Good morning from Paul & Graham.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries

Ramsdens Holdings (LON:RFX) - 259p (+5%) (£82m) - Interims - Graham - GREEN

This financial services provider and retailer continues firing on all cylinders. We already knew that H1 figures would be very good but the company confirms today that the positive momentum has continued so far into H2. Valuation remains attractive in my book.

Hostmore (LON:MORE) - Down 3% to 22.4p (£28m) - AGM Trading Update - Paul (I hold) - RED

So far, the market doesn’t seem to have spotted that the “broadly consistent” messaging today on LFL sales is untrue. There’s actually been a sharp slowdown in the last 6 weeks, from -1%, to c.-8%. I think a profit warning is building, as forecasts don’t look realistic in the current climate. Very high risk of dilution, as bank debt is too high. Possible speculative turnaround maybe?

FireAngel (FA.) - down 27% to 4.75p yesterday (£8m pre dilution) - various - Paul - RED

Publishes poor FY 12/2022 results, sacks its CEO, replaces Chmn & CEO with former Directors from Universe Group, and launches a fundraise at 5.05p, with additional potential dilution from 3.0p warrants. So lots to take in here. I wouldn’t waste any time on it.

VP (LON:VP.) Up 4% to 670p (£269m) - FY 3/2023 Results - Paul - GREEN

I have a good rummage through the annual results, and come away impressed - this diversified equipment hire group looks decent quality, but shares seem cheap. 6% dividend yield, and a likely takeover bid at some stage when the 72-year old 50% shareholder wants to retire? Lots to like, so it's a thumbs up from me.

City Pub (LON:CPC) - 100.7p (+2%) (£103m) - AGM statement - Graham - AMBER

A pleasant update from CPC as like-for-like sales are up 13%. They argue that sales would have been even better if not for rail strikes, but as the Italians say, “If my Grandmother had wheels she would have been a bike”. This is a good company at a fair valuation.

Paul’s Section:

(I did this section below while waiting for the 07:00 RNS feed to start)

Fireangel Safety Technology (LON:FA.)

Down 22% to 4.75p yesterday (£9m before fundraise dilution) - Fundraise & new management - Paul - RED

A flurry of announcements yesterday from this financially distressed maker/distributor of fire safety alarms. It announced accounts for FY 12/2022, showing an underlying loss before tax of £5.0m. Also a £6.1m fundraising is announced, which sounds like it’s backed by existing shareholders, at 5.05p, plus warrants priced at 3.0p. I’m not clear if the £6.1m placing is in addition to the £6.1m open offer, or instead of, as a clawback is mentioned.

The company also announces it’s for sale, which has triggered an offer period.

The CEO is ditched, and replaced immediately with a new Chairman and CEO formerly of Universe Group, where they achieved a good exit at a premium price for shareholders, I remember covering it here for a few years.

Interestingly, a key supplier that is owed £2.1m, is subscribing for new shares for that amount plus another £0.7m, which looks encouraging.

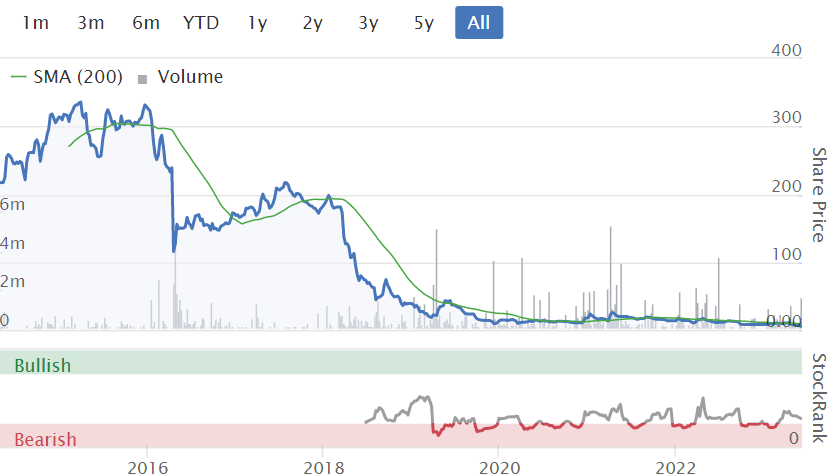

Paul’s opinion - this company looked really good years ago, when it was called Sprue Aegis - profitable, financially secure. But it’s gone horribly wrong since, with repeated profit warnings, and increasing financial pressure. This deal looks a credible attempt to turn the company around, so I wish it well. With a lot of potential dilution, and the warrants priced at 3.0p, I wouldn’t personally be interested in paying much more than 3p for the shares in future, and only if there’s a credible turnaround plan underway. So it’s best seen as a special situation for now, and in the last chance saloon as a listed company. I’ve only skimmed over the detail above, it would need a closer look for anyone considering buying or holding the shares.

