Good morning from Paul (now back from the holiday that wasn't a holiday because it was so busy here LOL!), and Graham.

Today's report is now finished.

Mello Monday is tonight from 17:00 - details here. That link also gives details of Mello London physical investor show, hopefully see you there on 29 & 30 November.

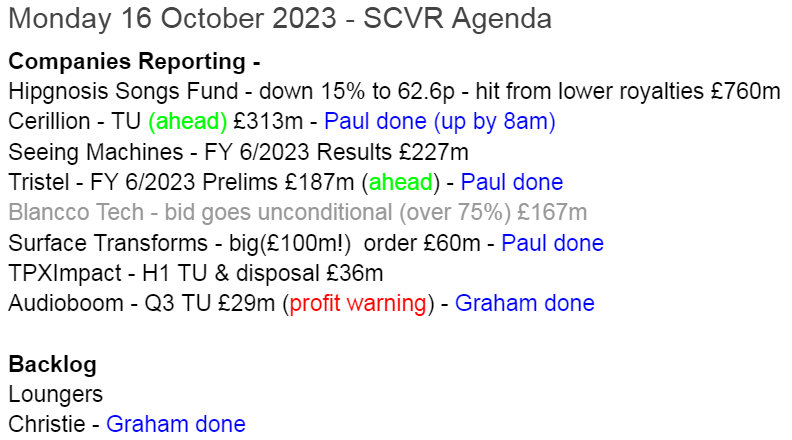

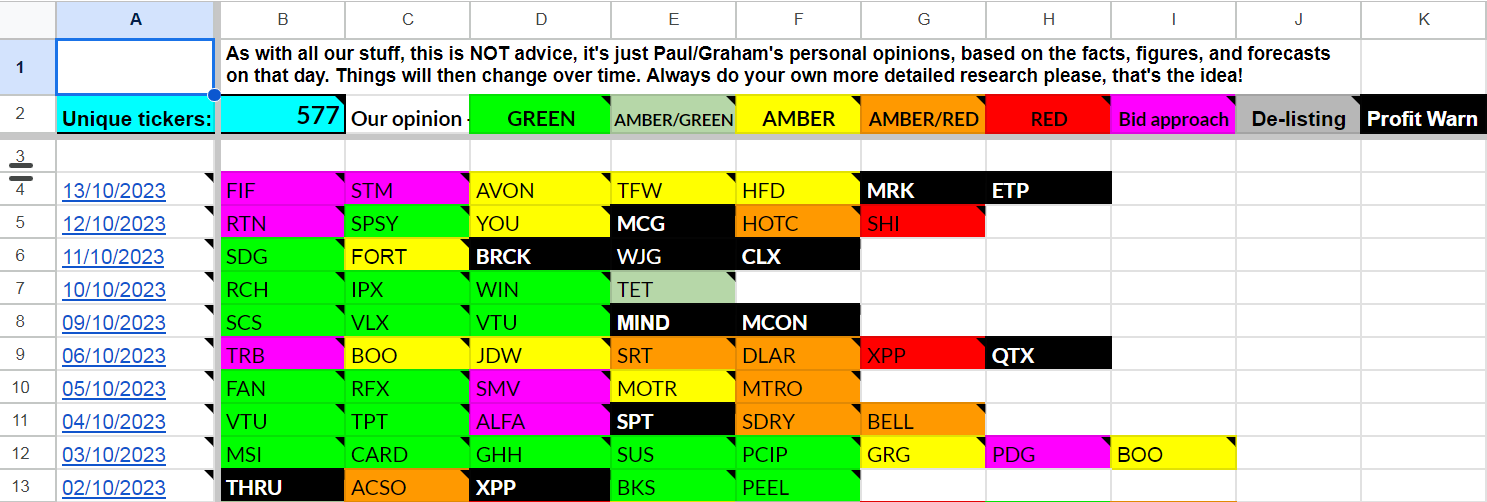

Loads of profit warnings in the last fortnight, which after an excellent reader suggestion, I'm now colour-coding as black on my at-a-glance summary spreadsheet.

