Good morning from Paul!

I've got a bit of catching up to do today, so you have my full & undivided attention until at least 13:00, possibly longer.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

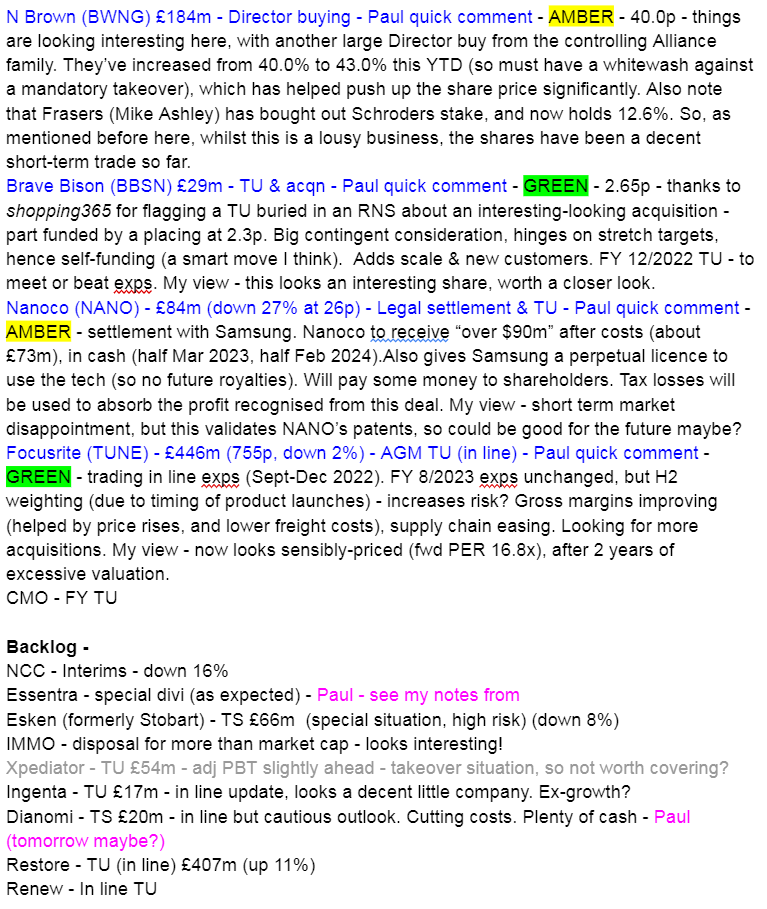

Agenda/Summaries -

I'll aim to look at some of the items in the backlog section from previous days this week -

Paul's Portfolio Now

This started off as a reply to a reader comment, but it's probably worth repeating here as a main section.

People might be interested in my current holdings, since I recently deployed some spare cash from a successful bid at BUMP.

As always, it might shock you that I'm taking a fair bit of risk here, but just because I write a value/GARP column, doesn't mean I have to invest my own money in the same way! So here goes (initially a reply to joshwood's comment below)

Yes good idea, I can do an updated list of my own personal holdings. It would be quite easy now, because (as mentioned numerous times here & in my podcasts), I capitulated with my spread bet accounts last year, and closed them. Now I'm just concentrating on ungeared investing, so smaller positions, and less risk. The plan being to just gradually rebuild, rather than shoot for the moon & the stars again, before burning up on re-entry, which is the story of my life to date! ;-)

Actually, let's do it now, it won't take long - my current portfolio, positions in descending size order (so BOTB is my largest holding), with reasons -

Some of these are quite recent purchases, from the proceeds of selling my Seraphine (LON:BUMP) shares (takeover bid in progress, but I gave away the last 3% in order to grab some opportunities where I see more immediate upside (and so far so good))

In size order, largest first -

Best Of The Best (LON:BOTB) - I'm very impressed with the most recent update - interims, reviewed here. Business has now stabilised after the pandemic boom. Cash in bank, pays generous divis/buybacks, fwd PER is only 8.5, so under-priced as it is now. But international growth through Tedi Sagi's 30% investment is the exciting bit, which could transform things for the upside. If BOTB's cautious management don't want to run fast enough, then maybe Sagi might bid for the whole thing? Risk:reward looks tremendous to me, but might need to be patient. Intended holding period - 2 years to begin with, but depends on newsflow.