An absolute disaster for shareholders -

Hostmore (LON:MORE) (Paul holds)

21.8p (pre-market open) (£28m) - AGM Trading Update - Paul - RED

I picked up a tiny position in this TGI Fridays restaurant chain, based on an upbeat recent presentation from new management lately, but that’s looking like a mistake now.

In my opinion, today’s update seems deceptive. We’re told that LFL sales in the first 16 weeks were down 1% vs LY. This they claim today has remained “broadly consistent” at -3% for the first 22 weeks. Doing some simple number crunching, which ignores seasonality, I calculate that this actually means the most recent 6 weeks saw LFL sales down -8.3%, which is not in any way “broadly consistent” with the previous 16 weeks. It’s actually a big lurch down. On 77% gross margin, that has a nasty leveraged impact on profit. Yet the company doesn’t mention anything about performance vs market expectations today, so we’re meant to assume it’s trading in line with expectations, but I don’t see how that can possibly be true when the last 6 weeks have seen such a sharp deterioration in sales.

On the plus side, it says EBITDA is seeing an improvement from cost savings, as planned. Also it’s seeing an additional £1m saving in utilities costs, from delaying its hedging arrangements. This is an interesting general point actually - companies which benefited from hedging last year, might now be suffering if they hedged at high prices during the energy crisis. Taking the risk of not hedging at high prices is paying off at the moment.

Guest scores are improving we’re told. I’ll mystery shop the Bournemouth site shortly, to see if they’ve managed to work out how to carbonate the sodas yet?!

The Chairman is stepping down at the AGM today, which sounds planned.

Paul’s opinion - this update looks more like a PR release than a trading update, and it commits the sin of not commenting on trading versus expectations. The latest forecast suggests adj PBT for FY 12/2023 of £(0.6)m. Given weak sales in the last 6 weeks, I struggle to see how it’s likely to meet forecasts, so in my opinion a profit warning is probably in the pipeline. With higher mortgage costs likely to gradually hit working families (probably MORE’s core customers), then it’s difficult to imagine trading is going to improve any time soon.

Which leaves the risk of bank debt, which we already knew was much too high for a company not likely to be making a profit this year. Banks are more interested in EBITDA though, especially now that new site openings have been stopped, in order to generate cashflow, and hence reduce debt. Management said recently that they have an aspiration to reduce net debt by £10m pa. If that can be achieved, then the shares could multi-bag from here. However, after today’s update, I think there’s a considerable question mark over how realistic this plan is? Hence I have to maintain my “red” view of MORE shares, from a value investing point of view. It’s more of a speculative, high risk situation, as we’ve mentioned here several times before. It might work out, but I think there’s a very high risk of a dilutive equity fundraise being required to keep the bank on side.

UPDATE - a short note from Finncap has just come through, saying it's too early in the year to revisit forecasts. That seems odd, given that we're just over 3 weeks away from the half year. Finncap's assumption of +2% LFLs for the year looks way too optimistic, so I think we can just ignore existing forecasts as being unrealistic.

This has been a disaster for shareholders, since demerging from Electra Private Equity -

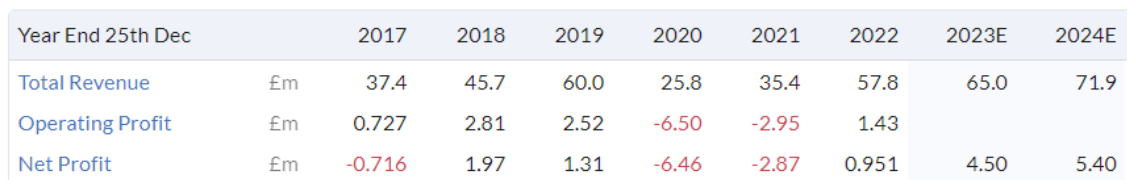

VP (LON:VP.)