(click picture to view google sheet - no need to ask for permission, as anyone with the link can view it, but obviously not edit it)

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

This is the plan, and where you can track our progress if you want to -

Summaries

Cerillion (LON:CER) - up 9% to 1,160p (£341m) - Trading Update (ahead) - Paul - GREEN

Despite profit warnings in the telecoms sector, CER is still powering ahead. It's "meaningfully ahead" re profits for FY 9/2023, which brokers reckon to be c.10% higher. Also the outlook & pipeline for the new year sound positive. Plenty of net cash. It's not cheap by any means, but the premium rating is well worth it, due to superb performance since 2020. One of the best growth shares in the UK, in my view.

Christie (LON:CTG) - down 2.5% on Friday to 97.5p (£25m) - Trading Statement (profit warning) - Graham - AMBER

This share has been a horrible disappointment in 2023 with three profit warnings so far as commercial transactions haven’t happened as expected. I’m stubbornly staying neutral despite the bad news as I see value here in a recovery or if they dump loss-making units.

Audioboom (LON:BOOM) - down 1% to 178.45p (£29m) - Q3 Trading Update (profit warning) - Graham - RED

Another upbeat statement from management but revenue and profit expectations for 2023 have been slashed here. The company is hopeful of better times in 2024 but for me this is a bargepole stock with many issues and very little to recommend it.

Surface Transforms (LON:SCE) - up 13% to 28p (£68m) - £100m New Business Award - Paul - AMBER

Another really impressive contract win, but production not starting until 2027, and it needs a third phase of expansion for production capacity. Not clear at this stage how this (and the working capital from ramping up production) will be funded, with cash low. So considerable dilution risk, but very impressive products & contracts. I would be above AMBER if the funding position was clearer, as the commercial opportunity here looks really good.

Tristel (LON:TSTL) - Up 4% to 413p (£195m) - Audited Results FY 6/2023 - Paul - AMBER

Impressive numbers for sure. It all boils down to valuation though - almost 40x implies that the market is already assuming the long-awaited US launch will be a big success. If it's not, then you've got problems here over its high valuation.

Paul’s Section:

Cerillion (LON:CER)

One of my favourite growth companies, but as discussed in my weekend podcast, I was worried that 2 profit warnings had emerged in this sector (B2B services for the telecoms sector). CER shares have dropped sharply in sympathy, after profit warnings from Spirent Communications (LON:SPT) and Calnex Solutions (LON:CLX) (plus apparently another 2 sector larger caps). With a tightly held, illiquid share like CER, it doesn’t take much to move the price.

.

Cerillion, the billing, charging and customer relationship management software solutions provider, is pleased to announce an update on trading for the financial year ended 30 September 2023.

Positive trading has continued.

CER shareholders can breathe a sigh of relief, and un-clench everything -

As a result of this continued strong progress, adjusted profit before tax is expected to be meaningfully ahead of the consensus market forecast of £14.3m.

Revenue is expected to be approximately £39.0m, with sales to existing customers significantly greater than any previous year, reflecting the growing value of the installed base.

Net cash at 30 September 2023 closed strongly at approximately £24.7m (30 September 2022: £20.2m).

That’ll do nicely!

Outlook also sounds good -

As well as the demand the Company is experiencing from the existing customer base, the new customer sales pipeline grew again in the second half and includes some large opportunities. The Company therefore expects to make further encouraging progress over the course of the new financial year.

Paul’s opinion - looks like a strong candidate for an opening bell purchase to me, but I imagine the price is likely to gap up, so that might not be possible.

