Good morning from Paul & Graham!

Breaking news! HSBC has bought SVB UK, in a deal that involves no taxpayer money. Details here.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham’s Section:

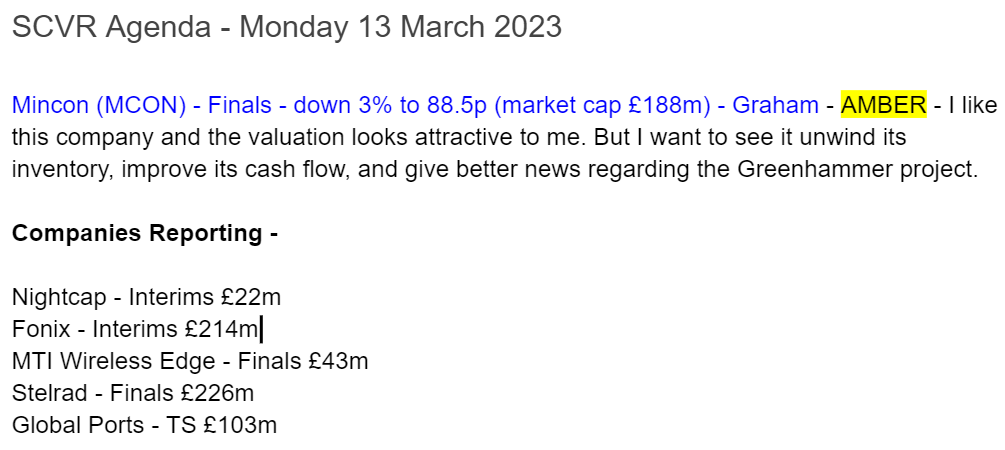

Mincon (LON:MCON)

Share price: 88.5p (pre-market)

Market cap: £188m / €212m

This is an Irish engineering group that designs, manufacturers, sells and services rock drilling equipment. Perhaps we can think of it as the “anti-Somero” (since the equipment from Somero Enterprises (LON:SOM) is designed to create perfectly smooth surfaces!). Like Somero, Mincon sells its own proprietary equipment, though Mincon also sells some 3rd-party gear.

Today, Mincon publishes its results for 2022, and here are the highlights:

Revenue +18% to €170m, with 19% growth in its own products vs. just 10% growth in 3rd party products. Own products are now responsible for 83% of total revenue.

Gross profit +11% to €54m.

Operating profit +9% to €19.7m

Net income +1% to €14.7m

Financial results

As you might notice from the above, there is a disappointing lack of progression as we go down the income statement: the percentage increases get smaller rather than larger!

This is worth investigating, as usually we want operational leverage to produce the opposite result.

First, the reduction in the gross profit margin: this is caused by two factors. 1) Input cost inflation, although the company says that cost increases were implemented in H2 to “largely” offset this. 2) There were significant new project costs and these are included in the calculation.

Mincon is one of those companies that applies zero adjustments to its numbers. While others might find a way to keep new project costs out of the “adjusted” profits, Mincon simply states what its actual results were. How refreshing!

This being the case, I think we have a reasonable explanation as to why gross margin dropped a few percentage points. It’s not reflective, in my view, of the company’s underlying pricing power.

Profitability was also held back by a c. 50% increase in borrowing costs. The company reports various bank loans adding up €31m and that have “a mixture of variable and fixed interest rates”. The average interest rate currently is 4.89%.

I calculate the company’s return on equity for the year as 10%, similar to the prior year.

2022 review / outlook

Mincon serves three industries and it was construction that stood out in 2022 with 45% revenue growth from this source as it won mid-to-large project contracts in North America. (Mining is the primary industry served by Mincon, and the other is geothermal.)

Supply chain / freight conditions- the difficulties experienced last year started to ease in H2 and Mincon has begun to “normalise” its shipping arrangements and unwind its working capital. Improved factory lead times will also reduce the need to use expensive air freight.

Order books are “strong”.

The Greenhammer project in Australia has run into some difficulties, but management remain confident in its potential:

We have been on site with the system drilling blastholes with our Mincon owned test rig. The Greenhammer system has performed to expectations when operating. However, it has been challenging to consistently deliver drilled metres due to reliability issues encountered with the drill rig. As a result, we had to carry out an extensive rebuild on the rig which we are confident will reliably support the system. While this delay has been frustrating in the short term, we remain confident in the long-term success of this project and believe that the system will be transformational for Mincon and the hard rock surface mining industry.

There is also a subsea project and it has seen “a number of significant milestones achieved”, but commercialisation is some time away.

The CEO says:

…we remain confident that we will deliver in the year ahead as well as make significant progress on our ambitious product development projects.

These ambitious projects challenge us, but they are essential to underpin our future, maintain our competitive advantages and to drive our profitability and return on capital employed.

My view

These results could have been a little more exciting for prospective Mincon investors. But 2022 was a difficult year, for reasons which affected many companies.

Additionally, the complications with Greenhammer in Australia are a slight worry, and Mincon’s increased use of bank loans are also not ideal for anyone who prefers investing in cash-rich smaller companies.

If I subtract Mincon’s bank loans from its cash position, net debt has increased to €15m, from only about €4m a year ago.

I’m still inclined to think that this is a company of above-average quality. Greenhammer continues to make progress, and the cash position should improve as the company unwinds the inventory it built up in 2022. There was a €13m increase in the inventory position last year, and this alone can account for its increase in net debt.

I’m on the fence, not sure if I should rate this stock positively or stay neutral. I think on balance I’ll stay neutral, looking for more certainty and a better cash flow performance before hopefully switching back to a positive stance.

It’s finely balanced, because valuation does not look excessive to me:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.