Good morning from Paul & Graham.

In case you missed it, here's my audio interview with Belvoir (LON:BLV) recorded yesterday afternoon.

I'll be talking to Portmeirion (LON:PMP) (I hold) today. EDIT: my interview with Portmeirion's CEO has also now gone live.

I enjoy your feedback on these interviews, so do leave a comment if you wish.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Main Sections -

(summaries here, main sections further down)

Moonpig (LON:MOON)

Trading Update - up 17% to 133p (market cap £455m) - Paul - RED

This market leader in online greetings cards & gifts issues a reassuring update for FY 4/2023 - it's trading in line with expectations. It expects a return to growth in FY 4/2024, with an H2 weighting. The market likes MOON a lot more than I do! In the section below I flag up a terrible balance sheet, overloaded with debt, hence no prospect of meaningful divis any time soon. Thumbs down from me, due to poor finances.

XLMedia (LON:XLM)

Final Results - down 9% to 13.4p (market cap £35m) - Graham - AMBER

Reasonable results but 2023 forecasts are downgraded today. The market rates this as if it were a Chinese stock which may be too harsh. Management team is entirely new.

Aquis Exchange (LON:AQX)

Final Results - down 2% to 381p (market cap £105m) - Graham - AMBER

Excellent results. This UK exchange also facilitates trading of EU equities in lit markets and dark pools. High rating justified by extraordinary profitability of successful stock exchanges.

James Latham (LON:LTHM)

Trading Statement - up 5% to 1225p (market cap £246m) - Paul - GREEN

In line with expectations. I have a thorough ponder of how trading might fall back once the bumper profits from pandemic-related factors unwind. I'm a bit worried that 2024 forecasts might be too high, so increased risk of a profit warning. Despite this, the balance sheet is so strong (£100m surplus liquid capital in my view) that shareholders have an immensely big and soft cushion underneath them! Valuation stacks up, even if we assume earnings halve. So it has to be a thumbs up.

Robinson (LON:RBN)

Final Results FY 12/2022 - up 3% to 100p (market cap £17m) - Paul - AMBER

Prompted by a reader request below from MarkT, I've had a quick skim through these numbers, which look quite good. Outlook also seems fine, and in line with expectations. Balance sheet has too much debt, but offset by surplus freeholds. Main downside is lack of liquidity & wide bid:offer spread. Why get involved when larger companies in the sector are also strikingly good value?

Quick comments -

Revolution Beauty (LON:REVB) - Paul - suspended - says it hopes to publish long delayed accounts at end April 2023. Hopes to restore trading in its shares after that. Bank facilities reduced from £40m to £32m, revised covenants, fully drawn, but has £11m cash. Nothing said about trading, but at least it is still trading! Will be interesting to see what happens when the shares return.

Shoe Zone (LON:SHOE) - Paul - GREEN - £3m share buyback starts today. Management owns 55.4% now, and confirm their waiver from the Takeover Code not to be compelled to make an offer for the company (since they hold over 30%). This implies trading is in line with expectations, I think - “The Company confirms that it currently has no unpublished price sensitive information.”

Sanderson Design (LON:SDG) - Paul - GREEN - “Major licensing agreement” with Sainsburys, to provide designs for “a wide range of licensed products” for the Habitat and Tu brands owned by Sainsbury. Products to be launched in Spring 2024. This is the second major licensing deal signed this year (FY 1/2024). No numbers provided, so I assume it won’t affect the current year’s performance? A note from Progressive today says no change to forecasts until next results/outlook details are published.

Trackwise Designs (LON:TWD) - Paul - RED - down c.50% today to only 0.6p - yet more contract problems & delays. Looks set to be out of cash (again) imminently (May 2023), or possibly later depending on what happens with customer re-design of product. Such a pity, as this looks promising technology, but as usual with UK startups, it hasn't been properly funded, so looks set to fail. I suspect it's very near the end of its time as a listed company. too risky to get involved I think.

