Good morning! I'm in London for the next few days, so am "enjoying" the constant noise from scaffolders, emergency services sirens, the appalling noise from binmen crashing around with wheelie bins & emptying recycling bins full of bottles, and fat women with pushchairs who decide to stop right outside my window and have a chat, which basically involves them bellowing at each other at the tops of their voices. Joy. So what with all that, and a bit of a red wine hangover, I'm not in the best of moods today. Still, at least I have the delight of a Chilango burrito to look forward to for lunch!

Blur (LON:BLUR)

Share price: 54.5p (down 33% today)

No. shares: 47.1m

Market Cap: £25.7m

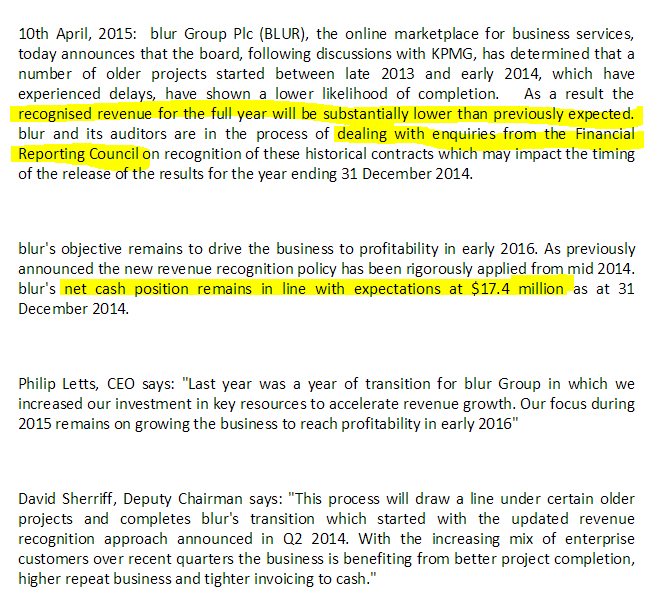

Profit warning - it's becoming increasingly clear that this company's name is also an apt description of their approach to accounting. They have run into revenue recognition problems several times before, and it's happened AGAIN today. Today's announcement has left me speechless;

My opinion - this company has absolutely zero credibility now. I've always been highly critical of it, as the figures to date have been so bad, but I went slightly wobbly on it (i.e. toying with the idea that they might have something worthwhile?) after listening to an upbeat presentation from the new FD at an investor show in Feb 2015. It now seems that my notes from that presentation can safely be filed in the tray marked (polite version) "nonsense".

The company last reported net cash of $24.4m at 30 Jun 2014, and today says it was down to $17.4m just six months later, so that's cash burn of $7.0m in six months, and implies there is enough cash to last until about Mar 2016. So the begging bowl is likely to come out, yet again, in late 2015. I'll be amazed if anyone is prepared to refinance this company again. So it stays on my bargepole list, with the most likely outcome being insolvency in 2016, in my opinion.

Yet another jam tomorrow story stock that is dismally failing to deliver on the hype. AIM is becoming (or has become?) a complete joke, with practically all of its jam tomorrow stocks doing disastrously badly.

If I held shares in this crock, I'd take off the rose-tinted glasses, and ditch them without hesitation after today's announcement. With a Stockopedia StockRank of only 5, you can see why it's best to steer clear of over-priced junk like this.

Bonmarche Holdings (LON:BON)

Share price: 261p (down 5.4% today)

No. shares: 50.0m

Market Cap: £130.5m

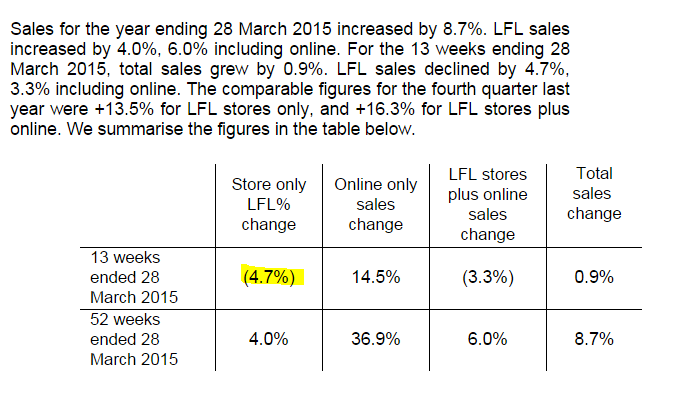

Trading update - for the 52 weeks ended 28 Mar 2015. This low priced ladieswear retailer has run into very strong comparatives in Q4 of last year (up 13.5% LFL ["Like For Like"}), and has delivered a comparatively poor sales performance in Q4 this year, down 4.7% LFL (stores only, partially offset by a good performance from online sales), as set out in this table;

