Good morning from Paul & Graham!

I hope you're coping alright with the heatwave. I'm fine with a desk fan blowing on me 24/7, and a siesta each afternoon! I wonder how many companies will blame the weather for the next batch of profit warnings?!

Right I've got to dash for another City lunch, so we'll leave it there for today. Graham has offered to help out tomorrow, so we can make a dent in the backlog.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

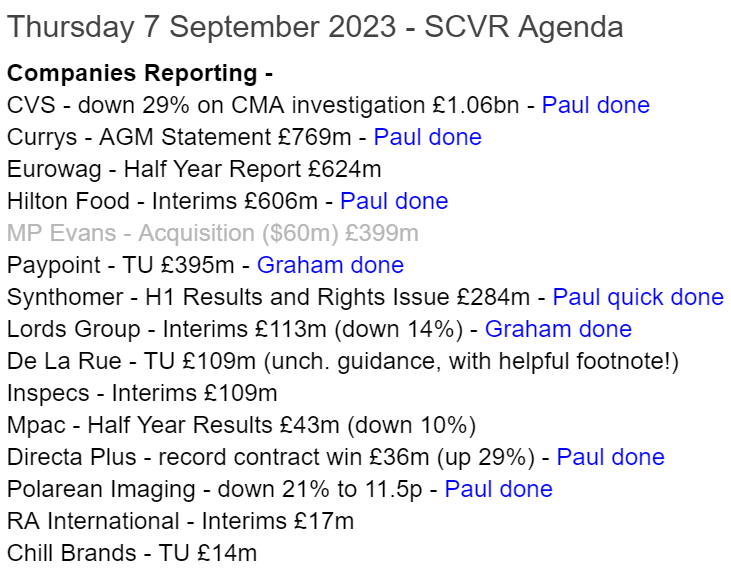

Busy again for reporting. So we'll probably do about half of these, trying to pick the more interesting, and price-sensitive ones as priorities -

Summaries -

Restore (LON:RST) - 205p (up 14% y’day) £281m - New CEO & big contract win - Paul - AMBER

I'm pleased to say we spotted the turning point here in 16 August's SCVR (suggesting it as possible rebound trade at 125p), and RST shares have since bounced over 60% in just 3 weeks. Although the 14% surge yesterday was due to new information about a significant contract win with HMRC. Note that a long-serving (10 years) former CEO is rejoining as new CEO, so will be able to hit the ground running. Interesting, but I've shifted back to amber, due to the large recent bounce in share price.

Currys (LON:CURY) - 49p (pre market) £554m - AGM Trading Statement - Paul - RED

A reassuring trading update, with no change to guidance. Although LFL sales are down 2% in its largest market (UK & Ireland). I reiterate the extremely weak balance sheet risk, with the business entirely dependent on c.£2bn trade credit - this is why I continue to see the shares as high risk, hence RED.

Directa Plus (LON:DCTA) - up 29% to 56p (£37m) - Contract win - Paul - RED

An impressive-sounding contract win today has put a rocket under this graphene products company. Although the investment case quickly falls apart on some basic scrutiny. It's a big cash-burner, and I suspect will need more funding in 2024. Revenues are rising nicely, but losses remain stubbornly high. No evidence of any decent gross margin either, so I can't see the vitally needed operational gearing here. Thumbs down from me at this stage, but I'll keep an open mind if things improve in future.

Synthomer (LON:SYNT) - down 31% to 42p - Fundraising - Paul - RED

Quick comment - I’ll keep this brief. We flagged the dilution risk here on 13 Dec 2022, concluding with a RED view - “Risk of a dilutive fundraise strikes me as high. This share looks complicated & risky, so I’ll steer clear.” The problems were caused by a disastrous, large debt-fuelled acquisition, and then a deterioration in trading. It didn’t take any particular insights to spot this, just a quick look at the stretched balance sheet. Paul’s opinion - I can’t see any merit in spending time analysing the terms of today’s refinancing, we’ll take a fresh look at it once the dust has settled in future. H1 results are poor, and the right issue doesn't solve the debt problem, just mitigates it. Bank facilities dependent on rights issue. Looks a mess. [no section below]

CVS (LON:CVSG) - down 29% to 1484p (£1.06bn) - CMA investigation - Paul - RED

Quick comment - many thanks to readers below who flagged this issue. I was wondering why this chain of pets had plunged 29% this morning with no RNS news. Redice spotted a BBC article here which says the CMA is to investigate over-charging by vets, and how the market has consolidated with corporates gaining market share and driving up prices unreasonably. Long overdue I’d say, this sector is a disgrace in my opinion, in the way some vets exploit owners’ love for their animals through outrageously high charges. An example of capitalism working badly I’d say, so let’s hope the CMA gouges the gougers! I won’t be bottom-fishing here, at any price. Note that CVSG doesn’t have any balance sheet support either, with NTAV last reported around zero. I'd be worried about shorters getting involved. Update: CVS has published this brief response to the CMA announcement. It points out that there's a shortage of vets in the UK, and that wages (and other costs) are rising. [no section below].

