Good morning from Paul only today, with it being Friday.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Quiet for news, and I have to finish a bit earlier today -

Quick Comments

XLMedia (LON:XLM)

Down 17% to 9.4p (£24m) - AGM TU - Paul - AMBER

This is a strange one. XLM makes money from directing people online to gambling companies’ websites. XLM says it continues to expect to trade in line with its (whatever those are) expectations for FY 12/2023. However, the shares have dropped 17%, from an already bombed out valuation compared with previous glories.

There are a number of negative factors mentioned in the update, but if it’s still in line with expectations overall, then why does that matter?

The PER only seems to be about 4x, so it’s tempting to do some more digging, to find out why the market doesn’t rate the company’s prospects. I see the previously generous divis dried up in Nov 2019. Directors have been mainly buyers for years now, to no avail.

Paul’s opinion - I’m just not interested in online marketing companies like this. They often find a lucrative, but short-lived way of exploiting advertisers. The shares in this sector always look inexplicably cheap, and usually get cheaper still. So it’s not for me. However, for a more balanced & thorough view, Graham did an excellent review of XLM’s FY 12/2022 here on 31 March 2023.

Kin and Carta (LON:KCT)

Down 9% to 65p (£116m) - Trading Update (profit warning) - Paul - RED

Graham and I don’t think much of this company, and consistently report negatively on it, see Graham’s review here of H1 results, issued in March 2023. Our main issues are the extensive adjustments to the accounts every year, poor performance, profit warnings, utterly confusing communications, and no divis since 2019.

Today it says various external factors have caused a revenue miss of about 6% from what I can see compared with the StockReport’s consensus forecast. It doesn’t say directly how this will impact profits, instead (as before) quoting revised profit margins. I’m not minded to spend the time working out the numbers. There are no broker notes available to us either.

Customers are reluctant to commit to large projects, or delays are occurring. Increasing signs of a slowdown in B2B activity? (which would make sense in the current wobbly macro environment).

On the upside, it says recent contract wins are looking more positive for the next financial year, FY 7/2024.

Paul’s opinion - both Graham and I prefer simpler businesses whose accounts are not dripping with large adjustments. So this one remains an avoid for us. But who knows, at some point it might be seen as oversold by other investors, and a recovery play, so I’ve no idea what will happen to the share price, it’s just not a company that I personally would be interested in investing in, almost irrespective of the valuation.

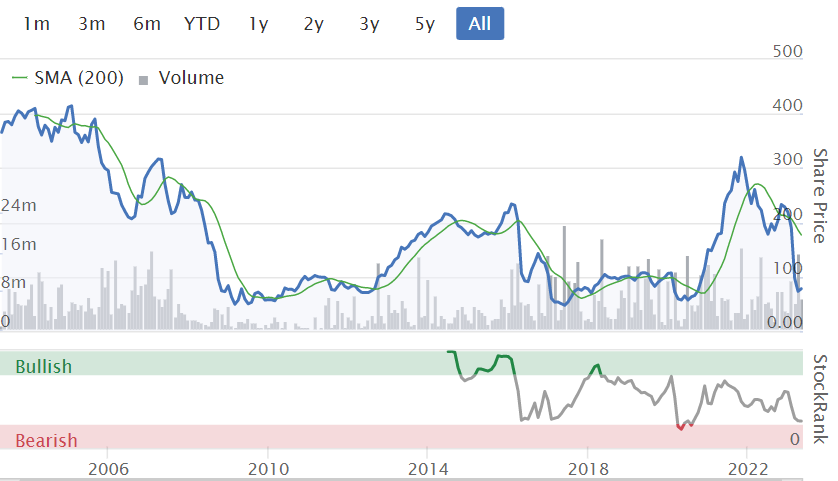

The long-term chart echoes with the howls of disappointment from several generations of investors -

Paul’s Main Sections:

ASOS (LON:ASC)

418p (pre-market)

Market cap £418m

Paul's view - RED

New Financing Arrangements and Equity Raise

Announced last night, after the market closed. Here are the key points -

Placing at 418.1p (no discount) to raise £75m - I make that 17.94m new shares.

Retail offer via Primary Bid is only £5m, also at 418.1p, so 1.20m new shares.

Assuming full take up of the Primary Bid offer, then that’s 19.14m new shares.

Existing shares in issue are 100.0m, so it’s c.19% dilution. The RNS mentions c.20% dilution, maybe that includes share options dilution too?

