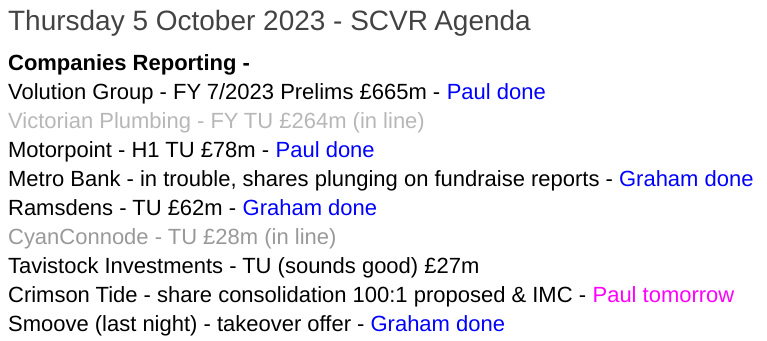

Good morning from Paul & Graham! Hopefully Graham's on the mend now, he's been under the weather lately.

Today's report is now finished.

Really grim market conditions too, with the AIM 100 dropping below 700 yesterday, a multi-year low. So tough times for sure, but the valuations are so attractive, and most companies reporting in line with expectations, that I remain positive about the medium-term potential being offered on a plate to us with the best UK small caps. Short term? No idea, anything could happen, as always.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Motorpoint (LON:MOTR) - 87p (pre market) £78m - H1 Trading Update - Paul - AMBER

It's half-year update shows an improving profit trend from Q1 to Q2, but it's still loss-making overall. Finance costs stand out as being much higher than operating profit, so it needs to do more work to improve basic profitability, which is only marginal at present. I do see potential here, and with the market cap down a lot, this could be a recovery share to add to our watchlists. Net cash has improved a lot, so I don't have any solvency or dilution concerns.

Ramsdens Holdings (LON:RFX) - up 6% to 201p (£64m) - Interim Results (ahead) - Graham - GREEN

Record results at Ramsdens with PBT set to come in at least slightly ahead of expectations (the RNS announcement could be a bit more helpful). The business continues to fire ahead and I don’t see any reason to change my positive stance. PER 8x and divi yield c. 5.5%.

Smoove (LON:SMV) - up 18% to 52p (£30m) - Recommended Cash Acquisition - Graham - AMBER

An excellent outcome for Smoove as they get a 54p offer from Australian group PEXA. The 54p bid is nearly 70% higher than the price at which the shares were trading before PEXA got involved. I would vote for this deal and I think that Smoove shareholders are going to.

Volution (LON:FAN) - up 10% to 370p (£734m) - FY 7/2023 Results (prelims) - Paul - GREEN & Podcast *MYSTERY SHARE*

Smashing results, and what seems a reasonable valuation, for a quality business. I like everything about it, maybe apart from a rather hollowed out balance sheet (full of acquisition-related intangibles), but that's not a deal-breaker as net bank debt is still modest compared with impressive cash generation. Looks a lovely business! I'll probably make this a podcast mystery share at the weekend. Maybe no rush to buy in current market conditions though, but certainly one for my watchlist.

Metro Bank Holdings (LON:MTRO) - down 26% to 37.2p - Response to press speculation - Graham - AMBER (Paul: RED)

This bank might need to raise equity as it ponders its balance sheet and liquidity questions. The shares are “cheap” but then so is the entire UK financial system. With so many high-quality financial stocks trading cheaply, I wouldn’t be tempted to bet on this one.

Paul’s Section:

Motorpoint (LON:MOTR)

87p (pre market) £78m - H1 Trading Update - Paul - AMBER

Motorpoint Group PLC, the UK's leading independent omnichannel vehicle retailer, provides an update on its trading performance for the six months ended 30 September 2023 ("H1 FY24").