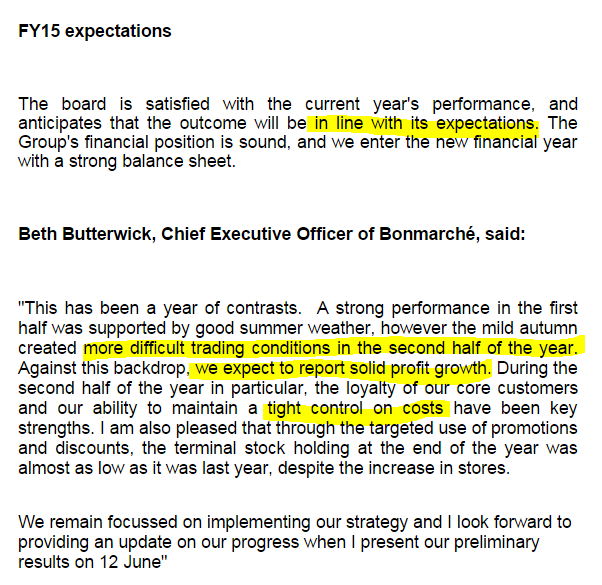

Outlook - I'm impressed with the company's commentary (below). Being able to report results in line with expectations, despite a disappointing sales performance in Q4, is no mean feat;

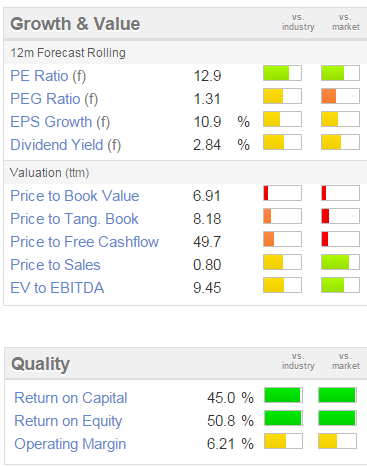

Valuation - this is not a great quality business, so to my mind it should be priced on a PER of about 10. The price has come off quite a bit, but is still a bit above my target buying price of c.200p;

My opinion - I've been saying for a while that it was fully priced, but it's coming down nicely now, so who knows, I might get a chance to buy at a sensible price in due course? Actually, it's not really a stock that I want to own, so the price would have to be very keen to tempt me in. Maybe a PER of 8, thinking about it a bit more, which is c.170p per share. I can't see any reason to pay more, especially since the latest LFL sales figures are now negative. If that continues, then it must hit profits.

Laura Ashley Holdings (LON:ALY)

Share price: 29.13p

No. shares: 727.8m

Market Cap: £ 212.0 m

(at the time of writing, I hold a long positon in this share)

Preliminary results - for the 53 weeks to 31 Jan 2015 were published at 14:38 this Friday afternoon - I'm unhappy with this on three fronts:

Firstly, I was winding down for the weekend, so it is inconsiderate of the company to publish its results at this time.

Secondly, announcing results during market hours is unfair on shareholders, some of whom will be able to read & digest the results quickly, and hence gain a competitive advantage by buying more, whilst other shareholders may not read the results until the weekend and might have to pay more on Monday morning to buy shares.

Thirdly, this is the first time the company has informed the market of how it has traded, since its interim results on 5 Sep 2014 - that's far too long a gap to leave shareholders in the dark, and it should have put out a Xmas trading update.

Key points;

Anyway, setting those grumbles aside, these figures are a pleasure to read, and seem positive on almost all fronts;

- LFL sales up 1.3% for the full year - reasonably good

- Profit before tax up 14.6% to £23.5m

- Adjusted EPS up 22.1% to 2.43p (beats consensus EPS forecast of 2.1p by 15.7%)

- Net cash of £27.8m (3.8p per share, 13.1% of the market cap)

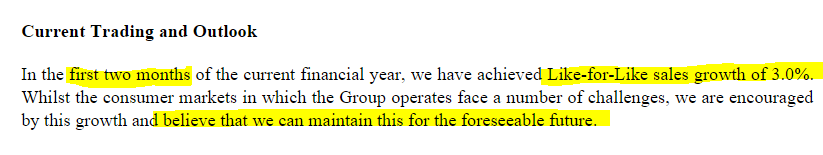

- Current trading is stronger - at 3.0% LFL sales growth for Feb- Mar 2015

- Total divis of 2.0p maintained, giving a tremendous 6.9% yield

- Online sales growth was good, at +8.6%, now totals 16% of all sales

- Balance sheet is sound, with £43.9m NAV, and £41.9 NTAV (writing off intangibles)

- Pension deficit has risen from £8.8m to £17.8m

So clearly all of those points are positive, apart from the very last one, which is negative, but unavoidable.

