Good morning! It's Graham and Roland here with today's report.

Today's report is now finished (10.30). See you tomorrow!

MelloMonday - save 50%

There's a MelloMonday show tonight (online) giving investors a chance to hear from a selection of interesting companies and investors. The usual Mello BASH session (Buy, Avoid, Sell or Hold) will feature three companies, including a presentation from well-known private investor Richard Crow (aka Cockney Rebel).

Alan Charlton will be updating on Sosandar after the trading news last week and Dorian and Louise from Belvoir are doing a results Q&A , so there could be plenty of interest for SCVR readers.

https://melloevents.com/mm1704...

Stockopedia subscribers can use the discount code MMSTOCKO50 to save 50% on their tickets.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham’s Section

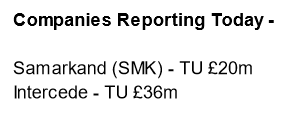

Supreme (LON:SUP)

- Share price: 109.35p (+11%)

- Market cap: £128m

Some good news here as FY March 2023 is “ahead of consensus expectations” and they now anticipate that FY 2024 will be “slightly ahead of current consensus expectations”.

The company helpfully indicates what these expectations were:

FY 2023 expectations prior to today: revenues of £ 138 million and Adjusted EBITDA of £ 18.5 million.

FY 2024 expectations prior to today: revenues of £ 150.5 million and Adjusted EBITDA of £ 22.2 million.

As a reminder, Supreme issued a major profit warning last July, after it emerged that customers of their lighting division were overstocked following Covid.

See how earnings expectations fell, and then stabilised:

2023 revenues are now expected to come in at £150m, nearly 10% higher than market expectations!

And 2023 adjusted EBITDA is expected at £19.3m, 4% higher than market expectations.

Please note that there was a gap of £4m between adjusted EBITDA and actual operating profits last year, so it’s important to always bear that gap in mind.

Vaping success

Supreme is a wholesale distributor of batteries, lamps, vapes and sports nutrition products.

Its most valuable property might be the 88vape brand, which it owns.

It appears that vaping has led the recovery charge in recent months. Some of this growth is organic, and some via acquisition:

The Group's Vaping category has delivered another excellent performance, nearly doubling revenues from £43.5 million in FY22 to around £75.0 million in FY23. This record performance, underpinned by the Group's core 88Vape brand, has been buoyed by a number of earnings accretive acquisitions in the period, alongside strong new customer momentum, increased market share on e-liquids and favourable market conditions.

Supreme also points to the government’s plans to promote vaping as a tool to help adults quit smoking.

Indeed, this update contains little information about trading in any of the other divisions. They merely say that the remainder of their business, i.e. excluding vaping, is “profitable”, and that there are signs of recovery in the lighting business.

Net debt: at the half-year, the company reported “net debt” (excluding leases) of £18m.

This figure included deferred consideration of £5m. If you exclude that, the company’s net bank debt was £12.9m.

Today’s announcement informs us that net bank debt has improved all the way back to neutral. This sounds like a very impressive feat of cash generation in just six months! I’ll be curious to see if if includes any one-off or unusual cash movements.

Graham's view

My impression of Supreme is that it has one very successful and potentially very valuable business: vaping, especially 88vape. Its other vaping brands might prove to be useful additions over time, too.

I take an interest in this industry and have a long position in British American Tobacco (LON:BATS) which owns the Vuse vaping brand. It seems to me that Big Tobacco still have just enough muscle to defend themselves from political momentum that could ruin their businesses. One of the main ways these companies have defended themselves is by working hard to develop popular next generation products, including vapes.

These enormous businesses are constantly acquiring each other, getting bigger and bigger, and perhaps that is how the Supreme story will ultimately end, with a buyout by Big Tobacco? If you have a successful vaping product, then personally I don’t see the point in it being owned by a small company, when it can get plugged seamlessly into the machinery and the protection of a larger group that owns dozens or hundreds of nicotine brands.

When I last looked at Supreme (November 2022), I perceived it as being primarily a distributor. But I am now leaning towards the view that it’s primarily a vaping company - vaping is already responsible for half of its revenues, and growing rapidly. The other businesses don’t seem to be performing particularly well, but at least they are profitable in the aggregate.

Since it has eliminated its net bank debt, and since I now perceive it as being primarily a vape business, I will give Supreme the thumbs up at this valuation.