PayPoint (LON:PAY) - up 3% to 558.9p (£406m) - Trading Update (in line) - Graham - GREEN

This provider of services to convenience stores and their customers gives an “in line” update. I’m enthused to read about their plans for the businesses acquired with Appreciate (“Love2shop” and Park). I view this as a quality fintech stock but it’s valued very cheaply.

Hilton Food (LON:HFG) - unch at 678p (£609m) - Interim Results (in line) - Paul - AMBER/RED

Quick comment - I’ve had a skim of today's interim results, and see nothing of interest here. In fact I’m struggling to understand why the market cap is anywhere near this level? Very low margin food producer, and finance costs have almost doubled, and now consumes about two-thirds of operating profits. Only £27m aPBT in H1, on £2.1bn revenues. Net debt of £217m is a lot, and given very small profits, I’m a bit concerned about this level of debt, and the cost of it. Paul’s opinion - the only bull case I can think up, is if investors believe margins can be strongly rebuilt. On over £4bn revenues, that could provide nice upside maybe? Outlook comments sound reassuring, with confidence in expectations for FY 12/2023. But why get involved, when we have so many other, better investing options?

Lords Trading (LON:LORD) - down 12% to 60.05p (£99m) - Interim Results (in line) - Graham - AMBER

These interim results contain a profit warning as macro conditions are unfavourable to this builders merchant/distributor. I note the fall in house prices announced this morning and see some sources of concern with this share. A cheap valuation may be fair in this case.

Polarean Imaging (LON:POLX) - down 21% to 11.5p (£25m) - Interim Results - Paul - RED

Quick comment - this has been a complete disaster unfortunately. I took a hit on it personally, buying when I thought it looked cheap, but ditching them at about 15p recently, as it just continuously fell, and confidence in the company seems to have completely collapsed. The cash runway is running out - this is the key sentence today -

The Company is funded until the end of Q2 2024, and the continued progress on the above initiatives will help support future financing at the appropriate time.

That’s now too soon for comfort, so it looks as if this share is now in a doom loop, a bit like we saw with Creo Medical (LON:CREO) earlier this year. There was a nice trade in that one, for a bounce, but only after it hit rock bottom with a discounted placing.

Paul’s opinion - it’s impossible to value Polarean shares right now. The tech sounds great, but with the clock now ticking re the next fundraise, in horrid market conditions, it’s unknowable what terms the next fundraise will be on. Whoever is putting in the next tranche of money can just name their terms. For that reason, I haven’t got any choice, this has to be RED I’m afraid, due to the big uncertainty over the next fundraise. I hope it works out OK for holders, but it’s just a gamble at this stage, with such high dilution risk.

Paul’s Section:

Restore (LON:RST)

205p (up 14% y’day) £281m - New CEO & big contract win - Paul - AMBER

New/old CEO - an interesting situation, announced 5 Sept, that a former CEO (2009-2019) has been reappointed as new CEO. They felt he was the best candidate, and will hit the ground running. It might be worth checking why he left. I see the share price took a big tumble in late 2018.

Significant contract win - this gave RST shares a 14% boost yesterday. This looks a decent contract win, providing digital services to HMRC. Up to £140m, over 5-7 years, starting this month. We don’t know what the profit margin is of course, and as yet I cannot find any broker forecast changes.

Paul’s opinion - I’m pleased to say we spotted the value, and timed it perfectly too (you see, we do get some things right occasionally!), in the SCVR here on 16 Aug suggesting that RST could be good for a bounce trade at 125p, based on a reassuring trading update that came at the end of a horrendous drop in share price. In 3 weeks, it’s risen 64%, demonstrating that there are some good opportunities out there right now, if we spot good or reassuring news from a share that’s been in freefall, such as this.

Personally I banked my profits at something like 160-170p from memory, but well done to anyone who is still holding.

If we spot any similar situations, you’ll be the first to know here!

I’ll move down from amber/green, to just amber, to reflect that the share price has shot up a lot recently, and there’s still some way to go to turn around this group. Although there’s also an argument for just running with the bull run, now that it’s looking established. Your money, your choice!

Currys (LON:CURY)

49p (pre market) £554m - AGM Trading Statement - Paul - RED

Trading update for 17 weeks ended 26 August 2023

Nothing much to say here, as the first bullet points says -

All guidance for the year remains unchanged

Interestingly, it says revenue trends in July & August improved from May & June.

Its largest market, UK & Ireland saw revenues down 2% for the first 17 weeks - so not a good performance I’d say, given that many costs (especially staff and energy) will probably be a good bit higher.