Valuation - the most appropriate EPS figure to use for valuation purposes is the 2.43p adjusted EPS, so at 29.13p the PER drops out at 12.0, which strikes me as being a bargain, given that the company is trading well, and profit growth this year should be good.

Cantors has upgraded its 2015/16 EPS forecast from 2.3p to 2.45p, which strikes me as very conservative. I'm pencilling in between 2.7p to 3.0p EPS for this year. If you adjust out net cash of 3.8p per share, and go with my forecasts, then the cash neutral PER would be between 8.4 and 9.4, which looks too cheap, in my opinion.

Cantors has a price target of 35p, which looks achievable, in my opinion, so there should be a good 20% upside on the current share price, in my view.

Outlook - 3.0% LFL sales growth in Feb - Mar 2015 is good going, well ahead of last year, and it sounds like management are confident this will continue;

My opinion - what's not to like?! These are good figures, with a positive outlook, and the shares look good value to me. I love the big dividend yield here, and that alone should trigger a re-rating, as it's looking increasingly likely that the big divis will probably be maintained.

One of the reasons I bought these shares a while ago was because their website shows off attractive products, at reasonable prices (for the good quality). The company seems to be in the same upmarket niche as John Lewis partnership, and hence its customer base is probably doing alright for disposable income at the moment.

The outlook is good, so I'll be buying more on any dips in price from now on.

Note that the Stockopedia StockRank is very high, at 98, so another good result chalked up there, with the algorithms correctly identifying an attractive share, although as Ed always stresses, the StockRanks are meant to be used on a portfolio basis (i.e. it will generally outperform as a portfolio, but within that inevitably there will be the occasional dog - as indeed is true for every stockpicking approach - it's unavoidable).

Although the chart has been unimpressive in the last two years, if you add in 4p divis received over that time, the total return has been positive. Also, I like charts which haven't yet reflected strong fundamentals - that's a buying opportunity, not a negative! (unless you're a momentum investor, in which you like paying more for shares!) For me, BLASH is the way to go (buy low and sell high), because BHASH (buy high and sell higher) is fraught with risk - we have been spoiled with momentum since 2009, but sooner or later that's going to stop working, and then things could get very interesting! (i.e. perfect conditions for a stock market crash could be building up now).

OMG (LON:OMG)

Share price: 47p (up 15% today)

No. shares: 113.4m

Market Cap: £53.3m

(at the time of writing, I hold a long position in this share)

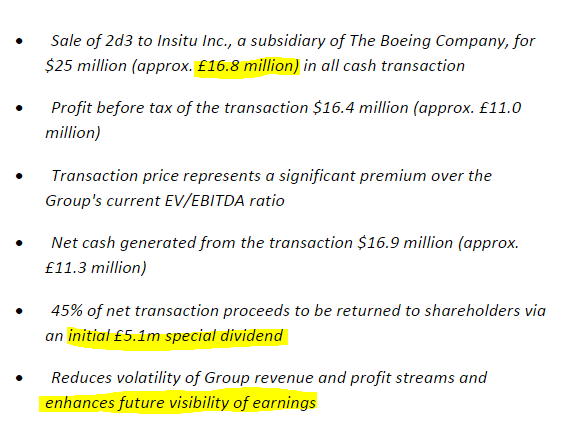

Disposal - this imaging software group has announced the disposal, for cash of £16.8m, of its subsidiary called 2d3, to Boeing. I like the way the key points have been put into a bullet point list;

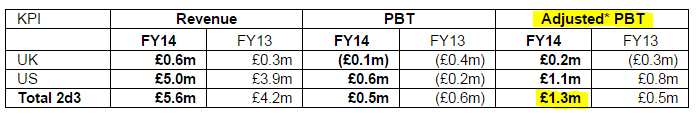

Checking the last set of full year results for OMG, this was the performance of the 2d3 subsidiary which is being sold. It provides software for military applications.

So based on last year's adjusted profits of £1.3m, the sale price of £16.8m looks a good deal.

Special dividend - the group is intending to pay a 4.5p per share special divi, with the shares going ex divi on 23 Apr 2015 - so the opening share price will be marked down by 4.5p on that day.

The possibility of a further special divi is mentioned, as well as possible acquisitions.

My opinion - the reason I bought these shares is because there is hidden value in the group due to heavy losses from one of its subsidiaries (called OMG Life) which has obscured the strong profitability of the rest of the group. A change of strategy, to wind down OMG Life and thus eradicate its losses, means there is a catalyst for a large jump in profitability.

So the disposal announced today of 2d3, a relatively small part of the group, for what seems a good price, is additional upside which I had not expected, and is therefore very welcome. Although it does of course mean that forecast earnings will drop somewhat from 2d3 dropping out of future results.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.