Here's today's to do list -

Paul's Section:

Moonpig (LON:MOON)

128p (up 12% at 08:23)

Market cap £435m

I last looked at this online greetings card/gifts company here on 7 Dec 2022. I viewed it negatively (RED) because interim results showed a balance sheet that had been wrecked with a bad acquisition, and carrying too much debt. Plus I think it’s been impacted by Royal Mail strikes.

The shares are up 11% this morning though, so maybe it’s time to change stance on it?

Trading update -

Moonpig Group plc (the "Group"), the leading online greeting card and gifting platform in the UK and the Netherlands, today provides an update on its trading performance in the current financial year.

This is FY 4/2023.

It looks more like a relief rally that things aren’t getting worse, as this is just in line with expectations (I would have expected more for a +12% share price movement) -

Trading performance has been resilient across the second half of the year to date and Moonpig recorded its largest ever week of sales in the UK ahead of Mother's Day. Accordingly, we confirm that our expectations for Group annual revenue for the financial year ending 30 April 2023 remain unchanged at around £320 million.

Expectations for full year Adjusted EBITDA also remain unchanged, reflecting our disciplined approach to indirect cost management and our flexible business model.

Outlook - not madly exciting -

Looking forward, whilst we remain mindful of the macroeconomic environment, we expect revenue to be in growth across FY24, with the rate of growth weighted towards the second half of the year…

We are excited to return to revenue growth in the year ahead, underpinned by continued investments in our technology, marketing and operational capabilities. As the clear online leader in greetings cards, Moonpig Group is well positioned to benefit from the long-term structural market shift to online."

Re-platforming now complete, so focusing now on driving revenue growth.

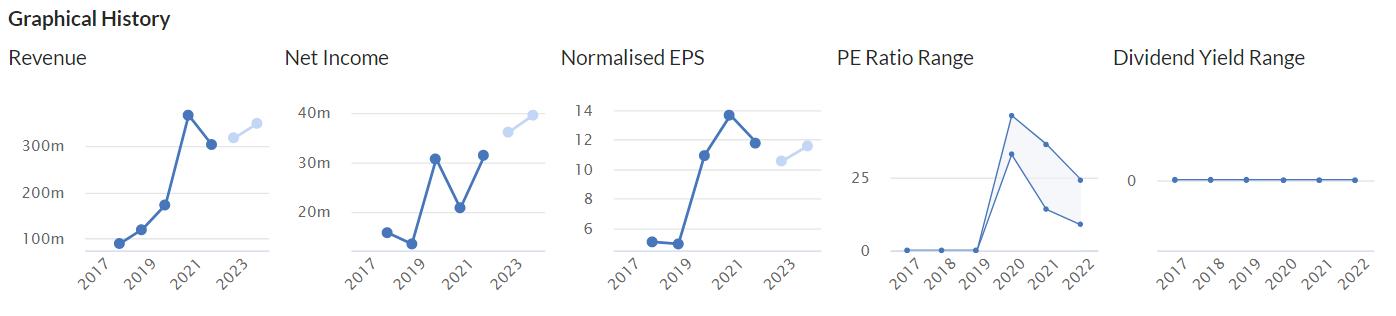

Valuation - I can’t find any broker notes. The Stockopedia consensus forecasts graph shows that EPS expectations for this year (FY 4/2023) have been reduced in stages from about 13p last summer, to 10.5p now.

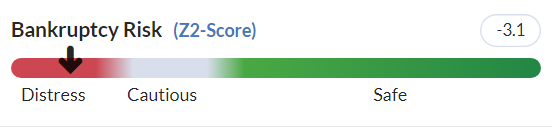

So at 128p per share, that’s a PER of 12.2x - which looks quite a moderate valuation. Although one look at the balance sheet will put off value investors from going near it - NAV was negative at £(57)m at 31 Oct 2022. That included £213m of intangible assets. Write those off, and NTAV is negative a mind-boggling £(270)m - one of the worst balance sheets for any company on the market.

The long-term debt was £230m, which will takes years to repay. Senior bank facilities are committed until 6 Jan 2026. It has partially hedged its interest rate exposure.