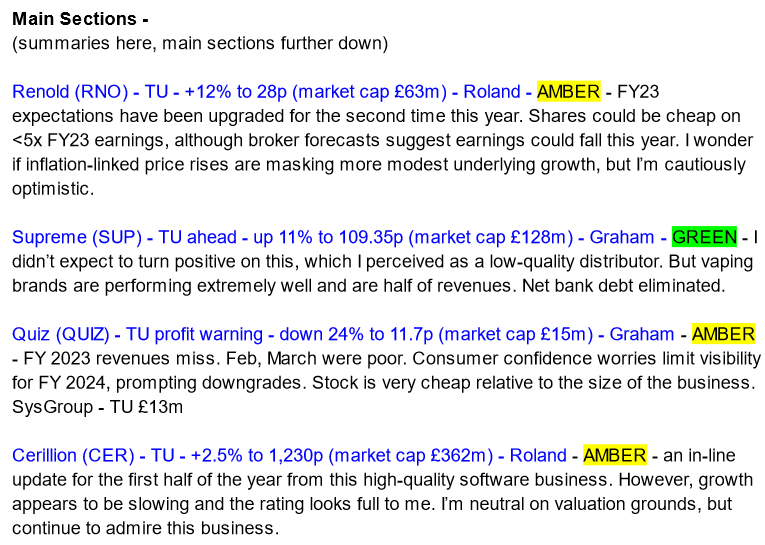

Quiz (LON:QUIZ)

- Share price: 11.7p (-24%)

- Market cap: £15m

Paul normally covers this one but let’s take a quick look!

Sentiment has been on the floor here for a long time:

Today we have a full-year update for FY March 2023.

Key points:

Revenue +17% to £92m, led by 23% growth in UK stores and concessions. This appears to be below expectations (£95m).

Like-for-like revenues fell in February and March 2023 (reasons: inflation, consumer confidence, difficult prior year comparatives).

Q4 revenues “broadly consistent” with FY 2019, the last year unaffected by Covid issues.

Full-year PBT not less than £2m (last year: £0.8m). This is consistent with expectations of £2m.

So it’s a miss in terms of revenue, by a few million pounds. What has spooked the market even more is probably the outlook statement:

... the widely reported and significant pressures on consumer spending seen in recent months are expected to continue into the new financial year. The Board believes these external headwinds may impact consumer demand across the Group's sector over the coming months, reducing its visibility for FY24. Notwithstanding this, the Board remains highly confident that the strength of the QUIZ brand and the Group's model provide a solid basis for future growth.

The new PBT estimate at broker Panmure Gordon has been released to the press:

“We are reducing our FY1/24 estimates from £3.9m PBT to £2.8m as we believe that would still represent decent progress given the uncertainties of the current year and the difficult conditions currently being faced,” he said. The firm is also reducing its target price from 20p to the current level of 15.5p and retaining a hold recommendation.

Net cash balance has improved from £4.4m a year ago to £6.2m.

Graham’s view

There is clearly a big opportunity with this stock, in theory, as it sits on a tiny price to trailing sales multiple of only 0.16x, has a net cash position that’s not far off half of its market cap, and has lease liabilities that are much more manageable after a restructuring. The interim balance sheet showed only about £5m of leases (discounted back to their present value).

At the current market cap, for me, this stock definitely has option value - with fair winds behind it, there has to be a chance that it’s a multi-bagger from here. The CEO and his relatives remain big shareholders, so he should be well-aligned.

Against that, we have to weigh the poor quality of a business that can only earn £2m (pre-tax) on over £90m of sales, that is so sensitive to changes in consumer sentiment, and that admits that its visibility over the next 12 months is limited.

Granted that the Covid disaster was beyond its control, and the renegotiation of its store leases was a big win, but there doesn’t appear to have been much progress since 2019, as revenues are now only “broadly consistent” with that year. Does the Quiz brand impress customers and generate loyalty? I think the jury’s out.

I’m not entirely convinced either way here, so I’ll stay neutral. A very interesting situation, all the same!

