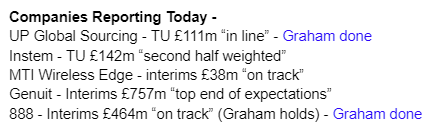

Good morning! Graham and Paul here. Today's report is finished - thanks for reading! (11.40am).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of Main Sections

Stelrad (LON:SRAD) - Up 4% to 118p (£150m) y’day - Interim Results - Paul - AMBER

H1 profit is down on 2022, and there’s too much bank debt for me to consider this a safe investment. PER and divis are superficially attractive, but how will it pay down all the bank debt? It’s not for me. Also, what will happen to radiators, as gas boilers are phased out?

888 Holdings (LON:888) - down 2.5% to 106.8p (£479m) - Interim Results - Graham - AMBER (Graham holds)

This is a special situation involving lots of debt (over £1.6 billion), a large acquisition, a new CEO, and an uncertain future. I provide some comments on the usefulness of EBITDA in this situation and the company's prospects for survival. I'm hopeful that the leverage multiple can continue to drift lower from here.

Quick Comment

UP Global Sourcing Holdings (LON:UPGS) - up 4% to 129p (£115m) - Trading update - Graham - GREEN

I gave this household goods company the thumbs up in July, when it announced that its year-end net debt was lower than expected.

Today we have a brief full-year trading update. Profits are in line with expectations:

Revenues +8% to £166.3m (exceeding expectations of 6% growth from Equity Development).

EBITDA +8% to £20.2m.

Adjusted PBT +6% to £16.8m.

Net debt finishes the year at £14.8m, as anticipated, so the leverage multiple here is comfortable.

Current trading is in line with expectations.

CEO comment:

"We are delighted that our brands continue to resonate so well with our customers, enabling us to deliver strong revenue growth with no overall price inflation. In achieving this, we are making good on our purpose of providing beautiful and competitively priced products to every home."

Graham’s view

There’s little reason to change your prior view on this, given that results are in line with expectations, and so is current trading.

One interesting snippet is the company’s statement that its current performance is based on “no overall price inflation”, meaning that its products are sold at “attractive and affordable prices” in this inflationary environment.

It’s great news for consumers, of course, but in general I’m looking for companies that can at least keep pace with inflation. It seems that UPGS is maintaining its revenue growth through volume increases, rather than pricing. Again, it's great news for customers, but what does it mean for owners of the company?

For me, it highlights that the company’s brands do not stand out in terms of their pricing power. There’s nothing wrong with that - not every brand can be special - but it probably does put a cap on the valuation of the company.

I’m going to retain my positive view on these shares for the reasons previously mentioned: a solid track record, good managerial performance throughout Covid, and a discounted valuation:

Paul's Section

Up 4% yesterday to 118p (£150m) - Interim Results - Paul - AMBER

Stelrad floated in the cursed year of 2021, when many floats were timed (and over-priced) to exploit the short-lived lockdown internet & home improvement booms. No wonder fund managers are seeing client redemptions of funds, and the new issues market is now almost dead - this is what happens when people get too greedy.

We’ve only looked at this manufacturer/distributor of heating radiators once on 27 Jan 2023, noting the strong FY 12/2022 results, and a trading update that said it was expecting 2023 to be challenging.

Then on 22 May 2023 there was a trading update, in line with management expectations YTD.

So it’s about time I have a proper look at some up-to-date figures.

Stelrad Group plc ("Stelrad" or "the Group" or "the Company", LSE: SRAD), a leading specialist manufacturer and distributor of steel panel radiators in the UK, Europe and Turkey, today announces its unaudited interim results for the six months ended 30 June 2023.

Strategy continuing to deliver with outlook for the full year unchanged

It’s a good thing that they got that line in first, as the H1 numbers look soft -

Revenue is OK, up 5% to £157m in H1, so over £300m annualised, a fair sized business.