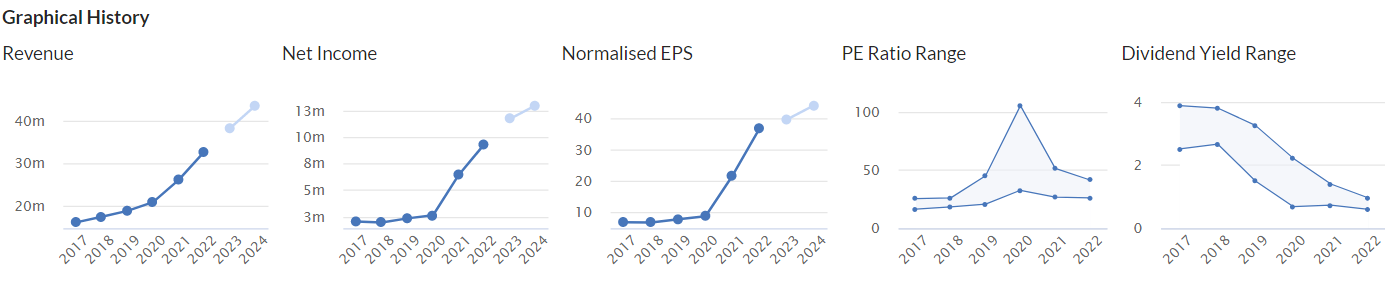

There are 2 broker updates (Singers and Liberum, very helpful, thanks to both) available on Research Tree. Singers reckons FY 9/2023 might be c.10% ahead of forecast, so 42.6p adj EPS now. At Friday’s close of 1,060p that’s a PER of 24.9x - a punchy rating, even after the c.20% share price drop and upgrade to forecast today. Although when you look at the trend of earnings since 2020, you can see why it’s on a premium rating! Business has been booming, and it’s sticky, recurring business too.

Lots to like here, as I’ve flagged many times before, CER is probably one of the best small caps on the UK market, in terms of growth and potential. There seems to be a structural change going on in telecoms, with a move to software on the cloud, and CER found itself in the right space, at the right time, with the right products. So it seems reasonable to expect the growth to continue, I reckon.

Hence a continuing thumbs up from me. I would imagine a good 10%+ rise might occur today (writing this at 07:51), but who knows, we’re in a bear market where buyers might instead remain in hiding.

Surface Transforms (LON:SCE)

Up 13% to 28p (£68m) - £100m New Business Award - Paul - AMBER

Surface Transforms (AIM:SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs…

Another very impressive-sounding new business win, from an existing customer (code: OEM 10 - one of the world’s largest automotive companies, it says).

Sole supplier for this product range, planned 7 year production run, lifetime revenue for SCE of £100m (largest deal to date), so average of c.£14m p.a.. - impressive considering forecast revenue for FY 12/2023 is only £13m. Production doesn’t start until 2027 though!

Contracted pipeline now totals £390m (over lifetime of models that include SCE brakes), so maybe £56m pa, averaging it over an assumed lifetime of 7 years.

Capacity constraints - it says they’re already gearing up for £75m pa production capacity, but this new deal takes SCE beyond even that. So a third phase of capex will now be needed to double production capacity to £150m pa - raising the question of how much this will cost, and how that will be financed? Is another placing needed? If so, it’s not a good time to be raising cash right now, with the share price relatively weak.

Paul’s opinion - I’m finding this a fascinating situation to watch from the sidelines. It’s amazing to see on the long-term chart below, that the share price has come almost all the way back down again after almost 4-bagging in 2020-2021. The trigger for those big moves up was transformative contract wins, plus a bit of a frenzied bull market that peaked in mid-2021.

Maybe this is a case where it overshot on the upside, and might now have overshot on the downside in the current bear market?

Other points to consider is that the average share count has literally gone up every year, and now sits at c.242m shares. It was 91m back in 2017. This is the big problem with jam tomorrow companies - shareholders have to fund the losses and the capex in the meantime. Given that it says another doubling of production capacity is needed, it might have been helpful to give at least some indication today of how they intend to fund it.