Roland's section

Renold (LON:RNO)

- Share price: 28p (+12% at 08.10)

- Market cap: £63m

Trading update and notice of results

the Board now expects underlying trading profit and margin for FY23 to be materially ahead of the previous upwardly revised market expectations

Industrial chain specialist Renold’s “power transmission products“ are used in a huge range of sectors, including agriculture, mining, shipping, and leisure (e.g. theme park rides). Renold was founded in 1864, so this really is one of those hidden businesses that’s part of the fabric of modern life.

Today’s year-end trading update is an upgrade – the second so far this year.

Main highlights: today’s update covers the financial year ended 31 March 2023. That means it’s backwards-looking, rather than referring to the current financial year. However, it’s still a useful update for us, as Renold doesn’t expect to publish its full accounts until July.

Management says that strong momentum from the first nine months of last year continued into the final quarter.

Revenue +26.6% to £247.1m (+18.8% constant currency)

Excluding the YUK acquisition (Aug ‘22), like-for-like revenue was +13.4% at constant currency

FY23 order intake was £260.3m (+16.3% vs FY22)

FY23 year-end order book: £99.5m (FY22: £84.1m)

Net debt at year end of £29.8m (30 Sept ‘22: £34m)

As a result of cost savings and inflation-linked price rises, underlying trading profit and margin for FY23 are now expected to be “materially ahead” of previous expectations. Today’s upgrade is the second this year - Renold also upgraded guidance in February. Use of the word “materially” implies a decent uplift to forecasts – at least 10%, I’d say.

According to the company, previous consensus forecasts for revenue and underlying pre-tax profit were £238.3m and £14.3m respectively. Stockopedia showed a consensus earnings estimate of 4.5p per share.

Helpfully, there’s an updated broker note on Research Tree from FinnCap this morning. The broker has upgraded its FY23 earnings forecasts by 21% to 5.8p per share.

At this morning’s opening price of 28p, FinnCap’s updated forecast puts the shares on an FY23 forecast P/E of 4.8, which looks potentially cheap to me.

FinnCap has also upgraded its FY24 forecasts, but these still imply a fall in earnings to 4.7p per share next year.

Stockopedia’s own consensus estimates also reflect this view; prior to today, no growth was expected this year:

Roland's view

Renold shares haven’t really delivered the kind of results in the past that we might have expected from a business with some quality characteristics.

The company has also been burdened with a hefty pension deficit and significant levels of debt, at times. However, my impression is that the current management team has made good progress resolving these issues and renewing growth.

Last year’s revenue growth appears to show some organic growth in addition to the acquisition of YUK. However, I think we need to be careful at the moment to discount the impact of inflation. The increase in energy and commodity costs over the last year means that merely passing these through to customers (as Renold says it has done) could lead to substantial increases in revenue.

There are also some obvious cyclical risks to this business. Today’s update does not make any reference to the outlook for the current year, which seems slightly surprising to me. This makes me question how much of the group’s revenue and order intake growth last year simply reflects the impact of inflation and one-off cost savings.

I don’t know enough about this business to form a strong conviction. But my impressions are broadly positive. I think it’s reasonable to suggest that the shares could offer value and upside potential, if the business can maintain or increase its order book this year.

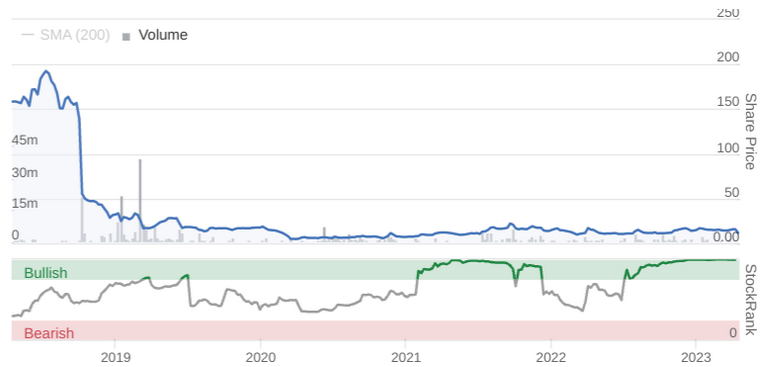

Cerillion (LON:CER)

Share price: 1,216p (+1.4% at 08.40)

Market cap: £352m

Cerillion provides billing and customer relationship management software, principally to the telecoms sector (mobile networks).

Today’s trading update from this software group covers the six months to 31 March 2023 and is in-line with expectations. This isn’t necessarily anything to be disappointed about, though – this business still appears to be growing at a respectable pace.

