Good morning from Paul!

Today's report is now finished.

Have a wonderful weekend, and rest assured I shall be publishing the next thrilling episode of my podcast tomorrow :-)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

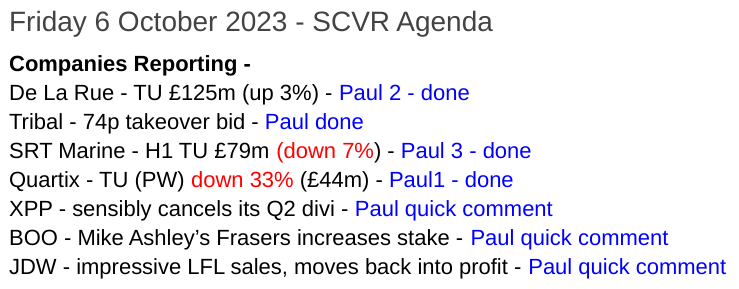

A nice manageable list today, so I should have these all done by 13:00 -

Summaries

Tribal (LON:TRB) - Up 37% to 72p (£152m) - Recommended 74p cash offer - Paul

A smashing outcome for shareholders in this accident-prone educational software/services business - a trade buyer (private equity backed) has offered a cash takeover (recommended by TRB management) at a fair 41% premium. Looks likely to go ahead, as institutions particularly like, and need, liquidity events to bolster performance and fund redemptions. Although I've been negative on fundamentals, I did flag the potential for a takeover bid here in the last 4 times we covered it.

Quartix Technologies (LON:QTX) - down 21% to 157p (£74m) - Trading Update (profit warning) - Paul - AMBER

The founder recently returned as Chairman, has conducted a review, announcing today some problems, and lowered profit guidance. It's admirably clear, and I don't see anything here as disastrous, just hopefully fixable problems. Valuation is still an issue though - on lowered forecasts, the PER is still high at 19x, which is not justified by historic track record of declining earnings for the last 6 years. Could be a takeover target though, it's got that look about it.

De La Rue (LON:DLAR) - up 3% to 62.5p (£122m) - Trading Update - Paul - AMBER/RED

A reassuring update, in line with expectations for FY 3/2024, with H1 being slightly better than expected. Problems of excessive debt, and a cash-hungry pension deficit haven't gone away. With so much great value around in other shares, that don't come with all the baggage, why get involved in DLAR? I think there are better risk:reward options out there currently.

SRT Marine Systems (LON:SRT) - down 8% to 40.5p (£78m) - H1 Trading Update - Paul - AMBER/RED

Yet again, SRT over-promises and under-delivers. Minimal revenues, and a heavy loss in H1 does not compute with all the mega-bullish stuff we've been told about huge contracts. Expect a very heavy H2 weighting they say. Balance sheet looks weak again, despite another fundraise. I think I've passed the point of giving management the benefit of the doubt - this cycle has been going on for donkey's years!

XP Power (LON:XPP) - down 10% to 730p (£144m) - Dividend Cancellation - Paul - RED

Graham covered this profit warning on 2 Oct, with the main concern now being that this overly-indebted company might be forced into a dilutive fundraise.

It announces today that, to save £3.75m in cash, the Q2 dividend of 19p (due to be paid imminently) has been cancelled. That makes sense to me, given the question mark over solvency.

Paul’s opinion - it’s total guesswork how this pans out, that depends entirely on how the bank and major shareholders decide to handle things, something we’re not party to, or can have any influence over.

What’s particularly shocking to me, is that I always thought XPP was a good solid company, based on a solid track record of profits & divis. So to see it crash by over two-thirds this week, is astonishing really.

There were risks though - without wishing to sound like a know-it-all (which I’m certainly not!) we did flag here on 12/1/2023 that net debt was too high at £152m, and that lenders had flexed the covenants. Also a nasty legal action costing $40m rang alarm bells.