Motorpoint operates car supermarkets - large, out of town sites, selling nearly new cars at fixed prices. Its history has been a dash for growth, but profits evaporated. I reviewed its breakeven PBT (on £1.44bn revenues!) FY 3/2022 results here on 14 June, concluding that it looks potentially interesting, if it can rebuild margins.

Next, on 26 July MOTR sensibly announced it was changing strategy to focus more on profit & cashflow, rather than revenue growth. I concluded that it might be able to beat modest forecasts, and viewed it moderately positively. That’s the background, let’s see what the latest news is today.

My notes (main points only), with my comments added -

Q1 - took action to increase margins and lower costs.

Difficult macro conditions continue - consumer uncertainty.

Affordability of used cars impacted by high prices and higher interest rates.

Broadened products from nearly new, to up to 5 years old.

Expecting used car prices to gradually return to normal as new car supply improves.

Underlying loss before tax of £(3.1)m in Q1, improving to £(0.6)m in Q2, £(3.7)m total H1. Not good, but at least the trend is improving.

This £(3.7)m u/l PBT is split: £1.6m u/l operating profit, less £5.3m interest expense - this shows how important finance costs have now become for car dealers, echoing a point I made yesterday in Vertu’s interim numbers. Clearly MOTR needs to do a lot more to improve operating profit, just to cover its own finance costs.

One-off exceptional charge of £1m for redundancies is an additional cost above the u/l figures above.

Liquidity - much improved, with net cash of £11m end Sept, up strongly from £2.2m end June. Plus a £35m facility on top. It doesn’t say this, but I presume the cash generation must have come from de-stocking.

A new site, Ipswich, was added in May 2023, taking the total to 20. Forecast revenue is £1.36bn, from just 20 sites, a remarkable £68m pa per site.

Paul’s opinion - I’m reassured mainly by the improvement in cash, which reduces risk for investors. An improving profit trend from Q1 to Q2 is good, but the figures are still much too low - not making any profit at all, after finance charges, does suggest maybe there’s something wrong with this business model, given that traditional car dealers are making good profits. It also gives an opportunity though, as only a small improvement in margin would give a much bigger profit number on £1.4bn revenues.

For now, I think the jury is out. Shares have come down a lot, as the bear market tightens its grip, particularly on unproven business models. That could change though, once the next bull market starts, and investors start looking at the figures with a more positive outlook - eg the margin opportunity on large volumes.

I’ll stick with AMBER for now, but at some point I think this share could be a potential recovery trade. Note that pre-covid it made profits of £15-20m pa. A return to that would mean a share price maybe 2-3 the current level, at a guess. So I think there’s potential here. Maybe all the online startup competitors have squeezed things but whether they survive is the big question. All MOTR has to do is survive, and market share could then drop back into its lap maybe? I think I’m almost talking myself into going AMBER/GREEN here, for the opportunity rather than the current state of affairs.

Note the despite the big share price fall below, there hasn't been any dilution from new share issuance, so in theory, were profitability to return to pre-pandemic levels, and investor sentiment improve, then this share could stage a potentially big recovery -

Volution (LON:FAN)

Up 10% to 370p - FY 7/2023 Results (prelims) - Paul - GREEN

Volution Group plc ("Volution" or "the Group" or "the Company", LSE: FAN), a leading international designer and manufacturer of energy efficient indoor air quality solutions, today announces its audited financial results for the 12 months ended 31 July 2023.

FAN share price has been steadily rising this morning, in a very tough market that’s telling me the figures & outlook must be good.

I’m not familiar with this company, but no harm in looking at something new. Graham usually covers it, summarising his previous comments (with more detail in the SCVRs of course):

14/12/2022 - GREEN - 349p - Graham sees potentially good value.

20/7/2023 - GREEN - 384p - FY trading update, at top end exps. Good 20% operating margin. Graham likes it.

FY 7/2023 Results - key points -

Revenue £328m (up 7%)

Adj PBT £65.1m (up 7% too, and note this is a really impressive PBT margin - so FAN clearly has pricing power, and competitive advantages, to achieve high profitability)

Statutory PBT much lower at £48.8m, so we’ll need to check the adjustments to make sure they’re reasonable.