Adj operating profit is down 26% to £14.0m - and this is an unreliable figure anyway, due to the size of finance charges of £3.5m, which come below operating profit.

PBT and PAT are not comparable with H1 LY due to an unusual LY cost of £5.4m (relating to high inflation/forex issues in Turkey), and also an unusually high tax charge last year. All a bit complicated.

It’s probably easiest to focus on adj EPS, which is down 42% to 6.4p (LY H1: 11.0p)

Adjustments seem reasonable, and mainly apply to last year’s numbers anyway.

Interim divi is held flat at 2.92p, so more than twice covered by H1 earnings, seems OK.

Net bank debt is £70.4m, which seems high to me.

Balance sheet - although NTAV is positive at about £45m, this includes a large fixed asset base of £89m. This leaves working capital, and some of the fixed assets, financed by excessive bank net debt of £70m.

I think that’s probably a deal-breaker for me. The company isn’t generating much free cashflow after capex and finance charges, so it’s difficult to see how that debt will be paid off.

My opinion - I don’t want to be investing in companies which are heavily reliant on bank debt right now. Especially when they describe market conditions as “extremely challenging”. With finance charges now so much higher, we’re increasingly seeing how geared up companies are paying out considerable amounts in interest. And what if the bank gets jittery and wants to reduce its exposure? Then we might see a discounted placing, with the limited number of people prepared to (or able to) fund placings, demanding their pound of flesh with some hideous discounts demanded of late.

Also, I’ve got to flag up the obvious question over how long traditional steel radiators will be around? Are we going to be pushed into installing electric heat pumps, or some other greener electric heaters (as opposed to gas boilers heating traditional radiators) in future? There’s a risk that Stelrad’s products might have a limited life before they become completely redundant maybe? I don’t know, but it’s an important question. If Stelrad has to completely switch to newer technologies, that might render a lot of its hefty fixed assets redundant perhaps?

So although the PER and dividend yield look attractive to value investors, it’s not so good once you factor in all that much more expensive bank debt.

For that reason, I can’t go above AMBER I’m afraid. I think there are probably better options in bombed out building supplies shares, with better balance sheets, and lower risk.

Graham's Section

888 Holdings (LON:888) 888

- Share price: 106.8p (-2.5%)

- Market cap: £479m

888 (LSE: 888), one of the world's leading betting and gaming companies with internationally renowned brands including William Hill, 888 and Mr Green, today announces its financial results for the six months ended 30 June 2023 ("H1-23" or the "Period").

(Graham has a long position in 888.)

This is a guilty holding of mine - I’m fully aware that it’s not investment-grade, and that it might end up being worth very little.

How did I end up in this position? Well, I bought into it back when it was cash-rich.

It then, during the Covid crisis, agreed to buy William Hill. The enormous financial risk created by this deal weighs heavily on the shares now:

Paul covered it negatively in April, saying the “balance sheet is one of the worst I’ve ever seen”.

I gave it a neutral rating back in January, when it lost the CEO who presided over the William Hill deal, and was forced to suspend VIP customer accounts in the Middle East.

Today’s interim results are as follows:

Revenue £882m, adjusted EBITDA £156m (both numbers have ballooned thanks to the acquisition).

After-tax loss £33m

“Pro forma” revenue is down 7% due to “compliance changes in dotcom markets together with refined marketing approach and market focus”.

Worries about unregulated operations were a longstanding feature of this share, but 95% of recent revenues were “locally regulated or taxed”. This says to me that 888 can no longer be considered an offshore, unregulated operator.

Deal synergies: for the William Hill deal to work, it must result in cost savings that enable the debt to be paid down. The headline here is:

Accelerated synergy delivery with £66m of cash synergies delivered in H1-23 and full £150m target benefit now expected to be achieved in 2024 (a year earlier than prior expectations)

As for the debt itself, net debt reduces by £68m to £1660m.

The leverage multiple (net debt / adjusted EBITDA) reduces from 5.6x to 5.1x. This is still an extreme level, of course.