Therefore I think everyone should really think long and hard about balance sheets, and borrowings, for every company we own or are thinking about investing in. Weak balance sheets are probably the main investing risk right now, and with higher interest rates, debt is now expensive, and can push a company into crisis if orders dry up, which seems to be happening at XPP. [no section below]

Boohoo (LON:BOO) - note that Frasers (LON:FRAS) has increased its stake to 13.4%. As mentioned the other day, eCommerce businesses seem more like special situations now, with the fundamentals now almost being a sideshow! Who knows how this will pan out. Same with Asos. Totally up in the air. [no section below]

J D Wetherspoon (LON:JDW) - I’m just about to sign off this report, and settle down with a tin of Cisk, and read Tim Martin’s latest (always interesting & quirky, whether or not I agree) rantings accompanying its preliminary results. Trading has moved back into profit. LFL sales are up an impressive 12.7% for the year, and up 9.9% in the most recent 9 week period. JDW shares overshot on the rebound in recent months I think, so seem fully priced for now. But I’m still going to enjoy reading his commentary! [no section below]

Paul’s Section:

Tribal (LON:TRB)

Up 39% to 72.6p (£154m) - Recommended 74p cash offer - Paul

This is a poorly performing, accident-prone educational software and services group. This is evidenced by a poor long-term share price, with considerable shareholder value destruction over the years, and not much in the way of dividends either.

Looking back through our notes here, I was RED on Tribal’s fundamentals, but moderated to AMBER/RED recently on 25 Aug, when better than expected interim results came through.

The main negative points with Tribal were its weak balance sheet (although arguably that doesn’t matter too much in the software sector), and a major legal dispute over a failed implementation in Singapore. Plus of course a distinctly patchy historical performance.

Although I did flag that Tribal could have value to an acquirer here in SCVRs dated: 1/12/2022, 20/3/2023, 2/5/2023, and 25/8/2023. Even poorly performing software companies seem to catch bids (e.g. the dismal Proactis, and Tungsten).

The terms of this deal - it’s recommended (by management), cash of 74p (a decent enough 41% premium to an already-rising share price). The buyer is Ellucian, which is a private equity-backed competitor in the educational software market.

There is so far 45% support for the deal from institutions and management, which is probably enough of a start to get the deal done. Particularly in a small caps bear market, where many institutions are desperate for liquidity events (takeovers, tender offers, buybacks) to enable them to finance client redemptions (if they’re open-ended funds).

Paul’s opinion - hearty congratulations to holders here, this strikes me as a good outcome. Not the best of stock picks, let’s be honest, but a 41% premium takeover bid is a happy outcome in my view, given TRB’s poorly performing management, and weak long-term track record.

It’s always good to scrutinise takeover bids, to see what patterns there might be, to help identify future bids. Software companies are definitely valued more highly, particularly by US investors. So I might have a rummage through that sector to see if there any interesting nuggets lying around (after watching the webinar from Beeks Financial Cloud (LON:BKS) [I hold] yesterday, I’m getting a lot more bullish on that one - an existing long-term holding, that I’ll be adding to now the outlook is much stronger, although I didn’t like the fudging of the revenue/profit miss for FY 6/2023 recently).

Can anyone else think of some software sector potential bid targets? If so, please do flag them up for us to discuss in the comments section below.

Other bid targets generally seem to be structural growth companies. We’re not really seeing takeover bids for value shares, there just doesn’t seem any interest in that area unfortunately.

Yet again, with another takeover bid, private markets are seeing some UK listed shares as attractively cheap. Those of you getting despondent should remember this point! UK small caps are cheap, and at some point they'll go up again, evidenced by the high number of takeover bids coming through.

Quartix Technologies (LON:QTX)

Down 21% to 157p (£74m) - Trading Update (profit warning) - Paul - AMBER

Bad luck to shareholders here, the downtrend just got steeper with a 21% sell-off this morning. Shares in this telematics company has now done a round-trip all the way back down to when it floated in April 2015, and down a painful 72% from the Mar 2021 peak of c.556p.