That’s far too much debt, with no asset backing. Hence why there are no dividends, and unlikely to be any meaningful dividends in future.

For these reasons, I think a low PER is justified, and this is not an attractive investment to me. I want to receive divis whilst I wait for capital growth, especially now that inflation is taking a chunk out of the purchasing power of our money - investments need to be generating a return to compensate for that. So with MOON shares, it’s a bet on the share price rising, with no income likely from dividends.

The Z-score is flashing a financial distress warning - remember this isn't infallible, but it's flagging potential risk - to take this risk, I would want seriously good upside potential, which isn't obviously present in my view -

My opinion - I can’t get excited about this. Getting debt down to reasonable levels is likely to take several years, so no divis for now.

As you can see from the graphs below, the revenue and profit growth has been impressive. The big growth was achieved in the pandemic, but MOON seems to have held on to that growth, instead of slipping back again, so that's a positive -

Today’s update reassures, but doesn’t inspire me to see this as anything particularly exciting.

The extremely weak balance sheet puts me off too - to get comfortable with such poor finances, I’d have to see much stronger profit growth in evidence.

So it’s still a thumbs down from me, due to the awful balance sheet mainly.

One of many failed 2021 floats - not a vintage year for IPOs! -

James Latham (LON:LTHM)

1225p (up 5% at 10:02)

Market cap £246m

We like LTHM here at the SCVRs, because it’s a well-run, owner-managed business, very conservatively financed, and with a terrific long-term track record -

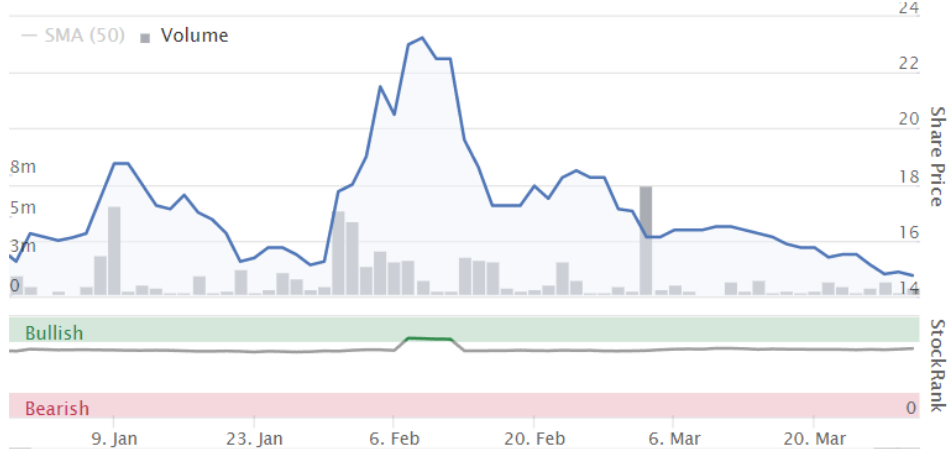

As you can see above from the StockRank chart below the share price chart, the Stockopedia computers are also positive to very positive since they started.

So I’m approaching this with a positive overall impression. However, as you can see from the Stockopedia graphs, it had a massive bonanza during the pandemic, when it was able to greatly increase selling prices, due to strong demand for home improvements, and competitors struggling with supply constraints. This is inevitably going to unwind, as the boom time profits won’t be sustainable -

We’ve seen this same one-off boom effect wreak havoc as it unwinds, on the whole eCommerce sector, and other suppliers of things to the home improvement market - Luceco (LON:LUCE) springs to mind.

So valuing shares like this is really all about ascertaining what future profitability is likely to settle at, and how much of the growth is structural, and how much one-off in nature? Tricky.

There’s also a further complication where companies and their suppliers built up inventories to ensure access to product. Which has now caused some companies to warn on profit, as customers retrench their new orders, and resulted in gluts of finished goods (readers, especially planetx have been discussing this in the comments - apparently there’s a glut of bicycles right now, so maybe a good time to negotiate a discount?!)