Yes, adjustments are reasonable - a clear table is provided setting them out, and it’s nearly all acquisition-related, which is fine, customary, to adjust out, in order to arrive at proper underlying trading performance.

Adj basic EPS 25.8p (up 7.5%) - giving a PER of 14.3x (although what about dilution? I prefer fully diluted EPS as a measure). Actually, dilution only seems modest (further down it says unadjusted basic EPS is 19.0p, and diluted is 18.7p, so that’s OK)

Dividend 8.0p (up 10%) - a rather unexciting 2.2% divi yield

Acquisitions - two done in the year, costed £29.7m, and another one for £8.5m post year-end - so this explains the modest divis, it’s using cashflow mainly to grow by acquisition it seems. However, if acquisitions were to stop, then the dividend paying capacity is a good bit higher. There have also been some modest share buybacks.

Wide geographic spread, and it operates 22 different “strong local brands”. I like that it achieves high operating margins in all geographies.

Outlook - a bit vague perhaps, but the last sentence seems to indicate further growth -

Whilst we are mindful of the impact of higher interest rates on consumer confidence and new build construction, the regulatory changes in our local markets continue to drive demand for our innovative and well-positioned low carbon product technologies.

In addition, our three new acquisitions completed in the last six months; our ongoing focus on operational excellence; and the depth of experience and commitment across our local teams provides resilience and gives us confidence of making further progress in the year ahead.

Net debt - of £89.3m is only slightly up on last year. Given the high level of profitability of £65m, then this level of net debt looks fine to me. Although remember debt is costly now. I like the table it has provided reconciling opening & closing net debt, with the relevant cashflows. These numbers are all very clear in presentation, which builds my confidence in the company and its management.

Oh, I’ve just realised the £89.3m net debt includes lease liabilities. Eliminating those arrives at net bank debt is £58.1m, much better!

Balance sheet - NAV is £226m, but dominated by intangible assets of £248m, which I’ll write-off, together with £13m deferred tax, arriving at my adj NTAV of £(9)m - which is weak, but given the highly profitable & cash generative nature of the business, I don’t think it matters.

The business is essentially funded by £117m of long-term bank debt, which would only become a problem if trading fell off a cliff in a recession. Given macro uncertainty, I would urge management not to embark on any big, debt-fuelled acquisitions for the time being. You're welcome, there’s no charge ;-)

It’s been growing by acquisition, but importantly this has been done without diluting shareholders - see the progression below, and with the share count slightly down - due to buybacks.

Cashflow statement - very nice. Post-tax operating cash inflow was £68m in FY 7/2023, and £42m last year (lower due to adverse working capital movements). Nearly half (£30m) of this cashflow was spent on acquiring other businesses, £8m on capex, £8m on interest & leases, £15m on divis, and £2m on share buybacks. All very straightforward, I really am enjoying reviewing these crystal clear accounts! I often find the cashflow statement makes more sense than the P&L.

Broker update - many thanks to Liberum for making an update note available on Research Tree, tremendously helpful. It says that 25.8p actual EPS is 2% ahead of forecast (25.2p).

Forecast for FY 7/2024 is left unchanged at 26.0p, hopefully leaving some room to beat that perhaps? Or scope to absorb any macro downturn hopefully?

Paul’s opinion - as you’ve probably gathered, I really like these numbers, Volution seems a high quality business priced attractively.

My main query is whether the high profit margins are sustainable? Big profits often attract competition, which can be particularly aggressive if eg Chinese companies target a particular market, and under-cut the incumbents.

Overall though, based on the current situation, facts, figures, and forecasts (which as always will change in future), at this point in time I’m happy to view Volution as GREEN.

