Good morning from Paul. Sorry, overslept this morning, I must be on Central European time: 8am is 7am.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Paul’s Section:

DP Poland (LON:DPP)

Unch at 7.7p (£55m) - H1 Trading Update - Paul - RED

DP Poland, the operator of pizza stores and restaurants across Poland and Croatia, announces a trading update for first half of 2023.

This company has the Dominos Pizza franchise for Poland (114 stores) and Croatia - the latter being a startup with only 4 stores. I'm not keen on companies that have to pay a third party to use their brand.

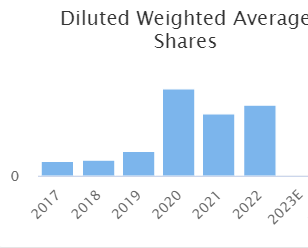

DPP has been listed since 2010, and has never made a profit. It’s been propped up with numerous equity fundraisings, and now has over 712m shares in issue. It’s always looked an absolute dead duck to me, but with a £55m market cap clearly there are plenty of optimists out there who think it might eventually succeed. So as always, I’ll approach it with an open mind, and look at the facts, figures, and forecasts.

Poland is the main operation. Today’s update only talks about revenues, not profitability.

Like-for-like (i.e. excluding site openings & closures) looks very good, at +18%, being volume +11.3%, and the rest must be price increases. Trading Economics (an excellent site for macro information) says inflation is currently 11.5% in Poland, having recently come down from a figure closer to DPP’s LFL, so maybe +18% isn’t so great after all? Everything needs to be seen in the context of higher inflation, and of course its costs (especially wages) will be rising fast too.

Outlook - always sounds optimistic, which I suppose management have to be, offering jam tomorrow instead of an insufficient number of pizzas today! -

High inflation in energy and food have eventually started to abate in May, and whilst labour rates are still under inflationary pressures we are constantly focusing on further optimization projects. We expect performance to continue improving and remain optimistic about the outlook for the Group."..

Inflationary costs have begun to diminish in food and energy, however, labour inflationary pressures have remained.

Cash - has dropped from £4.1m at Dec 2022, to £2.5m at end June 2023 - starting to look tight for cash again, when’s the next placing going to be then?

My opinion - nothing is said about profit/losses, so it’s not really a trading update as such.

Singers helpfully updates us, with no change to forecasts, showing £(1.1)m adj PBT loss this year FY 12/2023, which is a big improvement on the past, when annual losses were more usually £3-4m pa.

So I conclude that DPP looks as if it’s finally making some progress. Since it has a hefty depreciation charge for store fit-outs, it should now theoretically be cash generative.

I have to say, this is the closest DPP has looked to being a viable business, in the 13 years I’ve followed it.

Is it worth £55m though? Absolutely not, the market cap is crazy given the poor track record. If you have to invest in a fast food outlet, I would say Tortilla Mexican Grill (LON:MEX) (I hold) looks far better, and is a lower market cap too.

Note that the share count has risen from 142m to 712m since 2017 -

Thruvision (LON:THRU)

Down 7% to 28.5p (£42m) - FY 3/2023 Results - Paul - AMBER

Thruvision Group plc (AIM:THRU, "Thruvision" or the "Group"), the leading provider of walk-through security technology, today publishes its results for the financial year ended 31 March 2023.

This loss-making company has been on my watchlist, because the products look very interesting (similar to airport body scanners), and it has an impressive-sounding contract with US border forces. So the story is that performance could greatly improve if orders take off, and you can’t really get a better reference customer than the US border authorities.

Key numbers -

Revenue £12.4m, up an impressive 49%

Two thirds of revenue came from that big customer, US border, so horrible concentration there, making it high risk:reward.

Almost at breakeven EBITDA, a £(0.2)m loss.

Adj PBT is a loss of £(0.8)m, improved considerably from £(2.3)m last year.

Cash looks tight, £2.8m at Mar 2023, and £2.4m on 20 July 2023 (yesterday), so I imagine another placing is likely. It gives itself a clean going concern statement.

Outlook - very vague, with no specific information here - I think investors expect more than this waffle -

Having proved the value of our solutions beyond doubt, the focus of the business is now moving towards scaling as rapidly as our markets and resources will allow. We believe that our target markets are significant and should impose no foreseeable limits on our growth. Our growing sales team will focus equally on acquiring new customers, particularly in the US, and on increasing the Thruvision presence with existing customers. Meanwhile, our technology investment will ensure that we build an even greater lead over our competition.

The past year, combined with current activity levels, have reinforced our confidence that Thruvision will continue to grow well and become the solution of choice for walk-through security.

Balance sheet - NTAV is £8.7m, and includes £2.8m cash (with no borrowings). Both inventories & receivables look too high, so I’d want to see those turn into cash, which would then leave it in a satisfactory position. It might be able to escape without doing another placing, if working capital could be more tightly managed.

Paul’s opinion - quite high risk I think, due to the dependence on a single major customer. Also looks borderline in terms of cash, so there might be further dilution.

However, I remain intrigued by the product, so the next step would be to investigate its market, and what competitors are offering - is Thruvision’s technology unique and patented (good)? Or is it using generic technology (bad)?

Overall, I think this one is worth you doing some more detailed research, ideally talking to customers who have shopped around and chosen this product.

Optimists have not fared well here in the past -

DWF (LON:DWF)

Up 15% to 97.4p (£334m) - Recommended Cash Takeover - Paul

As we reported here on 11 July, DWF announced that it was in talks with Inflexion (mid-market private equity firm) about a possible takeover, at 97p+3p dividend. At the time, the market share price only rose to 88p, so some shareholders were clearly happy to sell in the market for certainty, rather than take the deal risk - which I think makes a lot of sense, given how many deals have fallen through of late. Or maybe take a hybrid approach, selling half in the market, and holding on for the full payout for the other half?

Anyway, the good news for people who held on, is that the deal is going ahead. 100p takeover price is over double the recent low, so well done to anyway who took the risk and bought at or near the low.

Paul’s opinion - this whole sector (legal services) looks quite interesting, as valuations are really bombed out, there must be some other bargains in the sector. Also some banana skins though maybe?

This deal once again shows that the public market for small caps is undervaluing many companies compared with the private market. This is very encouraging, and makes me increasingly convinced that small caps is now the best area to be invested in, with tremendously bullish potential, once the balance of buyers and sellers turns favourable, which is only a matter of time I think. Valuations are too cheap now, so risk:reward now looks the best it has done in years, in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.