XP Factory (LON:XPF) - more speculative, but I really like the concept of experiential leisure, and think the Boom Battle Bars concept is a winner. Very rapid roll-out done in 2022. In line recent update. Should out-perform regular bars. I think a consumer recovery is coming in 2023 or maybe 2024, so good upside from a bombed out sector maybe? Some risk, as cash looks tight, but it can safely run existing bars for cashflow (EBITDA positive now), and some are franchised, lowering risk. Great deals from landlords, who prefer this concept to regular bars, big reverse premiums cover most of the fit-out costs. Switched-on CEO.

WANdisco (LON:WAND) - bit of a punt. Mentioned a lot in SCVRs. Something big seems to be happening, with repeated, large contract wins in the last 6 months. Huge market cap for a loss-making co with a terrible track record. 3 out of 5 major shareholders (including shrewdie Richard Griffiths) are adding (recently). So this has credible backers (including USA funds), not a bulletin board ramp. Has amazing momentum at the moment - buyers are catching every dip.

Revolution Bars (LON:RBG) - a recent purchase at 6p. I'm worried about bank debt taken on to buy Peach Pubs, but am hoping that the bank might remain co-operative. Wobbly recent trading at core business, but good at Peach. Tiny market cap is the main attraction here, so just a shorter term trade on trading improving, which could make it return to 20p, a 3-bagger, possibly? Also, energy cost headwinds could become a tailwind, if current trends continue. Horrible sector, might gain market share as competition goes under? So quite high risk:reward here, not for widows/orphans. I've gone into it with eyes wide open, so it won't kill me if they have to do another discounted placing, which is main risk.

hVIVO (LON:HVO) - another recent purchase, covered in SCVR 25 Jan 2023. Readers got me onto this one, and I'm impressed with the latest update, big contract wins, moved into profit. All suggests something interesting is going on here, and claims to be world leader in its niche. CEO seemed a bit over-excitable in recent webinar! But with contracted order book covering nearly all 2023 forecast, looks set up for trading ahead exps updates.

Beeks Financial Cloud (LON:BKS) - a long-standing position, covered frequently in the SCVRs.

Watkin Jones (LON:WJG) - builds student housing, and build to let. Forward-sells projects, so little balance sheet risk. Demand returning from institutions, after wobbles caused by political shenanigans last autumn. Expect soft H1 2023, but after that should do well. Cheap on fwd PER & divi yield, lower margins for a year or two, but that's all baked into forecasts. I think shares could double/triple on a 2 year view.

Portmeirion (LON:PMP) - just too cheap, and performing well. Could be a doubler if things go well?

Cambridge Cognition Holdings (LON:COG) - longstanding position, I remain positive about it, long-term holding.

MJ GLEESON (LON:GLE) - my favourite housebuilder, bounced, but still cheap. Builds very affordable houses that are likely to remain in demand. I'm looking through likely soft patch in H1 of 2023. Could be a doubler, once economy back on track in 2024 or beyond? Amazing bal sht, so no risk, even in a bad recession (looking less likely now).

Oxford Biodynamics (LON:OBD) - just a punt, after they got a placing away at a premium. Low conviction, but small enough to not worry about this holding.

Please don't rush out and buy any of these without doing your own research. In fact, some readers might decide this is a good list to open short positions on, which would have served you well with my main share picks after the market peaked in about summer 2021!

So rather than just buying back my old stuff, I've mostly picked new ideas.

Anyway, I hope that's interesting, and gives you some ideas to research.

I've got a list as long as my arm of other ideas to invest in, so see my spreadsheet here of 2023's best value/GARP watchlist ideas from me - some of which will do well, others won't, which is what I expect to happen. Note the "Speculative" tab is fanning out quite strongly with some doing well, and some doing badly. But the main 2 tabs are up 12% YTD, because we're currently in a bull run for small caps, so they're just rising with the market I think. No stock-picking genius involved, I could have picked anything!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.