Up 4% to 670p (£269m) - Final Results - Paul - GREEN

I’ve got a favourable existing impression of this diversified equipment rental group, which is owner-managed, with Chairman Jeremy Pilkington owning slightly over 50% (maybe a little too high for comfort?) Note that Mr Pilkington put the business up for sale in spring 2022, but no acceptable offers were received. He’s 72 years old, so I think this is very interesting, as it seems clear he wants an exit, but won’t sell it on the cheap. I like that very much, and long-time readers will remember that we cleaned up here with a bumper sale of Avesco, in similar circumstances a few years ago. So I’ve been on the look out for another value share where a retirement sale for the major shareholder is looking likely. Plus shareholders get an attractive dividend yield of c.6% whilst they wait for a sale in due course.

I’ve briefly reviewed the accounts, here are my notes on the main points -

Revenues up 6% to £371.5m, generated 90% in the UK.

International division is small, but showed strong profit growth.

Adj PBT £40.5m, with statutory PBT lower at £30.7m.

Exceptional costs of £5.0m include £1.7m aborted sale costs, and the balance is restructuring costs - a little bit questionable for the latter, as businesses like this often have to restructure depending on circumstances.

Other adjustments to profit include £4.5m of goodwill amortisation, which is fine to exclude.

Overall then I’m reasonably OK with the adjustments.

Finance costs have risen, and of course hire companies use a fair bit of debt, so finance costs are likely to rise further. Although VP has private placement notes (bonds) of £93m, which I seem to recall are at fixed, low interest rates.

Adj basic EPS is 79.0p, up 11%. Note 3 shows that there’s hardly any potential dilution from share options, which I like.

The PER is only 8.5, which strikes me as a bargain. That’s an earnings yield of a healthy 11.8% - attractive, when cash deposits are earning say 4-5%.

Year end net debt of £134.4m looks OK to me, in the context of £252m fixed assets. I generally like to see hire companies own about half their fleet, and the other half funded through debt, which is roughly the position at VP.

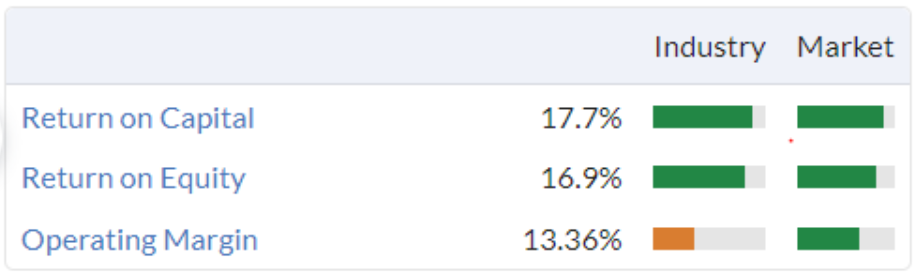

ROCE is 14.4%, it’s quite unusual to see this disclosed, and usually indicates management are prioritising good capital allocation (ie. only buying stuff that they can earn a good return from renting out).

Gearing & interest cover are “well within covenants”, so no sign of potential financial distress in any of these numbers or commentary.

Balance sheet looks OK to me - NAV £175m, less intangibles of £57.7m, so NTAV is £117m, which is pretty solid I think. There is a small pension accounting surplus, which would need careful checking to ensure it’s not a nasty actuarial deficit.

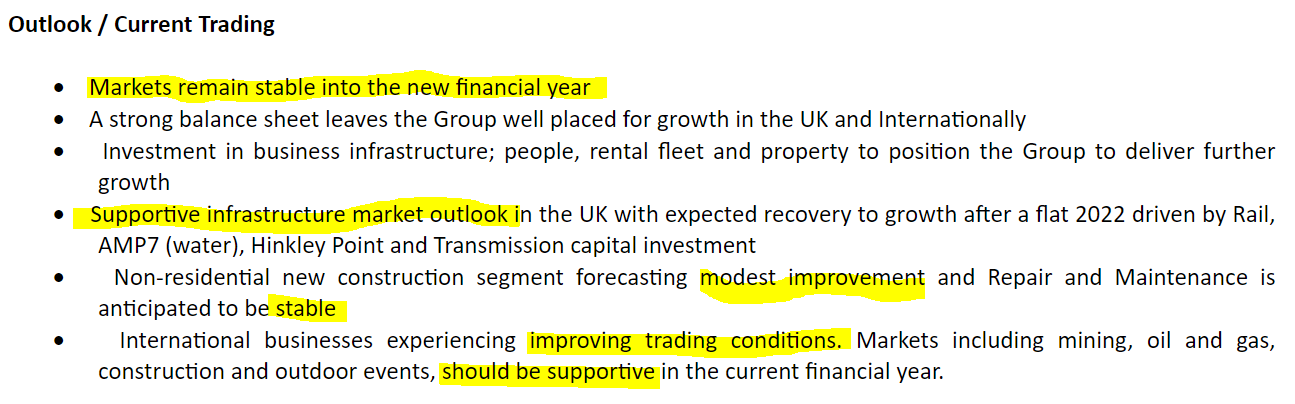

Outlook & the commentary generally sound good, with a nice mix of activities evening out performance. This bit below is interesting for wider read-across possibly -