Although to be fair, QTX has been a nice cash generator, and generous dividend payer, with a total of 91.6p divis paid since it floated in 2015.

Looking back at our previous comments, I’ve consistently baulked at the high PER over the years, given that there hasn’t been any earnings growth (EPS has fallen over the last 6 years) - customer & price attrition offsetting new business. Although we’ve always liked the quality, and cash generative nature of the business.

We've looked at QTX twice this year -

24/3/2023 (Paul) - AMBER at 275p - in line TU, forecast 10.4p EPS, so PER 26x far from cheap. Maybe it might grow into the valuation?

31/7/2023 (Roland) - AMBER/GREEN at 235p - H1 results, moderately positive.

Good that’s got me up to speed, apart from this bit in today’s update which I hadn’t previously spotted -

As announced on 26 September 2023, Andy Walters, founder and former CEO of Quartix, returned to the Company last week as Chairman. Since then he las led, on behalf of the Board, a preliminary review of the business which is summarised in the following update.

My summary of today’s update - I think this is disappointing, but not a disaster -

Growth in recurring revenues, up by £2.1m to £28.7m year-on-year, not clear if this means in the last 12 months, or the financial year to date? But it’s growth anyway.

Strategy is for a renewed focus on growth (what were they focused on before then?)

France good (as before), UK & USA “disappointing” growth.

Small acquisition made is loss-making c.£0.5m pa, reading between the lines do they regret doing this deal perhaps? Difficult to say, as it’s not spelled out.

France - 2G transition to cost c.£4.1m over 3 years. This is a repeat of previous problems in USA, where switching off old networks caused additional costs to QTX. Sounds like there might be some similar costs in the main UK market too, possibly?

Slightly lower margins due to manufacturing cost increases.

Profit guidance reduced - adj EBITDA lower by £1.1m in FY 12/2023, and £2.4m lower next year.

Dividend for 2023 will be reduced (new forecast: 3.3p), and no special divi on top - that’s fair enough, and at least some divi is still being paid, which makes me think this is not a crisis.

Broker update - I’m grateful to Cavendish for updating us, with FY 12/2023 adj EPS down a bit to 8.2p (and same for 2024). Its previous forecast showed 10.4p and 13.1p, so that’s a particularly nasty drop in 2024 expectations.

To reiterate my previous concerns, QTX really isn’t a growth company, in terms of profitability. So why is it still priced like one? Even after today’s share price fall, on the new forecasts, the PER is still 19x. I don’t see any justification for that, unless you believe it can beat the revised forecasts, or are happy to take a longer term more optimistic view.

Paul’s opinion - I wanted to say that the shares are looking good value now for a recovery, but they’re not, that’s the trouble. A track record of declining EPS over the last 6 years, and various troubles announced today (none of them disastrous though, to be fair), doesn’t make me inclined to want to pay up a PER of nearly 20x.

That said, I see the founder returning as a positive step, as he should know exactly what to do to turbocharge growth. QTX has always been a lovely cash generator, so there are not any solvency or dilution issues likely.

It could be a nice turnaround at some stage, but for me it’s too early to get involved. Shares could well bounce from people imagining it's oversold now, but without better fundamentals, any such bounces may not stick in this bearish market.

Could it be a bid target? Quite possibly yes, it’s got that look to it - very scalable, international, quite high margins - that’s the sort of thing private equity like to get involved with. So maybe QTX shares could be worth a flutter?

I’m happy to stick with AMBER here, as I don’t see today’s update as a disaster, more some hopefully fixable glitches. Although it does sound like that legacy 2G issue could be a further headache in future in its largest UK market. Maybe the company should be building up a balance sheet provision for that too, so it’s not another future profit warning?

De La Rue (LON:DLAR)

Up 3% to 62.5p (£122m) - Trading Update - Paul - AMBER/RED

This is the troubled banknote printing, and security authentication products group.