Graham’s Section:

Ramsdens Holdings (LON:RFX)

Share price: 201p (+6%)

Market cap: £64m

Ramsdens Holdings PLC, the diversified financial services provider and retailer, announces a pre-close trading update for the year ended 30 September 2023 ("FY23" or the "Period").

Ramsdens has “continued to trade well”, and therefore PBT will come in at “more than £10m”. I think this is a slight beat against expectations (it would be far more helpful if the announcement itself confirmed this!). Yes - a broker note from Liberum shows an existing PBT estimate of £9.98m. So this might be only the smallest of forecast beats - we won’t know for sure until the results are released in full.

Highlights:

Foreign currency revenue was up year-on-year by 8% (there is a clue regarding the importance of this revenue stream in the ticker code of the company!).

Check out the company’s newly-launched travel card - I think the main attractions of this product are to help people manage their holiday spending and to remove the risk of any unfortunate accidents affecting the traveller’s bank accounts/credit cards?

Jewellery retail revenue up 20% year-on-year “supported by particularly strong momentum online”.

Pawnbroking loan book up 20% to £10.3m (still only a fraction of the size of the H & T (LON:HAT) pawnbroking book).

Precious metal buying revenue up approximately 50% year-on-year, due to increased demand “in part as a result of the higher Sterling gold price”. The cost of living crisis is also surely a factor, as people look for ways to generate extra cash.

Eight new stores (they started the year with about 150). “Very pleased with the initial performances of these stores so far.”

CEO comment:

While the economic backdrop is challenging and Ramsdens is not immune to inflationary cost pressures, particularly energy and payroll, the Board remains confident that Ramsdens is in a good position to continue its positive momentum into the new financial year underpinned by the Group's proven and diversified business model, strong brand and clear growth strategy."

Graham’s view

I’ve been positive on this one due to valuation, e.g. most recently at 259p in June. At its H1 results, Ramsdens announced a 33% increase in revenue and a significant increase in the interim dividend, from 2.7p to 3.3p.

The yield here should be around 5.5%, after today’s share price increase.

A 1-year chart shows the market allowing these shares to drift lower in recent months, despite the attractive valuation metrics:

Here’s where we are in terms of those value metrics:

The PEG ratio shown above looks like it might be undercooked to me: it’s based on forecasts for only 1.7% EPS growth in the current financial year (FY September 2024). But given the momentum the business is currently enjoying, it seems to me like there is a wide range of potential outcomes with scope for better EPS growth than that over the next 12 months.

The broker note observes that the changing corporate tax rate (from April 2023) is a factor here. FY September 2023 is mostly at the lower tax rate, while FY September 2024 is mostly at the higher tax rate. They also think that “guidance is cautious” - I agree. But of course nobody knows for sure. It’s just a hunch!

The company has a tendency to over-deliver:

So for these reasons, I do think that the PEG number in the StockReport is a conservative estimate, and that EPS growth has a good chance of coming in better than forecast.

And if you strip out the change in the tax rate, then of course the underlying growth instantly looks more attractive.

In conclusion: I remain a fan of this business and have no reason to change my tune after another positive update today. There are plenty of cheap financial stocks in the market right now, but this is one of my favourites.

Smoove (LON:SMV)

Share price: 52p (+18%)

Market cap: £30m

This home buying services group is reaching the end of its life as an independent company, as it announces a recommended cash offer at 54p per share.

The share price yesterday was 44p, although the market knew that bid discussions were ongoing. Indeed, we’ve known since April that the Australian group PEXA were interested in buying Smoove. PEXA’s StockReport is available on Stockopedia (market cap $1 billion AUD).

As the announcement today acknowledges, the bid is actually a 69% premium to the Smoove share price prior to the date when the offer process officially began.

It’s an all-cash deal, with plans for the combined group to “build scale and depth in the UK market”

Smoove has strategic significance for PEXA: 7% of UK remortgages and 3% of UK sales and purchases are “intermediated” by Smoove.

A done deal? There are undertakings from Kestrel, Harwood Capital and Herald Investment Management to vote for it - these have 46.6% of the shares.