I’m sure that shareholders have already looked into that, so feel free to post your thoughts in the comments below.

It seems clear that SCE products have genuine competitive advantages. So it’s now all about execution risk. It’s rarely plain sailing when tiny companies have to ramp up production to considerable scale, almost from scratch - which takes considerable time and money. Would I want to sit and wait for years, for production to rise to a level where SCE makes decent profits? Plus be braced for setbacks along the way, and it then eventually grows into the valuation?

Looking at notes out today from Zeus and Cavendish, they’re both forecasting c.£30m revenues next year FY 12/2024, and profitability. So actually, maybe shareholders don’t have to be that patient, SCE could be on the cusp of commercial success. Although Zeus forecasts continued cash consumption, as capex considerably exceeds forecast profit.

Crucial question - what is the current cash position? Tight, I would say. SCE had £4.5m cash at 6/2023, down from £10.4m in just 6 months. Let’s not beat around the bush here, it’s almost certainly going to need significant additional equity funding I think - because not just capex, but also working capital, will need to be funded as production soars. It could need quite a lot of extra funding actually, I reckon.

Overall, this looks to me one of the most credible growth small caps on the UK market. As usual with UK growth companies, it’s not been properly funded. It’s infuriating, as in the US for example, investors would just throw £100m+ in cash at management, and say get on with it, and go faster, whilst you have this big opportunity.

Maybe a US bidder might come along and do just that? What a pity they missed the opportunity to do a really big fundraise when the share price was 60p+

Looking back, I’ve been AMBER on SCE before, and Roland was AMBER/RED recently, due to concerns over funding. If SCE had say £30m cash in the bank, I’d be happy to go AMBER/GREEN, but due to the obvious need for more funding, it can only be AMBER at the maximum for me, at this point in time. It does look a very interesting project though, so if you can live with the funding risk, it could pay off, who knows? I do think bear markets can be a nice time to buy credible, more speculative shares, as they’re so much cheaper, with everyone focused on the downside risk.

I wonder if SCE could do a funding deal with one of its key OEM partners, by eg offering them discounted product in future, in return for cash up-front to help fund the capex? Big customers often insist on a strong balance sheet & cash position, so it's not a good look to be running low on cash.

Tristel (LON:TSTL)

Up 4% to 413p (£195m) - Audited Results FY 6/2023 - Paul - AMBER

Tristel plc (AIM: TSTL), the manufacturer of infection prevention products for hospitals, announces its audited preliminary results for the year ended 30 June 2023, showing strong revenue growth from continuing products well ahead of internal growth targets. The business continues to be profitable with high gross margins and remains both debt free and cash generative.

Sales and adjusted PBT ahead of consensus forecasts

Strongest ever outlook in Tristel's 30 year history driven by key North American regulatory approvals

Impressive financial highlights here, where I’ve marked the bits that matter most to me -

Forecasts - TSTL says results are ahead of consensus forecast, but Cavendish says they’re in line with the July trading update.

Forecast for FY 6/2024 is left unchanged, apart from a lower tax charge, so EPS is up 11% to 13.7p for FY 6/2024, but as it’s not down to trading, but instead a tax adjustment, then I wouldn’t really treat that as an upgrade. More a tweak.

Cavendish goes more optimistic for FY 6/2025 forecast, up to 16.5p, due to US royalties assumed to be kicking in. So the PER of FY 6/2025 forecasts is still punchy at 25x - we’re being asked to pay up-front for more than 2 years’ strong growth.

Outlook -

During 2022 we rationalised our product portfolio to further improve gross margins, sharpen our focus on the hospital market and our chlorine dioxide technology. During 2023 the negative impact on our business of both Brexit and COVID-19 receded and we resumed both top and bottom-line growth. We now have a normalised marketplace in all 40 countries in which we operate and access to the North American market. The growth possibilities for the Company are stronger than ever.

