a negative share price reaction.

Overall, it’s an OK business, a decent turnaround I think in the last couple of years, under new management, from a previous basket case.

Valuation is the tricky bit. The price has crashed, along with tech valuations generally. Is it cheap now? That depends how you look at it. To me, the market cap of £69m looks reasonable, and as mentioned before, it might be a bid target at some point, doing most of its business in the USA. So overall, I'm neutral on this one.

Graham's Section:

PayPoint (LON:PAY) and Appreciate (LON:APP)

It’s farewell to Appreciate as a listed, standalone business as the shareholders of Appreciate vote to accept the proposed takeover. In the end, only 1 million shares (out of 186 million total outstanding shares) voted to reject the deal.

There are still some conditions to be satisfied but normally these are just a formality, after the FCA and shareholders have both supported the deal. The whole thing is expected to close by the end of March 2023.

I remain intrigued to see if PayPoint can wring some proper synergies out of this takeover. As I said last week, it strikes me as more of an opportunistic bid for a familiar company that had fallen out of favour in the stock market, rather than a truly synergy-driven deal. But we shall see. I do think it’s clever business by PayPoint and it increases the attractiveness of PayPoint shares as a value investment. See the metrics already on offer:

Dignity (LON:DTY)

Share price: 545p (+8%)

Market cap: £273m

Let’s check out the big news here first. Dignity shareholders are being offered 550p per share to relinquish control of the company.

That’s merely 9% higher than the share price as of last week, but it’s 29% higher than the share price which prevailed on January 3rd. That date is relevant because it was on January 4th that an official announcement was made regarding a “possible offer”.

So the trading in Dignity shares since then has been on the basis that an offer was possible or likely - here’s the 1-month share price chart:

Paul covered the Jan 4th announcement in some detail here, noting that proposals from the buyers had been made as far back as October 2022, but nothing was announced to the market until January.

Indeed, this is now at least the fifth bid proposal from these buyers: 475p, 500p, 510p, 525p, and now 550p. I wonder what they really think it’s worth?

Offer detail - under today’s proposal, DTY shareholders can choose to receive unlisted shares in the new Dignity holding company. Alternatively they can choose to receive listed shares in Castelnau (LON:CGL), an investment vehicle managed by Phoenix Asset Management.

The buyers - the proposal has been brought by a consortium consisting of Sir Peter Wood’s investment vehicle, an investment vehicle managed by Phoenix, and Phoenix themselves.

These are the same people who built a 58% position in Stanley Gibbons and then demanded that it go private, threatening to withdraw their financial support if it did not.

They are good, shrewd investors and I’m not sure that I’d want to be on the other side of a trade with them, to be honest.

Any Hornby (LON:HRN) shareholders must be aware that Phoenix owns a majority of that company and delisting risk at that company must be very significant indeed.

Phoenix understand very well that public, listed markets are often not the best environment for businesses to grow and prosper, particularly if surgery is needed. Here is an excerpt from their explanation as to why they Dignity should delist:

…under private ownership, Dignity will not only have access to patient, long-term capital, but also a supportive environment for management to implement its current strategy, ahead of an envisaged medium-term exit.

…Dignity's strategy will be enhanced through access to a significant level of investment to expand organically through increased marketing investment in its new funeral plan products, upgrading and modernising of physical infrastructure, further investment in its workforce and technology, and strategic expansion of its crematoria portfolio. Bidco will also provide Dignity with the financial support to grow inorganically by taking advantage of acquisition opportunities as they arise at attractive prices, given the current uncertain market environment.

So why couldn’t Dignity do all of these things as a public company, I hear you ask? That’s a good question. For the answer to that question, let’s switch over and take a look at today’s full-year trading update for 2022. Highlights:

Underlying revenue £275m (2021: £312m).

Underlying operating profit “no more than £20m” (2021: £55.8m).

Cash of £8.5m, net debt £508m (excluding IFRS 16 liabilities).

Commentary - the comments are uninspiring. There are “early signs of increases in market share growth” and “progress in addressing operational challenges”, but against that:

…performance continues to be impacted by changes in pricing strategy and the continued shift towards lowered-priced products, despite higher-than-average death rate persisting post-COVID 19.

Furthermore, excluding the impact of the lower promotional expense, the cost base of the Group has increased in the year because of planned investments across the estate and in facilities, as well as ongoing increases in regulatory and operational costs which have been partly driven by macroeconomic factors.

Bondholders have consented to waive covenants, a typical sign of financial stress.

So it’s not hard to understand the argument that Dignity, as a listed company, will be unable to fund the various investments it might like to make in the short-term. It’s highly indebted, low on cash, and profits are shaky. And this is not a good environment in which to raise new equity.

Here’s a snapshot of recent profits and losses:

My view

Given the amount of debt involved, I would be inclined to cut my losses here, as a Dignity shareholder (or take profits, if I was one of the lucky few sitting on a profit).

What can we learn from this? Maybe we need to be even more careful of the “value” opportunities the market often throws at us. More often than not, there’s a hidden risk lurking under the surface. The risk could be something as mundane as delisting risk - either because the company is too small to justify its listing expenses, or because the major shareholders want to turn it around themselves, away from the glare of the public markets.

Before buying any shares, I think a good question to ask is: “why is this company listed?”. If you are dealing in very small or troubled businesses, the answer might be unclear!

In this particular case, Dignity shareholders do have the option to take listed or unlisted alternatives to the 550p cash offer. So again, Phoenix have done more than the bare minimum they were legally required to do, for the benefit of smaller shareholders. Taking shares in the listed investment company Castelnau could be an interesting choice for some.

tinyBuild (LON:TBLD)

Share price: 80p (-1%)

Market cap: £163m ($202m)

A reader asked me to check this one out, so here we go!

TinyBuild is a publisher of indie (independent) video games, so it’s probably similar to Team17 (LON:TM17). It listed in March 2021 at 169p, and is now down by the customary 50%+.

Let’s see the highlights from this full-year trading update. FY 2022 is described as “a challenging year”:

Revenue in line with expectations, adjusted EBITDA “broadly in line” (usually means lower).

Cash finished over $25m, “impacted by timing of M&A and higher development spending on new titles, both announced and unannounced”.

Adjusted EBITDA reflects “a greater investment in marketing to accelerate revenue growth”.

A few small financial disappointments here, evidently. More positively, the games portfolio is said to have diversified into new genres, and the revenue sources have been diversified too.

As these are indie games, it’s no surprise that I’m unfamiliar with all of the titles mentioned in this update.

Staff - a remarkable increase in headcount from 147 at the time of the IPO, to over 500 now.

Outlook

Early indicators of positive consumer traction across the Company's diversified portfolio and pipeline are very encouraging, and the Board looks ahead to FY 2023 with confidence.

CEO comment - he mentions taking a “decentralised approach” to management, and “building something to outlive us as a generation”. Sounds interesting! I would also note positively that he is a co-founder of the business and is the largest shareholder (38%).

(On a side note, he also lives in the Netherlands and “doesn’t have any citizenship on Earth”. TinyBuild is headquartered in the US State of Washington and operates internationally.)

My view

I would need to build more familiarity before taking a view on this, but it sounds like it could be worth digging into.

According to the StockReport, there is a pleasing trend of rising revenues and profits, and the shares are only trading on a PER of about 10x.

Link to SCVR spreadsheet summary (which I update every day). There's no need to "request access" - you can view it just using the link, and bookmark, save a copy locally, if you find it useful. Please don't share outside of Stockopedia, as it's intended as a service specifically for subscribers here. Thanks!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.