So I’m approaching LTHM with all those uncertainties in mind.

Looking at those graphs, a return to trend profit/EPS would suggest something like 60-70p EPS might be a reasonable level to value the shares on. That would be a PER of about 19, which seems high until you look at LTHMs balance sheet. It’s stuffed full of cash, which accumulated in the boom, and is still in the company’s bank account. So we need to add on an extra amount to the shares valuation above what we would value it on based solely on future likely earnings.

Current broker consensus EPS is around 147p for both FY 3/2023 and FY 3/2024. That’s about double what I see as the normal trend level, so clearly we shouldn’t be valuing this share on a multiple of these bloated earnings forecasts, as those levels of profit are extremely unlikely to be sustained as supply chains & costs normalise.

Here’s the chart of lumber (wood) courtesy of TradingEconomics website here. The price is now back to normal, after some crazy gyrations during the pandemic -

It’s all getting a bit complicated isn’t it!

Enough background musings, let’s get onto today’s update -

The Board of James Latham provides the following trading statement ahead of the Company's results for the year ended 31 March 2023.

Revenues - strong, slightly ahead of market expectations.

“Cost prices have stabilised”

“Few signs of price weakness in the immediate future”

Sales volumes similar to last year.

Overheads continue to rise (as expected).

Profit before tax (PBT) will be in line with market expectations.

Balance sheet & cash “remain strong”.

Diary date - 29 June for publication of FY 3/2023 results.

That’s light on detail, but tells us the key thing we need to know, in line with market expectations.

As mentioned above Stockopedia has consensus of 147p for this year, so the PER is only 8.3x, but as we know, this level of profitability is highly unlikely to be sustainable in the longer term.

Hence I would say the 148p forecast for FY 3/2024 (next year) looks very vulnerable to a profit warning. because supply chains are easing, input prices are falling, and sooner or later that’s bound to see excess profit margins eroded back down to more normal historic profitability.

Balance sheet - no figures provided today, but it’s such a big part of the valuation of this company, I need to flag it.

Last reported as at Sept 2022, NAV was £181m (which will have gone up since). Intangibles were only £3m, so NTAV was £178m, or 72% of the market cap.

NAV jumped from £119m to £164m in just one year, from Mar 2021 to Mar 2022. Then up again to £181m 6 months later in Sept 2022. So we can clearly see how the assets are piling up, due to bumper pandemic trading. That’s real shareholder value accumulating. A lot of it has been sucked into inventories and receivables though.

The March 2022 Annual Report shows that fixed assets is mostly freehold land, with a book value (at cost) of £26m. I bet that’s worth well above book value too. Lathams was founded a long time ago, and floated in 1986 apparently.

I do like old school, family controlled businesses, as their balance sheets can be a treasure trove of value, and they’re usually super-conservative, not taking the risks that hired hands often take to trigger their lucrative share options, or just walk away with no consequences if it goes wrong.

By now, NTAV is probably knocking on the door of £200m, and something nice could happen - special divis, buybacks, acquisitions, who knows?

How much value to attribute to the excess capital on the balance sheet? I think there’s about £100m of surplus capital on the balance sheet. I’ve worked that out by applying a current ratio of 2.0x to the balance sheet, so £84m current assets, instead of actual of £181m.

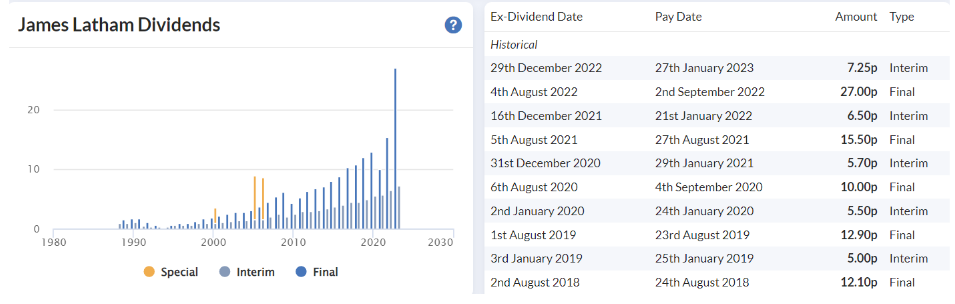

It did pay special divis in 2000, 2005, and 2006, so that could happen again maybe?