Paul’s opinion - see our archive for my previous comments on the balance sheet, which is absolutely horrendous. The whole business is financed by credit from suppliers, on a huge scale. So if confidence were to diminish, and suppliers (and trade credit insurers) start demanding cash up-front, then CURY would be bust.

So don’t let the low PER fool you. It’s cheap for a reason - because the finances are precarious.

Divis were cancelled in July, and it can’t afford to safely pay any divis for the foreseeable future, in my opinion. Hence I would ignore the forecast yield of c.4.2%.

That said, given how we’re constantly hearing about gloomy macro, today’s update that there’s no change to guidance might reassure some investors.

Also, look at how much, and frequently, expectations have been reduced -

Since I perceive balance sheet risk to be very high, I’ve got to continue viewing CURY negatively. Why take the risk, especially when consumer spending is under pressure? So it’s a RED opinion from me.

As always, I’ve no idea what the share price is likely to do, because many investors ignore balance sheet risk. That actually worked quite well when interest rates were zero, but it’s a completely different scenario now that debt is more expensive and macro conditions are tough. So high risk balance sheets are just best avoided in my opinion.

Directa Plus (LON:DCTA)

Up 29% to 56p (£37m) - Contract win - Paul - RED

This is a new one for me. Jack looked at it over 2 years ago, noting it was loss-making and speculative. That remains the case today. It came up on the top % risers list this morning, so I’ve had a quick look.

DCTA supplies patented graphene-based products for consumer & industrial use. The contract today is 5.5m Euros over 3 years, with potential to rise to 8.0 Euros. That’s nice, but nothing is said about the profitability of the contract. Since rising revenues in the past have not budged the annual 3-5m Euro losses, then I’d need more information about contract-level profitability, or at least a high gross margin to indicate it would be able to move into profit as contracts build.

Looking at the 2022 accounts, it’s not entirely clear what the gross margin is, but I see revenue is roughly equal to raw materials and staff costs put together, suggesting a not very good (if any) gross margin. Which raises the question, are they just busy fools, supplying products at or below cost?

It says the contract today was won in a public tender, suggesting that what it does is not unique.

More red meat is thrown to the bulls with an indication that the company is targeting a “new significant application” for its technology. Exciting!

Cash - nothing is said today, but I’ve checked the 2022 accounts, and it’s burning through cash at quite a rapid rate, and it seems obvious to me that another placing is likely to be necessary in the not-too-distant future.

Paul’s opinion - on the quickest of reviews, I can see that DCTA has exciting-sounding products, but I can’t see any evidence it’s commercially viable at this stage. Put that together with a clear need for more cash, probably in early 2024, and I wouldn’t be interested in speculating on this share myself.

The very concentrated shareholder base is another reason to steer clear in my view.

Bull market froth has mostly gone, but the market cap certainly isn't cheap, even now.

Note the Altman Z-score is flashing for potential insolvency risk.

The Z-score can be a clumsy tool, but it's statistically proven over the long term, so ignoring it is foolish - especially when funding is much harder to come by, in a bear market -

Graham’s Section:

PayPoint (LON:PAY)

Share price: 558.9p (+3%)

Market cap: £406m

This share has crept up by 22% since Paul last covered it in July.

Six-month chart:

Full-year results, published at the end of July, showed revenues up nearly 12% to £129m and underlying PBT up almost 6% to £50.8m.

The takeover of Appreciate (another financial stock we used to cover in this report) completed only at the end of February, so those results hardly included any contribution from that deal.

Today brings a trading update for the new financial year: FY March 2024.

The key message is in the opening paragraph:

The Group has continued the positive momentum outlined in the Q1 FY24 trading update issued on 28 July 2023 and has made further progress in the execution of its strategic objectives across all four business divisions, giving the Board confidence in delivering further progress in the year and meeting expectations.

Shopping - I’m very interested to see mention of Appreciate’s gift cards, Love2Shop:

…a number of new proposition initiatives are now underway, including the rollout of physical Love2shop gift cards into circa 2,600 multiple retailers stores ahead of Christmas 2023, followed by the second phase of the rollout into our independent retailer estate in 2024.

Overall, the Shopping division has seen “a strong sales performance” with growth in their point of sale platform (“PayPoint One”) and new campaigns carried out for huge brands by “PayPoint Engage”.

E-commerce - “excellent volume growth” at Collect+.

Payments & Banking - two new bank clients go live this month (“Neo Banks”, i.e. online payment apps). Deposits and withdrawals for their customers will be available throughout the Paypoint retail network.

Further Appreciate update: 500 retailers have been recruited as “PayPoint Park Super Agents” to help people save for their Christmas shopping. This is the old Christmas savings product - it’s nice to see that the Park name lives on! And PayPoint is working hard to reinvigorate it:

…there are a number of initiatives in progress to open up further channels for Park Christmas Savings, with further details to be shared at our interim results in November.