After a period of little change within the wider UK construction market, some adjustments to recent trends are forecast in the coming 12 months. Housebuilding which has been relatively buoyant for the last two years is forecast to experience moderate contraction in 2023 before recovering in 2024. Infrastructure will recover to modest growth after a flat 2022 driven by Rail, AMP7 (water), Hinkley Point and Offshore Wind capital investment. The non-residential new construction segment, comprising Public, Private Industrial and Private Commercial output is expected to see modest improvement overall and the Repair and Maintenance sectors are anticipated to be stable. This market backdrop remains positive for Vp.

Forecasts - Singers (many thanks) is forecasting 79.7p adj EPS for FY 3/2024, which I think sits comfortably with the commentary in today’s results. So I suspect the risk of a profit warning is probably quite low.

Paul’s opinion - I think this looks very good. VP strikes me as a good quality business, priced attractively cheaply at the moment - I think this could be a buying opportunity for medium to long-term investors.

It seems well-managed, and I like the catalyst for a takeover bid being received (retirement sale for the 50% shareholder).

So a thumbs up from me!

Graham’s Section:

Ramsdens Holdings (LON:RFX)

Share price: 259p (+5%)

Market cap: £82m

Ramsdens, the diversified financial services provider and retailer, today announces its Interim Results for the six months ended 31 March 2023 (the "Period").

This company raised expectations in April as every service it provided was booming: jewellery retail, foreign exchange, pawnbroking and precious metal buying.

Here are the interim highlights:

Revenue +33% to £39m

PBT +68% to £3.7m

Net assets up £5.4m year-on-year to £43m

Current trading - “positive momentum has continued so far into the second half of FY23”.

New stores - six new stores opened in H1, and another six are planned in H2, as the company continues its expansion into the South of England. I do consider this to be a risky move, as they are clashing head-on with H & T (LON:HAT) but hopefully they will move slowly enough to manage the risks involved. Total store estate is 158 stores.

Dividend - it’s worth mentioning a significant increase in the interim dividend from 2.7p to 3.3p. I don’t always bother mentioning dividend increases in this report but that’s a chunky increase!

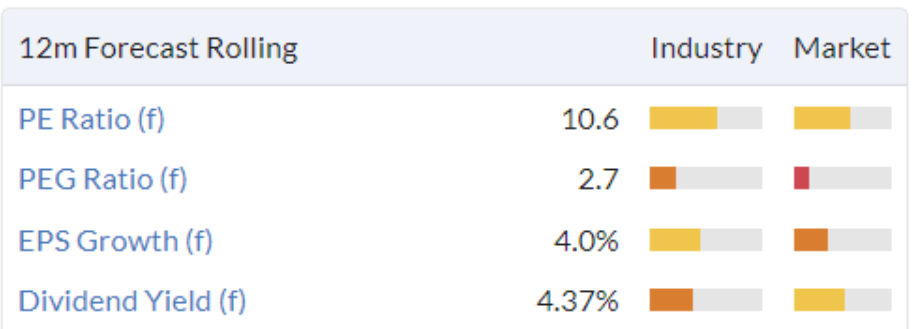

Stockopedia is forecasting 10.4p of total dividends this year, giving it an attractive yield:

Foreign currency exchange - this remains a very popular service and continues on its post-Covid recovery. In addition to the core service, Ramsdens will launch a new multi-currency card this summer to assist holidaymakers. CEO comment:

We are looking forward to the summer period with optimism supported by positive commentary by airlines and travel agents, albeit we do not currently anticipate that the total volume exchanged will exceed the levels seen prior to the pandemic in summer 2019.

Pawnbroking - also very strong right now, due to the cost-of-living crisis (and in my opinion a hostile regulatory environment for payday lenders).

With restrictions in the availability of other forms of small sum credit, and the continued squeeze on household incomes with higher bills, we believe that demand for small sum loans will continue to be high for the remainder of 2023.