That sounds OK - pricing is fine, at the same price Asos shares closed at last night, and dilution isn’t too bad at c.20%. So I don’t think shareholders can complain about this fundraise, it could have been a lot worse if the major shareholders had not stood their corners to protect the value of their existing equity.

Notes 14 & 18 in the recent interim results give details of existing borrowings. Most striking is an incredibly cheap convertible bond for £500m, costing only 0.75% pa interest, until April 2026. Whoever provided that lending must now be smarting about the terms! How is Asos going to pay it back? Good question, but April 2026 is probably far enough out to not have to worry either way - as Asos is likely to have either turned itself around, or gone bust by then.

Recent interims also revealed that the existing borrowing facilities of £350m RCF + £50m ancillary facilities, had been extended to Nov 2024. So it seems odd to so quickly announce that it is now refinancing again with a different lender. Two sets of expensive fees, in rapid succession.

The new facility looks smaller, at £200m term loan, and £75m RCF. Interestingly, the provider is Bantry Bay. They came up as the higher risk lender who refinanced Superdry (LON:SDRY) recently. I wonder if they'll be the next SVB, providing riskier lending to distressed companies? It would be interesting to find out more about them, and what their capital base is like.

Bantry Bay’s new facility is expensive - charging c.11% pa interest, plus arrangement fees. We haven't seen lending costs like that for many years, it's a big issue for investors to factor into our calculations - the era of free money seems to be over, and that makes highly geared companies a lot riskier.

It’s “covenant light”, having only a minimum liquidity covenant.

Asos says the cash financing costs in H2 alone (6m to Aug 2023) will be a staggering £55m. Therefore a key point here is that Asos has bought more time to turn itself around, but at a considerable cost. Maybe the lenders (and especially the bondholders) might end up owning the business, if performance doesn’t improve longer term?

This is all necessary because Asos is trading badly, and its balance sheet is weak - with little NTAV remaining, likely to go negative I think, and way too much inventories - which I suspect is likely to need another write-down.

Paul’s opinion - I remain of the view that Asos is in a mess, but this deal buys it more time, at a cost. Whether the equity is worth anything now depends on how the turnaround plan goes. We’ll just have to wait and see on that.

Boohoo (LON:BOO) demonstrated in its recent results that a big reduction in inventories can dramatically improve cashflows. Asos needs to do the same, it’s obviously, seriously over-stocked, with probably a lot of gear that nobody wants, hence likely to need a write-off I think, like the large one it’s already done. Or it can just keep selling things at a discount, giving a horribly low gross margin, which has always been Asos’s achilles heel.

I’d say Asos shares are now just for traders really. Nobody knows if the turnaround plan will work or not, so it’s not much more than a gamble now, with a weak, overly indebted balance sheet. I wouldn’t go near it personally. But as a trade, it could be interesting - a sniff of good news, and you could see shorts rush to cover their positions.

UPDATE - while I was typing the above, another RNS came out, confirming that the placing has been done, as expected.

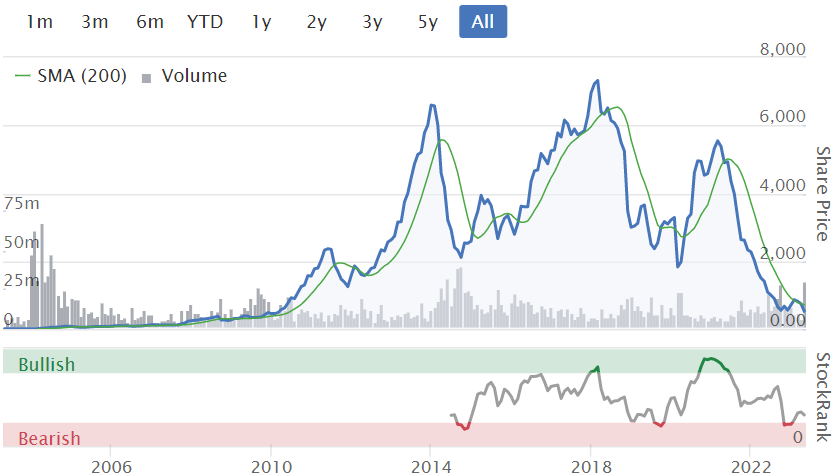

Are we seeing the full life cycle of a company, from start to finish? Or will Asos once again regain its allure to investors? Time will tell!