PayPoint’s new Northern Hub is in Liverpool (Appreciate/Park’s home city).

New CFO - PayPoint has a new CFO. The retiring CFO gave over six years of service.

Graham’s view

I’m a long-term fan of this business so it’s hard for me to be anything other than positive on it.

The StockReport doesn’t provide much counter evidence with a StockRank of 98.

Valuation remains modest, with a chunky yield:

Quality metrics tend to be excellent, with amazing cash generation and margins:

What’s the catch, I hear you ask? In my view, the market simply views it as boring - a legacy business, without much growth prospects.

But when you look into its individual parts, I think you find that it’s not a business that’s sitting still.

It’s true that some activities - especially bill payments in cash - are likely to be in secular decline, as the unbanked population gradually declines. It is estimated that the unbanked population fell from 1.3 million in 2017 to 1.1 million in 2021.

But there are so many other parts to PayPoint, and it generates enough cash to reinvest in new, adjacent opportunities - Collect+ and Appreciate being prime examples of this.

I’m afraid I can’t provide much of a bear case on this stock, because I’ve been a believer in it for too long!

Lords Trading (LON:LORD)

Share price: 60.05p (-12%)

Market cap: £99m

Lords (AIM:LORD), a leading distributor of building materials in the UK, today announces its unaudited Interim Results for the six months ended 30 June 2023 ('H1 2023' or the 'Period').

These shares have taken a turn for the worse this morning, on the back of this profit warning.

But first, here are the H1 highlights:

Revenues of £223m are down 4.4% like-for-like, or up 3.9% in total.

Operating profit of £8.1m, up 11.6%.

Unchanged interim dividend of 0.67p.

It appears that the company’s key financial performance indicator is its adjusted EBITDA margin:

The Board remains confident of delivering our strategic targets of £500 million revenue by 2024 and improving EBITDA margins to 7.5% in the medium term.

In isolation, I view revenue and EBITDA targets as problematic - because they can signal that the company is willing to sacrifice its quality metrics in exchange for scale.

As a builders merchant/distributor, Lords has low profit margins but its return metrics have otherwise been quite good in recent years:

Let’s quickly review how Lords did in H1:

Merchanting is said to be “robust” but like-for-like sales were down 5.1%.

Plumbing and Heating is “solid”, down 3.8% like-for-like.

Two acquisitions (one of them was announced only last week, a small one mentioned by Paul here). “ Management remains focused on further opportunities that are complementary to Lords' strategy of product range and geographic expansion.”

Current trading/outlook

They believe they are outperforming the market, based on construction industry forecasts for double-digit declines in housing spending this year. But:

Since our last market update, persistent high levels of inflation, increasing interest rates and weaker consumer confidence have continued to reduce demand in the Group's key end markets of private repairs, maintenance and improvements (RMI) and new build housing, and consequently demand for the Group's products.

Given the continuing challenging backdrop, the Board now anticipates that demand will remain at current levels throughout the remainder of H2 2023. Accordingly, the Board expects the Group to deliver full year revenues of approximately 450 (LON:450) million and Adjusted EBITDA of approximately £27 million.

The previous forecast from Cenkos was for Revenues of £476m and adj. EBITDA of £31m.

With a cut to adj. EBITDA of c. 15%, we can see why the shares are down by a similar amount.

Net debt increases from £19m to £38m over six months. Additional working capital was needed due to “historical industry wide boiler supply issues”, but this is expected to unwind.

Here’s an excerpt from the CEO comment, talking about the medium-term strategy:

We have a substantial opportunity to grow the Group's current < 1% market share through attracting new customers, a greater share of existing customer wallet, product range extension, new geographies, digital capability and value added acquisitions. Our focus on the essential and resilient 'Repair' sector of RMI positions us more defensively during periods of volatility

Graham’s view

This one is also “cheap”, but perhaps for good reasons in this case?

This morning brought news that house prices have fallen by the most since 2009, according to the Halifax Index. It’s a 4.6% fall year-on-year, with a noteworthy 1.9% drop in August alone.

Of course it’s possible that interest rates will fall again soon, but does that mean we can expect house price movements to turn positive again? I don’t think so. We already knew that transaction numbers had stalled. We know that bank lending to first-time-buyers has collapsed. Perhaps sellers need to capitulate, and development needs to stall, before prices can stabilise?

Lords might offer decent value here but I would personally feel too uncertain about the macro backdrop to want to get involved here.

Other factors that make me wary: it’s a 2021 IPO, it operates in an extremely competitive market with low margins, and it uses KPIs (revenues/EBITDA) which I find to be problematic.

So this one is not for me. But I’ll maintain a neutral stance at this valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.