Even if the family decide to just sit on the cash pile, at least now they can earn some interest from it.

The 2022 final divi was much larger than usual, as you can see below, so I imagine shareholders should receive good divis in future due to the almost embarrassingly strong balance sheet -

My opinion - wrapping this up, my preferred method of valuation would be to ignore current trading as still untypical, and instead assume EPS might be heading for about 70p as a long-term, sustainable level - less than half current trading, so I’m being really prudent here.

I’d be happy to put that on a PER of 12 times, which fits into the PER bands of previous years, towards the lower end, which is necessary given that interest rates are now much higher, so PERs should be lower than we got used to in 2008-2022 zero-interest rate world.

That’s 840p value for the company.

I’ll then add £50m (248p per share) for half of the excess value (since the family will never pay out all the surplus capital I reckon is about £100m.

That gets me to a total (prudent) valuation for LTHM shares of 1088p.

The actual current price is 1225p, which is 13% above my theoretical valuation.

I think that’s close enough for me to go GREEN on this share, as there are so many things I like about it, and I’ve been really quite conservative with my valuation method. Thumbs up.

Robinson (LON:RBN)

100p (up c.3% at 13:52)

Market cap £17m

Robinson plc ("Robinson" or the "Group" stock code: RBN), the custom manufacturer of plastic and paperboard packaging, is pleased to announce its audited results for the year ended 31 December 2022.

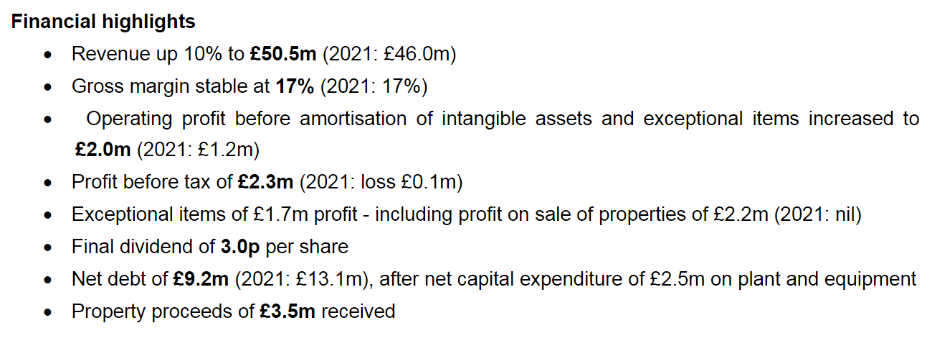

To save my re-typing it, here’s a picture of the highlights table -

Looks promising.

Pension scheme - previously announced, this has been hived off, so no longer an issue at all.

“Substantial capital investment” in 2023 for new projects. Will increase revenues from 2024, but it does highlight the capital-intensive nature of this sector. I prefer to see companies leveraging existing assets for growth, not having to spend up-front.

Cost inflation - it’s “seeking substantial price increases from all customers for 2023” - I’d prefer to be hearing that cost increases have already been agreed, not that they’re being sought.

Outlook - expecting 2023 operating profit to exceed 2022, and be in line with expectations - sounds good , given the macro uncertainty.

Medium term target to achieve 6-8% adj operating profit margin. Great, if that’s do-able. It’s a competitive sector though, so might be harder to say, than do.

Surplus properties - it says today £8.1m fair value, versus £2.8m net book value. Disposals ongoing, and could take time, but that should cover most of the bank debt, so it’s material for valuing the shares.

Dividends - very good, total 5.5p, excellent for a 100p small cap. But as others have pointed, out the wide bid/offer spread on the shares would probably consume at least a year’s divis. Although the actual market price is often well inside the quoted spread, so it’s worth checking with a dummy trade. I just tried, but was rejected with an “insufficient funds” reply!