Michelmersh Brick Holdings (LON:MBH)

92.5p (unchanged)

Market cap £88m

Paul's view - GREEN

Thanks to eagle-eyed readers FREng, and cheeky_minnows, who spotted that this brick maker had slipped a trading update into an RNS about the CEO resigning, no doubt to reassure the market that nothing has gone wrong -

Michelmersh Brick Holdings PLC (AIM: MBH), the specialist brick manufacturer, announces that Frank Hanna, Joint Chief Executive Officer ("JCEO"), has informed the Board of his decision to leave the Company in May 2024 to take up the role of Chief Executive Officer ("CEO") of Brickability Group plc.

I’ve only just noticed that he’s not leaving for another year! It’s May 2024 departure date. I wonder, is it a good idea to keep someone on for a year, when they’re planning on leaving to join a competitor? I’m not sure about that. My general view is that when someone has decided to leave, it’s best to just get them out immediately.

The other joint CEO, will become the sole CEO from May 2024, so there are no succession issues.

Here’s the reassuring trading update added to today’s announcement -

The Company has made a robust start to 2023, and combined with a balanced forward order book, remains on track to meet the full-year expectations for FY23.

This is what it said in the recent 18 May AGM update -

The Group has made a robust start to 2023, and combined with our balanced forward order book, we remain on track to meet full-year expectations."

That looks precisely the same meaning, but with insignificant tweaks to the wording.

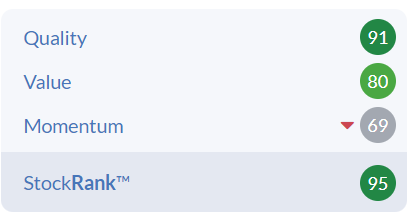

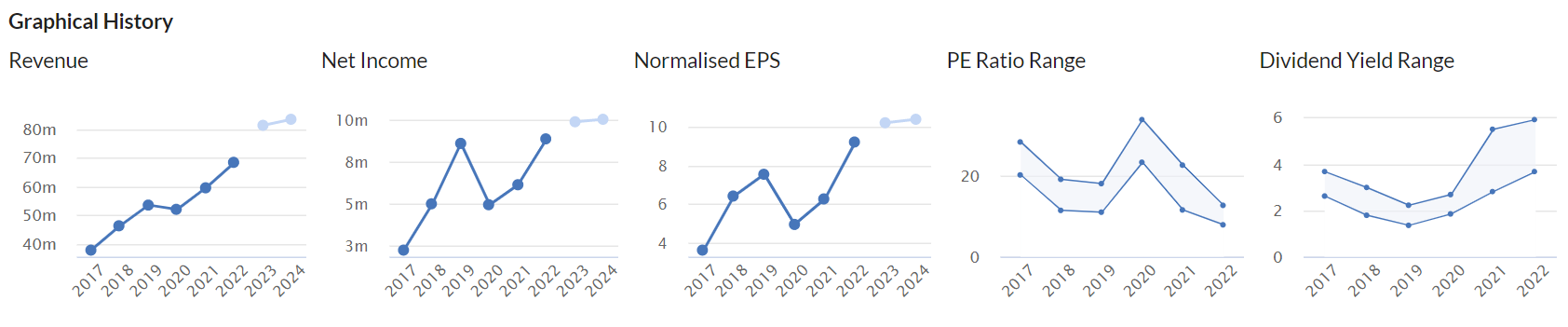

I like the look of the growth, value, and quality measures on the StockReport -

Note above that, as well as a low PER, a good dividend yield, MBH shares also offer considerable safety through asset backing. The Price to Tangible Book of only 1.38 is very solid (the lower the number, the better).

I also like the fact that broker forecasts have actually been rising for MBH, when given tough macro, and reduced housebuilding starts, I would have expected the opposite -

Further reassurance comes with a high StockRank -

This is a value stock, that’s actually a growth company. Imagine what the market cap would be if a software company produced growth like this! -

Paul’s opinion - obviously I have no idea what the future holds, so can only ever base my opinion on the current facts, figures, and forecasts.

On that basis, I have to give MBH a thumbs up, with a GREEN opinion.

As with many companies, the share price chart is a reminder of what a really bad recession looks like, in 2008. So if your macro view now is very negative, clearly any cyclical business like this would be off your agenda.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.