There is also a letter of intent from Schroders to vote for it. That’s another 9.4%.

I therefore expect the deal to go through.

Graham’s view

I wrote in July that Smoove should take any reasonable offer from PEXA. Smoove’s results for FY March 2023 were very poor, with a statutory loss of £5.8m and a remaining cash balance of £10m (after Smoove confidently made a return of capital to its own shareholders).

Losses in the current financial year were expected to moderate to £4m but the risks around Smoove continuing to operate as an independent company remained significant: how could the company be confident that it would get to breakeven quickly enough? Especially considering the difficult conditions in the housing market, with the company relying on lower-margin remortgage work, it was not a bet that I’d have been willing to make.

In the circumstances, this offer looks like an excellent outcome for Smoove shareholders and I would vote for it. Hopefully the company will have a bright future in the hands of its Australian parent. The story of this particular stock ends here.

Metro Bank Holdings (LON:MTRO)

Share price: 37.2p (-26%)

Market cap: £65m

Here is an excerpt from Metro Bank’s response to press speculation (emphasis added):

…the Company continues to consider how best to enhance its capital resources, with particular regard to the £350m senior non-preferred notes due in October 2025.The Company continues to meet its minimum regulatory capital requirements and had a total capital plus MREL ratio of 18.1% and a leverage ratio of 4.4% as at 30 June 2023.

The Company is evaluating the merits of a range of options, including a combination of equity issuance, debt issuance and /or refinancing and asset sales. No decision has been made on whether to proceed with any of these options.

This follows a negative update in September: the Prudential Regulation Authority indicated that Metro would not be approved this year to use its own internal risk models to determine its capital requirements. This would likely mean a reduction in required balance sheet capital, giving the bank more flexibility and boosting its returns.

The interim balance sheet (for June 2023) showed net tangible assets of £4.42 per share. A far cry from the share price: about £1 then, and only 37p now.

With the shares trading at such a discount, the market was pricing in terrible news; in the best-case scenario, it was pricing in extremely poor capital allocation.

I note that the bank’s guidance set a target of “mid-single digit” return on tangible equity by 2024.

I don’t know about you, but the prospect of mid-single digit returns doesn't get me excited! Not in a low-interest rate environment, and certainly not in a high interest environment.

And the price paid for these returns - in terms of the risk taken - is enormous. A cursory look at Metro’s interim balance sheet shows equity of less than £1 billion supporting assets of nearly £22 billion.

That may be an overstatement of risk: the company had a CET1 Capital Ratio of 10.4% and a Total Capital Ratio of 13.2%, which are materially above the minimum requirements.

These are good measures of solvency but poor measures of liquidity. Specific mention in today’s announcement of the £350m notes due in October 2025 suggest that the bank is unsure how it will handle their maturity.

Do I think Metro is a zero? I doubt it, but you can never be sure. I specifically avoid studying bank shares because of their complexity and their poor returns.

Of course, it is possible that so many people have taken this approach that bank shares are now egregiously undervalued.

However, that still doesn’t make them a high-grade investment. Banking is one of the few industries (perhaps the only one?) where I find that smaller companies are of much higher quality than larger ones. I can easily find a host of small-cap financials earning double digit returns, but the same can’t be said of the larger institutions.

Metro’s share price might make it a small-cap, but it’s trapped in the body of a large-cap with balance sheet equity that runs ten digits long. It might make for an entertaining gamble but there are easier ways to make a few quid in the stock market, than betting on this sort of thing.

(Paul adds: the market cap is now so tiny, that my worry is the risk of massive dilution in any equity fundraise which now looks necessary. So for me it's a RED, but there again I don't invest in banks at all, and don't know much about Metro Bank. Could be a wipe-out for equity, if regulators force an emergency restructuring. Paul covers in more detail in this weekend's podcast, deciding it's bright RED, with imminent failure a very real risk, and equity holders first in line for losses of course).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.