Balance sheet - pretty solid. There’s too much bank debt, but that’s mostly supported by the surplus property value, so I think it’s fine to offset those.

My opinion - worth investigating further I think. Although personally I don’t see a lot of point going right down to something this tiny, when other packaging companies like Macfarlane (LON:MACF) and the larger ones, are such good value, and you won’t have problems with liquidity or bid/offer spread with those larger companies. Hence I’ll just say I’m neutral on RBN. But there's nothing serious wrong with it, so I wouldn't try to talk anyone out of investigating this share further.

Very high StockRank of 98, and the share price chart looks like it might possibly be starting an uptrend?

Graham’s Section:

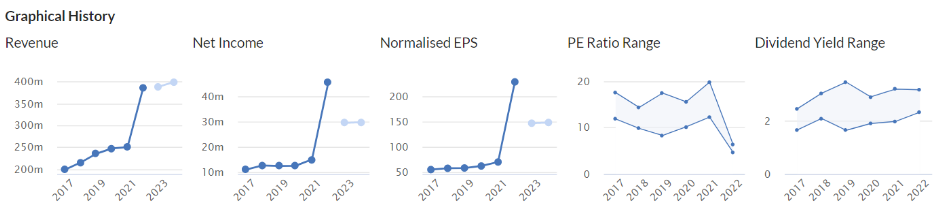

XLMedia (LON:XLM)

Share price: 13.36p (-9%)

Market cap: £35m / $43m

This stock has been trading very weakly in recent times:

At 21p in early February, I thought it could potentially offer some value. So I’m intrigued to see it below 15p!

Let’s find out if today’s full-year results for 2022 can help to illuminate matters.

Financial highlights for continuing operations, focusing on XLM’s sports and gambling-related activities::

Revenue +24% to $72m

Operating profit $5.1m

Cash balances $10.8m

NB: XLM is treating its personal finance websites as discontinued operations, so their contributions are excluded from the revenue and profit figures above. However, the personal finance websites have not yet actually been sold.

US expansion: XLM is now active in all 19 regulated online sports states in the US.

Management team: 2022 saw the installation of a new Chairman, CEO, CFO, COO, CMO and Company Secretary. This all follows a collapse in trading in 2020, after Google manually demoted 100 of its casino websites.

Google doesn’t do that sort of thing lightly, so I interpret this as reflecting very poorly on XLM’s prior management and on the quality of the demoted websites [disclosure: I’m a shareholder in Alphabet ($GOOGL).]

Another change is that an entire layer of management was removed both in XLM’s US and European operations. Overall headcount is reduced from 267 to 193. So it is a very different company compared to two years ago.

Outlook:

The Group has made a solid start to 2023 with the launch of online sports betting in Ohio on 1 January 2023 with early performance in-line with management's expectation. The immediate focus is now on growing revenues from the recent launch of online sports betting in Massachusetts which went live after the NFL season had finished, and as a result, we expect revenues in this state to grow more gradually.

No other states are expected to launch in 2023.

And a quick excerpt from the CEO comment:

"We made good progress in 2022, having re-engineered the business to become one of the leading sports betting affiliates in North America and our US business is expected to continue to evolve at a rapid pace as the market starts to migrate from up front acquisition payment to revenue share agreements.

It's nearly always preferable to generate revenue that is more recurring and predictable each year, rather than one-off in nature.

XLM is therefore negotiating with US operators to achieve a “hybrid” model, which will have a lower upfront payment and then an ongoing revenue share.

My view

I’m very tempted to change my rating on this from Amber to Green, since the valuation has reduced significantly. The enterprise value is now only $33m.

However, it’s important to understand that the word “spike” is mentioned eleven times in today’s report, referring to the short-term bounce in revenues that XLM experiences when online sports betting is legalised in new states. The revenue figures achieved in 2022 may not be very easily repeatable, without new state launches.

Indeed, the broker Cenkos has this morning reduced its FY 2023 revenue estimate from $72m to $70m. So it is now expecting revenues to decline marginally in the current year.