Year-end leverage is expected to be “slightly below 5x”.

I’d love to see this multiple get to 4x, which would almost start to feel reasonable!

EBITDA

There is an important point about EBITDA which I think it’s important to explain here.

The reason value investors tend to sniff at EBITDA is that it doesn’t include lots of important costs. These are costs that do show up in the long-run. Depreciation and amortisation, in particular: these represent the wearing out of tangible or intangible assets which were paid for in the past and will likely need to be replaced in the future, if company performance is to be sustained. Long-term equity investors can’t ignore these costs.

So why does EBITDA remain in use among investment bankers and private equity investors? The reason is that it can be used as a proxy for short-term operating cash flow. If you want to know whether or not a company in a leveraged buyout can survive the next few years, EBITDA can help. If you want to know whether or not a debt-ridden IPO can survive the next few years, EBITDA can help.

In short, if your timeframe is “a few years”, and your concern is company survival, then EBITDA is relevant. It provides an insight into its immediate cash flow generating possibilities.

In the case of 888, for example, it reports an adjusted EBITDA of £156m.

If I go to the cash flow statement myself and calculate an EBITDA figure that I’d be comfortable with, I get £133m (take the pre-tax loss and add back depreciation, amortisation and interest expenses).

For me, this is the short-term cash flow that 888 is able to play with: from this amount it has to pay taxes, pay interest, make investments in its own businesses, pay leases, and hopefully pay down debt.

It may be possible for a company to reduce internal investments for a period of time, in order to prioritise interest and debt payments. That would be bad for long-term earnings, but it could ensure short-term survival! So I hope you can see why a company’s reported EBITDA figure (or an EBITDA figure you might calculate for yourself) can provide some insight into its short-term survival prospects.

Going concern statement - notes that the majority of the company’s debt is repayable in 2027/2028, with the next due date in 2026. So there is time to organise a refinancing. The company’s revolving credit facility has a net leverage covenant, but it’s currently undrawn, and “the remainder of the Group’s debt does not contain any financial covenants”.

“Severe but plausible” downside scenarios have been considered, and have “enabled the Directors to conclude that the Group has adequate resources to continue to operate for the foreseeable future”. They say that they could withstand “a decrease in forecast EBITDA of 64.1%”!

For a company in severe financial straits, this going concern statement is about as bullish as a shareholder could hope for.

Outlook

Overall, this has been a good first half, reflecting our really strong financial discipline and delivering on our targets to increase profitability and deleverage…

…we remain on track for our full year revenue guidance of a low to mid single digit decline on a pro forma basis, with the decline likely to be at the mid single digit end of the range, reflecting the pace of recovery in the Middle East, which has been slower than we anticipated.

We also remain on track to deliver an Adjusted EBITDA margin of 20% this year… with the phasing of marketing investments and synergies, we have good visibility on this reaching 20% for the full year.

New CEO - before wrapping this up, I should mention that 888’s new CEO from October will be Per Widerstrom (this was announced last month). He was previously CEO at Fortuna, “the leading omni-channel betting and gaming operator in Central and Eastern Europe”.

Graham’s view - this is the riskiest share in my portfolio by a long way, but it’s also my smallest position (3%). If it sinks under the weight of its debt, I will be fine.

I do regret not selling it back when the William Hill deal was announced, but I also still think that there is a chance it pulls through or survives long enough to be acquired at an attractive price by someone else in the industry.

I note that the company’s €450 million secured bond is not trading at a distressed price. It trades on the Frankfurt Exchange with a yield of 11%:

Honestly, I’m surprised to see the bonds trading so strongly. You can see from the above chart that they were trading much lower in February. That’s around the time that Moody’s gave 888’s credit rating a negative outlook, on top of its “B1” speculative-grade rating.

But the news flow since then has been ok, and the 888 share price doubled from the low it reached earlier this year.

One final point: there is no equity analyst coverage of this share, so we are on our own researching it!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.