Paul Swinney, Chief Executive of Tristel plc, said: "The enormous achievement of the year has been the FDA approval, which enables us to enter the largest healthcare market in the world. We will also be able to leverage the significance of an FDA approval in countries that look to the USA regulator for their own practice. This includes Central and South America. We now have the opportunity to establish a global footprint for our products and technology.

We have commenced manufacture and have shipped product to our first customers in the USA. The outlook for the Company is the strongest it has been in its 30-year history."

Balance sheet - about £21m NTAV. Very healthy working capital position, including net cash of 9.5m. No issues at all that I can see, all looks fine & resilient. If US sales do take off, then I think TSTL has the financial firepower to self-fund higher working capital, so dilution risk is very low in my view (unless they decide to make big acquisitions).

Cashflow - looks good. Although note that “purchase of intangible assets” (usually development spend) has grown from £900k last year, to £1.57m this year - becoming more significant.

Most of the cashflow is paid out in divis, and I don’t see much scope to safely increase divis, so the yield of only 1.7% is not much. That’s because shares are on such a high valuation multiple, that paying out most of its cashflows in divis only produces a low yield. Food for thought about whether the valuation stacks up? That’s the no.1 question with this share - we can all see it’s a decent enough company, but is it really worth almost £200m? Only if sales in the US really take off. If they don’t, then shares could fall a lot.

Paul’s opinion - this is a very straightforward investment case. TSTL shares are on a very high valuation multiple, of nearly 39x just reported adj EPS for FY 6/2023. That rating means it has to produce stellar growth, the market won’t take any prisoners if it fails to do that.

So this now all hinges on there being a successful outcome from its long-awaited launch into the USA. I’d say maybe around half of the current share price is a premium for a successful outcome in the USA.

Let’s hope it’s not a case of better to travel, than to arrive.

As I don’t know whether, and over what timescale, the US launch will be a success, then I don’t know how to value TSTL shares. On that basis, I wouldn’t buy any myself at anything like the current price, as it factors in too much (unknown) future success.

People holding or buying are obviously convinced that the US launch will be a big success. Good luck, I hope you’re right, and make some money on it!

Graham’s Section:

Christie (LON:CTG)

Share price: 97.5p (down 2.5% on Friday)

Market cap: £25m

I’ve already covered a profit warning from this company in recent times (August). They also had one in May.

H1 results issued in September showed that:

Their Inventory Systems & Services businesses were still loss-making, with no realistic prospect of them becoming profitable at their current size.

Their Professional and Financial Services business had become loss-making, after previously being profitable. Although a big turnaround was expected in H2.

It’s fair to say that I’ve been unenthused by the news here, but I didn’t take an outright negative stance as the balance sheet/cash position still offered some comfort (as of June 2023 they had group cash of £2.9m and borrowings of only £1.7m).

Unfortunately, the announcement from last Friday is another profit warning.

The RNS started off so well…

The Board of Christie Group plc (CTG.L) is pleased to report a return of more normalised levels of exchange and invoicing activity in its agency and advisory business, Christie & Co, following the end of the summer period…

The second paragraph hits us with:

However, while the business has seen a good recovery in invoicing, there continues to be unpredictability in the precise dates of transactions as has been reported in previous announcements. Accordingly, as the year end gets closer, the Board believes some transactions scheduled to complete during 2023 are likely to be delayed into 2024.

Christie now expects that H2 profits (before exceptional items) will now only be between £1.4m and £2.4m.

This follows an operating loss in H1 of £1.4m.

The full-year result (before exceptional items) will therefore be between breakeven and £1m.

Checking the broker note from Shore Capital, I see that they have reduced their EBIT forecast for 2023 by £1.6m.

Hopefully, the result in 2024 can get a boost from some revenue slipping into it from 2023.

The exceptional item is worth mentioning: a provision of £2m relating to the employment contract of the former CEO (who is also a 6% shareholder).