Cenkos also reduces its adjusted profit estimate for FY 2023 from $10m to $8m.

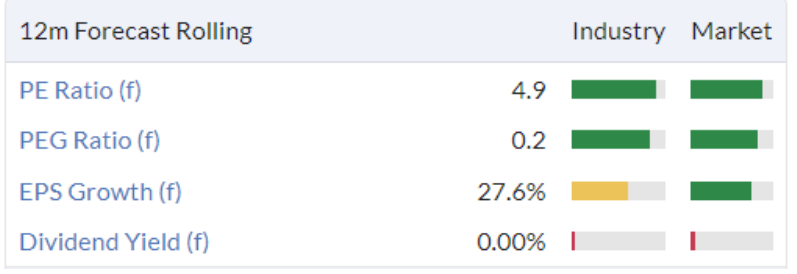

Despite these downgrades, the stock could still be viewed as very, very cheap quantitatively speaking. I almost feel forced to give this stock the thumbs up when it is so cheap.

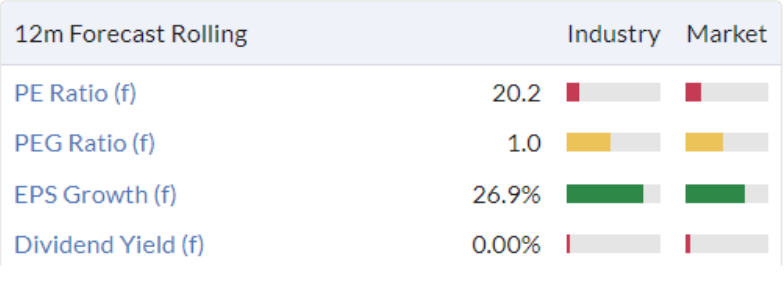

If we had something between Amber and Green, that’s what I would choose. I will stick with Amber for now. It is rated like a Chinese stock, which may be unfair:

Aquis Exchange (LON:AQX)

Share price: 381p (-2%)

Market cap: £105m

Some nice results from this stock exchange:

Net revenue +24% to £20m

PBT +27% to £4.5m

Cash £14m

2022 was a very difficult year for AIM and for many other equity markets, which I think puts these results in an even better light. Aquis had 22 IPOs, “the most of any growth company exchange in the UK”.

Current trading is in line with expectations.

The company has just finished a rebrand and now has three divisions:

Aquis Markets: a subscription-based service that offers secondary trading for 16 European markets, now including dark pools. Impressively, the company claims that in Q4 it achieved a 5.2% market share of all EU secondary market trading.

Aquis Technologies: software and technology division.

Aquis Stock Exchange: this is the bit that most of us are already familiar with. It’s the exchange below AIM. You can find a list of its stocks here, including their market caps. This exchange moved into profitability ahead of schedule during 2022, and there is a pipeline consisting of a further 50-60 companies who are looking to IPO.

Balance sheet: net assets of £23m, almost fully tangible.

My view: investors will be aware that a successful stock exchange is a life-changing investment. Here’s the share price for the London Stock Exchange:

The key word here is “successful”. Aquis might fall by the wayside. However, it claims to have a differentiated business model that is working:

[The Aquis trading facilities] apply a non-aggressive trading model, which means that certain types of trading behaviour are not allowed, and it encourages more passive trades to rest in its order book. This creates greater depth of liquidity and less potential for information leakage or "toxicity" in the market. Independent studies have verified that Aquis' non-aggressive trading model has materially lower toxicity than its competitors, which reduces adverse price movements thereby lowering the implicit costs of trading for the end investor…

The principal competitors to Aquis' business are the incumbent national exchanges and other pan-European trading venues. In secondary markets they charge customers on a per transaction model to allow fully aggressive trading.

Given that Aquis is profitable and growing, and given that stock exchanges can be some of the most incredibly successful investments when they work out, I think the high rating here might be justified.

Consolidation is a major trend in this sector, so it’s unlikely that Aquis will maintain its independence if it does continue this positive momentum.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.