Trading has been very strong, with the six-month period ended 31 March 2023 setting new records for both revenue and adjusted EBITDA.

The company says the first-half results reflect strong customer demand and favourable industry trends:

a wider back-drop of continuing strength in demand for telecoms services and substantial on-going investment in 5G and fibre rollout.

H1 financial summary: today’s half-year update reveals record revenue and EBITDA numbers and certainly seems encouraging.

Revenue +27% to £20.5m (H1 2022: £16.1m)

Adjusted EBITDA +38% to £9.9m (H1 2022: £7.2m)

Net cash +43% to £23.6m (Mar ‘22: £16.5m)

However, I think a closer look suggests the strong momentum seen in last year’s results may be slowing slightly.

Today’s numbers seem to suggest that Cerillion’s results will have an H1 weighting this year.

The H1 revenue reported above equates to 54% of the current FY23 consensus of £38m.

H1 EBITDA of £9.9m appears to represent more than 60% of full-year EBITDA, based on forecasts I’ve seen elsewhere.

Today’s statement reiterated that full-year results are expected to be in-line with current consensus, so I think it’s reasonable to draw these conclusions.

For context, Cerillion’s results in recent years have usually been evenly weighted or had a modest H2 weighting. If this trend is reversing, does this point to a slowdown in growth?

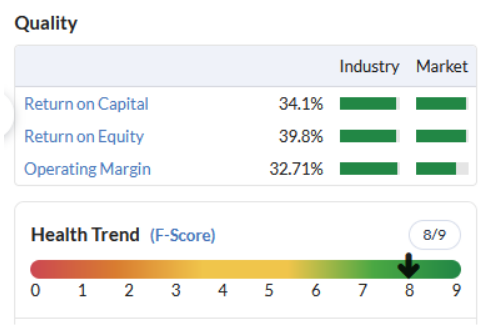

Roland’s view

Cerillion has been an excellent investment for shareholders who’ve spotted the company’s momentum in 2020 – the shares have five-bagged since then:

The company is wonderfully profitable and cash generative and boasts a very comfortable net cash position. I’ve no concerns about fundamentals.

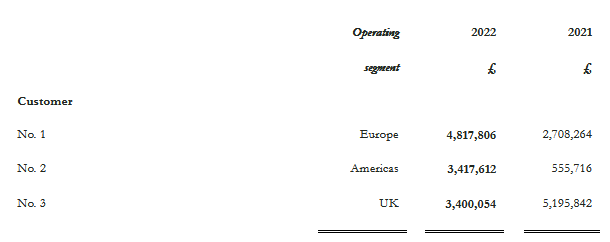

However, I can see one or two potential risks. Customer concentration is a potential concern, for example. Last year’s results showed that 36% of revenue came from the group’s top three customers:

In fairness, I’d imagine that Cerillion’s products are quite sticky once in place – changing billing and CRM software is a challenging process companies won’t undertake lightly.

A more serious concern for me, as a potential investor, is whether Cerillion shares still offer an attractive combination of valuation and momentum.

Broker forecasts for FY23 and FY24 show continued growth. But as I mentioned above, forecasts for this year appear to imply a weaker performance during the second half of the year (Mar-Sept):

FY23: 7.1% eps growth (reiterated today)

FY24: 14.3% eps growth

To put these numbers in context, Cerillion’s adjusted earnings rose by 38% last year. This means that growth is expected to slow significantly this year, before recovering somewhat next year.

In terms of valuation, my sums suggest that operating profit for the current year could equate to an earnings yield (EBIT/EV) of 4%. That’s a little higher than I normally like to pay, but it’s not necessarily too much for a high-quality growth business.

An alternative metric in this situation might be the PEG ratio. Looking ahead to next year, the PEG ratio drops to 1.9. Reducing this to a more palatable 1.5 would imply a share price of around 925p – a level last seen late last year.

On balance, slowing growth forecasts and today’s in-line trading update suggest to me that Cerillion shares are fully priced at current levels. I think it’s worth remembering that the stock has doubled since March 2022 and has risen by 20% over the last month alone.

As usual, I think the StockRanks provide a useful and balanced view on this situation:

I could be wrong, but my feeling is there will be better opportunities to buy into this excellent business in the coming weeks and months. For now, I’m neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.