New website - Ramsdens has an attractive new jewellery retailing website which delivered sales of £3.7m in H1 (up 89% year-on-year).

Outlook

With our diversified income streams, strong brand and growing customer base, we believe we are well positioned to further grow our profitability in this financial year and in coming years, and continue to deliver on our progressive dividend policy.

Graham’s view

I gave this stock the thumbs up in April (share price: 230p) and there is little reason to change my stance today! The share price is up over 10% since then but positive momentum continues to build and the valuation remains, in my view, very reasonable.

I tend to think of H & T (LON:HAT) as a mini-bank, because its loan book is so large and so important to its financial performance.

Ramsdens Holdings (LON:RFX) is different because its loan book only accounts for about a quarter of its gross profit. So it can be thought of more as a retailer or a retail service provider than a bank.

This isn’t good or bad, just different. I calculate the return on equity for the company in H1 as circa 6.7% (so double it for an annual figure), which is very good - and Stockopedia agrees that this is a quality outfit:

For a “retailer” to generate these metrics shows that it is doing things right, and it’s reasonable to expand when it’s able to generate these sorts of returns - it will just need to be very careful to do so responsibly.

In this regard, I am comforted by the CEO’s statement that “we continue to value flexibility in our lease portfolio. Lease renewals have generally resulted in rent reductions and / or greater flexibility. On occasion, we have relocated to take advantage of lower rents in a much better footfall location.”

Overall I remain very impressed by this company and its performance.

City Pub (LON:CPC)

Share price: 100.7p (+2%)

Market cap: £103m

Roland provided an excellent analysis of this company at the time of its full-year results in April.

Today we have an AGM trading update for the first 23 weeks of the new financial year (I’m pretty sure there is no significance to that number of weeks - it’s purely a function of when the AGM falls!).

Trading continues to be “strong”, with total sales up 20%:

LFL sales improved by 13% on 2022 and would have been higher if not for recent train strikes. The strong LFL performance is being driven by our strategy to further premiumise the estate and a continuous focus on customer service. We expect this trend to continue through H2 and we will also benefit from the new openings from 2022 which have performed well to date.

Rail strikes have been an issue for some time; I noted in relation to Q4 2022 that the World Cup had boosted revenues while rail strikes had held them back. The bottom line is that there is always some issue beyond a pub’s control that is affecting performance - if nothing else, then it’s the weather!

Inflation - “Costs have remained in line with expectations and there is now clear evidence of abatement in some areas, although food inflation remains high”. Excellent news.

Net debt is considered “low” at £8m although this does represent a doubling from the year-end figure. Still, the main point about CPC is that it’s a mostly freehold estate, which greatly reduces the financial risk associated with the stock (and puts it in a different league to many other pub investments).

According to the full-year results for 2022, “the company’s portfolio is 61% freehold and these pubs account for over 90% of our investment”. The balance sheet showed less than £20m of lease liabilities.

Additionally, they have claimed to hold “very strict criteria” for acquisitions, and they continue in that vein in today’s update:

Whilst we are looking at acquisition opportunities carefully, we still believe that in the short-term pub prices will fall and we are therefore in no rush to go out and acquire. We will continue to focus on organic growth from our existing estate.

Mosaic pubs

CPC has gradually increased its level of investment in “Mosaic Pub and Dining Group”, paying another £0.7m to bring its total investment to £7m. It now has 52% ownership and is taking operational control of the 9 pubs in this estate.

Chairman comment

The strategy that we have pursued over that last couple of years is now manifesting itself in our out performance. We have an excellent estate of high-quality premium pubs, well invested, located well and trading strongly… Our estate is growing through cost effective acquisitions and we have reached a landmark moment for the City Pub Group as we now own and operate more than 50 premium -predominantly freehold - pubs in the south of England and Wales

Graham’s view

Whenever I see the word “freehold” in relation to pubs I am far more comfortable, as I don’t need to worry about landlords extracting most of the value from the business or (worst-case scenario) becoming a nightmare creditor.

Instead, this business is largely its own landlord, and its post-Covid recovery expansion and expansion look set to result in some nice profits:

Is it worth £100m+? Perhaps, but I’m not sure it’s worth much more than that; balance sheet net assets were £94m as of December 2022 so it is trading at price/book and price/sales multiples both in excess of 1x. For pubs, I don’t think that’s cheap. Price/earnings is also at the higher end of the spectrum.

Therefore, while I like everything I’ve read about this company, I have to agree with Roland and I wouldn’t personally be in any rush to buy the shares at this level.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.