We viewed it negatively on 5/4/2023 with a major shareholder requisitioning an EGM, and the turnaround plan apparently not working.

On 12/4/2023 another profit warning came out, and it sought relaxation of bank covenants and pension payments, so looked very high risk.

However on 29/6/2023 I shifted us from RED to AMBER, as FY 3/2022 results statement contained some positives - in line results & current trading, Bank & pension negotiations successful, and going concern “material uncertainty” was removed. I concluded it was still high risk, but stabilising/improving.

The share price has also been making some progress recently, not bad in such tough markets. The 12-month chart is looking like a possible change in trend from down to up -

Although zooming out, the 5-year chart is a lot less convincing! -

On to today’s update - no great shakes either way, mildly reassuring I’d say -

For H1 FY24, which ended 30 September 2023, the Company expects adjusted operating profit to be marginally ahead of previous guidance* given at the time of our full year results announcement on 29 June and reconfirmed at our AGM in September. Net debt is expected to be improved versus previous guidance, in the low £80m range.

For the full year FY24, the Board's expectations for adjusted operating profit remain unchanged, reinforced by the half year position. Net debt for full year FY24 is now expected to be marginally better than previous guidance, in the mid £90m range.

* Guidance was that full year adjusted operating profit for the Group would be in the low £20m range for the full year and broadly break even for the first half year. Net debt would rise to around £100m at both half and full year.

Operating profit is not a good metric for a company which has lots of debt, because debt is expensive now. Net finance costs for FY 3/2023 was a hefty £9.3m.

Breakeven operating profit in H1 means a loss before tax of course. So I can’t get excited about this.

Broker notes - nothing available, so I can’t really take this any further.

Paul’s opinion - I’ll stick with amber. The problems of too much debt, and a cash hungry pension deficit are still clearly big issues. Although a return to modest full year profitability seems to be on the cards.

In the last few weeks, I’ve seen numerous shares in my portfolio and watchlist, declining irrationally, for companies that are financially strong, trading well, have sound balance sheets, and are priced attractively low. So why would I want to get involved with DLAR shares, in the hope that the turnaround might be gathering pace, and it might eventually dig itself out of financial trouble, when there are so many better risk:reward options out there with other shares?

Actually, I think I’m going to be a bit harsher, and move to AMBER/RED, as there’s still a lot of downside risk, and there are much better options available from better quality, lower risk companies right now. Why take a risk, when we don't have to?

SRT Marine Systems (LON:SRT)

Down 8% to 40.5p (£78m) - H1 Trading Update - Paul - AMBER/RED

I got caught up in the excitement of massive contract wins back in May & June, and even very briefly owned some shares in this maritime tracking systems company. However, I quickly gave myself a good slap, and sold out a few days later, for a loss of about 10%.

On to today’s update -

SRT, the global provider of maritime surveillance, monitoring and management systems, is pleased to provide an initial trading update for the six months trading period ended 30th September 2023, prior to the issue of full interim results on 20th November 2023.

This reads very badly to me -

H1 revenues £5.5m

H1 loss before tax of £(4.5)m

Heavy H2 weighting expected for this year FY 3/2024.

Gross cash £3.9m at 30 Sept. (what about net cash? - note that it had c.£8m drawdown on loan notes at last year end, so despite a £5.4m equity fundraise post year end, I suspect this means the overall position is probably still net debt).

Claimed £160m contracted order book.

Paul’s opinion - I think this is looking increasingly high risk. Why is the lender LGB Capital Markets willing to extend a £40m facility to such a high risk, jam tomorrow company?

Results historically from SRT have been extremely erratic, with it seems almost zero visibility on these huge contracts & pipeline.

At what stage do investors conclude that they can’t believe anything the company says? I’m probably at that stage now. So it’s AMBER/RED from me this time, just due to the almost complete lack of visibility over these huge contracts it keeps talking about. And I think the balance sheet looks wobbly again. It could go either way, but coming up with the goods (instead of upbeat talk) is now many years overdue.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.