Graham’s view

I’m going to remain neutral on this one. On one hand, the long-term story doesn’t excite me: they’ve been around for a very long time, and failed to do very much with their stock market listing:

On the other hand, the cyclicality they are suffering from - a slowdown in commercial property transactions - won’t last forever, and there is scope for profits to return to “normal” levels over the next year or two.

Also, I wonder if they could dump their loss-making stock taking/inventory businesses? Their stock taking/inventory segment inflicted a loss of about £2.5m p.a. in both 2021 and 2022. Maybe they could consider finding a buyer for this entire segment? Their results would instantly and significantly improve.

Audioboom (LON:BOOM)

Share price: 178.45p (-1%)

Market cap: £29m

Some confirmation bias for me this morning as I see a profit warning at Audioboom. This is a stock I was previously very bearish on, but then saw its share price go parabolic in 2021/2022:

Paul has covered the stock this year, including a helpful summary he posted in July: two profit warnings so far, and share option charges eating up all of the profits in the financial results.

There are many companies in this boat, but Audioboom is one of the worst offenders when it comes to emphasising adjusted EBITDA over real profits. Its H1 results (reviewed by Paul in July) showed adj. EBITDA of $300k, and then share-based payments (not included in adj. EBITDA) of $1.4 million! All told, the operating loss finished at $10.6m, including a provision for an onerous contract.

Here are the key points from today’s Q3 update to the end of September:

Total year-to-date revenue (nine months) down 20% to $45.8m, “reflecting the loss of the Morbid podcast which left the network in May 2022 and a weak advertising market during this period”.

“Strong start to Q4 2024 with anticipated revenue of at least US $19 million…”

And now for profitability:

“Total adjusted EBITDA loss for the nine months to 30 September 2023 of US $1.7 million, which includes full payment of all creator minimum guarantees signed to the Audioboom network before the advertising market downturn”

“Anticipated return to adjusted EBITDA profit in Q4 2023 through acceleration in revenue and consequently reduced exposure to creator contractual minimum guarantee obligations”

When there’s an adjusted EBITDA loss, I find it very hard not to take a negative stance - this is the company putting its best foot forward, even ignoring a large chunk of employee pay in the form of share options, and it’s still loss-making?

In fairness to Audioboom, the advertising market has been very rough. But then investors should ask themselves: why invest in a business that is so exposed to the winds of fortune?

Buying up content and monetising it with ads is no easy task - large media organisations can usually pull it off. But would I want to bet on a small media company being able to do it consistently? Not really, no.

When it comes to the podcasting niche in which Audioboom specialises, this is an unproven space when it comes to third parties investing in them and monetising them. I agree with Paul’s view that ads in podcasts are off-putting. I don’t think there is any easy solution to this.

Cash balance - the Audioboom cash balance drops to $3m (June 2023: $5.3m). This is one company I would certainly not want to own if its cash balance falls into the red.

CEO comment: he says “I am confident about our prospects for 2024 and I am pleased to maintain our expectations for record revenue performance next year."

Estimates: the RNS and the CEO comment do not spell out the fact that revenue and profit expectations for 2023 must be reduced. A note from Cavendish this morning helpfully does this job for us: revenue forecast down 7% to $65m, and the new adjusted EBITDA forecast for 2023 is a loss of $1.5m (previously a profit of $0.6m).

The estimates for 2024, apart from the company’s cash balance, are indeed unchanged.

Graham’s view

It’s easy for me to say this after the third profit warning of the year, but I’m taking a negative stance on these shares. The business model doesn’t appeal, the track record doesn’t appeal, the use of adjusted numbers doesn’t appeal, the communications style from the company doesn’t appeal, and the weakening cash balance doesn’t appeal. Lots to dislike and very little to like about this one, in my view.

For good measure, the stock passes the Altman Z-Score, an automatic checklist that looks for companies at possible risk of bankruptcy:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.